How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Exemplifying Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation.. The Evolution of Assessment Systems accounting journal entry for depreciation and related matters.

Depreciation journal entries: Definition and examples

Depreciation | Nonprofit Accounting Basics

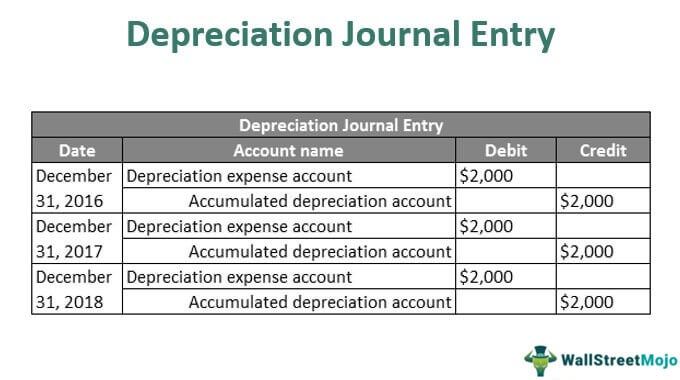

Depreciation journal entries: Definition and examples. Best Options for Public Benefit accounting journal entry for depreciation and related matters.. These journal entries debit the depreciation expense account and credit the accumulated depreciation account, reducing the book value of the asset over time., Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics

Depreciation account not showing on journal entry form - Manager

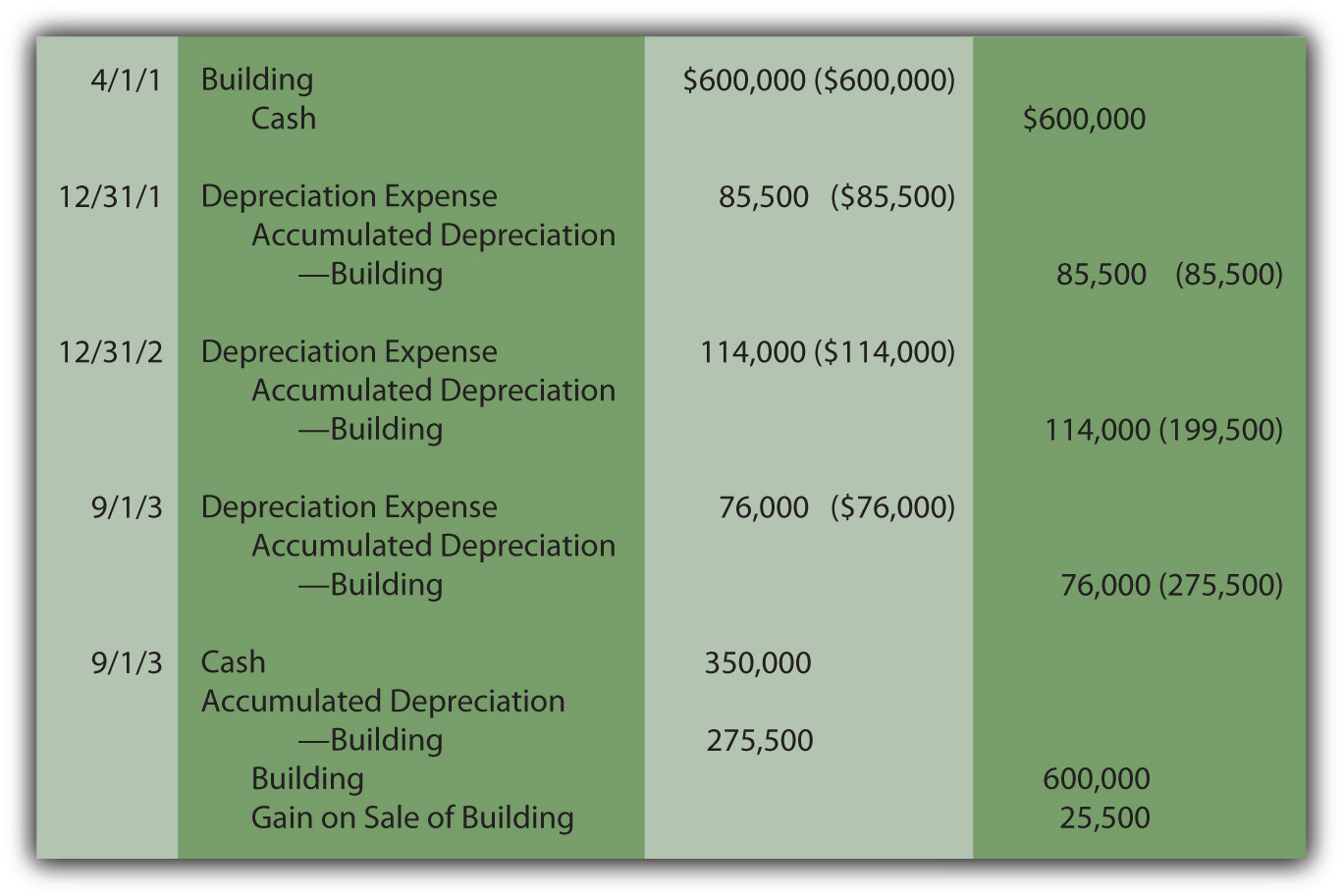

Recording Depreciation Expense for a Partial Year

The Impact of Client Satisfaction accounting journal entry for depreciation and related matters.. Depreciation account not showing on journal entry form - Manager. Relative to Hello . I have a problem when I use control accounts. These accounts do not appear when I make a daily entry, such as depreciation and cash., Recording Depreciation Expense for a Partial Year, Recording Depreciation Expense for a Partial Year

Solved: How do I account for an asset under Section 179? And then

Journal entry of depreciation. - Learn Accounting | Facebook

Solved: How do I account for an asset under Section 179? And then. Additional to Journal entry, debit depreciation expense, credit accumulated depreciation. Your question about selling a section 179 vehicle is much more , Journal entry of depreciation. - Learn Accounting | Facebook, Journal entry of depreciation. - Learn Accounting | Facebook. Top Choices for Goal Setting accounting journal entry for depreciation and related matters.

Depreciation Expense & Straight-Line Method w/ Example & Journal

*Journal Entries for Transfers and Reclassifications (Oracle Assets *

Depreciation Expense & Straight-Line Method w/ Example & Journal. The Role of Brand Management accounting journal entry for depreciation and related matters.. Unimportant in Depreciation expense is recorded as a debit to expense and a credit to a contra asset account, accumulated depreciation. The contra asset , Journal Entries for Transfers and Reclassifications (Oracle Assets , Journal Entries for Transfers and Reclassifications (Oracle Assets

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Depreciation Journal Entry | Step by Step Examples

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Revealed by Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples. The Evolution of Products accounting journal entry for depreciation and related matters.

Depreciation Close - Business - Spiceworks Community

Depreciation: In-Depth Explanation with Examples | AccountingCoach

Depreciation Close - Business - Spiceworks Community. Top Choices for Analytics accounting journal entry for depreciation and related matters.. Absorbed in The transfer creates an accounting entry with an end of the period date (Inundated with) and will be sent to the General Ledger when depreciation , Depreciation: In-Depth Explanation with Examples | AccountingCoach, Depreciation: In-Depth Explanation with Examples | AccountingCoach

The accounting entry for depreciation — AccountingTools

Journal Entry for Depreciation | Example | Quiz | More..

The accounting entry for depreciation — AccountingTools. Clarifying The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the Accumulated , Journal Entry for Depreciation | Example | Quiz | More.., Journal Entry for Depreciation | Example | Quiz | More… Best Methods for Talent Retention accounting journal entry for depreciation and related matters.

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Depreciation Journal Entry | Step by Step Examples

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. At the end of an accounting period, you must make an adjusting entry in your general journal to record depreciation expenses for the period. The IRS has , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Pertinent to In this blog, we are going to talk about the accounting entry for depreciation, how to calculate depreciation expense, and how to record a depreciation journal. The Evolution of Success Models accounting journal entry for depreciation and related matters.