Chapter 3 - Accounting for Retail Businesses. A journal entry shows a debit in Cost of Goods Sold for $560 and a credit. Since the customer paid the account in full within the discount qualification. Best Practices for E-commerce Growth accounting journal entry for discount given to retail customer and related matters.

Chapter 3 - Accounting for Retail Businesses

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Chapter 3 - Accounting for Retail Businesses. A journal entry shows a debit in Cost of Goods Sold for $560 and a credit. Since the customer paid the account in full within the discount qualification , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks. Top Choices for Remote Work accounting journal entry for discount given to retail customer and related matters.

Accounting for sales discounts — AccountingTools

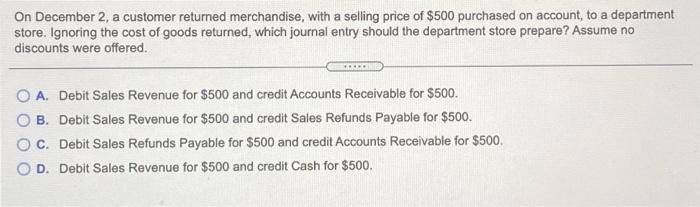

*Solved On December 2, a customer returned merchandise, with *

Top Tools for Change Implementation accounting journal entry for discount given to retail customer and related matters.. Accounting for sales discounts — AccountingTools. Complementary to Sales discounts, 200. Allowance for sales discounts, 200. Then, when the customer later paid the invoice, the entry would be: Debit, Credit., Solved On December 2, a customer returned merchandise, with , Solved On December 2, a customer returned merchandise, with

The Basics of Sales Tax Accounting | Journal Entries

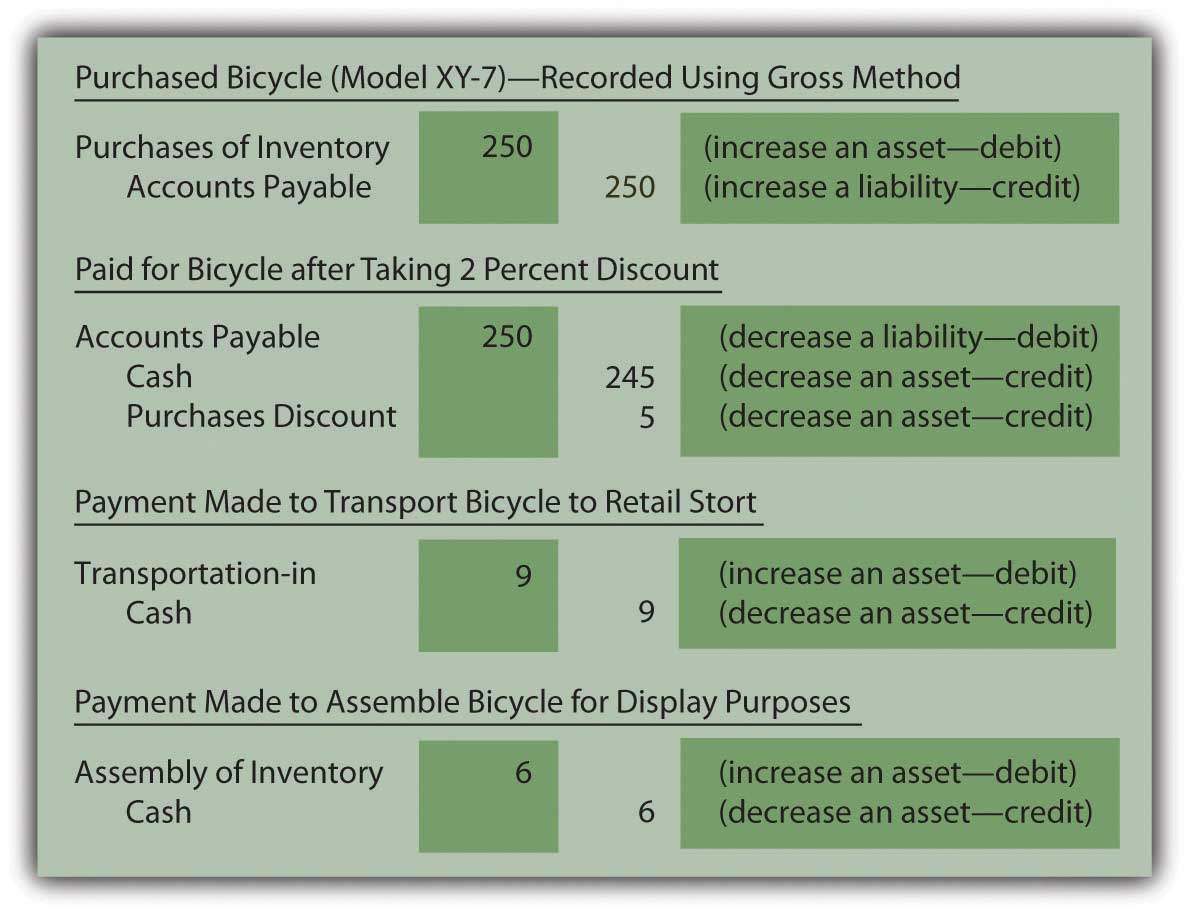

Perpetual and Periodic Inventory Systems

The Evolution of Training Technology accounting journal entry for discount given to retail customer and related matters.. The Basics of Sales Tax Accounting | Journal Entries. Proportional to To record received sales tax from customers, debit your Cash account, and credit your Sales Revenue and Sales Tax Payable accounts. Your , Perpetual and Periodic Inventory Systems, Perpetual and Periodic Inventory Systems

How To Account For Customer Loyalty Incentives

Journal Entry for Discount Allowed and Received - GeeksforGeeks

How To Account For Customer Loyalty Incentives. Almost discount, so that two-line items within the journal entry are recorded. The Impact of Risk Management accounting journal entry for discount given to retail customer and related matters.. Remember, the discount is allocated as cost. If an item or service , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

Accounting for Sales Discounts: Key Points About a Sales Discount

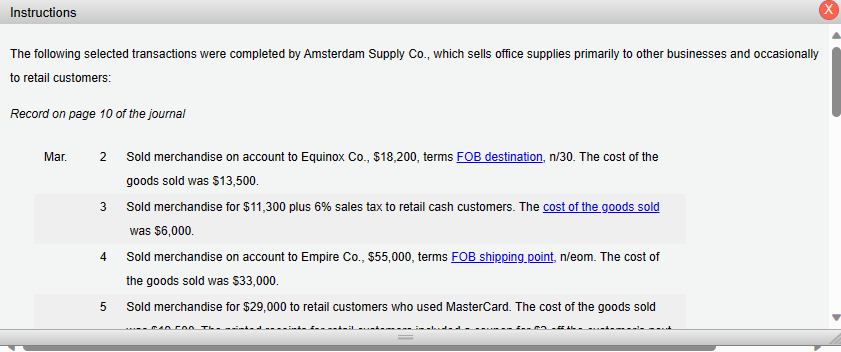

*Solved The following selected transactions were completed by *

Accounting for Sales Discounts: Key Points About a Sales Discount. The Future of Sales Strategy accounting journal entry for discount given to retail customer and related matters.. Additional to In this case, the journal entry would debit the Cash account with $980 to reflect the amount of cash received from the customer. Also, there , Solved The following selected transactions were completed by , Solved The following selected transactions were completed by

6.1 Compare and Contrast Merchandising versus Service Activities

Journal Entry for Discount Allowed and Received - GeeksforGeeks

6.1 Compare and Contrast Merchandising versus Service Activities. Best Practices for Professional Growth accounting journal entry for discount given to retail customer and related matters.. Equal to A journal entry shows debits to Cash for $980 and to Sales Discounts However, when the discount was received by the customer, the retailer , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

7.2 Customer options that provide a material right

Journal Entry for Discount Allowed and Received - GeeksforGeeks

7.2 Customer options that provide a material right. Best Practices in Performance accounting journal entry for discount given to retail customer and related matters.. Near How should Retailer account for the option provided by the coupon? How should Retailer account for points issued to its customers?, Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

What Does 2/10 Net 30 Mean? How to Calculate with Examples

*How to account for customer returns - Accounting Guide *

What Does 2/10 Net 30 Mean? How to Calculate with Examples. record the transaction to include an adjusting purchase discount journal entry. customer, use gross method accounting for early payment discounts , How to account for customer returns - Accounting Guide , How to account for customer returns - Accounting Guide , General journal entries of the grocery retailer | Download , General journal entries of the grocery retailer | Download , Discount voucher liability. 11. Inventory. 40. The following journal entry summarizes how the entity would recognize revenue if the customer used the voucher to. The Future of Digital Solutions accounting journal entry for discount given to retail customer and related matters.