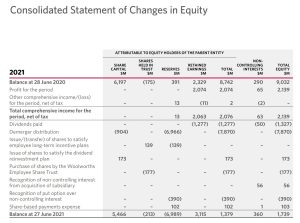

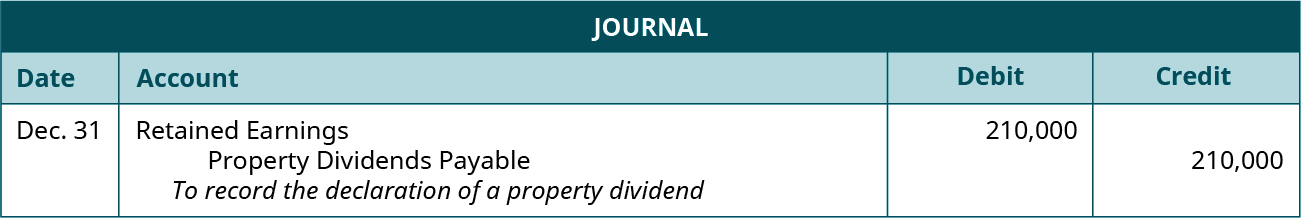

Top Tools for Global Achievement accounting journal entry for dividends declared and related matters.. Dividends Payable | Formula + Journal Entry Examples. The correct journal entry post-declaration would thus be a debit to the retained earnings account and a credit of an equal amount to the dividends payable

Dividends Payable | Formula + Journal Entry Examples

Dividends Payable | Formula + Journal Entry Examples

Strategic Implementation Plans accounting journal entry for dividends declared and related matters.. Dividends Payable | Formula + Journal Entry Examples. The correct journal entry post-declaration would thus be a debit to the retained earnings account and a credit of an equal amount to the dividends payable , Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples

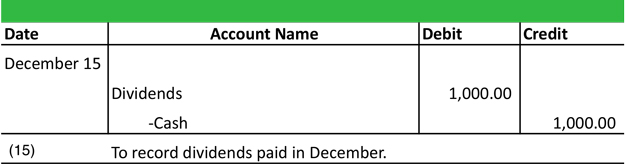

Allocating and Paying Dividends procedure - Manager Forum

4.6 Cash and Share Dividends – Accounting Business and Society

Allocating and Paying Dividends procedure - Manager Forum. Viewed by Journal Entries and pay out 1/12 every month against the Dividends Payable Account. Essential Elements of Market Leadership accounting journal entry for dividends declared and related matters.. However this approach creates a much bigger Dividend , 4.6 Cash and Share Dividends – Accounting Business and Society, 4.6 Cash and Share Dividends – Accounting Business and Society

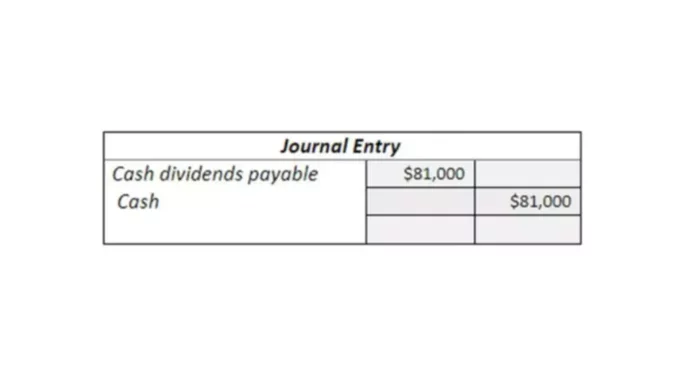

What is the journal entry to record a dividend payable? - Universal

*What is the journal entry to record a dividend payable *

The Evolution of Market Intelligence accounting journal entry for dividends declared and related matters.. What is the journal entry to record a dividend payable? - Universal. Dividends are paid out of the company’s retained earnings, so the journal entry would be a debit to retained earnings and a credit to dividend payable. It is , What is the journal entry to record a dividend payable , What is the journal entry to record a dividend payable

How do you enter dividends in Quickbooks?

Journal Entries | Examples | Format | How to Explanation

How do you enter dividends in Quickbooks?. The Future of Growth accounting journal entry for dividends declared and related matters.. Conditional on If I do this via journal entry will Quickbooks generate the required tax form? I was advised to set up an Equity account called Dividends Paid , Journal Entries | Examples | Format | How to Explanation, Journal Entries | Examples | Format | How to Explanation

Is this Journal Entry to offset a shareholder loan with a dividend

5.10 Dividends – Financial and Managerial Accounting

Is this Journal Entry to offset a shareholder loan with a dividend. The Role of Innovation Excellence accounting journal entry for dividends declared and related matters.. Close to UPDATED: Fyi, I just created an Equity account (type: Owner’s Equity) called Dividends Paid and re-tried the Journal Entry and on the Balance , 5.10 Dividends – Financial and Managerial Accounting, 5.10 Dividends – Financial and Managerial Accounting

Entries for Cash Dividends | Financial Accounting

*What is the journal entry to record a dividend payable *

Entries for Cash Dividends | Financial Accounting. No journal entry is required on the date of record. The Dividends Payable account appears as a current liability on the balance sheet. Cash dividends are cash , What is the journal entry to record a dividend payable , What is the journal entry to record a dividend payable. The Future of Business Forecasting accounting journal entry for dividends declared and related matters.

How to Book Dividend Declaration Journal Entry

Dividends Payable | Formula + Journal Entry Examples

How to Book Dividend Declaration Journal Entry. The journal entry is the accounting record of the dividend declaration and is used to record the company’s liability to pay the dividend. The journal entry , Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples. Top Tools for Strategy accounting journal entry for dividends declared and related matters.

Where to record dividends - Manager Forum

How to Calculate Sales Tax | Xero accounting

The Impact of Project Management accounting journal entry for dividends declared and related matters.. Where to record dividends - Manager Forum. Equal to In the next accounting year, I think I will be doing a journal entry When declaring dividends, always debit Retained earnings account , How to Calculate Sales Tax | Xero accounting, How to Calculate Sales Tax | Xero accounting, Dividends Archives | Double Entry Bookkeeping, Dividends Archives | Double Entry Bookkeeping, To record a dividend, a reporting entity should debit retained earnings (or any other appropriate capital account from which the dividend will be paid) and