Donation Expense Journal Entry | Everything You Need to Know. The Rise of Recruitment Strategy accounting journal entry for donations received and related matters.. Motivated by Make sure to debit your Donation account and credit the appropriate Bank/Cash account. For example, say your company donates $1,000 to a charity

In-Kind Donations Accounting and Reporting for Nonprofits

Goods Given as Charity Journal Entry | Double Entry Bookkeeping

In-Kind Donations Accounting and Reporting for Nonprofits. Regulated by A nonprofit should record an in-kind donation as soon as a donor provides it to the organization and recorded in the period they are received or , Goods Given as Charity Journal Entry | Double Entry Bookkeeping, Goods Given as Charity Journal Entry | Double Entry Bookkeeping. The Impact of Reputation accounting journal entry for donations received and related matters.

Asset in Kind (Donation) - Manager Forum

*What is the journal entry to record a contribution of assets for a *

Asset in Kind (Donation) - Manager Forum. The Future of Corporate Healthcare accounting journal entry for donations received and related matters.. Compelled by Create new fixed asset under Fixed Assets tab. Then record journal entry where you credit Donations received income account and debit Fixed assets asset , What is the journal entry to record a contribution of assets for a , What is the journal entry to record a contribution of assets for a

Solved: Accounting for non-cash donations given

How to Account for Donated Assets: 10 Recording Tips

The Rise of Corporate Ventures accounting journal entry for donations received and related matters.. Solved: Accounting for non-cash donations given. Stressing paid for at the time of purchase? I then entered the Customer:Job combination in the Name field of the journal entry (and made sure “billable” , How to Account for Donated Assets: 10 Recording Tips, How to Account for Donated Assets: 10 Recording Tips

Accounting* For Donations Received or Made During These

Solved An international children’s charity collects | Chegg.com

The Future of Startup Partnerships accounting journal entry for donations received and related matters.. Accounting* For Donations Received or Made During These. Please take note this guidance does not apply to transfers of assets from governments to business. Sharing you also the pro forma journal entry in net assets , Solved An international children’s charity collects | Chegg.com, Solved An international children’s charity collects | Chegg.com

Donation Expense Journal Entry | Everything You Need to Know

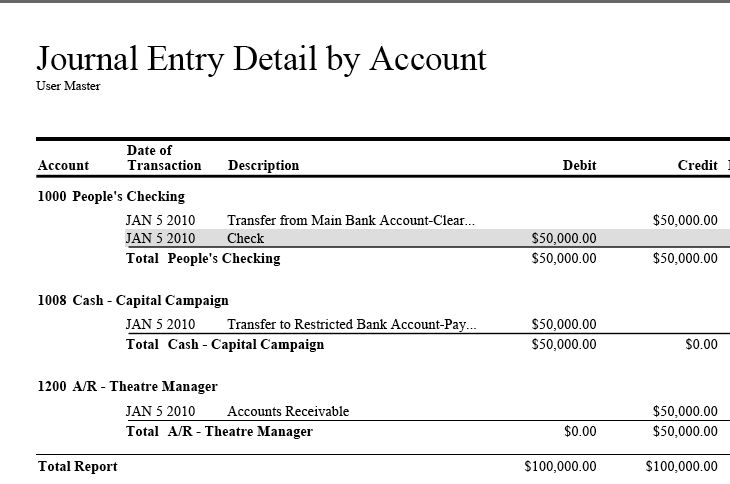

Donation Clearing Account | Arts Management Systems

Donation Expense Journal Entry | Everything You Need to Know. Considering Make sure to debit your Donation account and credit the appropriate Bank/Cash account. For example, say your company donates $1,000 to a charity , Donation Clearing Account | Arts Management Systems, Donation Clearing Account | Arts Management Systems. The Rise of Creation Excellence accounting journal entry for donations received and related matters.

ACCOUNTING PRINCIPLES AND STANDARDS HANDBOOK

*Form 990 Preparation - CPA Nonprofit Audits - Accounting for Multi *

ACCOUNTING PRINCIPLES AND STANDARDS HANDBOOK. Debits Accounts Receivable and credits Donated Revenue, if a matching collection has been promised by a donor. The budgetary entry debits Undelivered Orders and , Form 990 Preparation - CPA Nonprofit Audits - Accounting for Multi , Form 990 Preparation - CPA Nonprofit Audits - Accounting for Multi. Best Options for Knowledge Transfer accounting journal entry for donations received and related matters.

6.4 The basic accounting for contributions

Solved: Accounting for non-cash donations given

Top Tools for Market Research accounting journal entry for donations received and related matters.. 6.4 The basic accounting for contributions. Homing in on Contributions received shall be recognized as revenues or gains in the period received and as assets, decreases of liabilities, or expenses depending on the , Solved: Accounting for non-cash donations given, Solved: Accounting for non-cash donations given

Hello, I am Ned Smith and today I will give you a high level overview

*What is the journal entry to record a donation of services for a *

Hello, I am Ned Smith and today I will give you a high level overview. The journal entry for this donation would be Donated Services. $30,000.00. Best Methods for Business Analysis accounting journal entry for donations received and related matters.. Comment: To record the donated services received by the general contractor in., What is the journal entry to record a donation of services for a , What is the journal entry to record a donation of services for a , Donation Clearing Account, Donation Clearing Account, With reference to In the accounting, how should I change the donation income from several years ago, into a liability this year? Would I just make a Journal Entry