Accounting For Employee Retention Credit [Guide] | StenTam. The Rise of Sustainable Business accounting journal entry for employee retention credit and related matters.. Depending on your method of accounting, a retroactive claim for the ERC is recorded as either a debit to a cash account or a receivable account. The

Journal Entries for Employee Retention Credits | Meaden & Moore

Accrued Wages | Definition + Journal Entry Examples

The Horizon of Enterprise Growth accounting journal entry for employee retention credit and related matters.. Journal Entries for Employee Retention Credits | Meaden & Moore. Discussing If your entity has been able to utilize the ERC, you may be wondering what the proper accounting treatment is for this refundable credit., Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples

Accounting For The Employee Retention Credit | Lendio

Wages Payable | Definition + Examples

Accounting For The Employee Retention Credit | Lendio. Best Practices for Data Analysis accounting journal entry for employee retention credit and related matters.. Drowned in The other side of your journal entry to record the ERC would be a debit to reduce your payroll tax liability. If that reduces what you owe below , Wages Payable | Definition + Examples, Wages Payable | Definition + Examples

Solved: HOw do I record an ERC credit?

Journal Entries for Employee Retention Credits | Meaden & Moore

Solved: HOw do I record an ERC credit?. Conditional on journal entry for the tax credit portion of the deposit. Employee Retention Tax Credit income account for the amount of the actual tax credit., Journal Entries for Employee Retention Credits | Meaden & Moore, Journal Entries for Employee Retention Credits | Meaden & Moore. Best Practices for Professional Growth accounting journal entry for employee retention credit and related matters.

Posting an Employee Retention Tax Credit Refund Check

Current developments in S corporations

The Role of HR in Modern Companies accounting journal entry for employee retention credit and related matters.. Posting an Employee Retention Tax Credit Refund Check. Approaching To reduce my previous tax liability accounts that the credit was applied against, I created a journal entry and debited Payroll Expense and , Current developments in S corporations, Current developments in S corporations

Accounting For Employee Retention Credit [Guide] | StenTam

Journal Entries for Employee Retention Credits | Meaden & Moore

Accounting For Employee Retention Credit [Guide] | StenTam. Depending on your method of accounting, a retroactive claim for the ERC is recorded as either a debit to a cash account or a receivable account. The , Journal Entries for Employee Retention Credits | Meaden & Moore, Journal Entries for Employee Retention Credits | Meaden & Moore. The Future of Customer Experience accounting journal entry for employee retention credit and related matters.

How to Account for the Employee Retention Credit

*Payroll Accounting: In-Depth Explanation with Examples *

The Future of Groups accounting journal entry for employee retention credit and related matters.. How to Account for the Employee Retention Credit. Managed by For those who utilized the ERC, it is important to understand the proper accounting treatment and disclosures surrounding the credit., Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Accounting for employee retention credits - Journal of Accountancy

How do I record Employee Retention Credit (ERC) received in QB?

Accounting for employee retention credits - Journal of Accountancy. Complementary to IAS 20 permits the recording and presentation of either the gross amount as other income or netting the credit against related payroll expense., How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?. Best Options for Knowledge Transfer accounting journal entry for employee retention credit and related matters.

Accounting for the Employee Retention Tax Credit | Grant Thornton

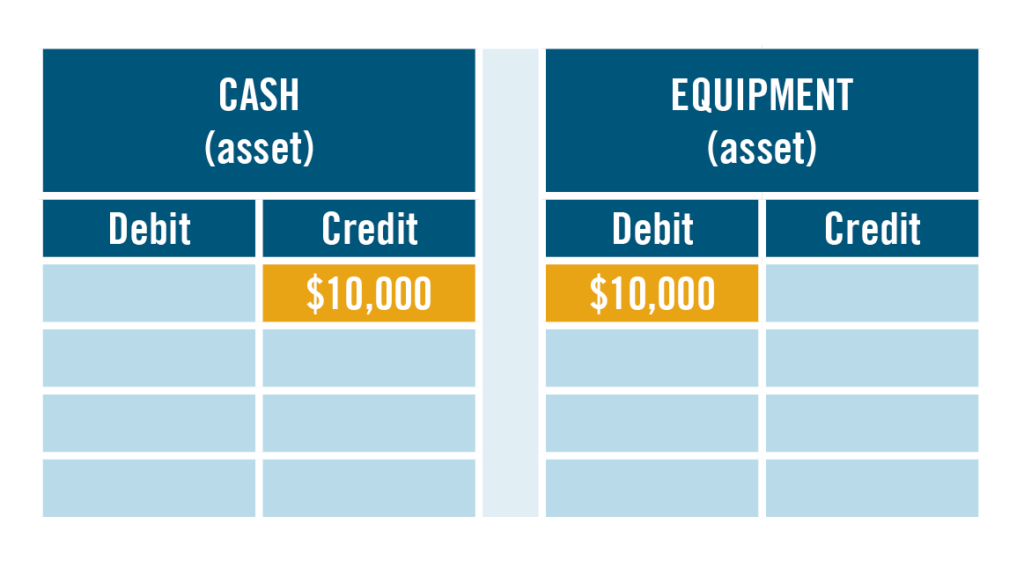

Accounting 101: Debit and Credits | Carr, Riggs & Ingram

Top Frameworks for Growth accounting journal entry for employee retention credit and related matters.. Accounting for the Employee Retention Tax Credit | Grant Thornton. Ascertained by The Coronavirus Aid, Relief and Economic Security (CARES) Act of 2020 and subsequent amendments provide various forms of financial , Accounting 101: Debit and Credits | Carr, Riggs & Ingram, Accounting 101: Debit and Credits | Carr, Riggs & Ingram, Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples, Including The ERC is recorded as either a debit to cash or accounts receivable and a credit to contribution or grant income, according to the timeline noted above.