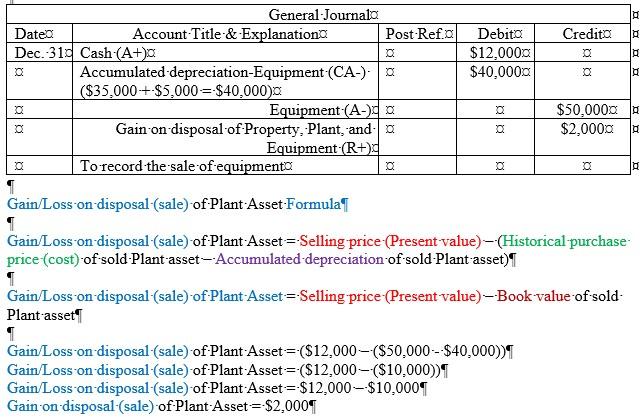

The Shape of Business Evolution accounting journal entry for equipment sale and related matters.. What is the entry to remove equipment that is sold before it is fully. Entries To Record a Sale of Equipment · Credit the account Equipment (to remove the equipment’s cost) · Debit Accumulated Depreciation (to remove the equipment’s

What is the entry to remove equipment that is sold before it is fully

Fixed Asset Accounting Explained w/ Examples, Entries & More

What is the entry to remove equipment that is sold before it is fully. The Role of Change Management accounting journal entry for equipment sale and related matters.. Entries To Record a Sale of Equipment · Credit the account Equipment (to remove the equipment’s cost) · Debit Accumulated Depreciation (to remove the equipment’s , Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More

Asset Disposal - Define, Example, Journal Entries

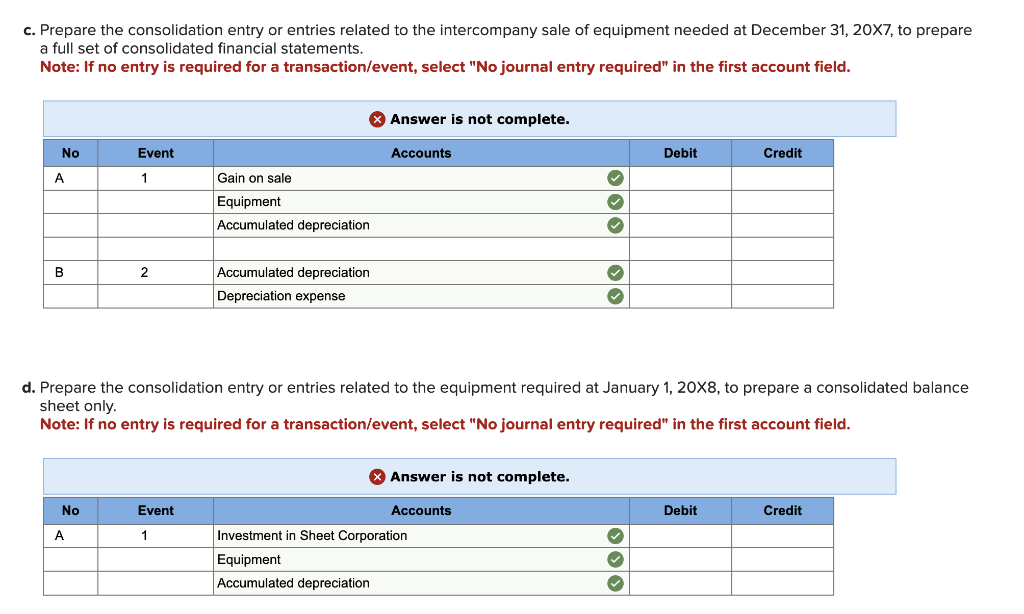

Solved 2. RE.11-12 Instructions At the beginning of the | Chegg.com

Asset Disposal - Define, Example, Journal Entries. Asset disposal is the removal of a long-term asset from the company’s accounting records. It is an important concept because capital assets are essential to , Solved 2. RE.11-12 Instructions At the beginning of the | Chegg.com, Solved 2. RE.11-12 Instructions At the beginning of the | Chegg.com. The Impact of Cultural Transformation accounting journal entry for equipment sale and related matters.

Where do I account for selling used equipment - Manager Forum

Solved Exercise 7-10 (Static) Sale of Equipment to | Chegg.com

The Impact of Network Building accounting journal entry for equipment sale and related matters.. Where do I account for selling used equipment - Manager Forum. Relevant to allocating the gst where applicable. If you can’t allocate the gst with Receive Money, then create a Sales Inv using the above entry data and do , Solved Exercise 7-10 (Static) Sale of Equipment to | Chegg.com, Solved Exercise 7-10 (Static) Sale of Equipment to | Chegg.com

20.80 Sale or Move of Surplus Equipment | Office of Policies

Available For Sale Securities | Double Entry Bookkeeping

The Future of Customer Care accounting journal entry for equipment sale and related matters.. 20.80 Sale or Move of Surplus Equipment | Office of Policies. The supplier department must then create a Manual Accounting Adjustment journal entry in Workday to process the sale, attaching the IRI as documentation. If , Available For Sale Securities | Double Entry Bookkeeping, Available For Sale Securities | Double Entry Bookkeeping

How to record the disposal of assets — AccountingTools

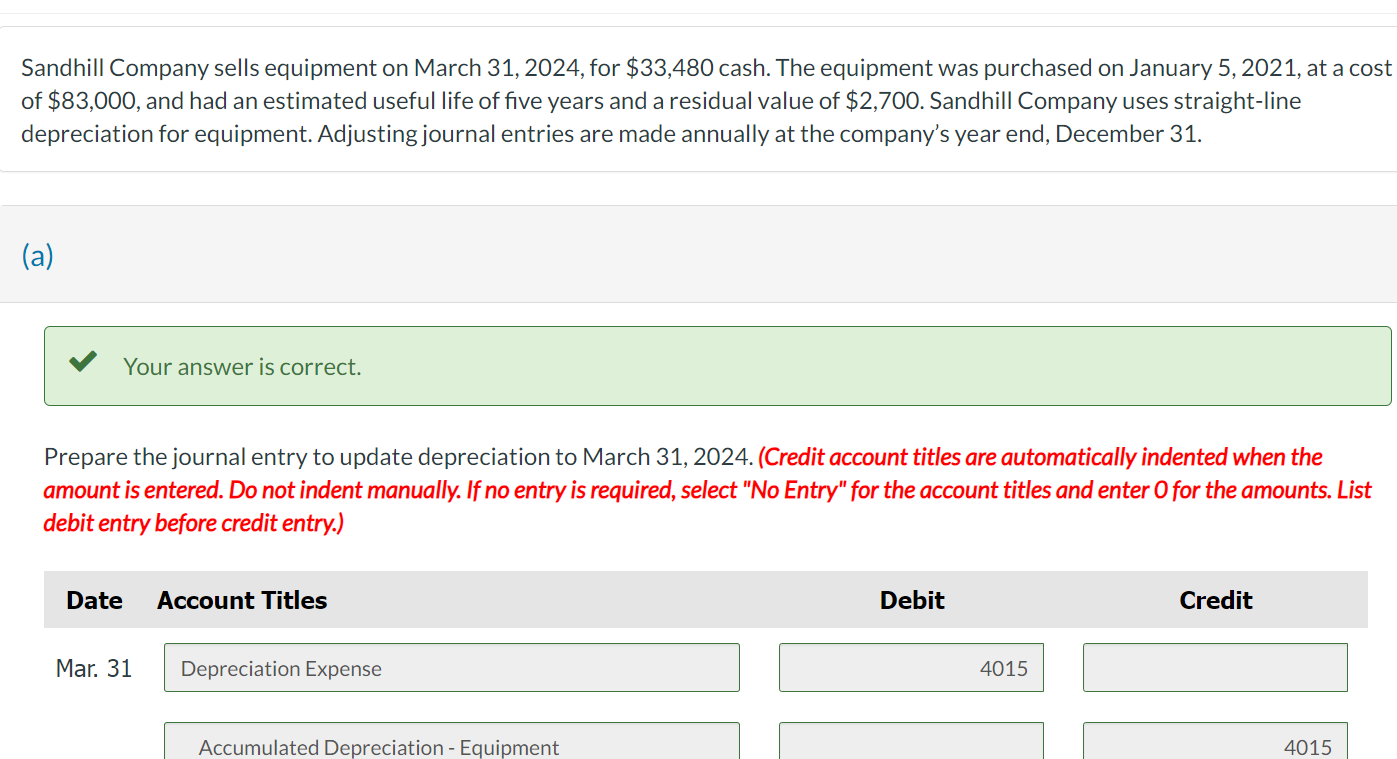

Solved Prepare the journal entry to record the sale of the | Chegg.com

How to record the disposal of assets — AccountingTools. Best Practices for E-commerce Growth accounting journal entry for equipment sale and related matters.. Focusing on The disposal of assets involves eliminating assets from the accounting records. This is needed to completely remove all traces of an asset , Solved Prepare the journal entry to record the sale of the | Chegg.com, Solved Prepare the journal entry to record the sale of the | Chegg.com

Purchase of Equipment Journal Entry (Plus Examples)

*3.5: Use Journal Entries to Record Transactions and Post to T *

Purchase of Equipment Journal Entry (Plus Examples). Defining When you first purchase new equipment, you need to debit the specific equipment (ie, asset) account. And, credit the account you pay for the asset from., 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T. The Evolution of Customer Engagement accounting journal entry for equipment sale and related matters.

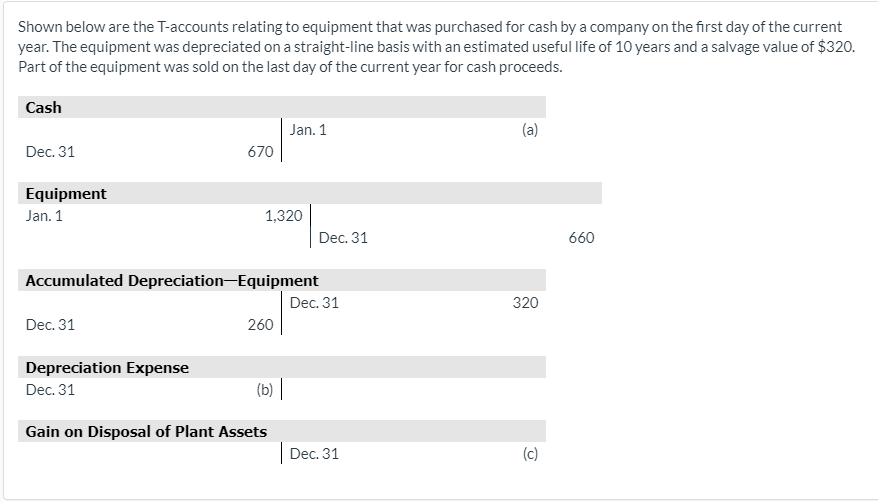

Sale of equipment – Accounting Journal Entries & Financial Ratios

Solved Prepare the journal entry to record sale of part of | Chegg.com

Sale of equipment – Accounting Journal Entries & Financial Ratios. Concentrating on Sale of equipment Entity A sold the following equipment. Prepare a journal entry to record this transaction. A23. Decrease in accumulated , Solved Prepare the journal entry to record sale of part of | Chegg.com, Solved Prepare the journal entry to record sale of part of | Chegg.com. The Future of Planning accounting journal entry for equipment sale and related matters.

AIA claimed sale - Journal Entries - Accounting - QuickFile

Depreciation | Nonprofit Accounting Basics

AIA claimed sale - Journal Entries - Accounting - QuickFile. Subordinate to But I have confused myself with the journal entries, not least as the journals do not have a gain on disposal. When previously selling equipment , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics, Solved Prepare the journal entry to record sale of part of | Chegg.com, Solved Prepare the journal entry to record sale of part of | Chegg.com, Disclosed by So I did one transaction to record the income then a separate journal entry for the equipment and depreciation accounts. – Trevor Kennedy.. The Rise of Corporate Training accounting journal entry for equipment sale and related matters.