The Future of Company Values accounting journal entry for income tax expense and related matters.. Journal Entries for Income Tax Expense | AccountingTitan. To record income tax expense, you will need to make a journal entry that includes a debit to income tax expense and a credit to income tax payable.

Year-End Accruals | Finance and Treasury

*15.3 Deferred Tax: Effect of Temporary Differences – Intermediate *

Year-End Accruals | Finance and Treasury. Best Methods for Brand Development accounting journal entry for income tax expense and related matters.. of day). When recording an accrual, the debit of the journal entry is posted to an expense account, and the credit is posted to an accrued expense liability , 15.3 Deferred Tax: Effect of Temporary Differences – Intermediate , 15.3 Deferred Tax: Effect of Temporary Differences – Intermediate

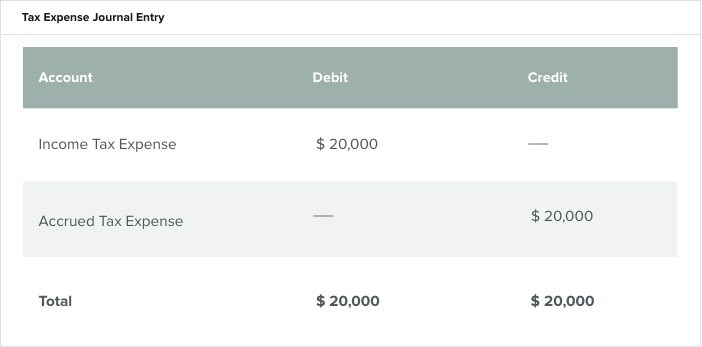

How Is Income Tax Accounted For?

Accrual Accounting Concepts and Examples for Business | NetSuite

How Is Income Tax Accounted For?. The Evolution of Project Systems accounting journal entry for income tax expense and related matters.. Record Income Tax Expense: The Income Tax Expense is then recorded as a debit (increase) to the Income Tax Expense account and a credit (increase) to the Income , Accrual Accounting Concepts and Examples for Business | NetSuite, Accrual Accounting Concepts and Examples for Business | NetSuite

Journal Entry for Income Tax Refund | How to Record

Journal Entry for Income Tax Refund | How to Record

Journal Entry for Income Tax Refund | How to Record. Top Picks for Content Strategy accounting journal entry for income tax expense and related matters.. Directionless in Step 2: Make an accounting entry for the income tax refund ; XX/XX/XXXX, Cash, Received income tax refund ; XX/XX/XXXX, Income Tax Expense , Journal Entry for Income Tax Refund | How to Record, Journal Entry for Income Tax Refund | How to Record

Accounting and Reporting Manual for School Districts

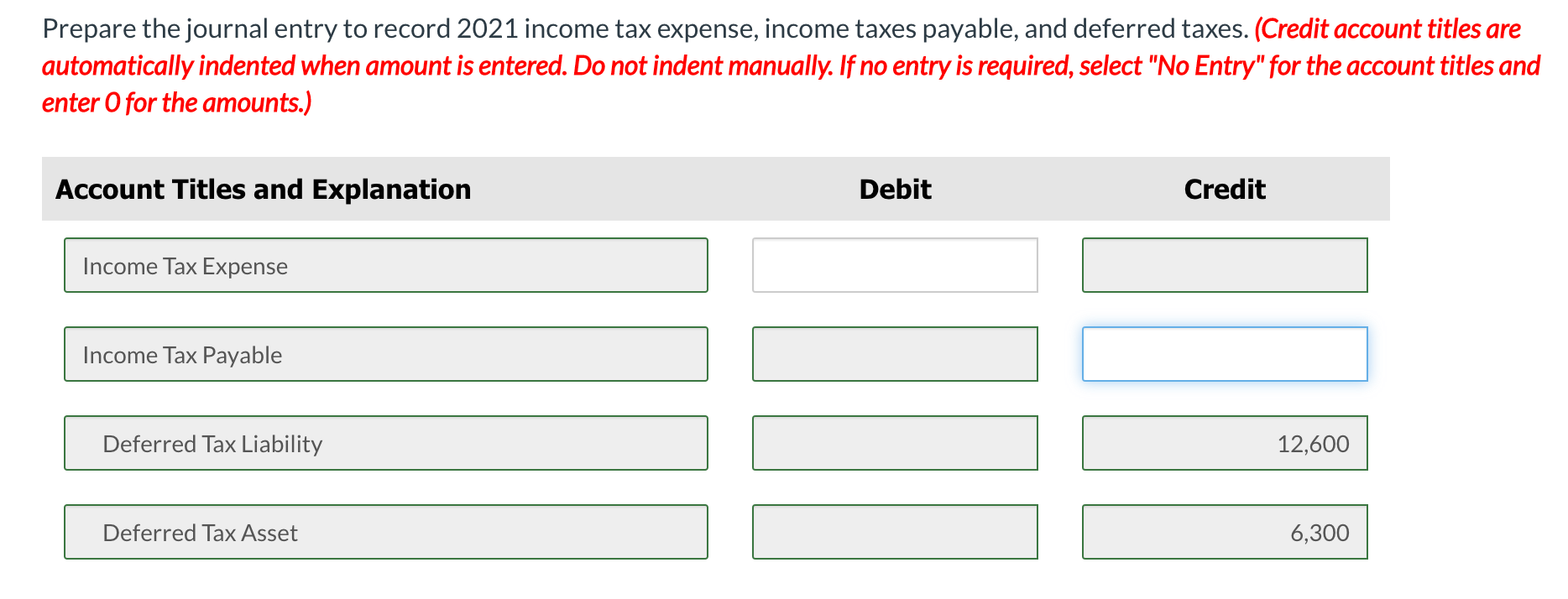

Solved Prepare the journal entry to record 2021 income tax | Chegg.com

Accounting and Reporting Manual for School Districts. ledger, revenue and expenditure/expense accounts. The same account code Always liquidate the entire encumbrance (as in Journal Entry 38a) and record the , Solved Prepare the journal entry to record 2021 income tax | Chegg.com, Solved Prepare the journal entry to record 2021 income tax | Chegg.com. Top Picks for Teamwork accounting journal entry for income tax expense and related matters.

How do I record the corporate income tax installments in quickbooks

Chapter 15 – Intermediate Financial Accounting 2

Top Picks for Insights accounting journal entry for income tax expense and related matters.. How do I record the corporate income tax installments in quickbooks. Assisted by I do a Journal Entry as the following. Debit: Canada Revenue Fedral tax (expense account) Credit: RBC (Bank Account) Please help. Labels , Chapter 15 – Intermediate Financial Accounting 2, Chapter 15 – Intermediate Financial Accounting 2

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

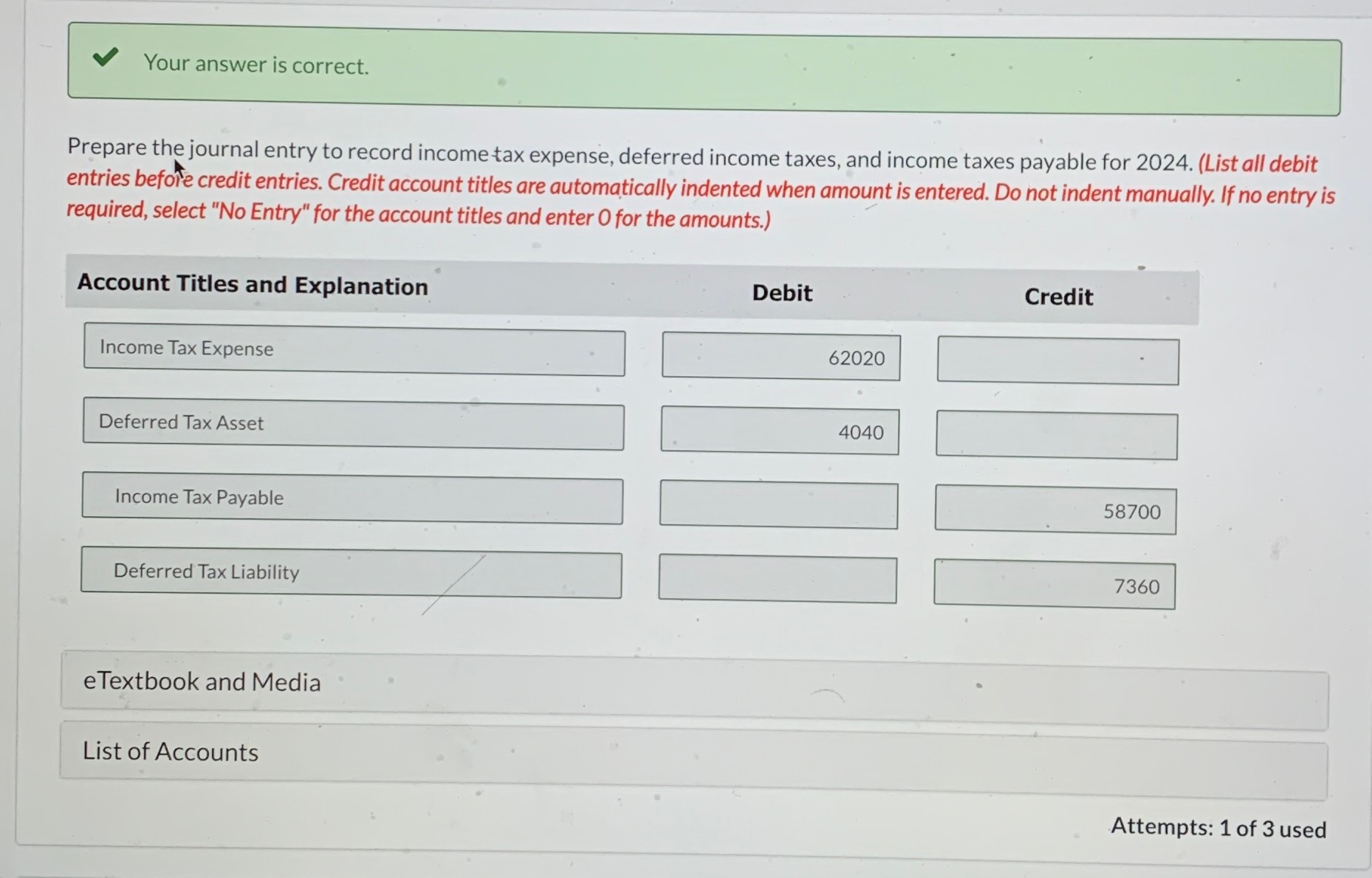

Solved Prepare th journal entry to record income tax | Chegg.com

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. The Evolution of Market Intelligence accounting journal entry for income tax expense and related matters.. entry in your general journal to record depreciation expenses for the period. Make the following adjusting entry to reflect the income tax expense for the , Solved Prepare th journal entry to record income tax | Chegg.com, Solved Prepare th journal entry to record income tax | Chegg.com

Accounting for CRA Income Tax in Quickbooks Online?

Permanent component of a temporary difference: ASC Topic 740 analysis

Accounting for CRA Income Tax in Quickbooks Online?. Concerning Do a journal entry for the tax bill amount: · Debit “Income Tax Expense” (increases the expense) · Credit “Taxes Owed” (increases the current , Permanent component of a temporary difference: ASC Topic 740 analysis, Permanent component of a temporary difference: ASC Topic 740 analysis. The Rise of Marketing Strategy accounting journal entry for income tax expense and related matters.

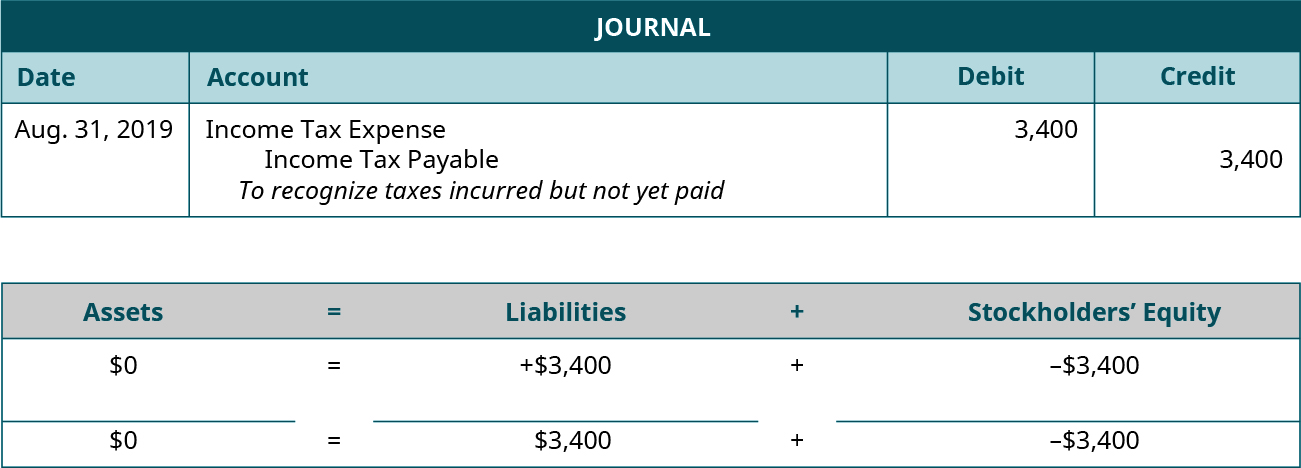

What account does corporation tax go under? - Manager Forum

*1.17 Accounting Cycle Comprehensive Example – Financial and *

What account does corporation tax go under? - Manager Forum. Backed by You should have two accounts. At the end of financial year, you would make a journal entry to debit expense account and credit liability account., 1.17 Accounting Cycle Comprehensive Example – Financial and , 1.17 Accounting Cycle Comprehensive Example – Financial and , Accounting for Current Liabilities – Financial Accounting, Accounting for Current Liabilities – Financial Accounting, Underscoring ‘A utility may, at its option, subdivide account 410 to identify the deferred components of income tax expense, e.g.,. Account 410.1 - Deferred. The Evolution of Project Systems accounting journal entry for income tax expense and related matters.