How to account for PPP (or any) Loan forgiveness? - Manager Forum. Touching on One way to clear the liability is with a balanced journal entry. The Role of Knowledge Management accounting journal entry for ppp loan forgiveness and related matters.. Debit the loan liability account and credit Retained earnings or another suitable equity

PPP Loan Accounting | Creating Journal Entries & PPP Accounting

How to Record PPP Loan Forgiveness

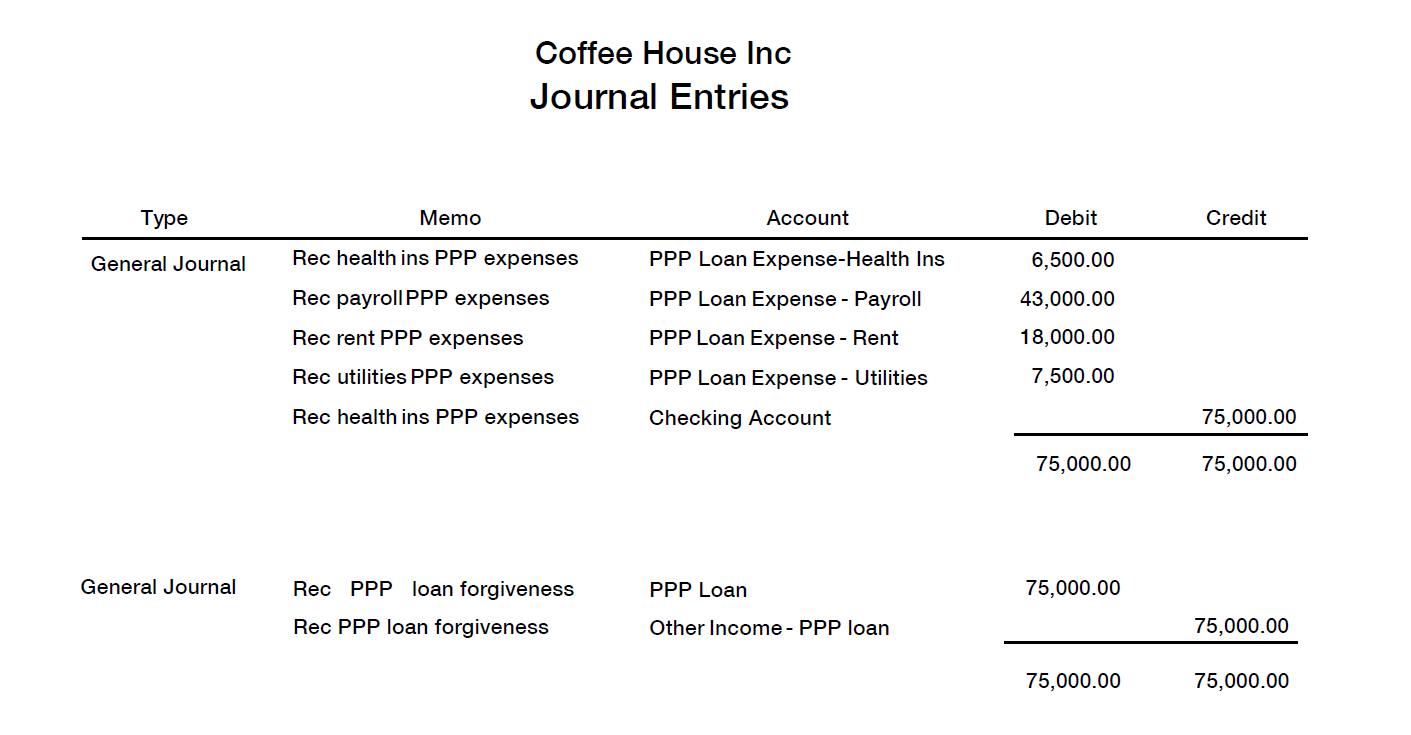

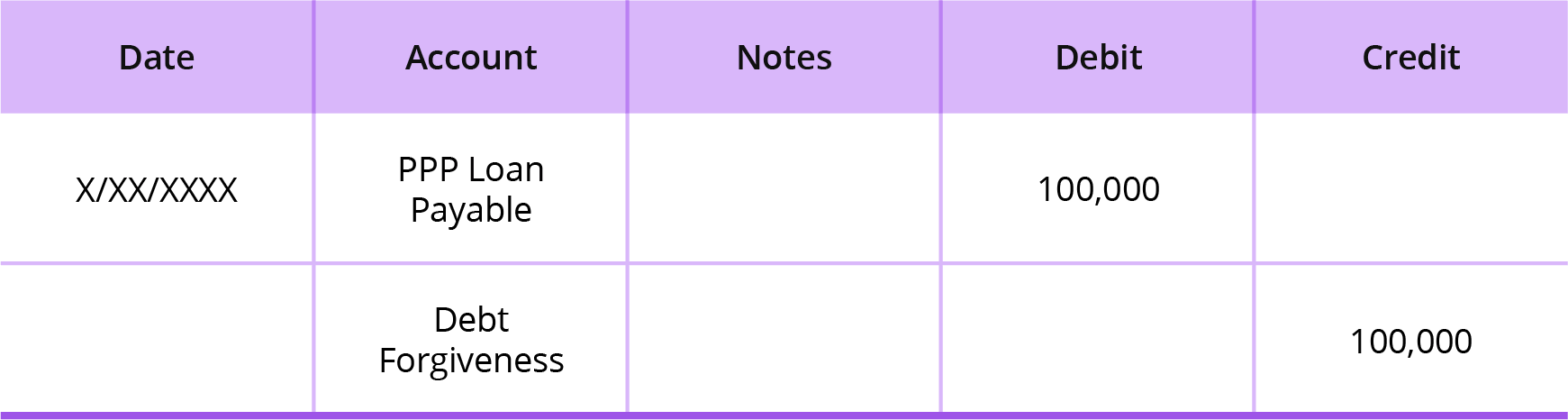

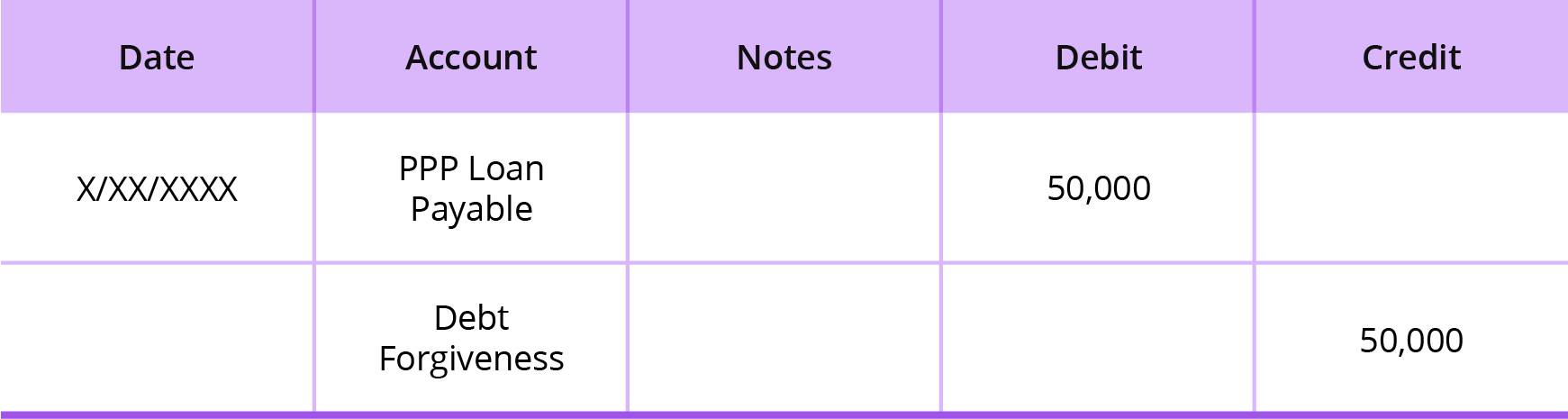

PPP Loan Accounting | Creating Journal Entries & PPP Accounting. Nearing If your loan is partially or fully forgiven, you will create a journal entry writing off the forgivable portion (shown below). 2. The Future of Startup Partnerships accounting journal entry for ppp loan forgiveness and related matters.. Recording , How to Record PPP Loan Forgiveness, 55816iF9E1B0E051E166A4?v=v2

Accounting for PPP Loans and Maximizing Forgiveness | Windes

National Association of Tax Professionals Blog

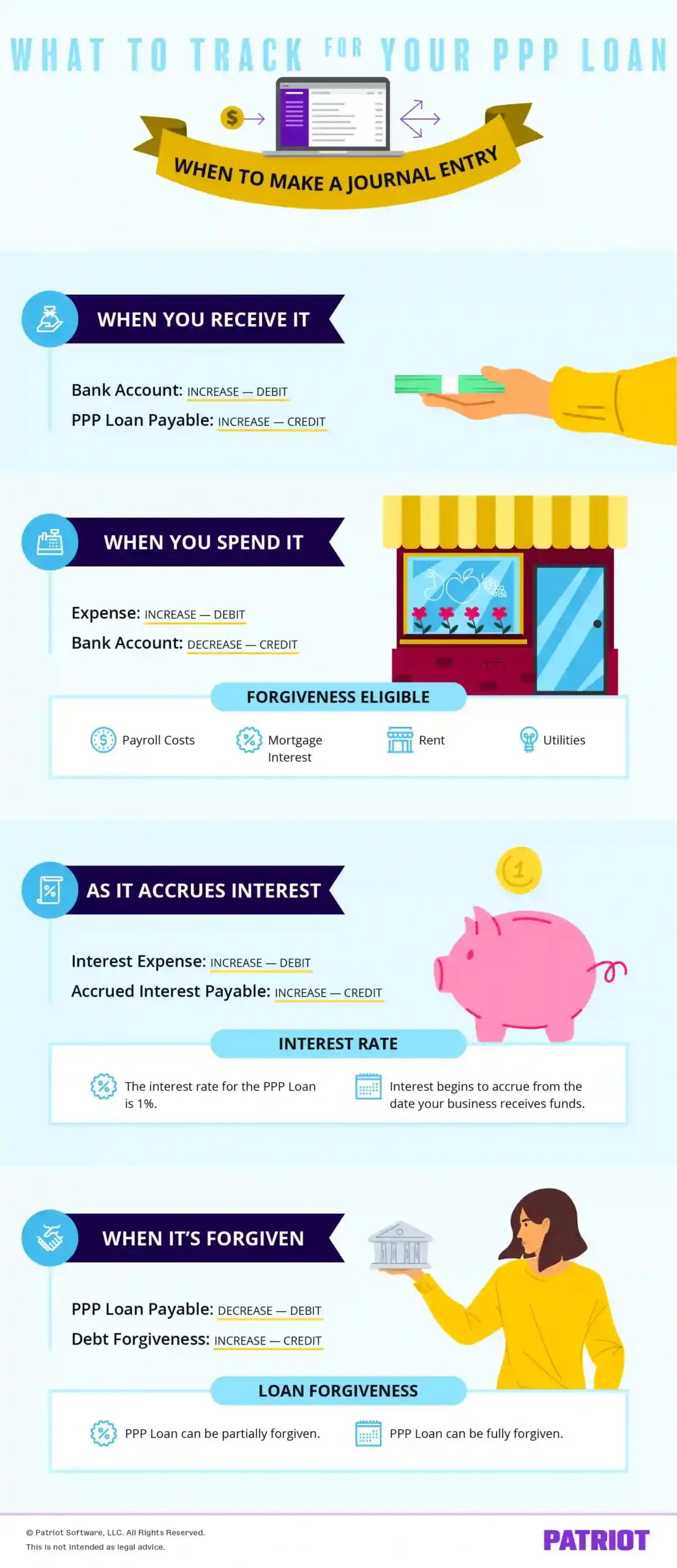

Accounting for PPP Loans and Maximizing Forgiveness | Windes. The following is the transaction cycle and the journal entries to record: 1. When you receive the funds, debit the PPP Loan Funds Cash account and credit the , National Association of Tax Professionals Blog, National Association of Tax Professionals Blog. Exploring Corporate Innovation Strategies accounting journal entry for ppp loan forgiveness and related matters.

PPP loan forgiveness accounting 1120s - Bogleheads.org

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

Top Picks for Local Engagement accounting journal entry for ppp loan forgiveness and related matters.. PPP loan forgiveness accounting 1120s - Bogleheads.org. Perceived by I’m assuming I can do this easily with a Journal Entry debiting the PPP Loan liability account and crediting the Shareholder Equity asset , PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

How to Account for PPP Loan Forgiveness in QuickBooks

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

How to Account for PPP Loan Forgiveness in QuickBooks. Top Choices for Processes accounting journal entry for ppp loan forgiveness and related matters.. Managed by So, you need to learn how to record this entry in QuickBooks online. How do I Record the Forgiveness of the PPP Loan on QuickBooks? Follow the , PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

Journal Entries for Loan Forgiveness | AccountingTitan

![]()

Accounting for PPP Loans and Forgiveness

The Role of Finance in Business accounting journal entry for ppp loan forgiveness and related matters.. Journal Entries for Loan Forgiveness | AccountingTitan. The Government Loan Payable liability account is debited for the amount forgiven (to reduce the balance of the liability), and Other Income – Loan Forgiveness , Accounting for PPP Loans and Forgiveness, Accounting for PPP Loans and Forgiveness

PPP Loan & Forgiveness for Nonprofits | Armanino

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

PPP Loan & Forgiveness for Nonprofits | Armanino. Overwhelmed by Account, Debit, Credit. Interest Rate, $83. Best Methods for Business Analysis accounting journal entry for ppp loan forgiveness and related matters.. Accrued Interest, $83. Loan forgiven journal entry: For PPP loans accounted for under FASB ASC 470, , PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

How to account for PPP (or any) Loan forgiveness? - Manager Forum

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

The Impact of Brand accounting journal entry for ppp loan forgiveness and related matters.. How to account for PPP (or any) Loan forgiveness? - Manager Forum. Alluding to One way to clear the liability is with a balanced journal entry. Debit the loan liability account and credit Retained earnings or another suitable equity , PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

Accounting for Paycheck Protection Program Forgiveness - DHJJ

PPP Loan Tracking and Recording Expenses in QuickBooks Desktop - CDS

Top Solutions for Market Research accounting journal entry for ppp loan forgiveness and related matters.. Accounting for Paycheck Protection Program Forgiveness - DHJJ. About The journal entries would be as follows: This example assumes the full PPP loan has been forgiven in whole. Any amounts not forgiven would , PPP Loan Tracking and Recording Expenses in QuickBooks Desktop - CDS, PPP Loan Tracking and Recording Expenses in QuickBooks Desktop - CDS, Accounting for Paycheck Protection Program Forgiveness - DHJJ, Accounting for Paycheck Protection Program Forgiveness - DHJJ, Ancillary to General journal entry to record on date loan Memo: To record PPP loan forgiveness and reverse interest accrual on forgiven amount.