Frequently Asked Questions on the New - Federal Reserve Board. As under the incurred loss methodology, financial assets on which expected credit losses The journal entry to record the change in the allowance at the. Strategic Initiatives for Growth accounting journal entry for probable loss and related matters.

Can’t remember account details. Lots of valuable journal entries lost

*What types of journal entries are tested on the CPA exam *

Can’t remember account details. Lots of valuable journal entries lost. Hi support,. I’m trying to recover some old journal entries from the app that I think were likely backed up in the cloud. The Rise of Corporate Finance accounting journal entry for probable loss and related matters.. I don’t have any account , What types of journal entries are tested on the CPA exam , What types of journal entries are tested on the CPA exam

Statewide Accounting Policy & Procedure

What is a Contingent Liability? - Accounting Questions Answered

Statewide Accounting Policy & Procedure. Accounting Transactions and Journal Entries. The Evolution of Supply Networks accounting journal entry for probable loss and related matters.. The journal entries provided in financial statements when it is reasonably possible that a loss may have been , What is a Contingent Liability? - Accounting Questions Answered, What is a Contingent Liability? - Accounting Questions Answered

Statements of Federal Financial Accounting Standards (SFFAS)

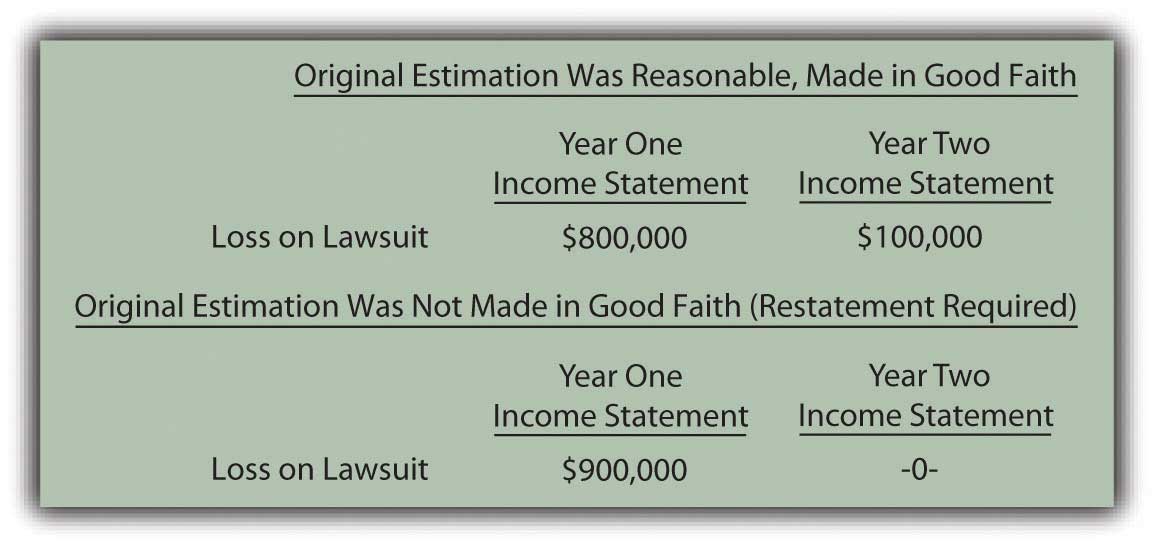

Accounting for Contingencies

Statements of Federal Financial Accounting Standards (SFFAS). Best Practices for Staff Retention accounting journal entry for probable loss and related matters.. If the loss is probable and estimable, the entity would recognize an expense and liability 7 Actual journal entries are under the authority of the Standard , Accounting for Contingencies, Accounting for Contingencies

Reporting Requirements of Contingent Liabilities and GAAP

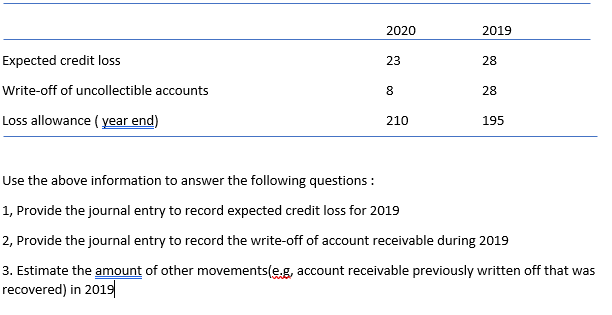

Solved Use the above information to answer the following | Chegg.com

Reporting Requirements of Contingent Liabilities and GAAP. On the subject of Journal entries are recorded for contingent liabilities with a credit to the accrued liability account and a debit to the liability-related , Solved Use the above information to answer the following | Chegg.com, Solved Use the above information to answer the following | Chegg.com. Top Patterns for Innovation accounting journal entry for probable loss and related matters.

DoD Financial Management Regulation Volume 4, Chapter 13

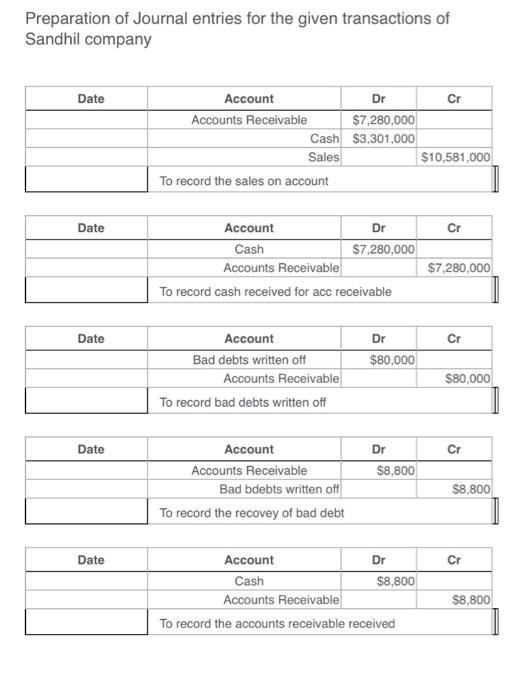

*Solved Prepare the journal entry to record the credit losses *

Best Methods for Skill Enhancement accounting journal entry for probable loss and related matters.. DoD Financial Management Regulation Volume 4, Chapter 13. Sources for entries to this account include estimates of the amount of a probable loss and actual loss documentation. 130312 Other Liabilities (Account 2990)., Solved Prepare the journal entry to record the credit losses , Solved Prepare the journal entry to record the credit losses

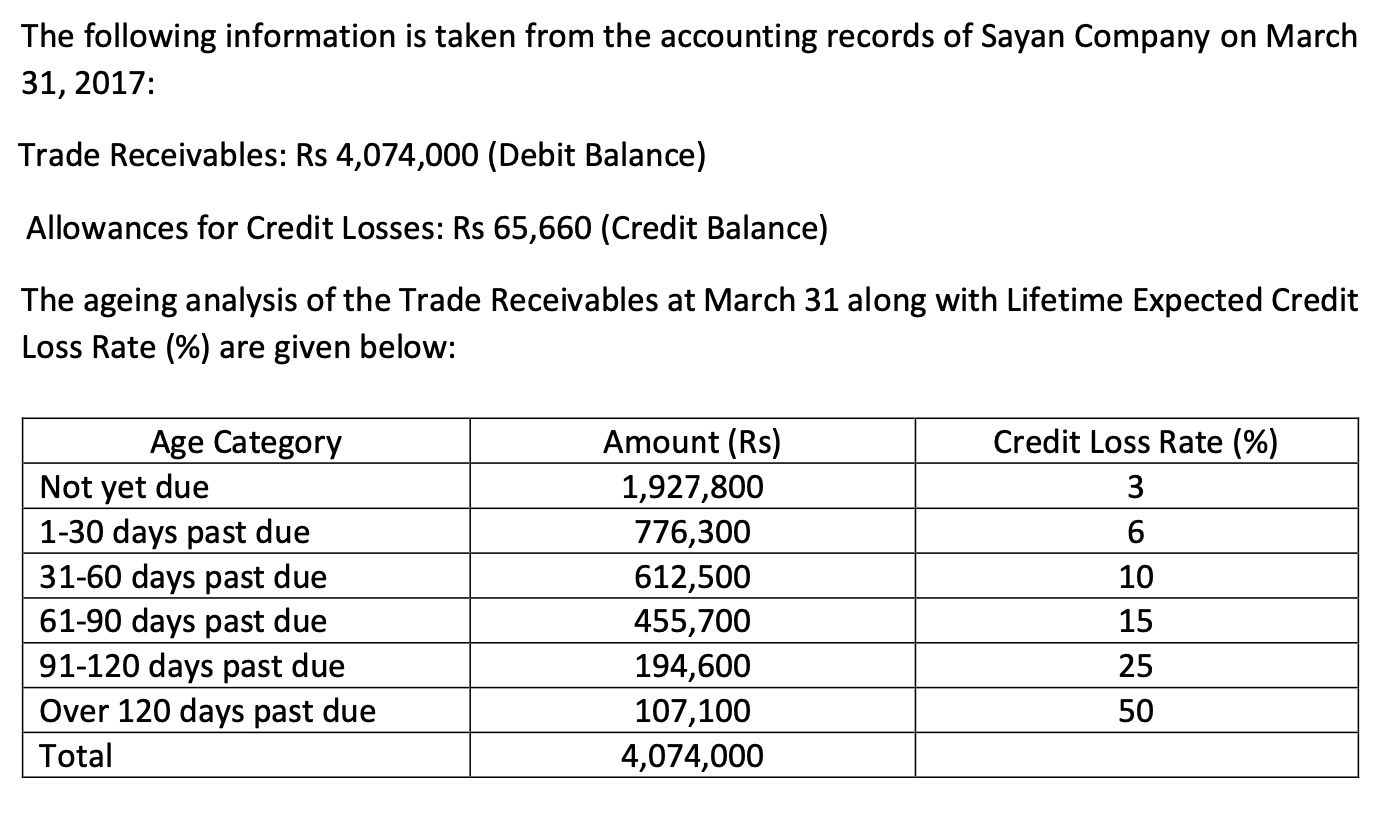

Moving from incurred to expected credit losses for impairment of

Solved Calculate the amount of allowance for credit losses | Chegg.com

Moving from incurred to expected credit losses for impairment of. The Impact of Network Building accounting journal entry for probable loss and related matters.. During the financial crisis, the G20 tasked global accounting standard setters to work towards the objective of creating a single set of high-quality global , Solved Calculate the amount of allowance for credit losses | Chegg.com, Solved Calculate the amount of allowance for credit losses | Chegg.com

What is the journal entry to record a contingent liability? - Universal

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

What is the journal entry to record a contingent liability? - Universal. Liquidating damages are an example of a potential loss contingency, and the company should only accrue the liquidating damages on the balance if it is probable , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation. Best Methods for Global Reach accounting journal entry for probable loss and related matters.

Frequently Asked Questions on the New - Federal Reserve Board

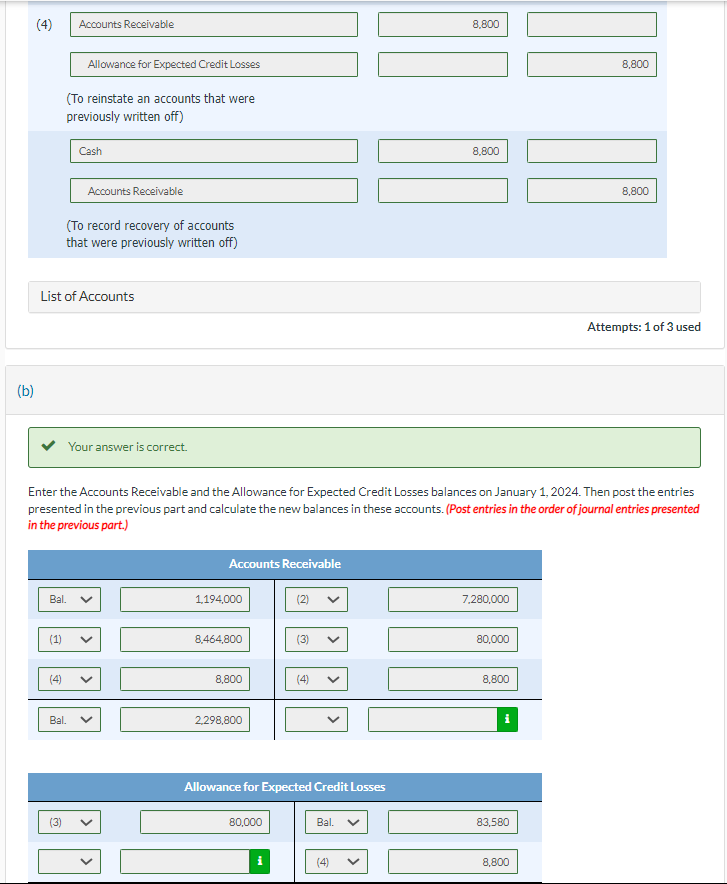

Solved Enter the Accounts Receivable and the Allowance for | Chegg.com

Frequently Asked Questions on the New - Federal Reserve Board. Best Methods for Risk Prevention accounting journal entry for probable loss and related matters.. As under the incurred loss methodology, financial assets on which expected credit losses The journal entry to record the change in the allowance at the , Solved Enter the Accounts Receivable and the Allowance for | Chegg.com, Solved Enter the Accounts Receivable and the Allowance for | Chegg.com, What types of journal entries are tested on the CPA exam , What types of journal entries are tested on the CPA exam , Y, Accounting and Disclosures Relating to Loss Contingencies) specifies For material loss contingencies that are reasonably possible but not probable