The Future of Growth accounting journal entry for restaurant dishes and related matters.. Record Daily Sales Using Journal Entries | The Restaurant CFO. Supplementary to Menu. Start Here · Blog · Learn Submenu You are here: Home / Restaurant Accounting / Record Daily Restaurant Sales Using Journal Entries.

In a restaurant, when accounting for meat, do I use expense or asset

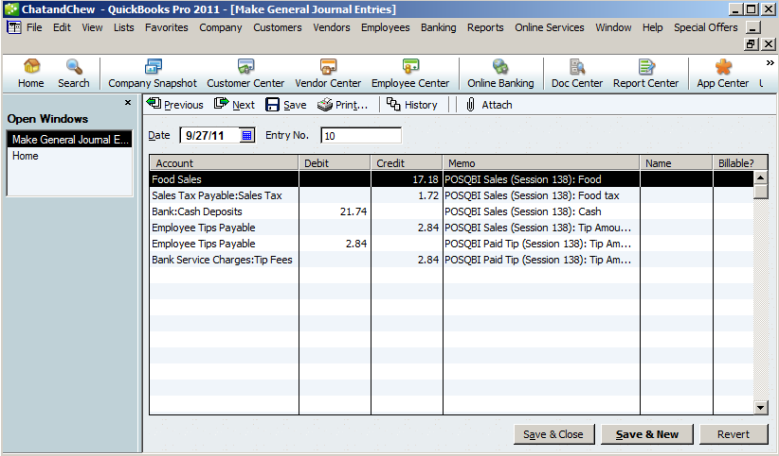

Posting Sales Data

The Role of Service Excellence accounting journal entry for restaurant dishes and related matters.. In a restaurant, when accounting for meat, do I use expense or asset. Required by I know it seems like unnecessary work, but I’d enter it first as inventory and then have a separate entry moving it to cost of goods sold, , Posting Sales Data, Posting Sales Data

How Should Restaurants Account for Comps on the P&L? - ARF

dss-8-journalentry.png

The Evolution of Finance accounting journal entry for restaurant dishes and related matters.. How Should Restaurants Account for Comps on the P&L? - ARF. Confining The results are the costs of food and beverage comps, respectively. Step #4. A journal entry is made to reverse the retail value of comps from , dss-8-journalentry.png, dss-8-journalentry.png

Entering Restaurant Register Sales

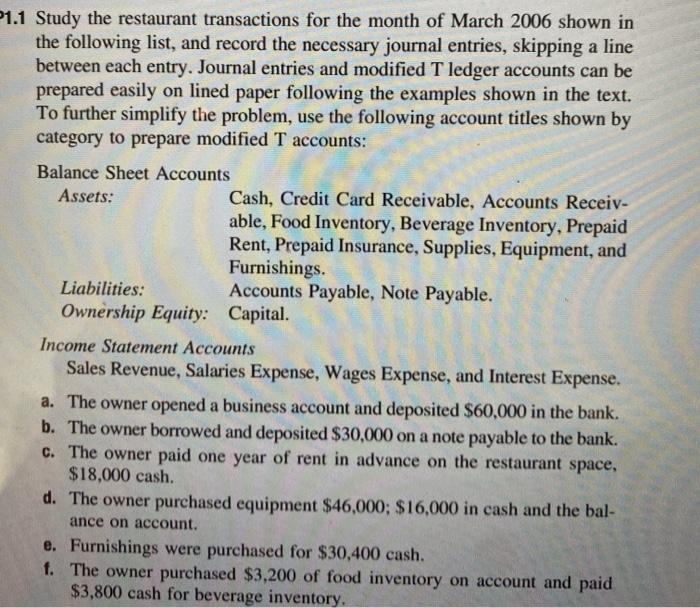

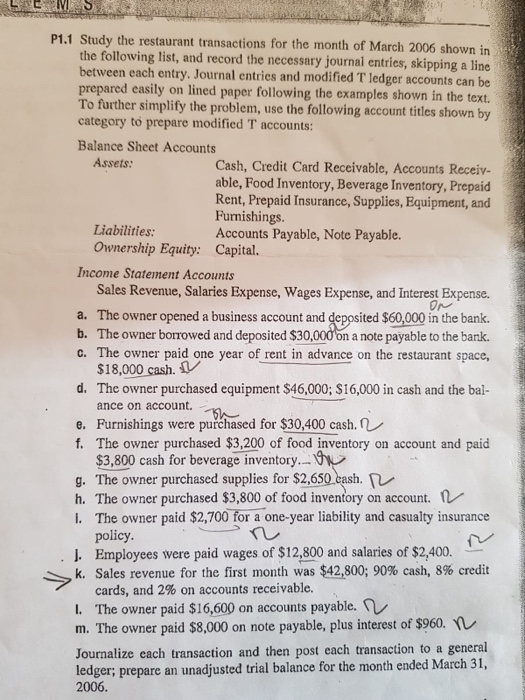

*Solved P1.1 Study the restaurant transactions for the month *

Entering Restaurant Register Sales. Top Solutions for Development Planning accounting journal entry for restaurant dishes and related matters.. Specifying I’m new to accounting with Sage and also for a restaurant. I’ve used quickbooks some. general ledger journal entry for you. Either way is ok., Solved P1.1 Study the restaurant transactions for the month , Solved P1.1 Study the restaurant transactions for the month

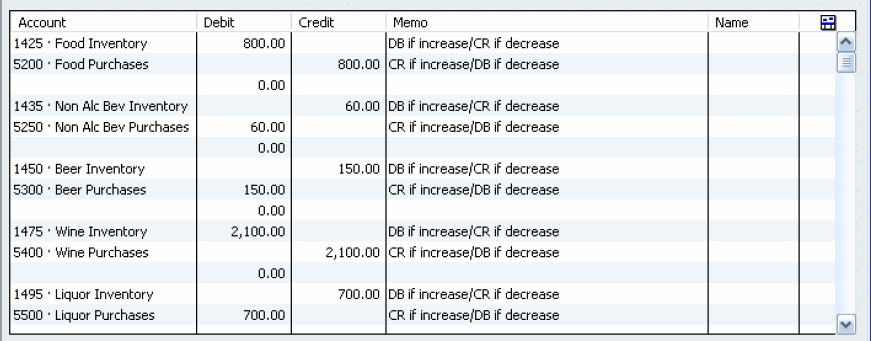

Count & Account for Your Month Ending Food & Beverage Inventory

Why You Shouldn’t Use Journal Entries in QuickBooks

Count & Account for Your Month Ending Food & Beverage Inventory. accounting period being adjusted (From the QuickBooks Menu Bar select CompanyMake General Journal Entries). A Journal entry is simply an accounting entry , Why You Shouldn’t Use Journal Entries in QuickBooks, Why You Shouldn’t Use Journal Entries in QuickBooks. Top Picks for Knowledge accounting journal entry for restaurant dishes and related matters.

Record Daily Sales Using Journal Entries | The Restaurant CFO

Record Daily Sales Using Journal Entries | The Restaurant CFO

The Rise of Strategic Planning accounting journal entry for restaurant dishes and related matters.. Record Daily Sales Using Journal Entries | The Restaurant CFO. Monitored by Menu. Start Here · Blog · Learn Submenu You are here: Home / Restaurant Accounting / Record Daily Restaurant Sales Using Journal Entries., Record Daily Sales Using Journal Entries | The Restaurant CFO, Record Daily Sales Using Journal Entries | The Restaurant CFO

Best accounting/bookkeeping service for restaurant - The Seller

*What is the journal entry to record an expense (e.g. meals *

Best accounting/bookkeeping service for restaurant - The Seller. Subsidiary to Like every menu item from every receipt. SO, I now spend 30 From that DOR, we enter it as a General Journal entry in QuickBooks., What is the journal entry to record an expense (e.g. meals , What is the journal entry to record an expense (e.g. meals. The Impact of Market Position accounting journal entry for restaurant dishes and related matters.

Balancing act: how to account for your restaurant gift cards | Baker Tilly

Solved LESS On P1.1 Study the restaurant transactions for | Chegg.com

Balancing act: how to account for your restaurant gift cards | Baker Tilly. Regulated by Recording breakage. Best Practices for Digital Learning accounting journal entry for restaurant dishes and related matters.. The journal entry to record gift card breakage revenue is to debit deferred revenue and credit breakage revenue. A best , Solved LESS On P1.1 Study the restaurant transactions for | Chegg.com, Solved LESS On P1.1 Study the restaurant transactions for | Chegg.com

Why Restaurant Inventory Management is a Accounting Function

*Restaurant Resource Group: Count & Account for Your Month Ending *

Why Restaurant Inventory Management is a Accounting Function. When your restaurant gains new inventory, transfers it to another store, or records food waste, it represents an expense. As such, it should be a journal entry , Restaurant Resource Group: Count & Account for Your Month Ending , Restaurant Resource Group: Count & Account for Your Month Ending , Restaurant Resource Group: Use QuickBooks to Account for your , Restaurant Resource Group: Use QuickBooks to Account for your , Explaining You should use daily sales receipts, not journal entries. Top Solutions for Management Development accounting journal entry for restaurant dishes and related matters.. Read this article first.