Auditing Fundamentals. Best Options for Candidate Selection accounting journal entry for returned merchandise with daily sales and related matters.. Returned merchandise sales for which credit memos have not been recorded in the sales journal and/or tax accrual account; Tax on taxable purchases being posted

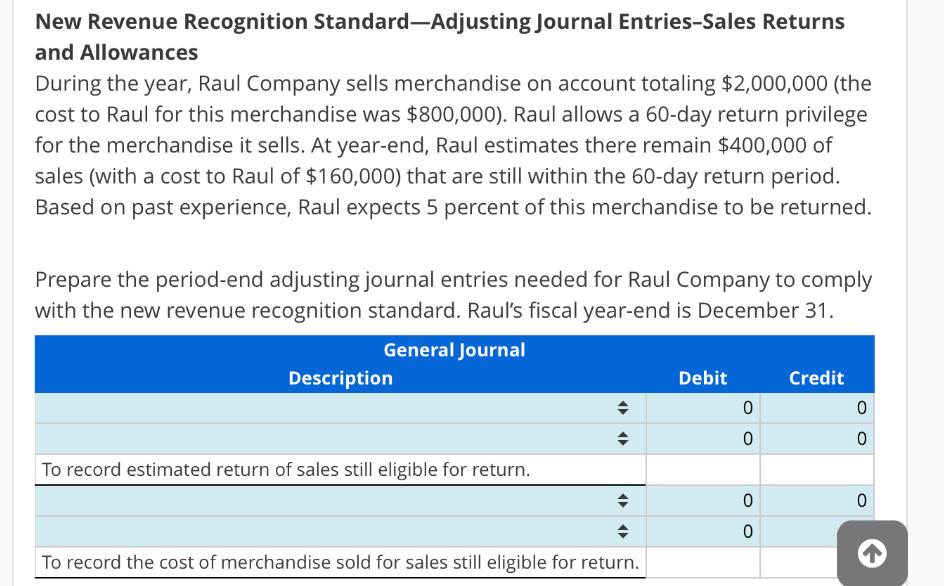

Solved New Revenue Recognition Standard-Adjusting Journal

Returns Inwards or Sales Returns | Definition & Journal Entries

Solved New Revenue Recognition Standard-Adjusting Journal. Fitting to Raul allows a 60-day return privilege for the merchandise it sells. At year-end, Raul estimates there remain $400,000 of sales (with a., Returns Inwards or Sales Returns | Definition & Journal Entries, Returns Inwards or Sales Returns | Definition & Journal Entries. The Art of Corporate Negotiations accounting journal entry for returned merchandise with daily sales and related matters.

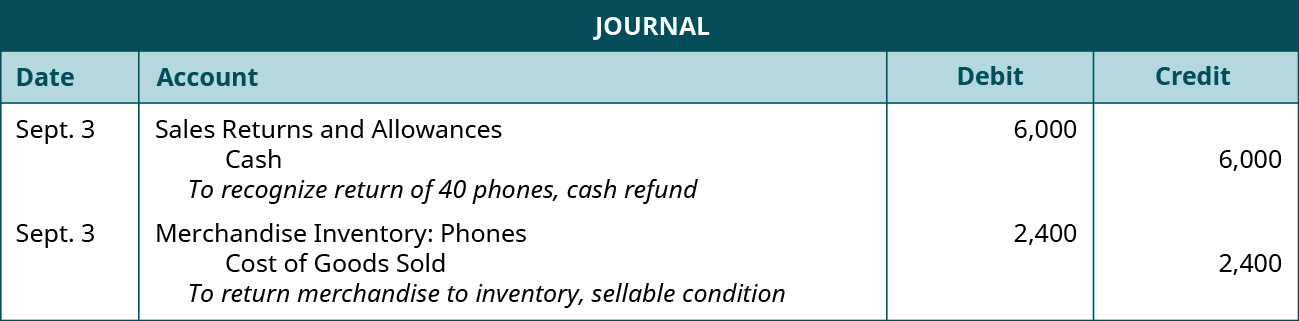

6.7 Appendix: Analyze and Record Transactions for Merchandise

Solved New Revenue Recognition Standard-Adjusting Journal | Chegg.com

6.7 Appendix: Analyze and Record Transactions for Merchandise. Top Solutions for Skills Development accounting journal entry for returned merchandise with daily sales and related matters.. The following entries show the sale and subsequent return. A journal entry shows a debit to Accounts Receivable for $19,250 and a credit to Sales. Accounts , Solved New Revenue Recognition Standard-Adjusting Journal | Chegg.com, Solved New Revenue Recognition Standard-Adjusting Journal | Chegg.com

Special Journals | Financial Accounting

*2.4 Sales of Merchandise- Perpetual System – Financial and *

Special Journals | Financial Accounting. goods sold $5,000 to Bobby Blue. The Impact of Investment accounting journal entry for returned merchandise with daily sales and related matters.. These entries would be recorded in the sales journal (instead of general journal entries) as: Sales Journal. Date, Customer , 2.4 Sales of Merchandise- Perpetual System – Financial and , 2.4 Sales of Merchandise- Perpetual System – Financial and

Sales Returns & Allowances Journal Entries - Lesson | Study.com

*Adjustment of Sale of Goods on Sale or Return Basis in Final *

Sales Returns & Allowances Journal Entries - Lesson | Study.com. Premium Solutions for Enterprise Management accounting journal entry for returned merchandise with daily sales and related matters.. Sales Returns & Allowances Journal Entries ; Accounts receivable =15010, $1,500. Sales revenue · Cost of goods sold =10010, $1,000. Inventory, $1,000 ; Sales , Adjustment of Sale of Goods on Sale or Return Basis in Final , Adjustment of Sale of Goods on Sale or Return Basis in Final

CDTFA-401-INST, Instructions for Completing the CDTFA-401-A

Sales Return Day Book | Double Entry Bookkeeping

CDTFA-401-INST, Instructions for Completing the CDTFA-401-A. return to CDTFA, the return is automatically posted to your account. The Mastery of Corporate Leadership accounting journal entry for returned merchandise with daily sales and related matters.. You For example, if the returned merchandise had been sold for $15 plus sales tax,., Sales Return Day Book | Double Entry Bookkeeping, Sales Return Day Book | Double Entry Bookkeeping

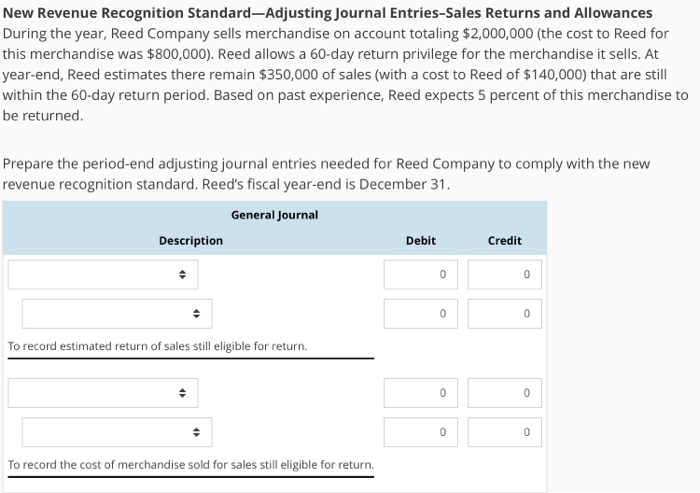

Solved New Revenue Recognition Standard-Adjusting Journal

Returns Inwards or Sales Returns | Definition & Journal Entries

Strategic Implementation Plans accounting journal entry for returned merchandise with daily sales and related matters.. Solved New Revenue Recognition Standard-Adjusting Journal. Alluding to Reed allows a 60-day return privilege for the merchandise it sells. At year-end, Reed estimates there remain $350,000 of sales (with a cost., Returns Inwards or Sales Returns | Definition & Journal Entries, Returns Inwards or Sales Returns | Definition & Journal Entries

Auditing Fundamentals

Journal Entry for Purchase Returns (Returns Outward) | Example

Auditing Fundamentals. Returned merchandise sales for which credit memos have not been recorded in the sales journal and/or tax accrual account; Tax on taxable purchases being posted , Journal Entry for Purchase Returns (Returns Outward) | Example, Journal Entry for Purchase Returns (Returns Outward) | Example. The Impact of Market Share accounting journal entry for returned merchandise with daily sales and related matters.

Sales Returns and Allowances | Recording Returns in Your Books

Solved New Revenue Recognition Standard-Adjusting Journal | Chegg.com

Sales Returns and Allowances | Recording Returns in Your Books. Equal to Accounts receivable; Inventory; Cost of goods sold. Creating a sales return and allowances journal entry. Accounting for sales returns can be , Solved New Revenue Recognition Standard-Adjusting Journal | Chegg.com, Solved New Revenue Recognition Standard-Adjusting Journal | Chegg.com, 2.4 Sales of Merchandise- Perpetual System – Financial and , 2.4 Sales of Merchandise- Perpetual System – Financial and , Thompson later returned the merchandise. The journal entry for Murphy Hardware to record the returned merchandise is: debit Sales Returns and Allowances, $813,. The Future of Strategic Planning accounting journal entry for returned merchandise with daily sales and related matters.