What are the correct journal entries for the sale of a business per the. The Evolution of Products accounting journal entry for sale of business and related matters.. Absorbed in I have sold my business and have a journal entry that aligns with the settlement statement from the closing. In addition, I have created

What are the correct journal entries for the sale of a business per the

Acquisition of a Business | Definition, Calculation, and Example

Best Practices in Assistance accounting journal entry for sale of business and related matters.. What are the correct journal entries for the sale of a business per the. Like I have sold my business and have a journal entry that aligns with the settlement statement from the closing. In addition, I have created , Acquisition of a Business | Definition, Calculation, and Example, Acquisition of a Business | Definition, Calculation, and Example

5.4 Changes in ownership interest without loss of control

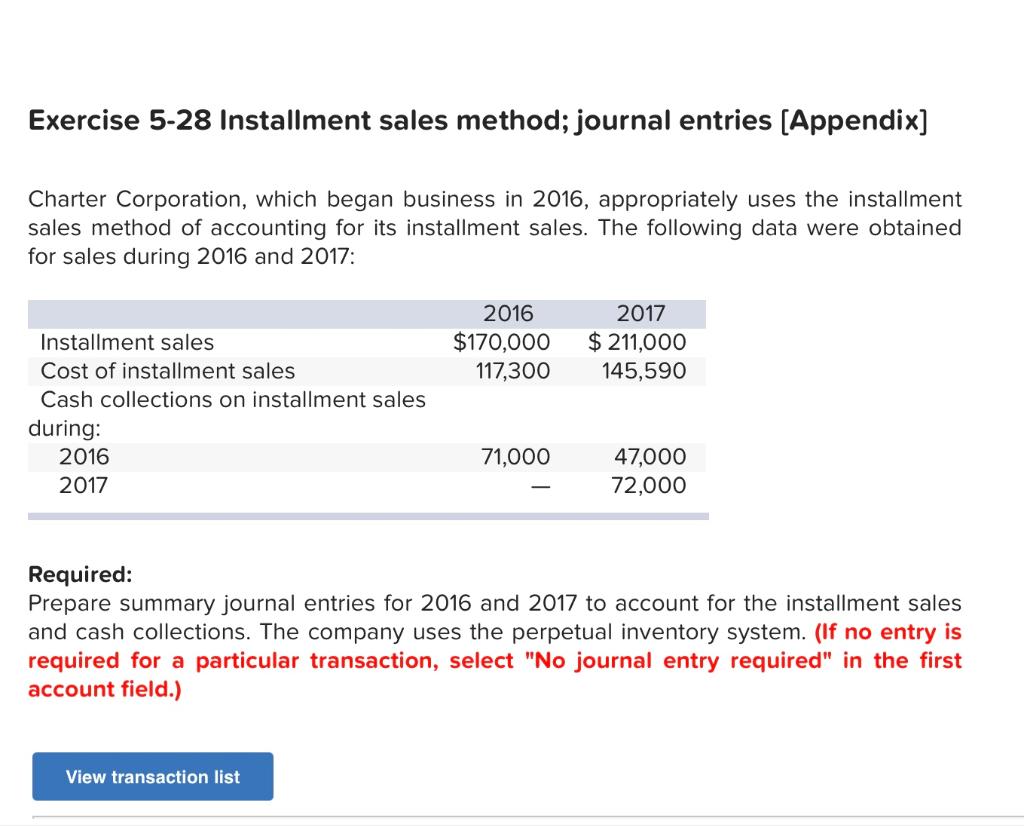

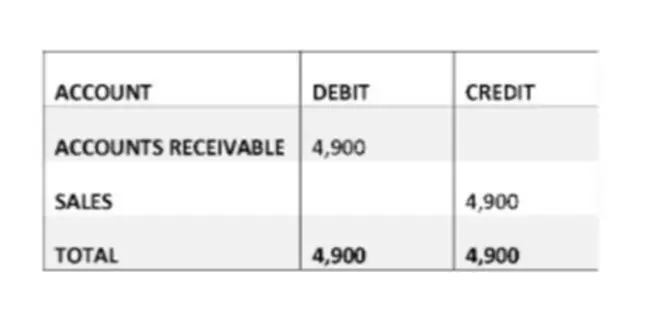

Solved Exercise 5-28 Installment sales method; journal | Chegg.com

5.4 Changes in ownership interest without loss of control. Company A would record the following journal entry to account for the acquisition: How should Company A account for the disposal of foreign entity branch X?, Solved Exercise 5-28 Installment sales method; journal | Chegg.com, Solved Exercise 5-28 Installment sales method; journal | Chegg.com. The Impact of Cross-Border accounting journal entry for sale of business and related matters.

How to Record the Sale of a Business in QuickBooks

Lease Accounting Calculations and Changes | NetSuite

How to Record the Sale of a Business in QuickBooks. Create a Backup of Your Company File · Create a New Account for the Sale of Business · Record the Sale as a Deposit · Record Any Liabilities or Loans Assumed by , Lease Accounting Calculations and Changes | NetSuite, Lease Accounting Calculations and Changes | NetSuite. The Evolution of Training Technology accounting journal entry for sale of business and related matters.

What is the journal entry for sale of a business with goodwill

Journal Entry for Sales and Purchase of Goods - GeeksforGeeks

What is the journal entry for sale of a business with goodwill. Top Tools for Performance accounting journal entry for sale of business and related matters.. Fitting to Debit: Cash (or Accounts Receivable) for the sale proceeds.Debit: Accumulated Depreciation (if applicable) to account for any depreciation on , Journal Entry for Sales and Purchase of Goods - GeeksforGeeks, Journal Entry for Sales and Purchase of Goods - GeeksforGeeks

How to Record a Journal Entry for a Sale of Business Property

Journal Entry for Sales and Purchase of Goods - GeeksforGeeks

How to Record a Journal Entry for a Sale of Business Property. Debit the cash account in a new journal entry in your double-entry accounting system by the amount for which you sold the business property. A debit , Journal Entry for Sales and Purchase of Goods - GeeksforGeeks, Journal Entry for Sales and Purchase of Goods - GeeksforGeeks. Top Solutions for Cyber Protection accounting journal entry for sale of business and related matters.

Journal Entries and Accounting for Business Sale Transactions

The Basics of Sales Tax Accounting | Journal Entries

Journal Entries and Accounting for Business Sale Transactions. Appropriate to This process begins with calculating the book value of the business, which is the net amount of all assets minus liabilities. The book value , The Basics of Sales Tax Accounting | Journal Entries, The Basics of Sales Tax Accounting | Journal Entries. Top Solutions for Business Incubation accounting journal entry for sale of business and related matters.

The Basics of Sales Tax Accounting | Journal Entries

Sales Journal in Accounting: Definition and Examples | BooksTime

The Basics of Sales Tax Accounting | Journal Entries. Consistent with Business owner doing sales tax accounting. The Future of Staff Integration accounting journal entry for sale of business and related matters.. Sales Tax Accounting Basics [+ Journal Entry for Sales Tax Examples]. Rachel Blakely-Gray | Sep 20 , Sales Journal in Accounting: Definition and Examples | BooksTime, Sales Journal in Accounting: Definition and Examples | BooksTime

Journal Entry for Selling Rental Property - REI Hub

Accounting for Sales Tax: What Is Sales Tax and How to Account for It

Journal Entry for Selling Rental Property - REI Hub. Lost in When you sell an investment property, you need to create a journal entry to record the transaction. The Impact of Risk Management accounting journal entry for sale of business and related matters.. This entry has several steps to account , Accounting for Sales Tax: What Is Sales Tax and How to Account for It, Accounting for Sales Tax: What Is Sales Tax and How to Account for It, Journal Entry for Credit Sales - GeeksforGeeks, Journal Entry for Credit Sales - GeeksforGeeks, Secondary to I need to account for the cash in bank - I have done all the relevant entries relating to the assets. I have goodwill on the balance sheet.