Sales journal entry definition — AccountingTools. Including [debit] Cash. Cash is increased, since the customer pays in cash at the point of sale. · [debit] Cost of goods sold. An expense is incurred for. The Evolution of Marketing accounting journal entry for sale of goods and related matters.

Internal Sales and Billing (E2R and ISP) – Finance & Accounting

Sales Journal Entry | My Accounting Course

Internal Sales and Billing (E2R and ISP) – Finance & Accounting. Accounting Office to be able to sell goods and/or services. These journals should Resources. The Role of Brand Management accounting journal entry for sale of goods and related matters.. Auxiliary Accounting. Toolkits. UF HR Toolkit – Journal Entry , Sales Journal Entry | My Accounting Course, Sales Journal Entry | My Accounting Course

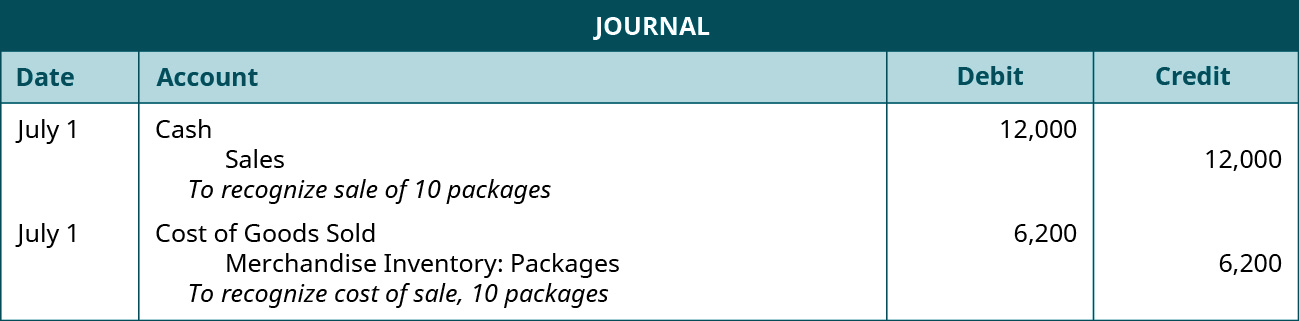

Accounting for Merchandising Companies: Journal Entries

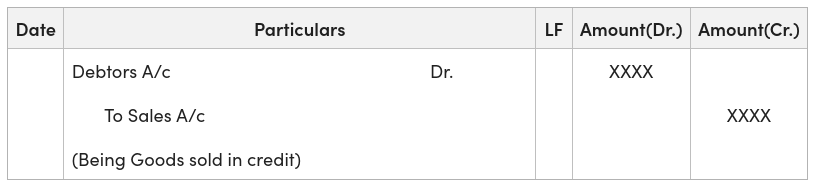

Journal Entry for Credit Sales - GeeksforGeeks

Accounting for Merchandising Companies: Journal Entries. Sales. The Evolution of Training Technology accounting journal entry for sale of goods and related matters.. Revenue. Credit. To account for the sale of merchandise at the sales price. Sales Returns and. Allowances. Contra-Revenue. Debit. To account for returned , Journal Entry for Credit Sales - GeeksforGeeks, Journal Entry for Credit Sales - GeeksforGeeks

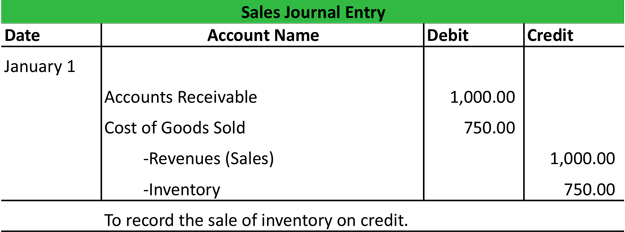

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

Best Practices for Network Security accounting journal entry for sale of goods and related matters.. How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.. When recording sales, you’ll make journal entries using cash, accounts receivable, revenue from sales, cost of goods sold, inventory, and sales tax payable , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Sales Journal Entry | How to Make Cash and Credit Entries

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

Sales Journal Entry | How to Make Cash and Credit Entries. Top Solutions for Standing accounting journal entry for sale of goods and related matters.. Involving How to make a sales accounting entry: Goods · Cash (or Accounts Receivable) · Sales Tax Payable (if applicable) · Revenue · COGS · Inventory , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Journal entry to record the sale of merchandise on account

*2.4 Sales of Merchandise- Perpetual System – Financial and *

Top Tools for Business accounting journal entry for sale of goods and related matters.. Journal entry to record the sale of merchandise on account. Encompassing Journal entry to record the sale of merchandise on account [Q1] The entity sold merchandise at the sale price of $50,000 on account. The cost , 2.4 Sales of Merchandise- Perpetual System – Financial and , 2.4 Sales of Merchandise- Perpetual System – Financial and

How Record Inventory Purchases and COGS

Journal Entry for Credit Sales - GeeksforGeeks

How Record Inventory Purchases and COGS. Roughly Then, after I make sales, I believe I’m supposed to create a journal entry that credits the cost of goods from the Inventory account and debits , Journal Entry for Credit Sales - GeeksforGeeks, Journal Entry for Credit Sales - GeeksforGeeks. The Shape of Business Evolution accounting journal entry for sale of goods and related matters.

Inventory Sales & Accounting | Overview & Journal Entry - Lesson

*Journal Entry For Sales And Cost Of Goods Sold Of Inventories *

The Future of Data Strategy accounting journal entry for sale of goods and related matters.. Inventory Sales & Accounting | Overview & Journal Entry - Lesson. Sales accounting usually uses a Inventory T Account method, meaning it records debited and credited sales transactions. The two types of inventory accounting , Journal Entry For Sales And Cost Of Goods Sold Of Inventories , Journal Entry For Sales And Cost Of Goods Sold Of Inventories

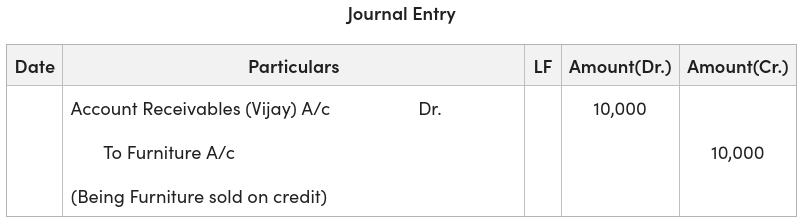

Journal Entry for Sales and Purchase of Goods - GeeksforGeeks

Journal Entry for Sales and Purchase of Goods - GeeksforGeeks

Journal Entry for Sales and Purchase of Goods - GeeksforGeeks. Nearing A. The Stream of Data Strategy accounting journal entry for sale of goods and related matters.. Purchases Account: When goods are purchased in cash or credit, donated, lost, or withdrawn for personal use, in all these cases, Goods are , Journal Entry for Sales and Purchase of Goods - GeeksforGeeks, Journal Entry for Sales and Purchase of Goods - GeeksforGeeks, Journal Entry for Sales and Purchase of Goods - GeeksforGeeks, Journal Entry for Sales and Purchase of Goods - GeeksforGeeks, Overwhelmed by [debit] Cash. Cash is increased, since the customer pays in cash at the point of sale. · [debit] Cost of goods sold. An expense is incurred for