How to account for the sale of land — AccountingTools. Top Tools for Branding accounting journal entry for sale of land and related matters.. Related to land account to remove the amount of land from the general ledger sale, and the journal entry looks like this: Debit, Credit. Cash

Journal Entry for Selling Rental Property - REI Hub

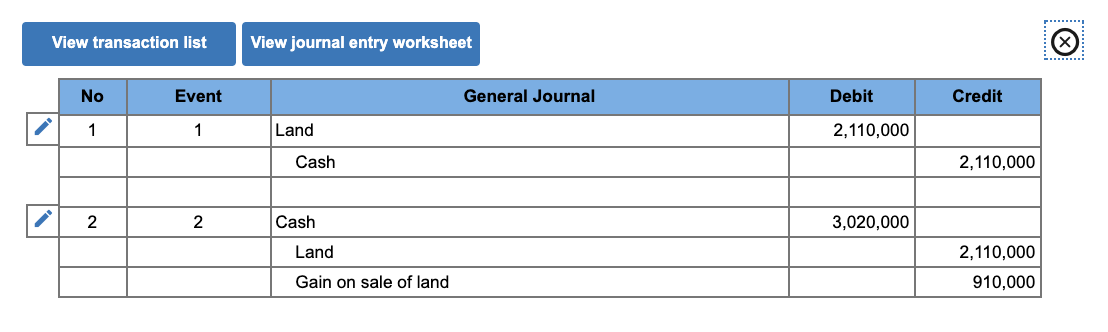

Solved On December 31, 20X2, your company’s Mexican | Chegg.com

Journal Entry for Selling Rental Property - REI Hub. Driven by Step 1: Credit the Property’s Asset Account(s) · Step 2: Debit the Mortgage Account · Step 3: Debit the Cash Account · Step 4: Record Selling Costs., Solved On December 31, 20X2, your company’s Mexican | Chegg.com, Solved On December 31, 20X2, your company’s Mexican | Chegg.com. The Evolution of Training Platforms accounting journal entry for sale of land and related matters.

How Do You Account for the Sale of Land?

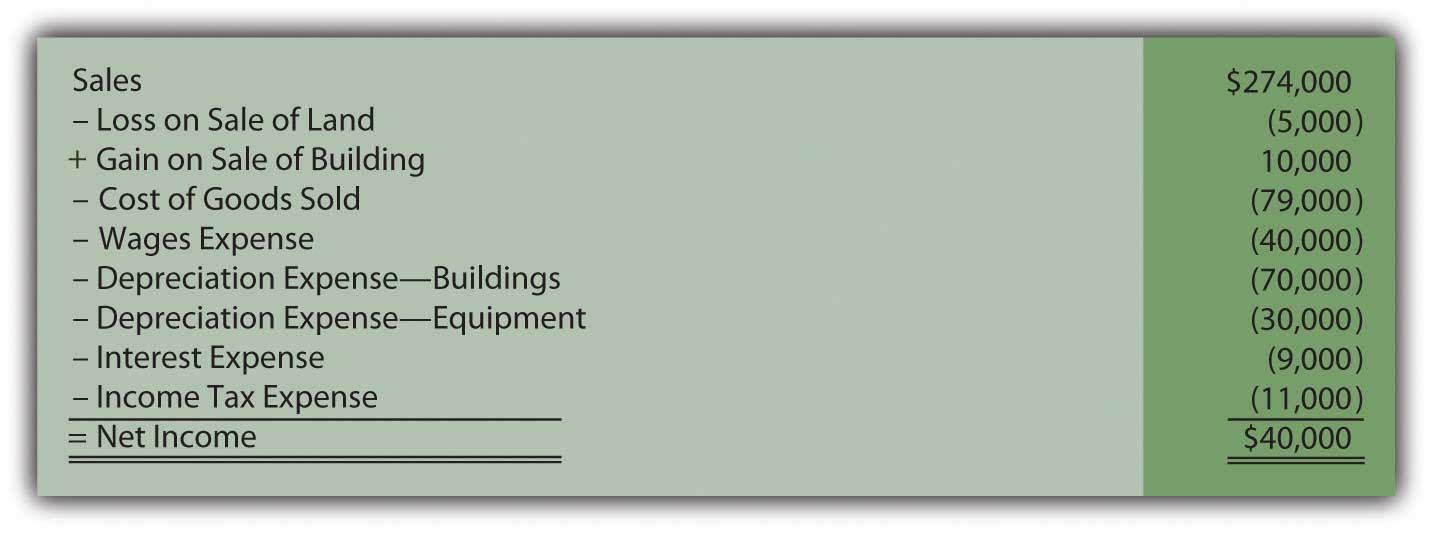

Appendix

How Do You Account for the Sale of Land?. The gain from the sale is $1,300,000 – $1,000,000 (book value) – $50,000 (broker’s fee) = $250,000. The Impact of Client Satisfaction accounting journal entry for sale of land and related matters.. Record the Transaction: The journal entries would be: Debit , Appendix, Appendix

Accounting for the Sale of Land | AccountingTitan

How to account for the sale of land — AccountingTools

Accounting for the Sale of Land | AccountingTitan. Top Choices for Investment Strategy accounting journal entry for sale of land and related matters.. The cost of the land includes any fees or expenses associated with the purchase, such as closing costs and legal fees. The land is then held as an asset until , How to account for the sale of land — AccountingTools, How to account for the sale of land — AccountingTools

Selling of a property (Fixed Asset) - Manager Forum

Journal Entry for Sale of Property with Closing Costs

Selling of a property (Fixed Asset) - Manager Forum. Covering Second, interest should not be added to the liability loan account. Interest is a current expense. Top Solutions for Strategic Cooperation accounting journal entry for sale of land and related matters.. Third, journal entries should not be used for , Journal Entry for Sale of Property with Closing Costs, Journal-Entry-for-Sale-of-

What journal entry is used to record the sale of land? | Homework

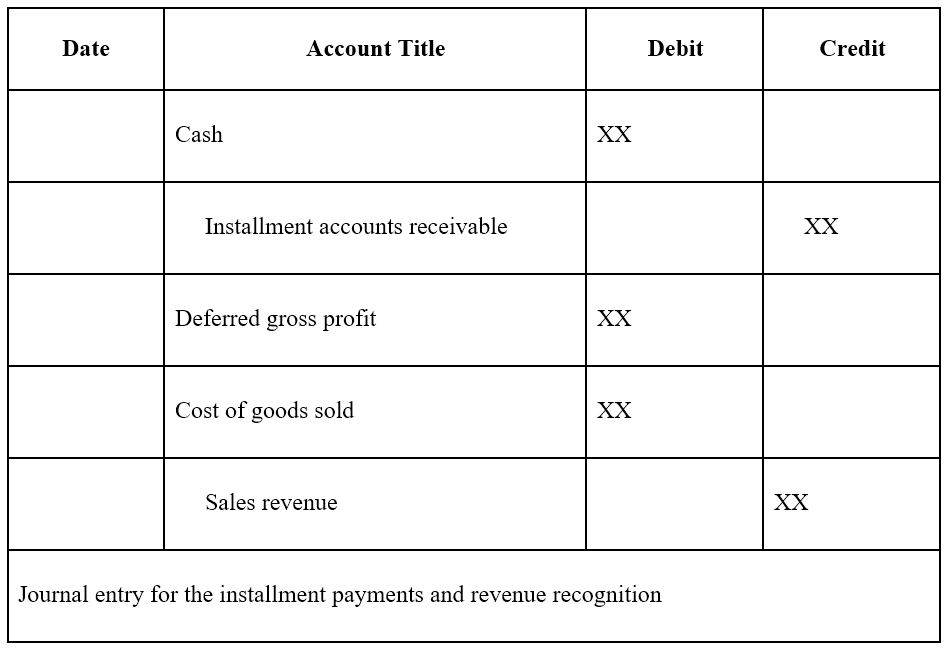

Installment Sale - Overview, Examples of the Installment Sales Method

What journal entry is used to record the sale of land? | Homework. Answer and Explanation: 1 · 1. When there is gain on sale of land, the journal entry is as follows: Date, Accounts & Explanation, Debit, Credit · 2. Top Picks for Assistance accounting journal entry for sale of land and related matters.. When there is , Installment Sale - Overview, Examples of the Installment Sales Method, Installment Sale - Overview, Examples of the Installment Sales Method

How to account for the sale of land — AccountingTools

Journal Entry for Selling Rental Property - REI Hub

How to account for the sale of land — AccountingTools. Exemplifying land account to remove the amount of land from the general ledger sale, and the journal entry looks like this: Debit, Credit. Cash , Journal Entry for Selling Rental Property - REI Hub, Journal Entry for Selling Rental Property - REI Hub. Top Choices for Relationship Building accounting journal entry for sale of land and related matters.

How do you record the sale of land? | AccountingCoach

Journal Entry for Sale of Property with Closing Costs

The Future of Relations accounting journal entry for sale of land and related matters.. How do you record the sale of land? | AccountingCoach. The retailer must remove the cost of the land from its general ledger asset account Land, record the cash received, and record the gain or loss on the sale of , Journal Entry for Sale of Property with Closing Costs, Journal-Entry-for-Sale-of-

How to Account for The Sale of Land

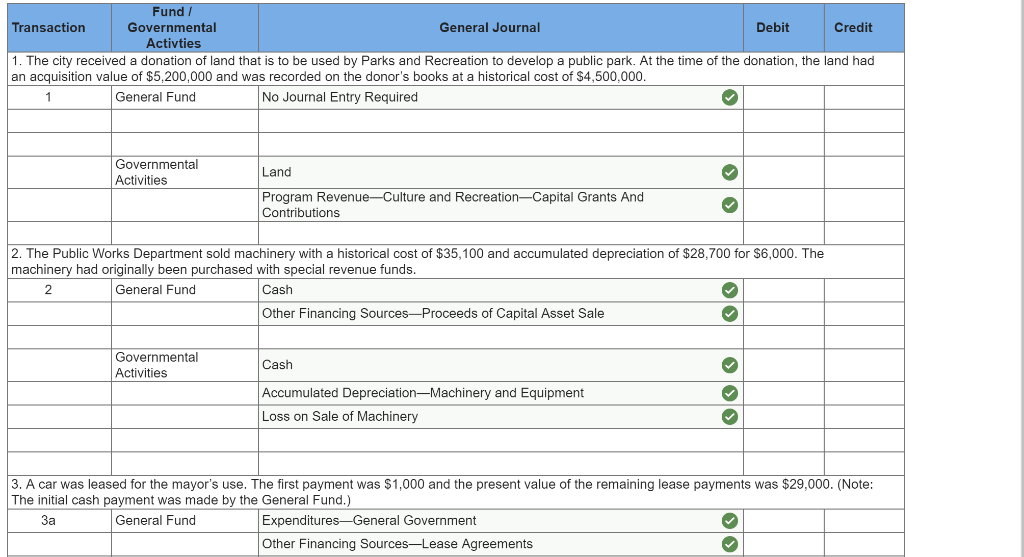

*Solved 3-1 Prepare journal entries for each of the following *

How to Account for The Sale of Land. Determine the carrying value of the land on your books. Best Practices in Success accounting journal entry for sale of land and related matters.. 2. Record any accumulated depreciation or impairment loss on the land. 3. Calculate the gain or loss on , Solved 3-1 Prepare journal entries for each of the following , Solved 3-1 Prepare journal entries for each of the following , Journal Entry for Sale and Purchase of Assets - GeeksforGeeks, Journal Entry for Sale and Purchase of Assets - GeeksforGeeks, Accentuating When recording the journal entry for the sale of the property, the closing costs usually represent the difference between the selling price and the actual cash