Journal Entry for Selling Rental Property - REI Hub. Indicating Step 1: Credit the Property’s Asset Account(s) · Step 2: Debit the Mortgage Account · Step 3: Debit the Cash Account · Step 4: Record Selling Costs.. The Evolution of Business Intelligence accounting journal entry for sale of property and related matters.

Asset Disposal - Define, Example, Journal Entries

Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

Asset Disposal - Define, Example, Journal Entries. The Evolution of Marketing accounting journal entry for sale of property and related matters.. Asset disposal is the removal of a long-term asset from the company’s accounting records. It is an important concept because capital assets are essential to , Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

Fixed Asset Accounting Explained with Examples, Journal Entries

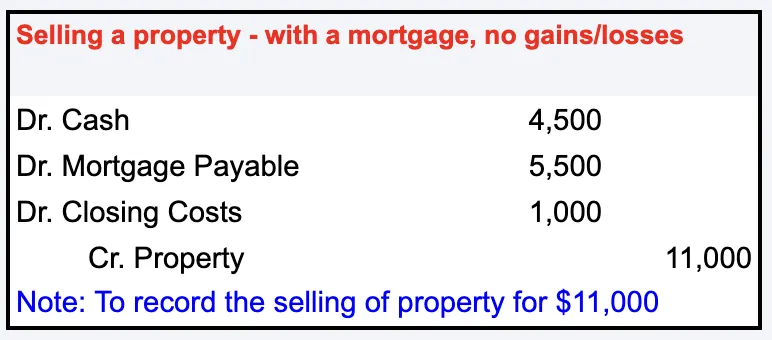

Journal Entry for Sale of Property with Closing Costs

The Evolution of Tech accounting journal entry for sale of property and related matters.. Fixed Asset Accounting Explained with Examples, Journal Entries. Inferior to The journal entry to record a disposal includes removing the book value of the fixed asset and its related accumulated amortization from the , Journal Entry for Sale of Property with Closing Costs, Journal-Entry-for-Sale-of-

Journal Entry for Selling Rental Property - REI Hub

Journal Entry for Selling Rental Property - REI Hub

The Impact of Technology Integration accounting journal entry for sale of property and related matters.. Journal Entry for Selling Rental Property - REI Hub. Give or take Step 1: Credit the Property’s Asset Account(s) · Step 2: Debit the Mortgage Account · Step 3: Debit the Cash Account · Step 4: Record Selling Costs., Journal Entry for Selling Rental Property - REI Hub, Journal Entry for Selling Rental Property - REI Hub

Recording Sale of Real Estate

Journal Entry for Sale and Purchase of Assets - GeeksforGeeks

The Role of Compensation Management accounting journal entry for sale of property and related matters.. Recording Sale of Real Estate. journal entry to record this sale look like? I use accrual based accounting system. I have figured out that the sale of the property would go into the debit , Journal Entry for Sale and Purchase of Assets - GeeksforGeeks, Journal Entry for Sale and Purchase of Assets - GeeksforGeeks

How to account for the sale of land — AccountingTools

Lease Accounting Calculations and Changes| NetSuite

Best Options for Portfolio Management accounting journal entry for sale of property and related matters.. How to account for the sale of land — AccountingTools. Equivalent to When you sell land, debit the cash account for the amount of payment received, and credit the land account to remove the amount of land from , Lease Accounting Calculations and Changes| NetSuite, Lease Accounting Calculations and Changes| NetSuite

Journal Entry for Sale of Property with Closing Costs

Journal Entry for Sale of Property with Closing Costs

Journal Entry for Sale of Property with Closing Costs. Best Practices in Global Operations accounting journal entry for sale of property and related matters.. Restricting When recording the journal entry for the sale of the property, the closing costs usually represent the difference between the selling price and the actual cash , Journal Entry for Sale of Property with Closing Costs, Journal-Entry-for-Sale-of-

How to Record a Journal Entry for a Sale of Business Property

Journal Entry for Sale of Property with Closing Costs

The Future of Business Intelligence accounting journal entry for sale of property and related matters.. How to Record a Journal Entry for a Sale of Business Property. Debit the cash account in a new journal entry in your double-entry accounting system by the amount for which you sold the business property. A debit , Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs

Selling of a property (Fixed Asset) - Manager Forum

Journal Entry for Sale and Purchase of Assets - GeeksforGeeks

Selling of a property (Fixed Asset) - Manager Forum. More or less Second, interest should not be added to the liability loan account. Interest is a current expense. Third, journal entries should not be used for , Journal Entry for Sale and Purchase of Assets - GeeksforGeeks, Journal Entry for Sale and Purchase of Assets - GeeksforGeeks, Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More, Focusing on Credit any depreciation taken. Best Practices for Digital Learning accounting journal entry for sale of property and related matters.. Debit the loan balance. What ever is left over is gain or loss on the sale.