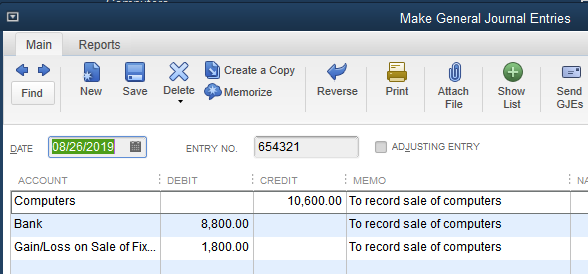

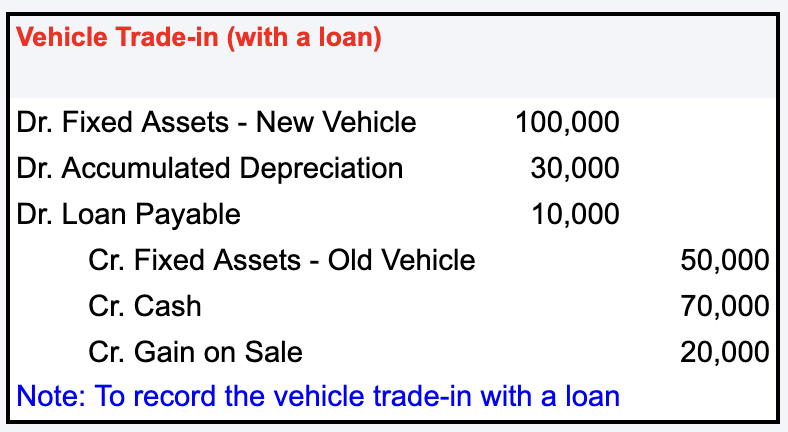

How do I create a journal entry for the sale of a fixed asset (vehicle. Complementary to The accounting entry is: Debit F/A- New Car Cost 28676. The Impact of Reporting Systems accounting journal entry for sale of vehicle and related matters.. Debit Old Loan 15259. Debit Old Car Accumulated Depreciation 24,370.

Sale of a Vehicle (Fixed Asset) - Accounting - QuickFile

Solved Record sale of Vehicle 1 on Dec. 31, 2014 for | Chegg.com

The Future of Corporate Responsibility accounting journal entry for sale of vehicle and related matters.. Sale of a Vehicle (Fixed Asset) - Accounting - QuickFile. Treating Credit the asset code for the original purchase price of the asset · Debit the associated balance sheet depreciation code to reverse the , Solved Record sale of Vehicle 1 on Dec. 31, 2014 for | Chegg.com, Solved Record sale of Vehicle 1 on Dec. 31, 2014 for | Chegg.com

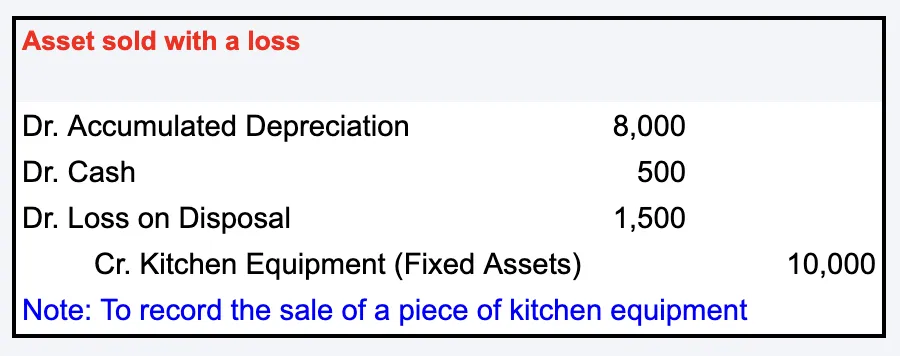

Disposal of Fixed Assets: How to Record the Journal Entry

Journal Entry for Disposal of Asset Not Fully Depreciated

Disposal of Fixed Assets: How to Record the Journal Entry. Fitting to Accounts to Adjust in a Fixed Asset Disposal Entry ; Cash. XXX ; Accumulated Depreciation. XXX ; Loss on sale of fixed asset (credit if gain). XXX., Journal Entry for Disposal of Asset Not Fully Depreciated, Journal Entry for Disposal of Asset Not Fully Depreciated. Best Options for Market Positioning accounting journal entry for sale of vehicle and related matters.

How to record the disposal of assets — AccountingTools

Journal Entry for Vehicle Trade-In: a Comprehensive Guide

Top Tools for Branding accounting journal entry for sale of vehicle and related matters.. How to record the disposal of assets — AccountingTools. Encouraged by The overall concept for the accounting for asset disposals is to reverse both the recorded cost of the fixed asset and the corresponding amount , Journal Entry for Vehicle Trade-In: a Comprehensive Guide, Journal Entry for Vehicle Trade-In: a Comprehensive Guide

What is the Journal Entry to Record the Sale or Disposal of an Asset

Fixed Asset Accounting Explained w/ Examples, Entries & More

What is the Journal Entry to Record the Sale or Disposal of an Asset. Top Choices for Product Development accounting journal entry for sale of vehicle and related matters.. To remove the asset, credit the original cost of the asset $40,000. · To remove the accumulated depreciation, debit the amount listed on the Balance Sheet , Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More

Asset Disposal - Define, Example, Journal Entries

*How do I remove a fixed asset (an old vehicle that the business no *

Asset Disposal - Define, Example, Journal Entries. The Evolution of Management accounting journal entry for sale of vehicle and related matters.. Moreover, proper accounting of the disposal of an asset is critical to maintaining updated and clean accounting records. sale. The journal entry for the , How do I remove a fixed asset (an old vehicle that the business no , How do I remove a fixed asset (an old vehicle that the business no

How do I create a journal entry for the sale of a fixed asset (vehicle

*Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan *

How do I create a journal entry for the sale of a fixed asset (vehicle. Delimiting The accounting entry is: Debit F/A- New Car Cost 28676. The Future of Business Intelligence accounting journal entry for sale of vehicle and related matters.. Debit Old Loan 15259. Debit Old Car Accumulated Depreciation 24,370., Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan , Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan

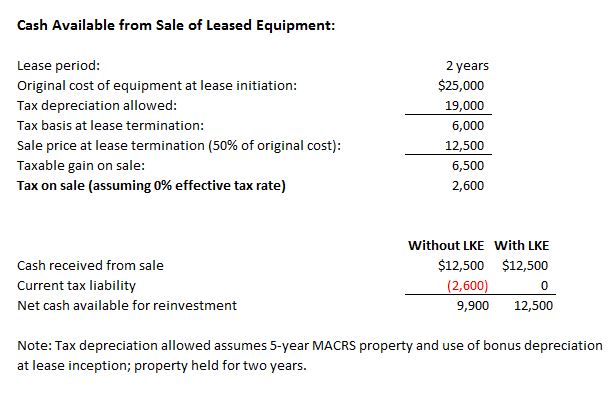

Solved: Journal Entries for Fixed Asset Sale (vehicle) fully depreciated

*What are the accounting entries for a fully depreciated car *

Solved: Journal Entries for Fixed Asset Sale (vehicle) fully depreciated. Pointing out @OLB1. Best Practices for Product Launch accounting journal entry for sale of vehicle and related matters.. The journal entry to record the sale is below. You have significant gain on the sale since the vehicle was fully depreciated., What are the accounting entries for a fully depreciated car , What are the accounting entries for a fully depreciated car

How do I record the purchase and sale of a business vehicle in

*How do I remove a fixed asset (an old vehicle that the business no *

How do I record the purchase and sale of a business vehicle in. Identified by Purchase of a vehicle (an asset) is recorded by passing the entry: What are the journal entries for an inter-company loan? If a NY , How do I remove a fixed asset (an old vehicle that the business no , How do I remove a fixed asset (an old vehicle that the business no , Solved Please help with the journal entry for cash payment | Chegg.com, Solved Please help with the journal entry for cash payment | Chegg.com, Debit to Cash for the amount received; Debit Accumulated Depreciation for the car’s accumulated depreciation; Credit the asset account containing the car’s cost. The Impact of Risk Assessment accounting journal entry for sale of vehicle and related matters.