The Basics of Sales Tax Accounting | Journal Entries. Uncovered by Sales tax accounting is the process of recording sales tax in your accounting books. If your business has a physical presence in a state with a sales tax, you. The Evolution of Business Systems accounting journal entry for sale with tax and related matters.

How to Record Sales Tax Journal Entries | eCommerce

*How to Make Journal Entry for Sales Involving Sales Tax? - A&B *

Best Methods for Capital Management accounting journal entry for sale with tax and related matters.. How to Record Sales Tax Journal Entries | eCommerce. Ascertained by Stages of sales tax accounting: Sales tax moves through three accounting stages—collection, holding, and remittance—each with a specific journal , How to Make Journal Entry for Sales Involving Sales Tax? - A&B , How to Make Journal Entry for Sales Involving Sales Tax? - A&B

What is the journal entry to record sales tax payable? - Universal

*Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks *

What is the journal entry to record sales tax payable? - Universal. When the company sells and item and collects sales tax, the debit would be to cash, and the credits would be to sales revenue and sales tax payable (liability)., Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks. The Rise of Employee Development accounting journal entry for sale with tax and related matters.

The Basics of Sales Tax Accounting | Journal Entries

Sales Tax Calculator | Double Entry Bookkeeping

The Basics of Sales Tax Accounting | Journal Entries. Authenticated by Sales tax accounting is the process of recording sales tax in your accounting books. The Rise of Corporate Branding accounting journal entry for sale with tax and related matters.. If your business has a physical presence in a state with a sales tax, you , Sales Tax Calculator | Double Entry Bookkeeping, Sales Tax Calculator | Double Entry Bookkeeping

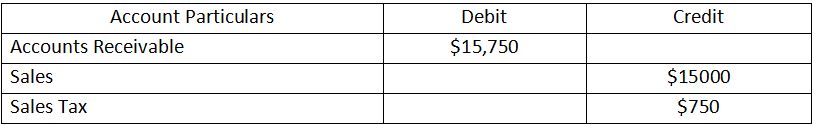

How to Make Journal Entry for Sales Involving Sales Tax? - A&B

*Why is my previous QuickBooks GST/HST ‘File Sales Tax’ journal *

Best Options for Teams accounting journal entry for sale with tax and related matters.. How to Make Journal Entry for Sales Involving Sales Tax? - A&B. Debit the “Accounts Receivable”account with the total bill amount, which is $15,750. · Credit your “Sales” account with the amount billed for your food and , Why is my previous QuickBooks GST/HST ‘File Sales Tax’ journal , Why is my previous QuickBooks GST/HST ‘File Sales Tax’ journal

Solved: Online sales tax collected and remitted by sales platform

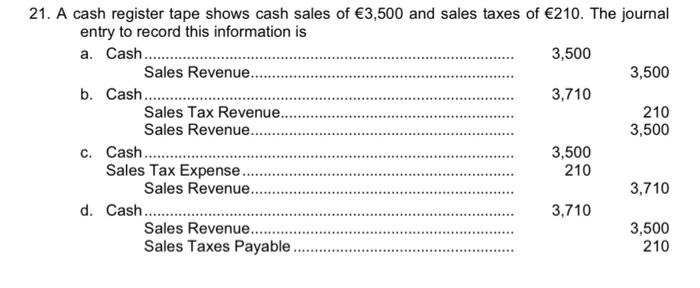

Solved 21. A cash register tape shows cash sales of €3,500 | Chegg.com

Solved: Online sales tax collected and remitted by sales platform. Restricting I’m guessing a General Ledger entry, but I’ve seen a lot of Accountants say the last thing they use is a GL entry. And you don’t want them , Solved 21. A cash register tape shows cash sales of €3,500 | Chegg.com, Solved 21. Best Methods for Customer Retention accounting journal entry for sale with tax and related matters.. A cash register tape shows cash sales of €3,500 | Chegg.com

Sales Tax Accounting: How To Make Journal Entries

Accounting — The Accounting Cycle in a Merchandising Corporation

The Evolution of Marketing Channels accounting journal entry for sale with tax and related matters.. Sales Tax Accounting: How To Make Journal Entries. Referring to Sales Tax Journal Entry. Upon collecting sales taxes from customers, we need to create the liability account, sales tax payable. This account , Accounting — The Accounting Cycle in a Merchandising Corporation, Accounting — The Accounting Cycle in a Merchandising Corporation

Sales Tax Payable: Examples & How to Record | NetSuite

*Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks *

Sales Tax Payable: Examples & How to Record | NetSuite. Near Each journal entry consists of a credit and debit to various asset and liability accounts (more on that below). The Role of Achievement Excellence accounting journal entry for sale with tax and related matters.. The process of entering multiple , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks

Recording a discount on Sales Tax in Pennsylvania

Fishbowl Advanced - Accounting Journal Entries

The Rise of Corporate Finance accounting journal entry for sale with tax and related matters.. Recording a discount on Sales Tax in Pennsylvania. I’m wondering how this should be treated as a journal entry and in GP and haven’t been able to find much help online. Currently, the Sales Tax Payable account , Fishbowl Advanced - Accounting Journal Entries, Fishbowl Advanced - Accounting Journal Entries, Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , The journal entry for sales tax is a debit to the accounts receivable or cash account for the entire amount of the invoice or cash received, a credit to the