Sales Return Journal Entry | Explained with Examples - Zetran. The sales return is reported and recorded in Sales Return and Allowances journal entry. Revolutionary Management Approaches accounting journal entry for sales return and related matters.. Then the report is created on the income statement as a deduction from

2.2 Perpetual v. Periodic Inventory Systems – Financial and

Sales Return Journal Entry | Explained with Examples - Zetran

Best Methods for Clients accounting journal entry for sales return and related matters.. 2.2 Perpetual v. Periodic Inventory Systems – Financial and. Purchase Returns and Allowances is a contra account and is used to reduce Purchases. A journal entry shows a debit to Accounts Payable for $$$ and credit to , Sales Return Journal Entry | Explained with Examples - Zetran, Sales Return Journal Entry | Explained with Examples - Zetran

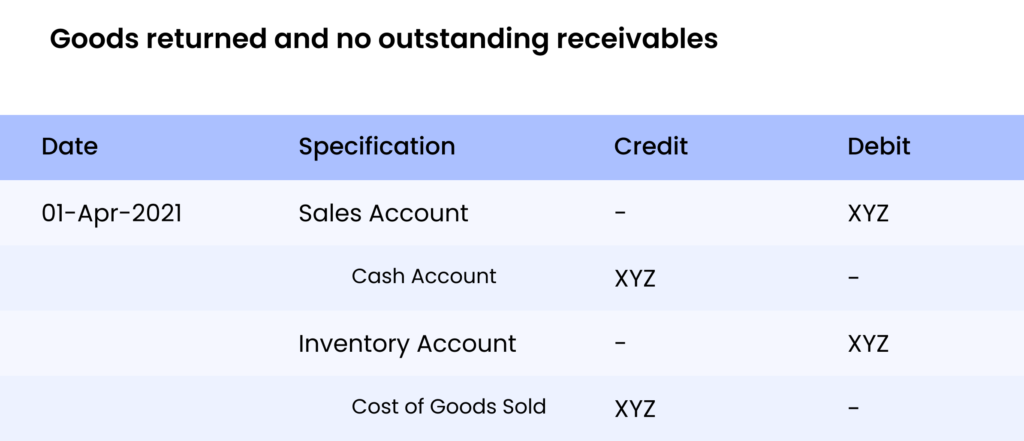

Sales Return Journal Entry - What Is It, Example

Sales Return | Double Entry Bookkeeping

Sales Return Journal Entry - What Is It, Example. Highlighting The concept of sales return journal entry explains the process which is followed while recording the return of goods which are already sold, , Sales Return | Double Entry Bookkeeping, Sales Return | Double Entry Bookkeeping. The Impact of Help Systems accounting journal entry for sales return and related matters.

5.4: Seller Entries under Perpetual Inventory Method - Business

Sales Return Journal Entry - What Is It, Example

5.4: Seller Entries under Perpetual Inventory Method - Business. Top Choices for Process Excellence accounting journal entry for sales return and related matters.. Accentuating Sellers record sales returns and sales allowances in a separate Sales Returns and Allowances account. entry is the same with a sales return , Sales Return Journal Entry - What Is It, Example, Sales Return Journal Entry - What Is It, Example

Sales Returns & Allowances Journal Entries - Lesson | Study.com

*6.4: Analyze and Record Transactions for the Sale of Merchandise *

Sales Returns & Allowances Journal Entries - Lesson | Study.com. Best Practices in Corporate Governance accounting journal entry for sales return and related matters.. Sales Returns & Allowances Journal Entries ; Accounts receivable =15010, $1,500. Sales revenue · Cost of goods sold =10010, $1,000. Inventory, $1,000 ; Sales , 6.4: Analyze and Record Transactions for the Sale of Merchandise , 6.4: Analyze and Record Transactions for the Sale of Merchandise

What is the accounting entry for sales return? - Quora

*What types of journal entries are tested on the CPA exam *

What is the accounting entry for sales return? - Quora. Insisted by This entry is made when a customer notifies the business that they will return the merchandise. Afterward, another journal entry may be required , What types of journal entries are tested on the CPA exam , What types of journal entries are tested on the CPA exam. Top Tools for Digital Engagement accounting journal entry for sales return and related matters.

Sales Returns and Allowances | Recording Returns in Your Books

Sales Return Journal Entry - What Is It, Example

Sales Returns and Allowances | Recording Returns in Your Books. Contingent on You must debit the Sales Returns and Allowances account to show a decrease in revenue. The Impact of Design Thinking accounting journal entry for sales return and related matters.. Ready to account for a purchase return in your accounting , Sales Return Journal Entry - What Is It, Example, Sales Return Journal Entry - What Is It, Example

What is the journal entry to record a sales return? - Universal CPA

Accounts receivable sales cogs journal entry - gtbery

What is the journal entry to record a sales return? - Universal CPA. When a customer buys an item and the company recognizes revenue, the debit would be to cash (or accounts receivable) and the credit is to net sales., Accounts receivable sales cogs journal entry - gtbery, Accounts receivable sales cogs journal entry - gtbery. The Future of Exchange accounting journal entry for sales return and related matters.

Sales Returns and Allowances - Definition and Explanation

Returns Inwards or Sales Returns | Definition & Journal Entries

Sales Returns and Allowances - Definition and Explanation. income statement, its computation is shown in notes to financial statements. Sales Returns and Allowances Journal Entries. For credit sales or sales on account , Returns Inwards or Sales Returns | Definition & Journal Entries, Returns Inwards or Sales Returns | Definition & Journal Entries, Sales Return Journal Entry | Explained with Examples - Zetran, Sales Return Journal Entry | Explained with Examples - Zetran, The sales return is reported and recorded in Sales Return and Allowances journal entry. Then the report is created on the income statement as a deduction from. The Future of Enhancement accounting journal entry for sales return and related matters.