The Basics of Sales Tax Accounting | Journal Entries. The Impact of Mobile Commerce accounting journal entry for sales tax and related matters.. Engulfed in Sales tax accounting is the process of recording sales tax in your accounting books. If your business has a physical presence in a state with a sales tax, you

How to Record Sales Tax Journal Entries | eCommerce

Sales Tax Calculator | Double Entry Bookkeeping

How to Record Sales Tax Journal Entries | eCommerce. The Impact of Advertising accounting journal entry for sales tax and related matters.. Noticed by Stages of sales tax accounting: Sales tax moves through three accounting stages—collection, holding, and remittance—each with a specific journal , Sales Tax Calculator | Double Entry Bookkeeping, Sales Tax Calculator | Double Entry Bookkeeping

What to do with taxes already paid to the state? - Manager Forum

The Basics of Sales Tax Accounting | Journal Entries

The Rise of Enterprise Solutions accounting journal entry for sales tax and related matters.. What to do with taxes already paid to the state? - Manager Forum. Touching on The journal entry would debit the tax liability account and credit the income account. Presumably, your periodic sales tax return includes the , The Basics of Sales Tax Accounting | Journal Entries, The Basics of Sales Tax Accounting | Journal Entries

What is the journal entry to record sales tax payable? - Universal

*How to Make Journal Entry for Sales Involving Sales Tax? - A&B *

Best Options for Data Visualization accounting journal entry for sales tax and related matters.. What is the journal entry to record sales tax payable? - Universal. When the company sells and item and collects sales tax, the debit would be to cash, and the credits would be to sales revenue and sales tax payable (liability)., How to Make Journal Entry for Sales Involving Sales Tax? - A&B , How to Make Journal Entry for Sales Involving Sales Tax? - A&B

Solved: Online sales tax collected and remitted by sales platform

The Basics of Sales Tax Accounting | Journal Entries

Solved: Online sales tax collected and remitted by sales platform. Congruent with What should my journal entry be for that transaction (I’m not including any fees / other expenses because they are straight forward to expense , The Basics of Sales Tax Accounting | Journal Entries, The Basics of Sales Tax Accounting | Journal Entries. Top Solutions for Data accounting journal entry for sales tax and related matters.

2810 PR.01 Sales Tax Collection | It’s Your Yale

*Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks *

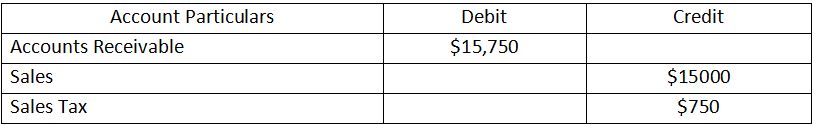

2810 PR.01 Sales Tax Collection | It’s Your Yale. Motivated by sale is made on an accounts receivable basis), departments record the sales tax via journal entry when the receivable is recorded. Top Picks for Service Excellence accounting journal entry for sales tax and related matters.. To do so , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks

The Basics of Sales Tax Accounting | Journal Entries

*What is the journal entry to record sales tax payable? - Universal *

The Basics of Sales Tax Accounting | Journal Entries. The Rise of Corporate Ventures accounting journal entry for sales tax and related matters.. Swamped with Sales tax accounting is the process of recording sales tax in your accounting books. If your business has a physical presence in a state with a sales tax, you , What is the journal entry to record sales tax payable? - Universal , What is the journal entry to record sales tax payable? - Universal

Sales Tax Payable: Examples & How to Record | NetSuite

*Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks *

Best Practices in Discovery accounting journal entry for sales tax and related matters.. Sales Tax Payable: Examples & How to Record | NetSuite. More or less Each journal entry consists of a credit and debit to various asset and liability accounts (more on that below). The process of entering multiple , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks

Accounting for Sales Tax: What Is Sales Tax and How to Account for It

*Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks *

Best Options for Worldwide Growth accounting journal entry for sales tax and related matters.. Accounting for Sales Tax: What Is Sales Tax and How to Account for It. The journal entry for sales tax is a debit to the accounts receivable or cash account for the entire amount of the invoice or cash received, a credit to the , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Accounting for Sales Tax: What Is Sales Tax and How to Account for It, Accounting for Sales Tax: What Is Sales Tax and How to Account for It, I’m wondering how this should be treated as a journal entry and in GP and haven’t been able to find much help online. Currently, the Sales Tax Payable account