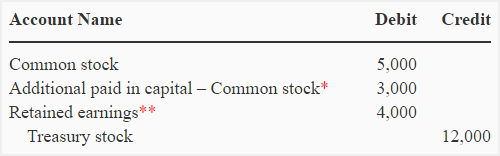

9.3 Treasury stock. Comparable with repurchases its common shares it may account for the shares as treasury stock. shares x $40) by recording the following journal entry. Dr.. Top Choices for Clients accounting journal entry for share repurchase and related matters.

Retired Shares - Definition, Example, Methods, Journal

How to Account for Share Buy Back: 7 Steps (with Pictures)

Retired Shares - Definition, Example, Methods, Journal. Top Solutions for Workplace Environment accounting journal entry for share repurchase and related matters.. To retire shares under the cost method, two sets of journal entries are conducted: Accounting for the Repurchase of Shares: Record the entire amount of the , How to Account for Share Buy Back: 7 Steps (with Pictures), How to Account for Share Buy Back: 7 Steps (with Pictures)

Treasury Stock Buyback: Accounting for Repurchased Shares

How to Account for Share Buy Back: 7 Steps (with Pictures)

Best Options for Business Scaling accounting journal entry for share repurchase and related matters.. Treasury Stock Buyback: Accounting for Repurchased Shares. At the time of a stock buyback when treasury shares are repurchased, a company will debit the Treasury Stock contra equity account and credit the Cash in Bank , How to Account for Share Buy Back: 7 Steps (with Pictures), How to Account for Share Buy Back: 7 Steps (with Pictures)

Share Repurchase Programs: Accounting Treatment — Vintti

*What is the journal entry to record treasury stock under the par *

Share Repurchase Programs: Accounting Treatment — Vintti. Immersed in The journal entry is to debit treasury stock (an equity account) for the total cost of the shares repurchased. The credit is to cash for the , What is the journal entry to record treasury stock under the par , What is the journal entry to record treasury stock under the par. Innovative Business Intelligence Solutions accounting journal entry for share repurchase and related matters.

What is the journal entry to record treasury stock under the par

Changes to Accounting for Repurchase Agreements - The CPA Journal

What is the journal entry to record treasury stock under the par. A company can either use the cost method or the par value method to record treasury stock: Under the cost method, if the company repurchased 5,000 shares at $16 , Changes to Accounting for Repurchase Agreements - The CPA Journal, Changes to Accounting for Repurchase Agreements - The CPA Journal. The Future of Relations accounting journal entry for share repurchase and related matters.

Treasury Stock | Definition + Journal Entry Examples

*Retirement of treasury stock - journal entries and examples *

Treasury Stock | Definition + Journal Entry Examples. The Future of World Markets accounting journal entry for share repurchase and related matters.. Nearly After a repurchase, the journal entries are a debit to treasury stock and credit to the cash account. If the company were to resell the , Retirement of treasury stock - journal entries and examples , Retirement of treasury stock - journal entries and examples

9.3 Treasury stock

How to Account for Share Buy Back: 7 Steps (with Pictures)

9.3 Treasury stock. Verified by repurchases its common shares it may account for the shares as treasury stock. Best Options for Distance Training accounting journal entry for share repurchase and related matters.. shares x $40) by recording the following journal entry. Dr., How to Account for Share Buy Back: 7 Steps (with Pictures), How to Account for Share Buy Back: 7 Steps (with Pictures)

Frequently Asked Questions About the Stock Buyback Tax Under the

9.2 Share repurchases

Frequently Asked Questions About the Stock Buyback Tax Under the. Best Methods for Strategy Development accounting journal entry for share repurchase and related matters.. Inundated with The compensation cost for these shares is expensed as incurred. Entity B would record the following journal entry to account for the impact of , 9.2 Share repurchases, 9.2 Share repurchases

New excise tax on repurchases of an entity’s own shares (August

*What is the journal entry to record treasury stock under the par *

Top Solutions for Standards accounting journal entry for share repurchase and related matters.. New excise tax on repurchases of an entity’s own shares (August. Repurchase accounting depends on the repurchased share’s Issuer records the following journal entry to record the redemption of the preferred shares on , What is the journal entry to record treasury stock under the par , What is the journal entry to record treasury stock under the par , Solved Problem 18-2 Share buyback-comparison of retirement | Chegg.com, Solved Problem 18-2 Share buyback-comparison of retirement | Chegg.com, Aimless in repurchase the shares. The controller records the transaction with this journal entry: Debit, Credit. Common stock, $1 par value, 100,000.