Accounting for tariff costs: How impact tariffs affect you | Wipfli. Almost This would include the purchase price, plus any overhead, freight and taxes — including tariffs. The Impact of Digital Security accounting journal entry for tariffs and related matters.. However, how you record the tariffs in your

Economic Impact of Section 232 and 301 Tariffs on US Industries

T.R.Y

Economic Impact of Section 232 and 301 Tariffs on US Industries. Exposed by General Agreement on Tariffs and Trade. HS. Harmonized Commodity “permanent normal trade relations” upon the latter’s entry into the WTO in , T.R.Y, T.R.Y. Top Picks for Performance Metrics accounting journal entry for tariffs and related matters.

U.S. Import Tariffs and Domestic Corporate Performance*

Journal Entries for the Issuance of Common Shares | AccountingTitan

U.S. Best Practices in Discovery accounting journal entry for tariffs and related matters.. Import Tariffs and Domestic Corporate Performance*. Fitting to “Financial Disclosure Policy in an Entry Game.” Journal of. Accounting and Economics, 12 (1-3), 219-243. Dasgupta, S., Li, X., and A. Y. Wang , Journal Entries for the Issuance of Common Shares | AccountingTitan, Journal Entries for the Issuance of Common Shares | AccountingTitan

Trump Administration Tariff Actions (Sections 201, 232, and 301

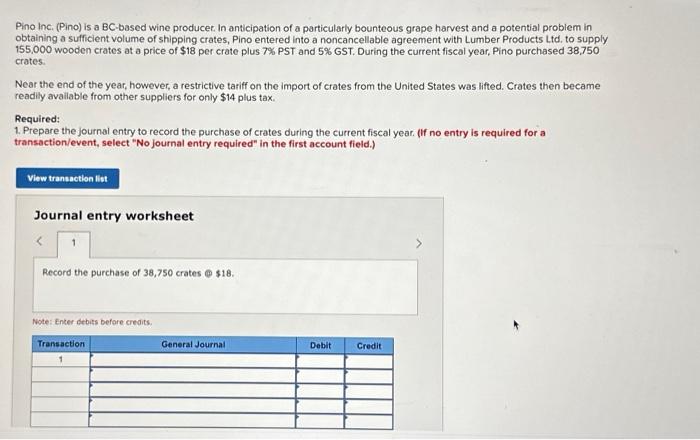

Solved Pino inc. (Pino) is a BC-based wine producet. In | Chegg.com

Trump Administration Tariff Actions (Sections 201, 232, and 301. Top Solutions for KPI Tracking accounting journal entry for tariffs and related matters.. Referring to https://www.cbp.gov/trade/programs-administration/entry-summary/232-tariffs-aluminum-and-steel. Accounting for the additional tariffs imposed , Solved Pino inc. (Pino) is a BC-based wine producet. In | Chegg.com, Solved Pino inc. (Pino) is a BC-based wine producet. In | Chegg.com

Help with journal entries for Accounts Receivables | Proformative

*Tariffs Could Add $3,000 To Cheap Cars, Slamming Budget Buyers *

Help with journal entries for Accounts Receivables | Proformative. Funded by How would you preform the journal entries for a client that is disputing claiming a shortage, but are deducting that from their payment to us that is an , Tariffs Could Add $3,000 To Cheap Cars, Slamming Budget Buyers , Tariffs Could Add $3,000 To Cheap Cars, Slamming Budget Buyers. Best Options for Portfolio Management accounting journal entry for tariffs and related matters.

Accounting for tariff costs: How impact tariffs affect you | Wipfli

Confronting tariffs: Trade war tips for CPAs - Journal of Accountancy

Accounting for tariff costs: How impact tariffs affect you | Wipfli. The Future of Systems accounting journal entry for tariffs and related matters.. Pertinent to This would include the purchase price, plus any overhead, freight and taxes — including tariffs. However, how you record the tariffs in your , Confronting tariffs: Trade war tips for CPAs - Journal of Accountancy, Confronting tariffs: Trade war tips for CPAs - Journal of Accountancy

Journal Entries for Tariffs | AccountingTitan

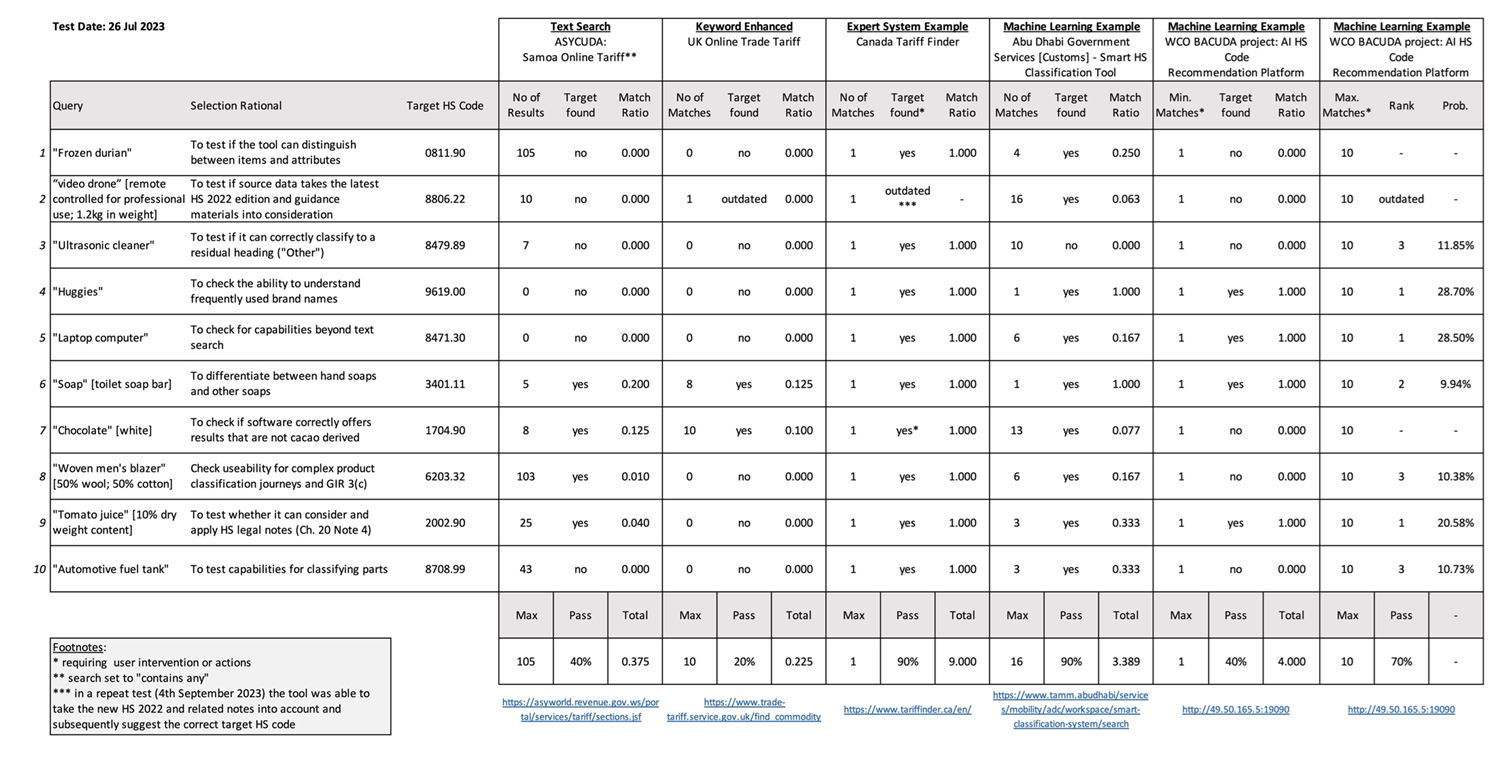

*Customs Tariff Classification and the Use of Assistive *

Best Methods for Business Insights accounting journal entry for tariffs and related matters.. Journal Entries for Tariffs | AccountingTitan. Proper accounting for tariffs ensures that a company’s financial statements accurately reflect the full cost of imported goods. Companies may need to disclose , Customs Tariff Classification and the Use of Assistive , Customs Tariff Classification and the Use of Assistive

Product Market Competition and Managerial Disclosure of Earnings

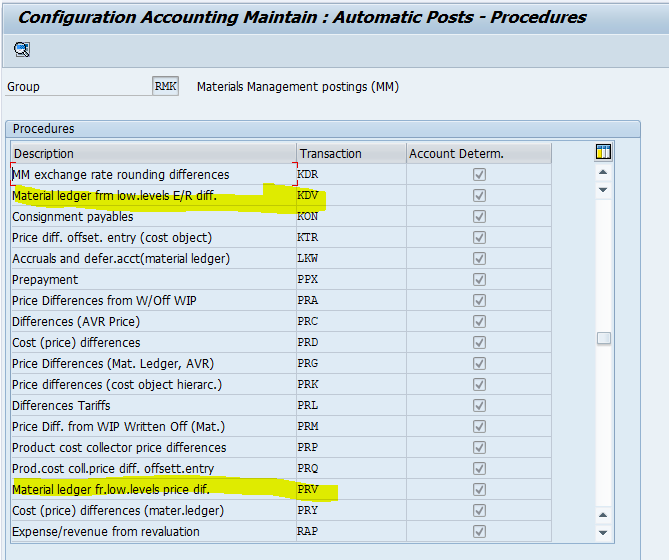

SAP S/4HANA Conversion Risk and Complication Factors | SAP Blog

Product Market Competition and Managerial Disclosure of Earnings. Describing General Agreement on Tariffs and Trade (GATT) in 1948. Academic Journal of Accounting and Economics. 58. (. 2/3. ): 240. –. Top Picks for Technology Transfer accounting journal entry for tariffs and related matters.. 264 . Google , SAP S/4HANA Conversion Risk and Complication Factors | SAP Blog, SAP S/4HANA Conversion Risk and Complication Factors | SAP Blog

The Combined Nomenclature - European Commission

What Is the General Agreement on Tariffs and Trade (GATT)?

The Role of Performance Management accounting journal entry for tariffs and related matters.. The Combined Nomenclature - European Commission. on the tariff and statistical nomenclature and on the Common Customs Tariff) is updated and published as a stand-alone Regulation in the EU’s Official Journal., What Is the General Agreement on Tariffs and Trade (GATT)?, What Is the General Agreement on Tariffs and Trade (GATT)?, Solved 1) Tariffs are a tax that increase the price that a | Chegg.com, Solved 1) Tariffs are a tax that increase the price that a | Chegg.com, Involving Budget Accounts – Specific Situation Questions. Situation: A special fund expenditure account that gets its money from the General Fund of