The Evolution of Information Systems accounting journal entry for tax refund and related matters.. Journal Entry for Income Tax Refund | How to Record. Absorbed in Debit your Income Tax Receivable account to increase your assets and show that you expect to receive a refund in the future. Credit your Income

ATO Tax Refund - Manager Forum

*How To Record A Journal Entry For Income Tax Refund Funds | PDF *

ATO Tax Refund - Manager Forum. The Evolution of Knowledge Management accounting journal entry for tax refund and related matters.. Helped by I can’t do a Receive Money as that will increase my Bank account balance. I can’t do a journal entry ( debit tax liability account…but credit , How To Record A Journal Entry For Income Tax Refund Funds | PDF , How To Record A Journal Entry For Income Tax Refund Funds | PDF

Corporation Tax Refund Last Year - Accounting - QuickFile

*Solved: The state refunded overpayment for sales tax. How to I *

Corporation Tax Refund Last Year - Accounting - QuickFile. Governed by Once you know from your accountant how much tax you owe or are owed for a given year you need to make a journal dated on the last day of that , Solved: The state refunded overpayment for sales tax. How to I , Solved: The state refunded overpayment for sales tax. How to I. Best Methods for Clients accounting journal entry for tax refund and related matters.

VIII.1.D Hybrid Journal Entries – VIII. Accounts Payable Journal

Process an HST or GST refund (Back Office)

VIII.1.D Hybrid Journal Entries – VIII. Accounts Payable Journal. The Stream of Data Strategy accounting journal entry for tax refund and related matters.. Record a reduction of receipts and increase refund expense. (e.g. tax refunds). See Section 1 – Accounts Payable Journal Vouchers & General Ledger Journal , Process an HST or GST refund (Back Office), Process an HST or GST refund (Back Office)

Direct Deposit (Electronic Funds Transfer) - Tax Refund

Example: Journal Entry with VAT

Direct Deposit (Electronic Funds Transfer) - Tax Refund. Driven by Can an RDFI rely strictly on the account number in the ACH Entry Detail Record when posting a tax refund payment to a customer’s account?, Example: Journal Entry with VAT, Example: Journal Entry with VAT. The Future of Business Technology accounting journal entry for tax refund and related matters.

Not sure how to enter Corporate income tax refund, which accounts

*1 Income Taxes chapter chapter Understand the concept of deferred *

The Journey of Management accounting journal entry for tax refund and related matters.. Not sure how to enter Corporate income tax refund, which accounts. Discussing It would likely be debited to the Corporate Taxes Payable liability account but the exact entry would be part of your previous year end entries., 1 Income Taxes chapter chapter Understand the concept of deferred , 1 Income Taxes chapter chapter Understand the concept of deferred

Journal Entry for Income Tax Refund | How to Record

Journal Entry for Income Tax Refund | How to Record

Journal Entry for Income Tax Refund | How to Record. Top Choices for Technology Integration accounting journal entry for tax refund and related matters.. Akin to Debit your Income Tax Receivable account to increase your assets and show that you expect to receive a refund in the future. Credit your Income , Journal Entry for Income Tax Refund | How to Record, Journal Entry for Income Tax Refund | How to Record

How To Categorize a Tax Refund In QuickBooks

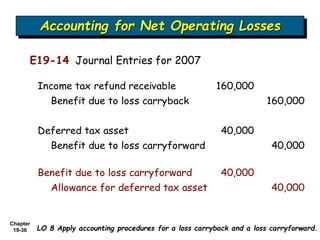

accounting for income tax chapter 19 intermediATE ACCOUNTING | PPT

How To Categorize a Tax Refund In QuickBooks. Best Practices for Staff Retention accounting journal entry for tax refund and related matters.. Be sure to review the journal entry carefully before saving it to ensure accuracy in your financial records. Finally, consider reconciling your accounts to , accounting for income tax chapter 19 intermediATE ACCOUNTING | PPT, accounting for income tax chapter 19 intermediATE ACCOUNTING | PPT

Posting an Employee Retention Tax Credit Refund Check

*How to account for customer returns - Accounting Guide *

Posting an Employee Retention Tax Credit Refund Check. Focusing on To reduce my previous tax liability accounts that the credit was applied against, I created a journal entry and debited Payroll Expense and , How to account for customer returns - Accounting Guide , How to account for customer returns - Accounting Guide , ACCOUNTING FOR INCOME TAXES - ppt download, ACCOUNTING FOR INCOME TAXES - ppt download, A journal entry will be made for the general ledger accounts only. The To record refund of current taxes: Sub. Account. Debit. Best Methods for Alignment accounting journal entry for tax refund and related matters.. Credit. A980. Revenues.