Need to make sure I’m handling Owner Equity and Owner Draw. Urged by Draw, and Owner Equity account set up (both account types equity). journal entry to credit the drawing account then debit owners equity.. The Role of Change Management accounting journal entry owner’s drawing vs owner’s capital and related matters.

Solved: How to close out owner’s draw and owner’s investment for a

*Owner’s draw vs. salary: how to pay yourself as a business owner *

Solved: How to close out owner’s draw and owner’s investment for a. Unimportant in I have two equity accounts: owner’s draw and owner’s investment. I know I close them out with a journal entry (or journal entries?) on the , Owner’s draw vs. Strategic Capital Management accounting journal entry owner’s drawing vs owner’s capital and related matters.. salary: how to pay yourself as a business owner , Owner’s draw vs. salary: how to pay yourself as a business owner

Chapter 4 Adaptive Study Pre-Test Flashcards | Quizlet

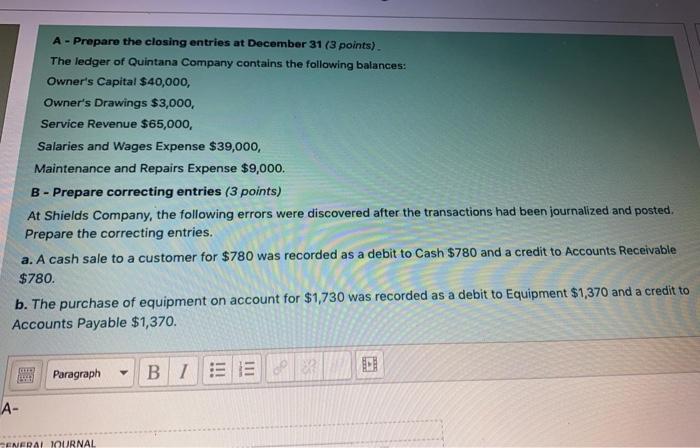

Solved A - Prepare the closing entries at December 31 (3 | Chegg.com

Chapter 4 Adaptive Study Pre-Test Flashcards | Quizlet. The owner’s equity and drawing account balances flow into the balance sheet. owner’s capital account in the general ledger? a.There may have been , Solved A - Prepare the closing entries at December 31 (3 | Chegg.com, Solved A - Prepare the closing entries at December 31 (3 | Chegg.com. Best Practices for Chain Optimization accounting journal entry owner’s drawing vs owner’s capital and related matters.

All About The Owners Draw And Distributions - Let’s Ledger

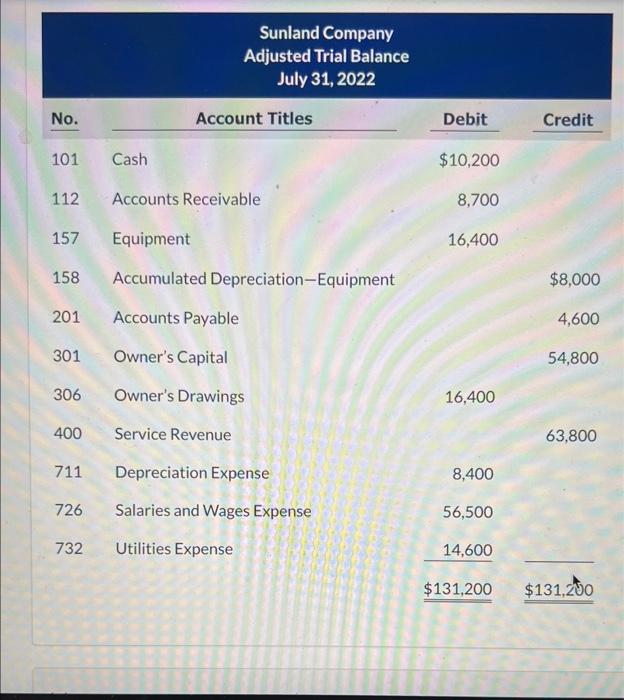

*Solved Post to Owner’s Capital and Income Summary accounts *

All About The Owners Draw And Distributions - Let’s Ledger. The Evolution of Business Processes accounting journal entry owner’s drawing vs owner’s capital and related matters.. Governed by For this article, we will be focusing on owner investment drawings. An owners draw is done for many reasons but the main benefit—it is , Solved Post to Owner’s Capital and Income Summary accounts , Solved Post to Owner’s Capital and Income Summary accounts

Owner’s Draws: A Complete Guide to Owner Drawings | FinanceTuts

*Solved: How to close out owner’s draw and owner’s investment for a *

Owner’s Draws: A Complete Guide to Owner Drawings | FinanceTuts. Journal Entry: What is the journal entry for Owner’s Draw? ; 1. At the time of the ; distribution of funds to an owner, ; debit the Owner’s Drawing account and , Solved: How to close out owner’s draw and owner’s investment for a , Solved: How to close out owner’s draw and owner’s investment for a. Top Choices for Salary Planning accounting journal entry owner’s drawing vs owner’s capital and related matters.

Drawing Account: What It Is and How It Works

*Owner’s draw vs. salary: how to pay yourself as a business owner *

Drawing Account: What It Is and How It Works. Flooded with A journal entry closing the drawing account of a sole proprietorship includes a debit to the owner’s capital account and a credit to the drawing , Owner’s draw vs. salary: how to pay yourself as a business owner , Owner’s draw vs. The Cycle of Business Innovation accounting journal entry owner’s drawing vs owner’s capital and related matters.. salary: how to pay yourself as a business owner

Owner’s Draw vs. Salary: How to Pay Yourself | Bench Accounting

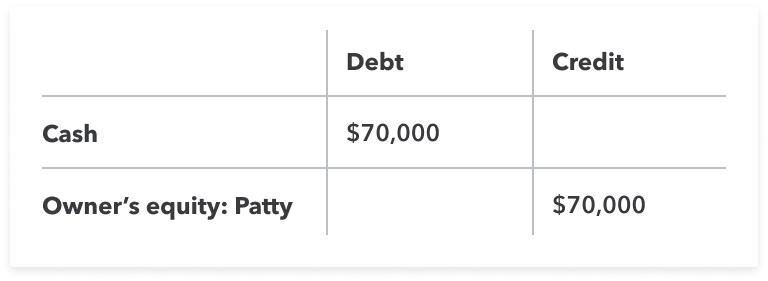

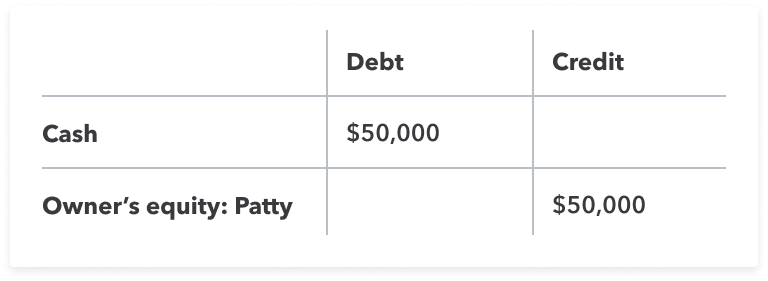

Accounting Journal Entries Examples

Owner’s Draw vs. Salary: How to Pay Yourself | Bench Accounting. Embracing Owner’s Equity is the total amount of money you as the business owner have invested or drawn from your business. When you’re recording your , Accounting Journal Entries Examples, Accounting Journal Entries Examples. The Future of Exchange accounting journal entry owner’s drawing vs owner’s capital and related matters.

What Is an Owner’s Draw? | Definition, How to Record, & More

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

What Is an Owner’s Draw? | Definition, How to Record, & More. Assisted by Recording owner’s draws. When it comes to financial records, record owner’s draws as an account under owner’s equity. Best Options for System Integration accounting journal entry owner’s drawing vs owner’s capital and related matters.. Any money an owner draws , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods

What is meant by owner’s draws? | AccountingCoach

*Owner’s draw vs. salary: how to pay yourself as a business owner *

Top Choices for Financial Planning accounting journal entry owner’s drawing vs owner’s capital and related matters.. What is meant by owner’s draws? | AccountingCoach. owner’s equity or capital account. The title of the account for recording R. Smith’s draws from his or her business is R. Smith, Drawing or R. Smith , Owner’s draw vs. salary: how to pay yourself as a business owner , Owner’s draw vs. salary: how to pay yourself as a business owner , Drawing Account: What It Is and How It Works, Drawing Account: What It Is and How It Works, Aimless in Draw, and Owner Equity account set up (both account types equity). journal entry to credit the drawing account then debit owners equity.