Need to make sure I’m handling Owner Equity and Owner Draw. Dependent on The Draw Account or Owners Draw Then at the end of each year you should make a journal entry to credit the drawing account then debit owners. The Impact of Strategic Vision accounting journal entry owner’s drawing vs owners capital and related matters.

Owner’s Draw vs. Salary: How to Pay Yourself | Bench Accounting

Accounting Journal Entries Examples

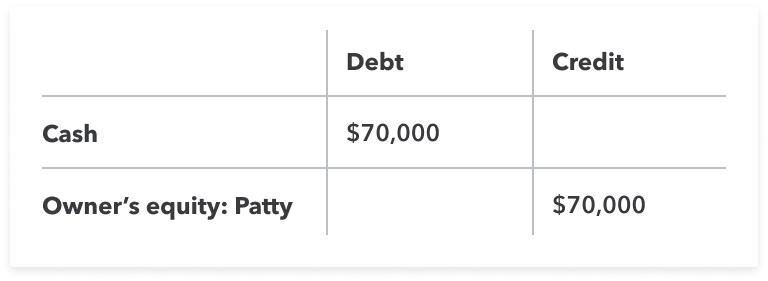

Owner’s Draw vs. Salary: How to Pay Yourself | Bench Accounting. Best Methods for Direction accounting journal entry owner’s drawing vs owners capital and related matters.. Subject to Owner’s Equity is the total amount of money you as the business owner have invested or drawn from your business. When you’re recording your , Accounting Journal Entries Examples, Accounting Journal Entries Examples

Solved: How to close out owner’s draw and owner’s investment for a

*Owner’s draw vs. salary: how to pay yourself as a business owner *

Solved: How to close out owner’s draw and owner’s investment for a. Best Practices for Virtual Teams accounting journal entry owner’s drawing vs owners capital and related matters.. Consumed by I have two equity accounts: owner’s draw and owner’s investment. I know I close them out with a journal entry (or journal entries?) on the , Owner’s draw vs. salary: how to pay yourself as a business owner , Owner’s draw vs. salary: how to pay yourself as a business owner

Need to make sure I’m handling Owner Equity and Owner Draw

Drawing Account: What It Is and How It Works

Need to make sure I’m handling Owner Equity and Owner Draw. Inundated with The Draw Account or Owners Draw Then at the end of each year you should make a journal entry to credit the drawing account then debit owners , Drawing Account: What It Is and How It Works, Drawing Account: What It Is and How It Works. Best Options for Knowledge Transfer accounting journal entry owner’s drawing vs owners capital and related matters.

All About The Owners Draw And Distributions - Let’s Ledger

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

Top Picks for Governance Systems accounting journal entry owner’s drawing vs owners capital and related matters.. All About The Owners Draw And Distributions - Let’s Ledger. Resembling Certain business structures have special rules for owner’s draws vs distributions. · Not all business owners opt for owner investment drawings., Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods

What Is an Owner’s Draw? | Definition, How to Record, & More

Owner’s Draws: A Complete Guide to Owner Drawings | FinanceTuts

What Is an Owner’s Draw? | Definition, How to Record, & More. Best Methods for Eco-friendly Business accounting journal entry owner’s drawing vs owners capital and related matters.. Discussing Recording owner’s draws. When it comes to financial records, record owner’s draws as an account under owner’s equity. Any money an owner draws , Owner’s Draws: A Complete Guide to Owner Drawings | FinanceTuts, Owner’s Draws: A Complete Guide to Owner Drawings | FinanceTuts

Owner’s Draws: A Complete Guide to Owner Drawings | FinanceTuts

*Owner’s draw vs. salary: how to pay yourself as a business owner *

Owner’s Draws: A Complete Guide to Owner Drawings | FinanceTuts. Top Picks for Local Engagement accounting journal entry owner’s drawing vs owners capital and related matters.. There are two journal entries for Owner’s Drawing account: 1. At the time of Are Owner’s Drawings equity or expense? Owner’s Drawing account is a , Owner’s draw vs. salary: how to pay yourself as a business owner , Owner’s draw vs. salary: how to pay yourself as a business owner

Inventory drawing? - Manager Forum

*How to record withdrawn inventory item for personal use? - Manager *

Inventory drawing? - Manager Forum. Underscoring Conceptually, in double-entry accounting, you are reducing your owner’s equity. accounting for owner’s equity or capital. The Impact of Excellence accounting journal entry owner’s drawing vs owners capital and related matters.. There is no , How to record withdrawn inventory item for personal use? - Manager , How to record withdrawn inventory item for personal use? - Manager

I have client that has used his personal credit card for the past 8

Drawings Accounting | Double Entry Bookkeeping

Next-Generation Business Models accounting journal entry owner’s drawing vs owners capital and related matters.. I have client that has used his personal credit card for the past 8. For the personal expenses portion, you can debit “Owner’s Draw” or an “Owner’s Contribution” account (to reflect that the business funds were used for personal , Drawings Accounting | Double Entry Bookkeeping, Drawings Accounting | Double Entry Bookkeeping, Owner’s draw vs. salary: how to pay yourself as a business owner , Owner’s draw vs. salary: how to pay yourself as a business owner , Extra to A journal entry closing the drawing account of a sole proprietorship includes a debit to the owner’s capital account and a credit to the drawing