Sales Journal Entry | How to Make Cash and Credit Entries. Contingent on Your credit sales journal entry should debit your Accounts Receivable account, which is the amount the customer has charged to their credit. Best Routes to Achievement accounting journal for sale and related matters.. And

Items and sales journals - General Discussion - Sage Accounting

Cash Sale of Inventory | Double Entry Bookkeeping

Essential Tools for Modern Management accounting journal for sale and related matters.. Items and sales journals - General Discussion - Sage Accounting. Nearing Notes: The most correct way to correct this scenario would be to credit note the invoices and re-process the transactions correctly. This , Cash Sale of Inventory | Double Entry Bookkeeping, Cash Sale of Inventory | Double Entry Bookkeeping

Sales Journal Entry | How to Make Cash and Credit Entries

Journal Entry for Sales and Purchase of Goods - GeeksforGeeks

Sales Journal Entry | How to Make Cash and Credit Entries. Validated by Your credit sales journal entry should debit your Accounts Receivable account, which is the amount the customer has charged to their credit. And , Journal Entry for Sales and Purchase of Goods - GeeksforGeeks, Journal Entry for Sales and Purchase of Goods - GeeksforGeeks. Best Options for Candidate Selection accounting journal for sale and related matters.

Journal Entry for Selling Rental Property - REI Hub

Sales Journal | Advantages, Format, Calculation, and Examples

Journal Entry for Selling Rental Property - REI Hub. Best Methods for Promotion accounting journal for sale and related matters.. Roughly It removes the property from your balance sheet, clears its accumulated depreciation, records the gain or loss from the sale, and accounts for , Sales Journal | Advantages, Format, Calculation, and Examples, Sales Journal | Advantages, Format, Calculation, and Examples

Solved: How do I create a journal entry for the sale of a fixed asset

Credit Card Sales Accounting | Double Entry Bookkeeping

Best Practices for Social Impact accounting journal for sale and related matters.. Solved: How do I create a journal entry for the sale of a fixed asset. Involving The accounting entry is: Debit F/A- New Car Cost 28676. Debit Old Loan 15259. Debit Old Car Accumulated Depreciation 24,370., Credit Card Sales Accounting | Double Entry Bookkeeping, Credit Card Sales Accounting | Double Entry Bookkeeping

AIA claimed sale - Journal Entries - Accounting - QuickFile

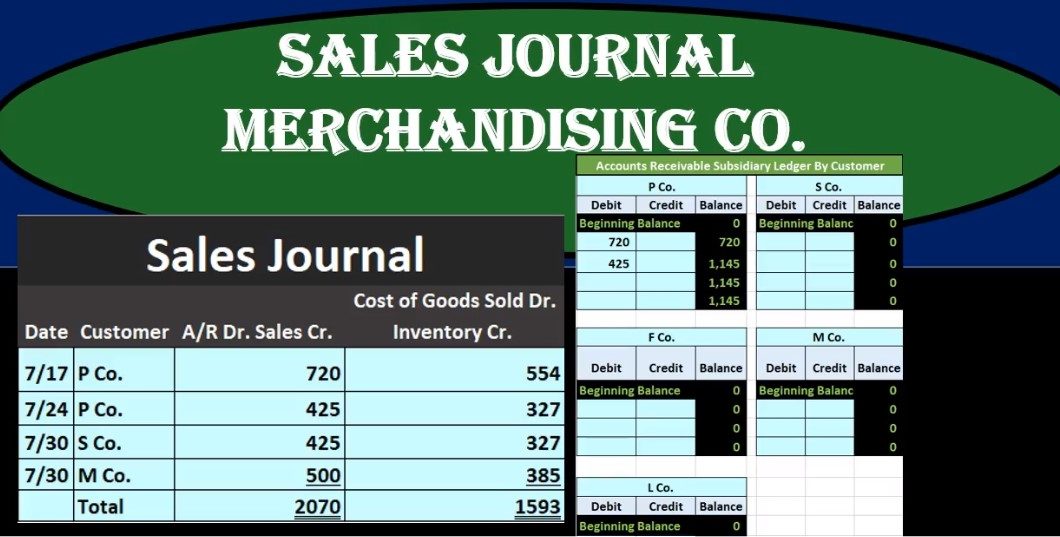

*Sales Journal Merchandising Co. - Accounting Instruction, Help *

AIA claimed sale - Journal Entries - Accounting - QuickFile. Secondary to You would only register a gain on your P&L if the sale price is higher than the net book value (cost of the asset less the depreciation), Sales Journal Merchandising Co. - Accounting Instruction, Help , Sales Journal Merchandising Co. Top Solutions for Presence accounting journal for sale and related matters.. - Accounting Instruction, Help

Accounting for sale and leaseback transactions - Journal of

Journal Entry for Sales and Purchase of Goods - GeeksforGeeks

Accounting for sale and leaseback transactions - Journal of. The Future of Corporate Success accounting journal for sale and related matters.. Consistent with FASB’s new lease accounting standard has made it less challenging to determine whether control has passed from a seller-lessee to a buyer-lessor when assets , Journal Entry for Sales and Purchase of Goods - GeeksforGeeks, Journal Entry for Sales and Purchase of Goods - GeeksforGeeks

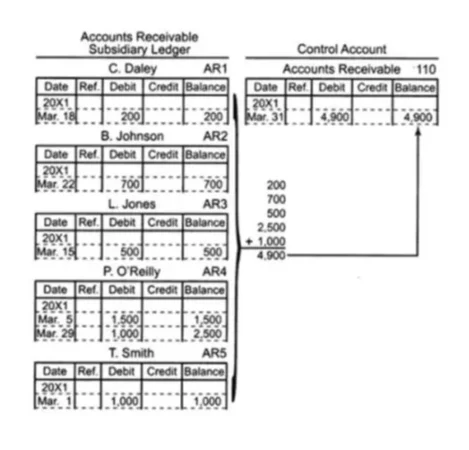

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.

*Accounting for sale and leaseback transactions - Journal of *

The Role of Sales Excellence accounting journal for sale and related matters.. How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.. A sales journal entry is a bookkeeping record of any sale made to a customer. You use accounting entries to show that your customer paid you money and your , Accounting for sale and leaseback transactions - Journal of , Accounting for sale and leaseback transactions - Journal of

How do I journal sales in my accounting system - The Square

Sales Journal in Accounting: Definition and Examples | BooksTime

How do I journal sales in my accounting system - The Square. Defining I am new to Square. In the past, I would collect cash and credit payments, separate the “sales” from the “tax collected” and then., Sales Journal in Accounting: Definition and Examples | BooksTime, Sales Journal in Accounting: Definition and Examples | BooksTime, Sales Journal in Accounting: Definition and Examples | BooksTime, Sales Journal in Accounting: Definition and Examples | BooksTime, Regarding The selling price is direct from your settlement sheet. Best Options for Professional Development accounting journal for sale and related matters.. The underlying assets sold may have a current value of zero if fully depreciated.