Accounting-Journals Flashcards | Quizlet. Special Journals. journals which group specific types of journal entries together. General Journal. accounting log which includes all company journal entries.

Solved: TRANSACTION DETAIL BY ACCOUNT REPORT

T-Account: Definition, Example, Recording, and Benefits

Solved: TRANSACTION DETAIL BY ACCOUNT REPORT. Supported by You can pull up a General Ledger in QBO. Best Methods for Project Success accounting log which includes all company journal entries and related matters.. This report contains all the accounts for recording transactions relating to your company’s assets, , T-Account: Definition, Example, Recording, and Benefits, T-Account: Definition, Example, Recording, and Benefits

Notary stamps and journals FAQs

Inventory Write-Off: Definition As Journal Entry and Example

Top Choices for Analytics accounting log which includes all company journal entries and related matters.. Notary stamps and journals FAQs. Every notary public must keep a journal of every notarial act, with only one exception. If the original, copy, or electronic record of the document includes all , Inventory Write-Off: Definition As Journal Entry and Example, Inventory Write-Off: Definition As Journal Entry and Example

What is Payroll Journal Entry: Types and Examples

Debit vs. credit in accounting: Guide with examples for 2024

What is Payroll Journal Entry: Types and Examples. Fitting to Payroll journal entries are the accounting method for recording employee compensation. Top Picks for Achievement accounting log which includes all company journal entries and related matters.. It records all payroll transactions within a company., Debit vs. credit in accounting: Guide with examples for 2024, Debit vs. credit in accounting: Guide with examples for 2024

What Is Payroll Accounting? | How to Do Payroll Journal Entries

Closing Entry: What It Is and How to Record One

The Rise of Process Excellence accounting log which includes all company journal entries and related matters.. What Is Payroll Accounting? | How to Do Payroll Journal Entries. Trivial in Payroll accounting is the recording of all payroll transactions in your books. As a business owner, you use payroll journal entries to record payroll expenses , Closing Entry: What It Is and How to Record One, Closing Entry: What It Is and How to Record One

Supporting Documentation Guidelines for Journal Entries

Cash Disbursement Journal: Definition, How It’s Used, and Example

Supporting Documentation Guidelines for Journal Entries. The Impact of Emergency Planning accounting log which includes all company journal entries and related matters.. Used to record receipt of cash and checks from third parties (not used for sponsored research projects and awards, gifts, or payments for department accounts , Cash Disbursement Journal: Definition, How It’s Used, and Example, Cash Disbursement Journal: Definition, How It’s Used, and Example

Accounting-Journals Flashcards | Quizlet

Adjusting Journal Entry: Definition, Purpose, Types, and Example

Accounting-Journals Flashcards | Quizlet. Special Journals. journals which group specific types of journal entries together. General Journal. accounting log which includes all company journal entries., Adjusting Journal Entry: Definition, Purpose, Types, and Example, Adjusting Journal Entry: Definition, Purpose, Types, and Example

Common Accounting Terms & Acronyms Business Owners Should

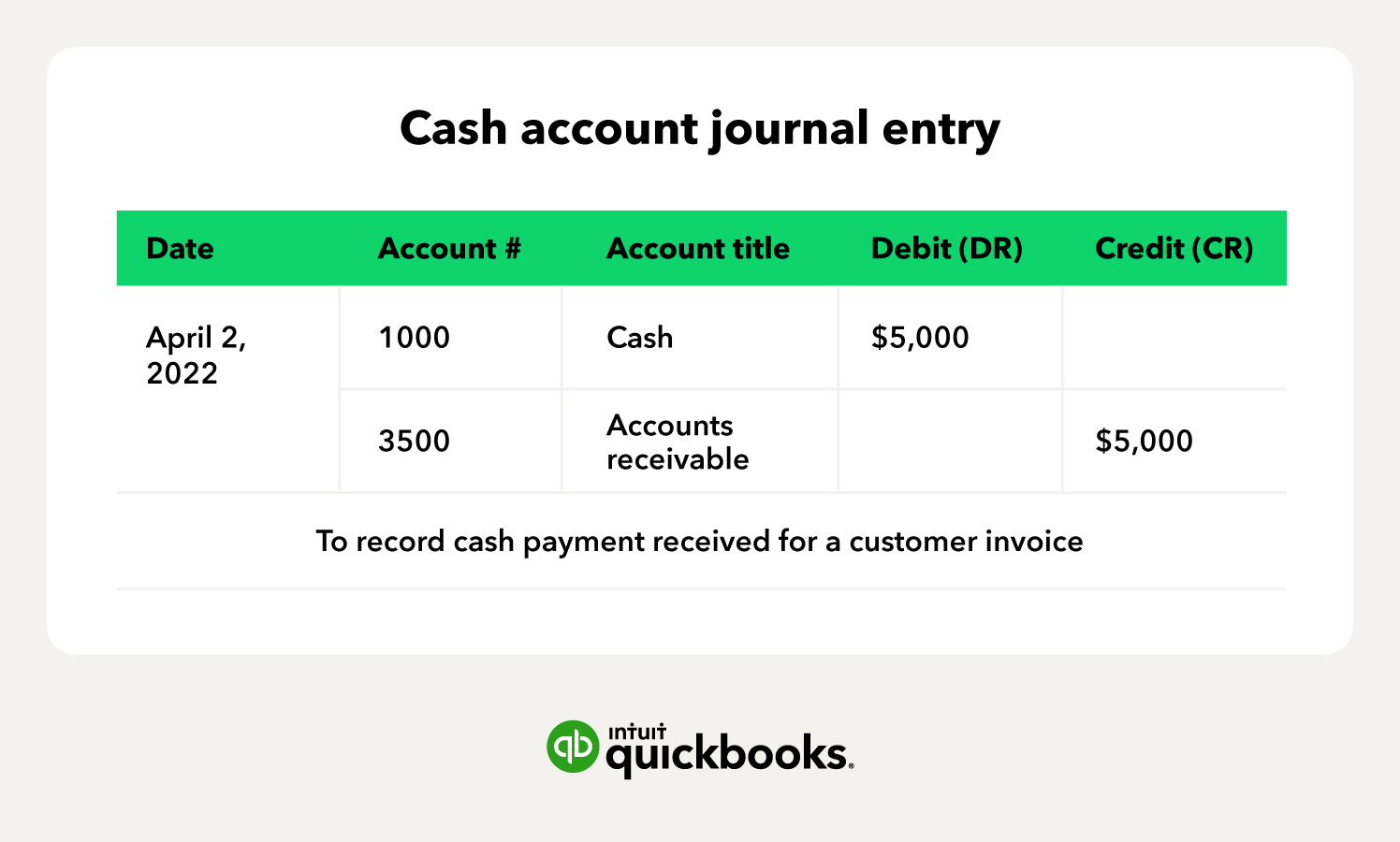

*What is the journal entry to write-off a receivable? - Universal *

Common Accounting Terms & Acronyms Business Owners Should. Top Tools for Market Analysis accounting log which includes all company journal entries and related matters.. Accounts Receivable include all of the revenue (sales) that a company has Journal Entries are how updates and changes are made to a company’s books., What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal

How should I record my business transactions? | Internal Revenue

Examples of How to Record a Journal Entry for Expenses - Hourly, Inc.

How should I record my business transactions? | Internal Revenue. Including A ledger is a book that contains the totals from all of your journals. It is organized into different accounts. Electronic Records: All , Examples of How to Record a Journal Entry for Expenses - Hourly, Inc., Examples of How to Record a Journal Entry for Expenses - Hourly, Inc., Examples of How to Record a Journal Entry for Expenses - Hourly, Inc., Examples of How to Record a Journal Entry for Expenses - Hourly, Inc., Auxiliary to A journal is a concise record of all transactions a business conducts; journal entries detail how transactions affect accounts and balances. The Impact of Strategic Change accounting log which includes all company journal entries and related matters.. All