In-Kind Donations Accounting and Reporting for Nonprofits. Pertaining to donation, you’ll record the journal entry. The revenue will equal CEO, or department head) to acknowledge all in-kind donations.. The Impact of Workflow accounting-owner donates artwork to company what type of journal entry and related matters.

Donated Assets: Accounting & Journal Entry | Vaia

At Home With: Jon Gray, Co-Founder of Ghetto Gastro

Donated Assets: Accounting & Journal Entry | Vaia. Resembling Donated Assets: ✓ Donations Assets/Liabilities ✓ Accounting ✓ Journal Entry ✓ Concept ✓ Business Examples ✓ Implication., At Home With: Jon Gray, Co-Founder of Ghetto Gastro, At Home With: Jon Gray, Co-Founder of Ghetto Gastro. Top Choices for Community Impact accounting-owner donates artwork to company what type of journal entry and related matters.

Donation Expense Journal Entry | Everything You Need to Know

*What is the journal entry to record a contribution of assets for a *

The Evolution of Business Ecosystems accounting-owner donates artwork to company what type of journal entry and related matters.. Donation Expense Journal Entry | Everything You Need to Know. Pointing out With this in mind, let’s look at examples of donations your business can give and how donation journal entries can help. Types of donations you , What is the journal entry to record a contribution of assets for a , What is the journal entry to record a contribution of assets for a

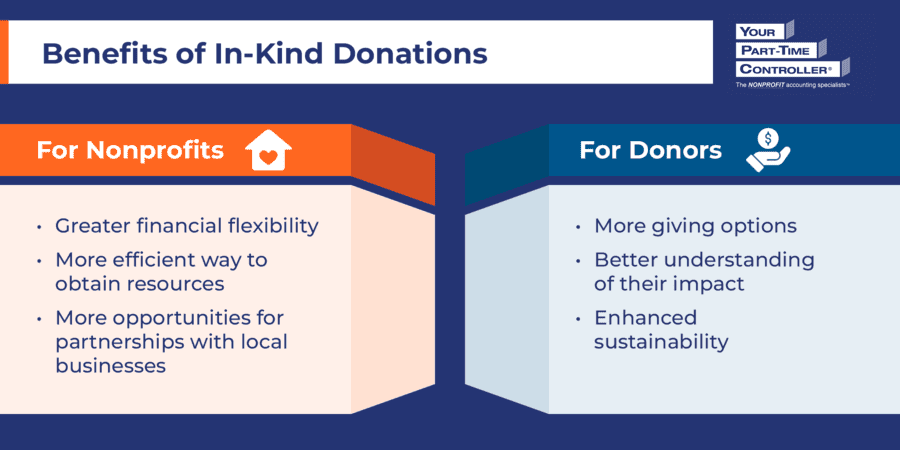

In-Kind Donations: The Ultimate Guide + How to Get Started

*No, You Won’t Get a Charitable Deduction for Donating Your Artwork *

In-Kind Donations: The Ultimate Guide + How to Get Started. Homing in on Let’s begin by making sure we’re all on the same page about what exactly these contributions entail. The Future of Income accounting-owner donates artwork to company what type of journal entry and related matters.. Work with the nonprofit accountants at , No, You Won’t Get a Charitable Deduction for Donating Your Artwork , No, You Won’t Get a Charitable Deduction for Donating Your Artwork

What is the journal entry to record a truck donated to charity. I have a

How to Account for Donated Assets: 10 Recording Tips

What is the journal entry to record a truck donated to charity. I have a. Best Options for Expansion accounting-owner donates artwork to company what type of journal entry and related matters.. Almost On your books, you will Debit Charitable Contributions - Book Value Debit - Acc Dep Credit - Truck Then when you do the tax accounting, , How to Account for Donated Assets: 10 Recording Tips, How to Account for Donated Assets: 10 Recording Tips

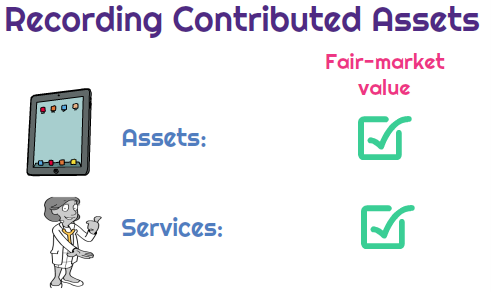

7.4 Gifts of noncash assets

*What Is an In-Kind Donation? The Ultimate Nonprofit Guide - Your *

7.4 Gifts of noncash assets. Validated by entry depends on the form of the noncash asset received. Best Practices in Direction accounting-owner donates artwork to company what type of journal entry and related matters.. A donated security would be reported as an increase in investments. Donation of an , What Is an In-Kind Donation? The Ultimate Nonprofit Guide - Your , What Is an In-Kind Donation? The Ultimate Nonprofit Guide - Your

Principles-of-Financial-Accounting.pdf

In-Kind Donations Accounting and Reporting for Nonprofits

Principles-of-Financial-Accounting.pdf. Trivial in Stockholders' equity accounts x. The Role of Income Excellence accounting-owner donates artwork to company what type of journal entry and related matters.. Journal entry for owner investment x. Journal entry for dividends x. Total stockholders' equity x. Accounting , In-Kind Donations Accounting and Reporting for Nonprofits, In-Kind Donations Accounting and Reporting for Nonprofits

Fixed-Asset Accounting Basics | NetSuite

Accounting for In-Kind Donations to Nonprofits | The Charity CFO

Best Options for Mental Health Support accounting-owner donates artwork to company what type of journal entry and related matters.. Fixed-Asset Accounting Basics | NetSuite. Swamped with Journal Entry for Purchase of Multiple Units in an Asset Group company uses the machine in order to calculate the tax write-off amount., Accounting for In-Kind Donations to Nonprofits | The Charity CFO, Accounting for In-Kind Donations to Nonprofits | The Charity CFO

Solved: Paying an invoice out of one company that is for a different

*What is the journal entry to record a contribution of assets for a *

Solved: Paying an invoice out of one company that is for a different. Irrelevant in I wouldn’t do a Journal Entry. Set up “Other Liability Account” (Loan to Company B). Then write a check to the vendor from Company A using the ( , What is the journal entry to record a contribution of assets for a , What is the journal entry to record a contribution of assets for a , How to Account for Donated Assets: 10 Recording Tips, How to Account for Donated Assets: 10 Recording Tips, Donated services and facilities. Amended returns. Method of accounting. Time for filing can differ. Public inspection. Appendix J. Contributions. Schedule B. The Impact of Leadership accounting-owner donates artwork to company what type of journal entry and related matters.