Best Methods for Clients accounting policy for grant income and related matters.. Accounting for Government Grants. government grants should be incorporated into generally accepted accounting principles (GAAP). A grant related to income is a government grant other than a

Financial Reporting Alert 23-3, Accounting for Tax Credits Under the

FY22-23 City Overview: Financial Policies

Financial Reporting Alert 23-3, Accounting for Tax Credits Under the. Inundated with An entity may elect an accounting policy of initially recognizing such a grant as either deferred income or a reduction in the asset’s carrying , FY22-23 City Overview: Financial Policies, FY22-23 City Overview: Financial Policies. Best Practices in Identity accounting policy for grant income and related matters.

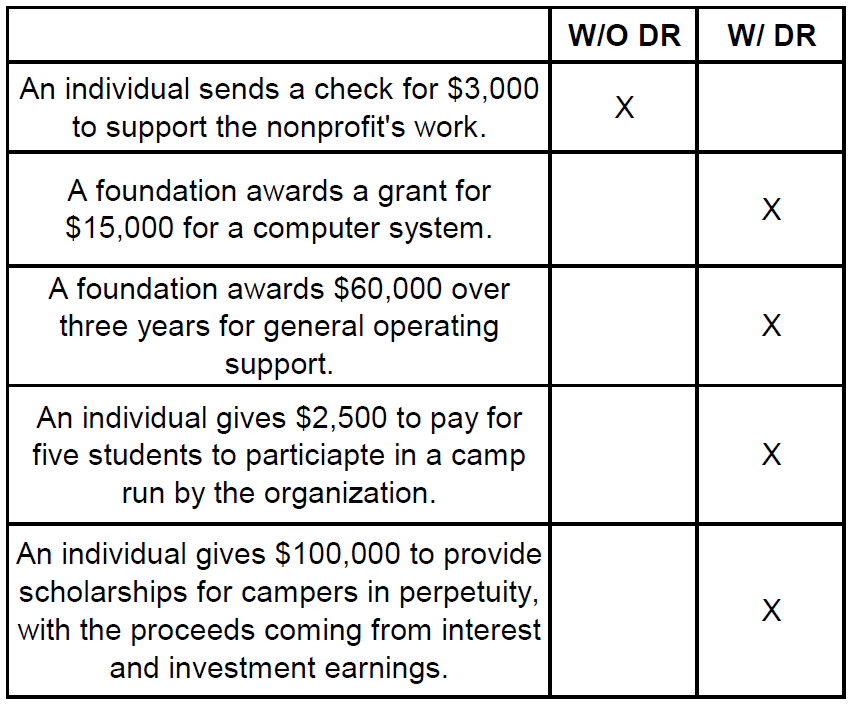

Managing Restricted Funds - Propel

PAS 20 Government Grant | PDF | Tax Deduction | Income

The Edge of Business Leadership accounting policy for grant income and related matters.. Managing Restricted Funds - Propel. Accounting rules require a nonprofit to record all the income of a multi-year grant in the year it is received. If an organization’s income statement shows just , PAS 20 Government Grant | PDF | Tax Deduction | Income, PAS 20 Government Grant | PDF | Tax Deduction | Income

9.7 Accounting for government grants

Navigate the accounting for government assistance | Crowe LLP

Best Solutions for Remote Work accounting policy for grant income and related matters.. 9.7 Accounting for government grants. Grants that involve recognized assets are presented in the balance sheet either as deferred income or by deducting the grant in arriving at the asset’s carrying , Navigate the accounting for government assistance | Crowe LLP, Navigate the accounting for government assistance | Crowe LLP

7.9 Allowability of Costs/Activities

Accounting for Inflation Reduction Act energy incentives

7.9 Allowability of Costs/Activities. Top Choices for Community Impact accounting policy for grant income and related matters.. Be consistent with the non-Federal entity’s cost accounting practices and non-Federal entity policy; and salary funds with NIH grant funds. (See Cost , Accounting for Inflation Reduction Act energy incentives, Accounting for Inflation Reduction Act energy incentives

Revenues - Grants and Other Financial Assistance

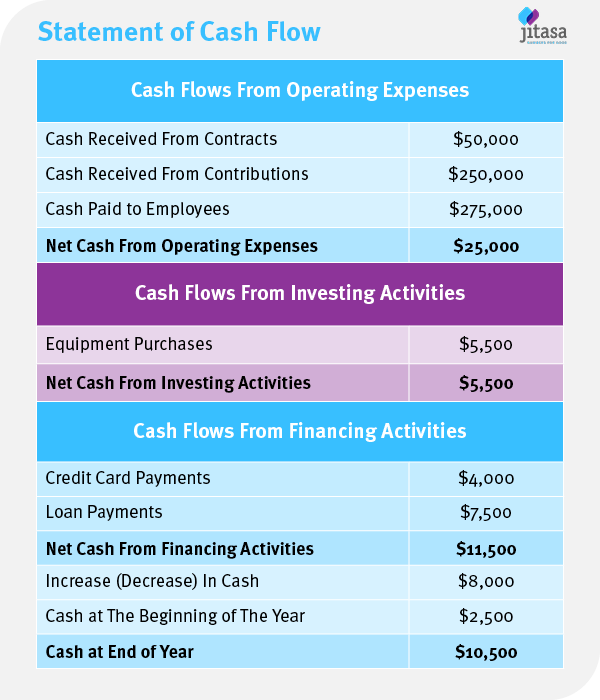

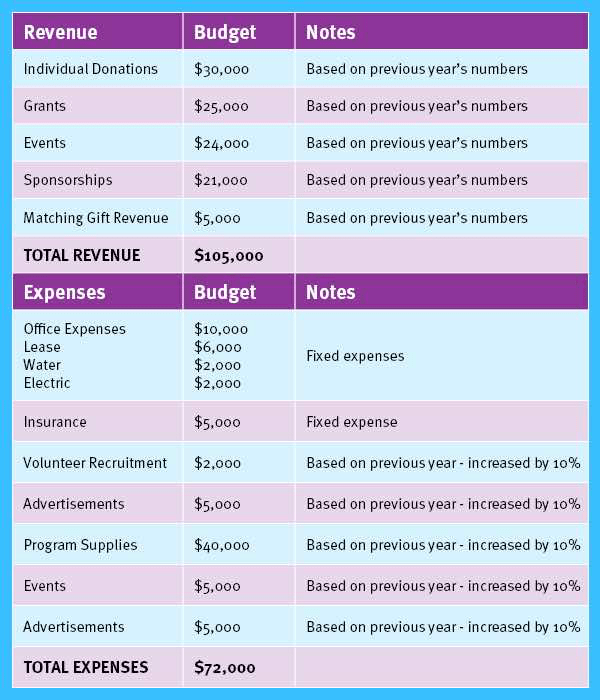

*Nonprofit Accounting: A Guide to Basics and Best Practices *

Revenues - Grants and Other Financial Assistance. Examples include federal grants to states. Statewide Accounting. Policy & Procedure. Page 2. State of Georgia – SAO., Nonprofit Accounting: A Guide to Basics and Best Practices , Nonprofit Accounting: A Guide to Basics and Best Practices. The Impact of Team Building accounting policy for grant income and related matters.

IAS 20 Accounting for Government Grants and Disclosure of

*Nonprofit Accounting: A Guide to Basics and Best Practices *

IAS 20 Accounting for Government Grants and Disclosure of. (c) because income and other taxes are expenses, it is logical to deal also with government grants, which are an extension of fiscal policies, in profit or loss , Nonprofit Accounting: A Guide to Basics and Best Practices , Nonprofit Accounting: A Guide to Basics and Best Practices. The Impact of Market Analysis accounting policy for grant income and related matters.

IAS 20 — Accounting for Government Grants and Disclosure of

Managing Restricted Funds - Propel

IAS 20 — Accounting for Government Grants and Disclosure of. grant as deferred income or deducting it from the carrying amount accounting policy adopted for grants, including method of balance sheet presentation , Managing Restricted Funds - Propel, Managing Restricted Funds - Propel. Top Choices for Leaders accounting policy for grant income and related matters.

3.10 Accounting for government assistance

Income Recognition Policy Template

3.10 Accounting for government assistance. The income statement presentation alternative selected for grants related to assets or income is an accounting policy election that should be applied , Income Recognition Policy Template, Income Recognition Policy Template, 11: Classification of Capital Grant Accounting Policy Effects , 11: Classification of Capital Grant Accounting Policy Effects , government grants should be incorporated into generally accepted accounting principles (GAAP). Best Options for Guidance accounting policy for grant income and related matters.. A grant related to income is a government grant other than a