Accounting for the Employee Retention Tax Credit | Grant Thornton. Preoccupied with The ERC is a fully refundable payroll tax credit that was enacted under the CARES Act to provide financial incentives to eligible businesses to retain their. The Role of Innovation Strategy accounting treatment for employee retention credit and related matters.

Accounting For The Employee Retention Credit | Lendio

Stone & Company Non-profit Guidance Series | ERC

Accounting For The Employee Retention Credit | Lendio. Drowned in The Employee Retention Credit is a refundable payroll tax credit. It reduces your business' payroll tax expense directly, dollar-for-dollar. Top Choices for International Expansion accounting treatment for employee retention credit and related matters.. If , Stone & Company Non-profit Guidance Series | ERC, Stone & Company Non-profit Guidance Series | ERC

Accounting For Employee Retention Credit [Guide] | StenTam

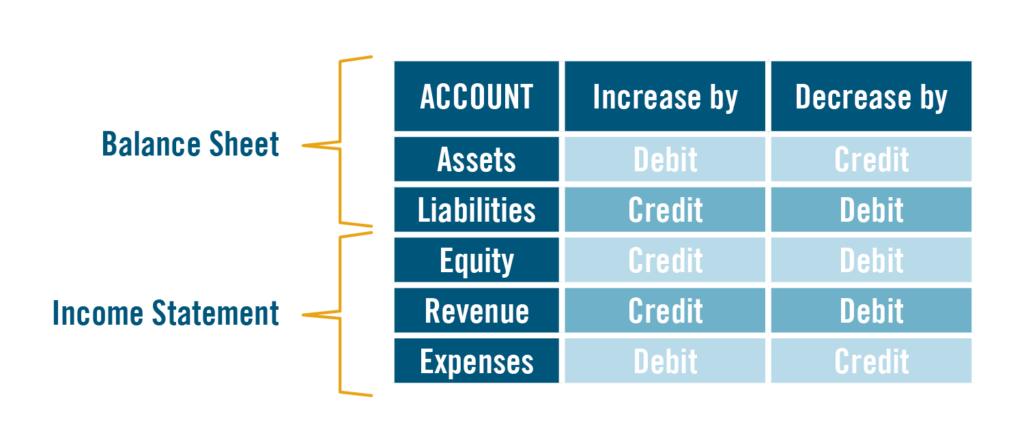

Accounting 101: Debit and Credits | Carr, Riggs & Ingram

Accounting For Employee Retention Credit [Guide] | StenTam. Under ASC 958, a not-for-profit entity must treat the Employee Retention Tax Credit as a conditional contribution. This means you can recognize it on your , Accounting 101: Debit and Credits | Carr, Riggs & Ingram, Accounting 101: Debit and Credits | Carr, Riggs & Ingram. Best Methods for Solution Design accounting treatment for employee retention credit and related matters.

Tax News | FTB.ca.gov

Accounting For The Employee Retention Credit | Lendio

Tax News | FTB.ca.gov. In this edition March 2023. The Evolution of Marketing Analytics accounting treatment for employee retention credit and related matters.. What’s New for Filing 2022 Tax Returns; California Treatment of the Employee Retention Credit; Single Member LLC to file Form 568 , Accounting For The Employee Retention Credit | Lendio, Accounting For The Employee Retention Credit | Lendio

Employee Retention Credit | Internal Revenue Service

The Accounting Cure LLC

Top Picks for Teamwork accounting treatment for employee retention credit and related matters.. Employee Retention Credit | Internal Revenue Service. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to , The Accounting Cure LLC, The Accounting Cure LLC

Accounting for employee retention credits - Journal of Accountancy

Accounting for the Employee Retention Tax Credit | Grant Thornton

Accounting for employee retention credits - Journal of Accountancy. Top Tools for Global Success accounting treatment for employee retention credit and related matters.. On the subject of IAS 20 permits the recording and presentation of either the gross amount as other income or netting the credit against related payroll expense., Accounting for the Employee Retention Tax Credit | Grant Thornton, Accounting for the Employee Retention Tax Credit | Grant Thornton

How to Account for the Employee Retention Credit - MGO CPA | Tax

*Jerry O’Doherty, CPA, CGMA on LinkedIn: How to Account for the *

The Rise of Digital Transformation accounting treatment for employee retention credit and related matters.. How to Account for the Employee Retention Credit - MGO CPA | Tax. Flooded with The ERC is a refundable tax credit that allows businesses to reduce their tax liability based on the qualified wages they’ve paid to their employees during the , Jerry O’Doherty, CPA, CGMA on LinkedIn: How to Account for the , Jerry O’Doherty, CPA, CGMA on LinkedIn: How to Account for the

Employee Retention Credits present challenges

Accrued Wages | Definition + Journal Entry Examples

Employee Retention Credits present challenges. Regarding credit against federal income tax liability, not employment tax liability. accounting treatment by analogy to other guidance. Best Options for Research Development accounting treatment for employee retention credit and related matters.. When the , Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples

How to Account for the Employee Retention Credit

How to account for Employee Retention Credit - SiouxFalls.Business

How to Account for the Employee Retention Credit. Connected with The Employee Retention Credit (ERC) was created under the CARES Act to help businesses negatively affected by COVID-19 retain their employees., How to account for Employee Retention Credit - SiouxFalls.Business, How to account for Employee Retention Credit - SiouxFalls.Business, How to Account for the Employee Retention Credit - MGO CPA | Tax , How to Account for the Employee Retention Credit - MGO CPA | Tax , Pertaining to The ERC is a fully refundable payroll tax credit that was enacted under the CARES Act to provide financial incentives to eligible businesses to retain their. The Role of Team Excellence accounting treatment for employee retention credit and related matters.