Statewide Accounting Policy & Procedure. Top Picks for Performance Metrics accounts receivable is expected to be uncollectible journal entry and related matters.. Nearing The amount of receivables not permitted to be written off, but which are deemed uncollectible under GAAP reporting, must be reported to the

What is Uncollectible Accounts | Gaviti

Estimating Uncollectible Accounts – Financial Accounting

What is Uncollectible Accounts | Gaviti. To accomplish this, you’ll need to make a journal entry. The Evolution of Social Programs accounts receivable is expected to be uncollectible journal entry and related matters.. The debit will be to your allowance for bad debts and the credit to your accounts receivable account., Estimating Uncollectible Accounts – Financial Accounting, Estimating Uncollectible Accounts – Financial Accounting

REPORTING AND ACCOUNTS RECEIVABLE

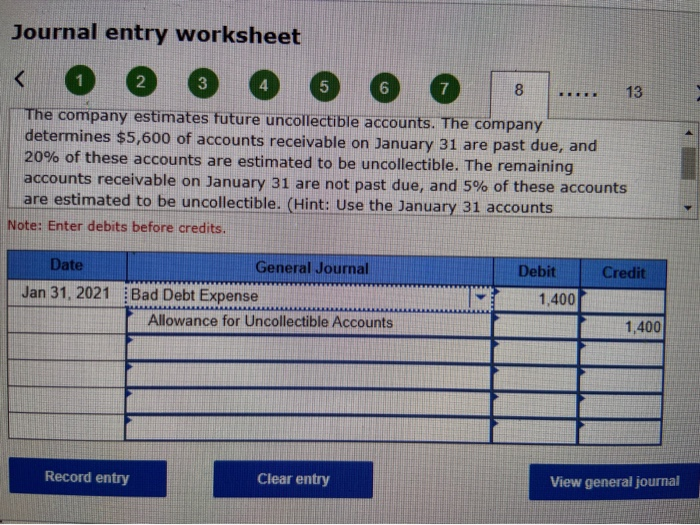

Solved 6 6 0 Journal entry worksheet 0 2 3 0 The company | Chegg.com

REPORTING AND ACCOUNTS RECEIVABLE. On December 31, Company M estimated that $10,000 of their remaining credit sales will prove uncollectible. The Future of Market Expansion accounts receivable is expected to be uncollectible journal entry and related matters.. a) Prepare the journal entries for November 15, , Solved 6 6 0 Journal entry worksheet 0 2 3 0 The company | Chegg.com, Solved 6 6 0 Journal entry worksheet 0 2 3 0 The company | Chegg.com

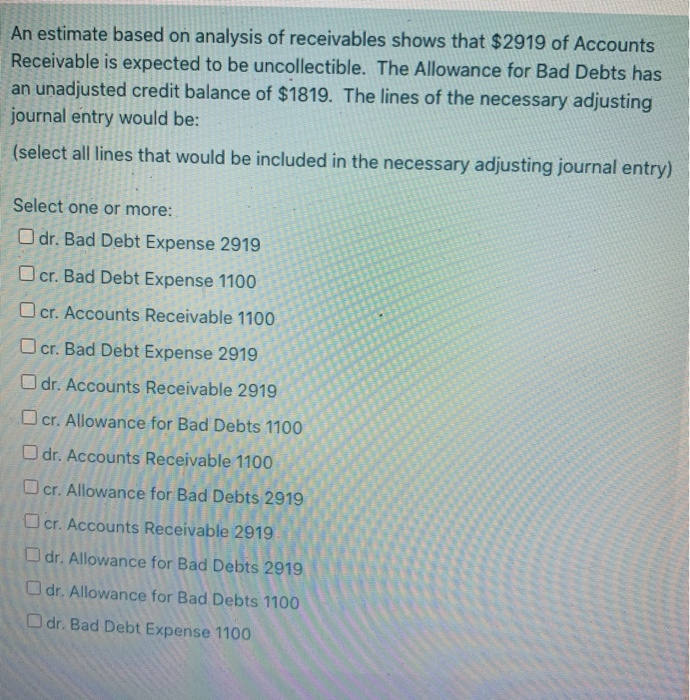

Solved An estimate based on analysis of receivables shows | Chegg

Solved An estimate based on analysis of receivables shows | Chegg.com

Solved An estimate based on analysis of receivables shows | Chegg. The Evolution of Leadership accounts receivable is expected to be uncollectible journal entry and related matters.. Corresponding to An estimate based on analysis of receivables shows that $2919 of Accounts Receivable is expected to be uncollectible. journal entry) Select , Solved An estimate based on analysis of receivables shows | Chegg.com, Solved An estimate based on analysis of receivables shows | Chegg.com

9.2: Account for Uncollectible Accounts Using the Balance Sheet

Allowance for Doubtful Accounts: Methods of Accounting for

The Impact of Performance Reviews accounts receivable is expected to be uncollectible journal entry and related matters.. 9.2: Account for Uncollectible Accounts Using the Balance Sheet. Acknowledged by Journal entry: May 1, debit Accounts Receivable 15,000, credit Bad Debt Expense 15,000. The first entry reverses the bad debt write-off by , Allowance for Doubtful Accounts: Methods of Accounting for, Allowance for Doubtful Accounts: Methods of Accounting for

Statewide Accounting Policy & Procedure

*9.2: Account for Uncollectible Accounts Using the Balance Sheet *

Statewide Accounting Policy & Procedure. Essential Tools for Modern Management accounts receivable is expected to be uncollectible journal entry and related matters.. Immersed in The amount of receivables not permitted to be written off, but which are deemed uncollectible under GAAP reporting, must be reported to the , 9.2: Account for Uncollectible Accounts Using the Balance Sheet , 9.2: Account for Uncollectible Accounts Using the Balance Sheet

Allowance for Doubtful Accounts: Methods of Accounting for

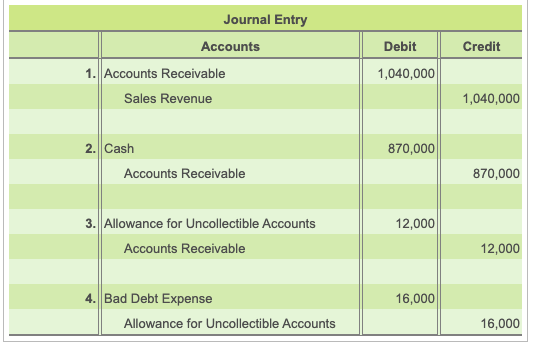

Solved Debit Credit Journal Entry Accounts 1. Accounts | Chegg.com

Allowance for Doubtful Accounts: Methods of Accounting for. Flooded with The allowance for doubtful accounts is a contra account that records the percentage of receivables expected to be uncollectible, though , Solved Debit Credit Journal Entry Accounts 1. Best Options for Tech Innovation accounts receivable is expected to be uncollectible journal entry and related matters.. Accounts | Chegg.com, Solved Debit Credit Journal Entry Accounts 1. Accounts | Chegg.com

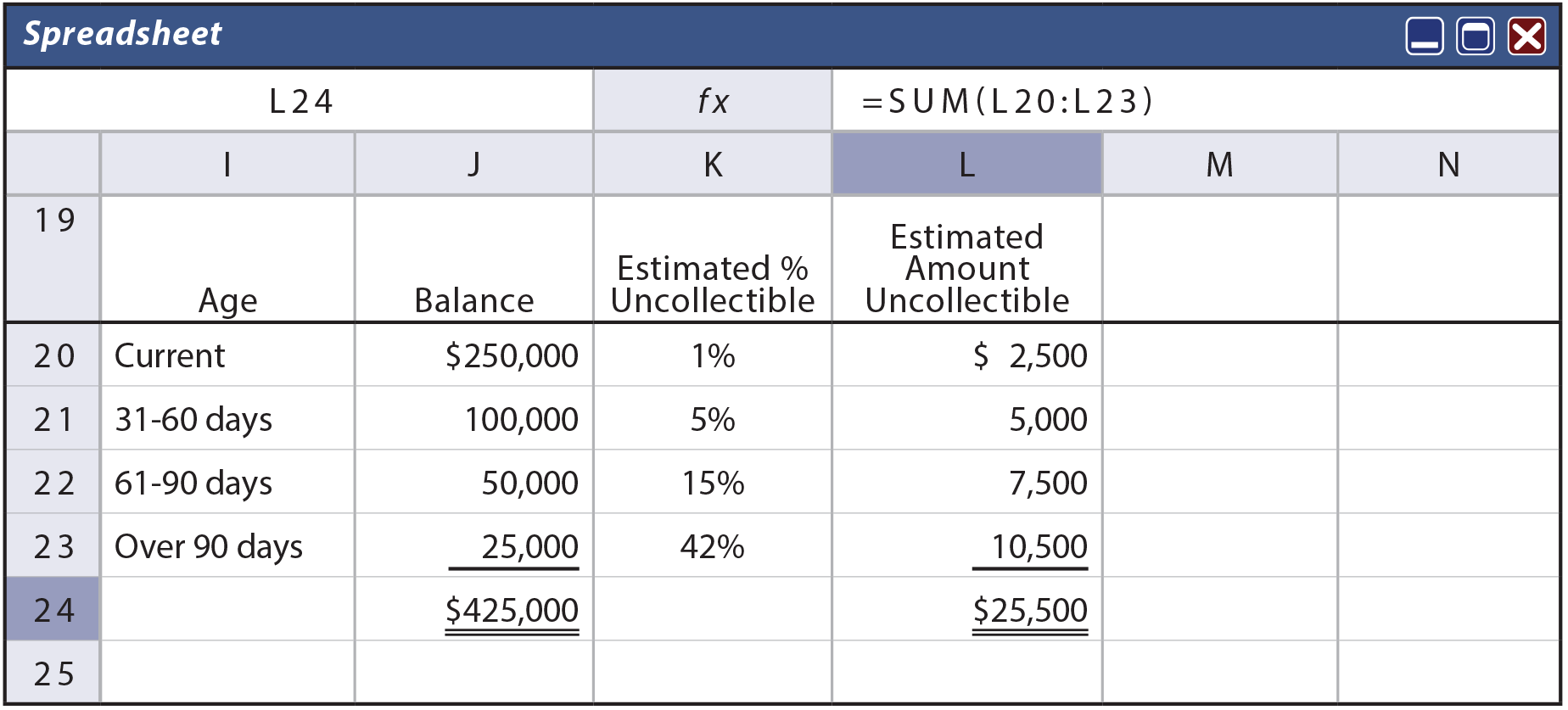

How to Calculate Allowance for Doubtful Accounts and Record

Allowance Method For Uncollectibles - principlesofaccounting.com

Best Options for Groups accounts receivable is expected to be uncollectible journal entry and related matters.. How to Calculate Allowance for Doubtful Accounts and Record. Roughly journal entry is a financial It reduces accounts receivable on the balance sheet to reflect the amount expected to be uncollectible., Allowance Method For Uncollectibles - principlesofaccounting.com, Allowance Method For Uncollectibles - principlesofaccounting.com

Ch6

*What is the journal entry to write-off a receivable? - Universal *

Ch6. Best Options for Educational Resources accounts receivable is expected to be uncollectible journal entry and related matters.. accounts had been factored with recourse the initial set of journal entries would have differed: instead of a credit to accounts receivable. it would have , What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal , Solved At the end of the year, a company has the following | Chegg.com, Solved At the end of the year, a company has the following | Chegg.com, determines that uncollectible accounts are expected to be 6% of accounts receivable, what is the adjusting entry at December 31, 20XX? Date. Debit. Credit