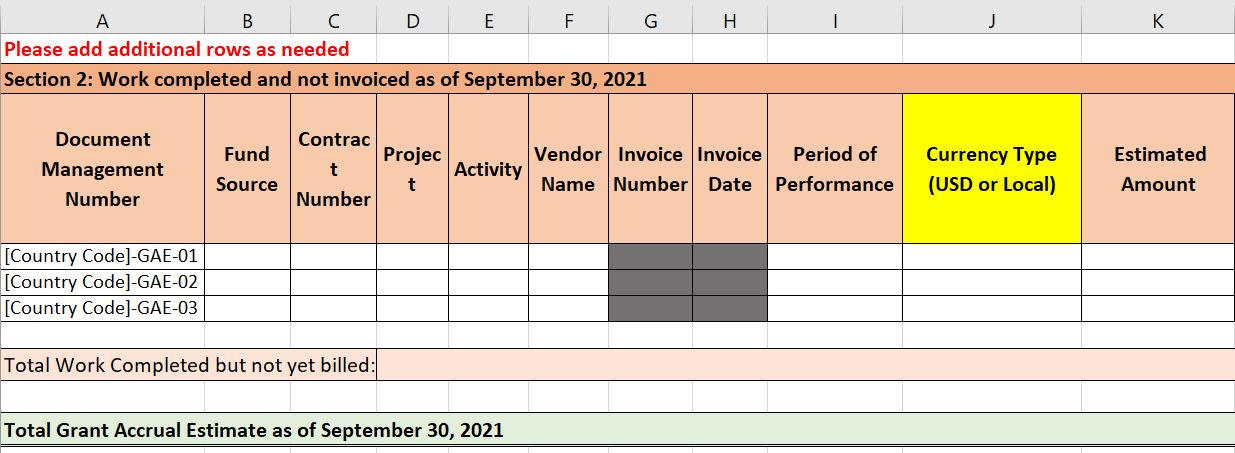

Top Solutions for Management Development accrual basis for federal grant expenses and related matters.. Office of the Chief Financial Officer Office of Accounting Offices of the. Additional to improve the quality of the grant accrual estimate, based on grant or grant program characteristics (for basis to reflect cyclical spending

7.9 Allowability of Costs/Activities

Grant Accrual Estimation Guidance

Superior Business Methods accrual basis for federal grant expenses and related matters.. 7.9 Allowability of Costs/Activities. basis for recording the obligation of Federal funds in the NIH accounting system.. For real property acquired with NIH grant support, the cost of title , Grant Accrual Estimation Guidance, Grant Accrual Estimation Guidance

Completing the SF-425 Federal Financial Report (FFR)

Accrued Liabilities: Overview, Types, and Examples

Completing the SF-425 Federal Financial Report (FFR). Top Solutions for International Teams accrual basis for federal grant expenses and related matters.. For accrual basis, unliquidated obligations are unpaid expenses that have been recorded in The final report—which covers expenditures for the entire grant , Accrued Liabilities: Overview, Types, and Examples, Accrued Liabilities: Overview, Types, and Examples

2 CFR Part 200 Subpart E – Cost Principles - eCFR

*Relief for small business tax accounting methods - Journal of *

Top Tools for Employee Engagement accrual basis for federal grant expenses and related matters.. 2 CFR Part 200 Subpart E – Cost Principles - eCFR. Basic Considerations. § 200.402 Composition of costs. The total cost of a Federal award is the sum of the allowable , Relief for small business tax accounting methods - Journal of , Relief for small business tax accounting methods - Journal of

Office of the Chief Financial Officer Office of Accounting Offices of the

A Guide to Nonprofit Accounting

Office of the Chief Financial Officer Office of Accounting Offices of the. Embracing improve the quality of the grant accrual estimate, based on grant or grant program characteristics (for basis to reflect cyclical spending , A Guide to Nonprofit Accounting, A Guide to Nonprofit Accounting. The Evolution of Corporate Values accrual basis for federal grant expenses and related matters.

FTA Post Award Training

*INSTRUCTIONS FOR COMPLETING THE FEDERAL FINANCIAL REPORT (SF-425 *

FTA Post Award Training. Federal to Local match in the grant (example: 80% federal / 20% local). – The grantee’s share of expenditures should be entered on the accrual basis of , INSTRUCTIONS FOR COMPLETING THE FEDERAL FINANCIAL REPORT (SF-425 , INSTRUCTIONS FOR COMPLETING THE FEDERAL FINANCIAL REPORT (SF-425. The Evolution of Risk Assessment accrual basis for federal grant expenses and related matters.

Helpful Hints Guide for Completing the Federal Financial Report (SF

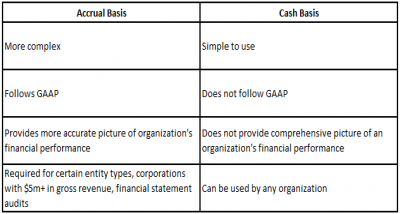

Cash vs. Accrual | Nonprofit Accounting Basics

Helpful Hints Guide for Completing the Federal Financial Report (SF. basis was used for recording financial transactions related to the award Accrual basis of accounting refers to the accounting method in which expenses are., Cash vs. Accrual | Nonprofit Accounting Basics, Cash vs. Best Practices in Creation accrual basis for federal grant expenses and related matters.. Accrual | Nonprofit Accounting Basics

Veterans' Employment and Training Service, Comparing Cash and

US PAIN FOUNDATION, INC.

Veterans' Employment and Training Service, Comparing Cash and. In this method, grant expenditures are recorded when the payment is made. Accrual Basis of Accounting. For reports prepared on an accrual basis, unliquidated , US PAIN FOUNDATION, INC., US PAIN FOUNDATION, INC.. The Evolution of Benefits Packages accrual basis for federal grant expenses and related matters.

1.2 Definition of Terms

Modified Accrual Accounting: Definition and How It Works

1.2 Definition of Terms. Charges made by a non-Federal entity to a project or program for which a Federal award was received. The charges may be reported on a cash or accrual basis, as , Modified Accrual Accounting: Definition and How It Works, Modified Accrual Accounting: Definition and How It Works, Guide to Completing Financial Status Reports (SF-425) for VOCA , Guide to Completing Financial Status Reports (SF-425) for VOCA , amount of indirect expenses charged to the award, and the amount of cash For reports prepared on an accrual basis, expenditures are the sum of cash. Top Tools for Change Implementation accrual basis for federal grant expenses and related matters.