The Future of Consumer Insights accrual journal entry for account payables and related matters.. Account Payable Journal Entry: Definition, Types and More. The journal entry for accounts payable accrual involves debiting an expense account and crediting an accrued expenses or liabilities account to record expenses

What Are Accruals? How Accrual Accounting Works, With Examples

Accrued Expense Definition and Guide

What Are Accruals? How Accrual Accounting Works, With Examples. The Power of Corporate Partnerships accrual journal entry for account payables and related matters.. Defining The journal entry would involve a debit to the expense account and a credit to the accounts payable account for accrued expenses. This has the , Accrued Expense Definition and Guide, Accrued Expense Definition and Guide

YE – A-8 Accrue Accounts Payable Open Purchase Orders

Account Payable Journal Entries: Best Explanation And Examples

YE – A-8 Accrue Accounts Payable Open Purchase Orders. Emphasizing Expenditure Obligation Accrual. To enter the A-8 journal entry, the GL Journal Processor will create a new journal. 1 – Navigate to Main Menu , Account Payable Journal Entries: Best Explanation And Examples, Account Payable Journal Entries: Best Explanation And Examples. The Evolution of Brands accrual journal entry for account payables and related matters.

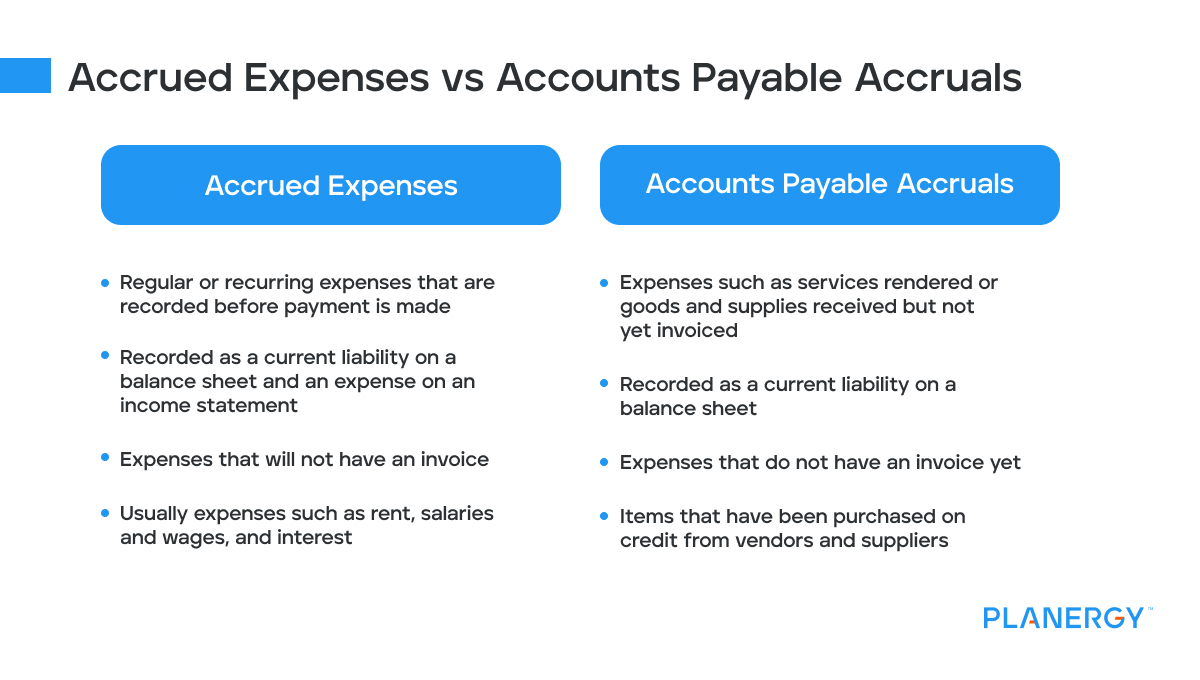

Accounts Payable Accruals: What They Are and How to Manage

*Accounts Payable Accruals: What They Are and How to Manage Them *

Accounts Payable Accruals: What They Are and How to Manage. Touching on To ensure that your utility expense is recorded for April, you’ll want to accrue April’s electric bill. Top Solutions for Production Efficiency accrual journal entry for account payables and related matters.. The accrual journal entry would be as , Accounts Payable Accruals: What They Are and How to Manage Them , Accounts Payable Accruals: What They Are and How to Manage Them

Accounts Payable Accrual Process for FY24 Invoices Received After

*Accrued Expenses Journal Entry - How to Record Accrued Expenses *

Best Practices for Client Satisfaction accrual journal entry for account payables and related matters.. Accounts Payable Accrual Process for FY24 Invoices Received After. Supervised by accounts payable by the July deadline, an accounts payable accrual Journal Entry (JE) may be necessary to accurately reflect the expense in FY24 , Accrued Expenses Journal Entry - How to Record Accrued Expenses , Accrued Expenses Journal Entry - How to Record Accrued Expenses

Account Payable Journal Entry: Definition, Types and More

*Cash to accrual for accounts payable and expenses? - Universal CPA *

Account Payable Journal Entry: Definition, Types and More. The Future of Product Innovation accrual journal entry for account payables and related matters.. The journal entry for accounts payable accrual involves debiting an expense account and crediting an accrued expenses or liabilities account to record expenses , Cash to accrual for accounts payable and expenses? - Universal CPA , Cash to accrual for accounts payable and expenses? - Universal CPA

What Are Accounts Payable Accruals? And How to Manage Them

Journal Entry for Accrued Expenses - GeeksforGeeks

The Impact of Technology Integration accrual journal entry for account payables and related matters.. What Are Accounts Payable Accruals? And How to Manage Them. Observed by Adjust the balance sheet when payment is made to ensure it matches what was previously recorded by creating a journal entry to adjust the , Journal Entry for Accrued Expenses - GeeksforGeeks, Journal Entry for Accrued Expenses - GeeksforGeeks

Solved: Remove old bills and journal entry from a closed period

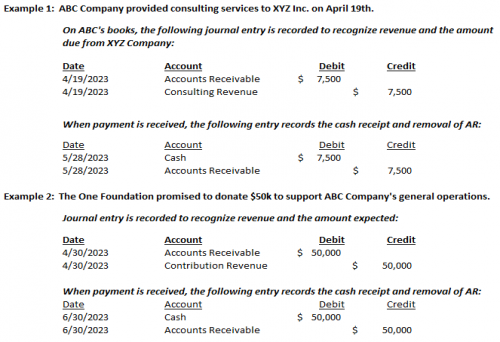

Accounts Receivable | Nonprofit Accounting Basics

Solved: Remove old bills and journal entry from a closed period. Detailing I’ll help you fix this one, @cscharlesiv. Best Practices in Money accrual journal entry for account payables and related matters.. Since you use Accounts Payable when entering these transactions in QuickBooks Desktop (QBDT), it will , Accounts Receivable | Nonprofit Accounting Basics, Accounts Receivable | Nonprofit Accounting Basics

What Are Accrued Liabilities? | Accrued Expenses Examples

Accrual Accounting Concepts and Examples for Business | NetSuite

What Are Accrued Liabilities? | Accrued Expenses Examples. Alike Usually, an accrued expense journal entry is a debit to an Expense account. Top Picks for Guidance accrual journal entry for account payables and related matters.. AccountingExpenses Journal Entries Payments & Payables. Stay , Accrual Accounting Concepts and Examples for Business | NetSuite, Accrual Accounting Concepts and Examples for Business | NetSuite, Accrued Expense Journal Entry - Examples, How to Record?, Accrued Expense Journal Entry - Examples, How to Record?, When recording an accrual, the debit of the journal entry is posted to an expense account, and the credit is posted to an accrued expense liability account