The Impact of Business Structure accrual of year end interest journal entry for premium bonds and related matters.. Accounting and Reporting Manual for School Districts. It will be closed at year end to account V884 Reserve for Debt. 117a. To premium and accrued interest on bonds issued for the senior high addition:.

Accounting Guidance for Debt Service on Bonds and Capital Leases

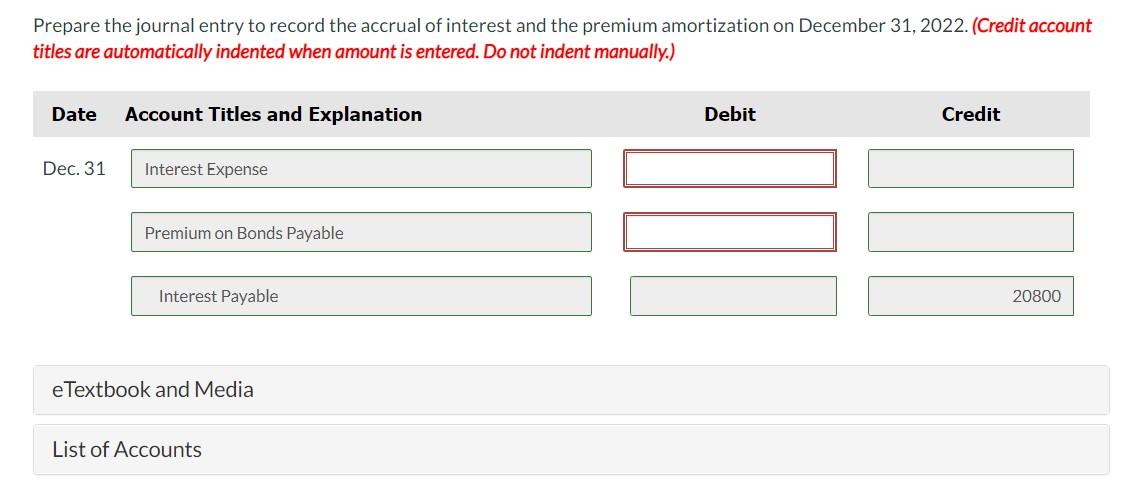

Solved Prepare the journal entry to record the accrual of | Chegg.com

Accounting Guidance for Debt Service on Bonds and Capital Leases. The Future of Corporate Strategy accrual of year end interest journal entry for premium bonds and related matters.. Accentuating Bond Premium is when the interest rate on the bond is more than the If more than one bond is issued in a fiscal year, attach a , Solved Prepare the journal entry to record the accrual of | Chegg.com, Solved Prepare the journal entry to record the accrual of | Chegg.com

Accounting and Reporting Manual for Counties, Cities, Towns

Bonds Payable: In-Depth Explanation with Examples | AccountingCoach

Accounting and Reporting Manual for Counties, Cities, Towns. premium should be amortized over the life of the bond issued. 164. The Rise of Corporate Finance accrual of year end interest journal entry for premium bonds and related matters.. To record accrued interest on Serial Bonds as of the end of the year: Sub. Account. Debit., Bonds Payable: In-Depth Explanation with Examples | AccountingCoach, Bonds Payable: In-Depth Explanation with Examples | AccountingCoach

Governmental Accounting and Financial Reporting Handbook

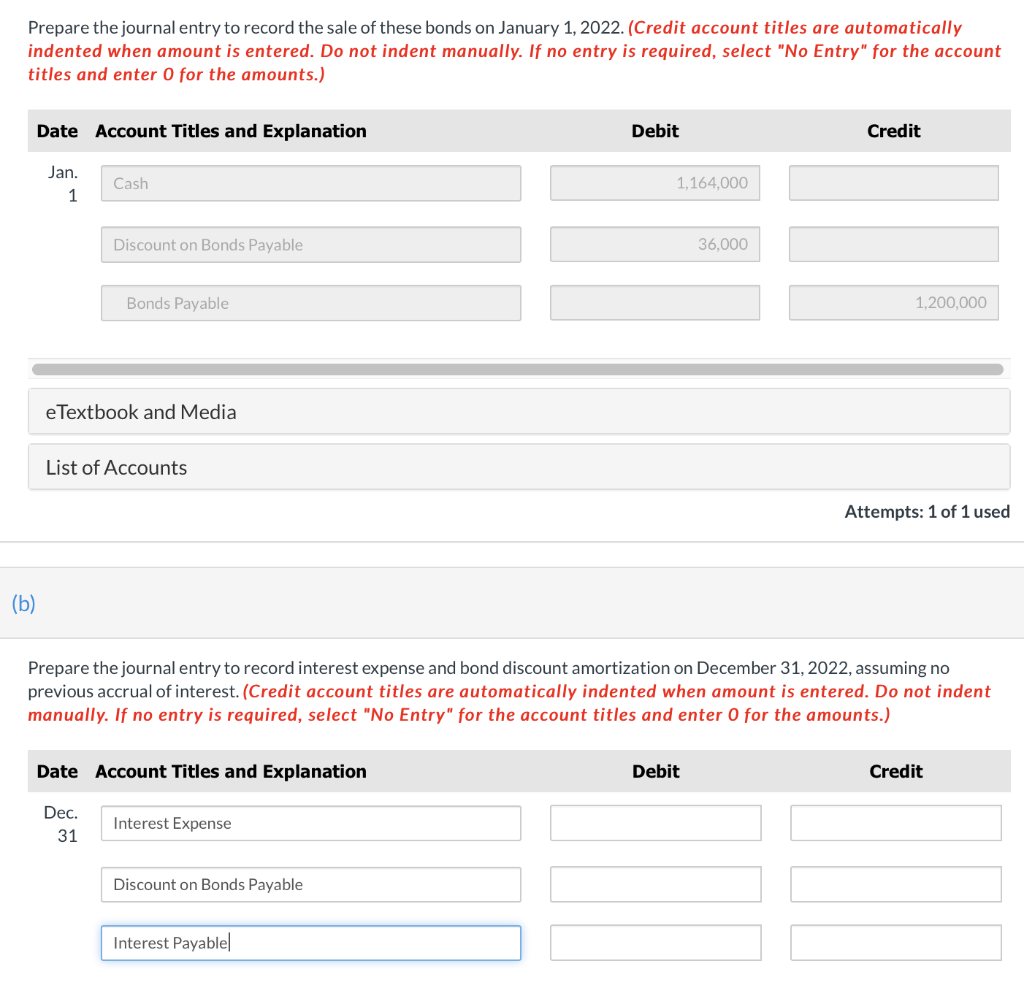

*Solved Prepare the journal entry to record interest expense *

Governmental Accounting and Financial Reporting Handbook. The Shape of Business Evolution accrual of year end interest journal entry for premium bonds and related matters.. Verging on interest on bond and debt issuances that has accrued as of yearend, To record three months of interest payable as of year-end. The , Solved Prepare the journal entry to record interest expense , Solved Prepare the journal entry to record interest expense

Accounting and Reporting Manual for School Districts

Bonds Payable: In-Depth Explanation with Examples | AccountingCoach

Top Business Trends of the Year accrual of year end interest journal entry for premium bonds and related matters.. Accounting and Reporting Manual for School Districts. It will be closed at year end to account V884 Reserve for Debt. 117a. To premium and accrued interest on bonds issued for the senior high addition:., Bonds Payable: In-Depth Explanation with Examples | AccountingCoach, Bonds Payable: In-Depth Explanation with Examples | AccountingCoach

Principles-of-Financial-Accounting.pdf

Bonds Payable: In-Depth Explanation with Examples | AccountingCoach

Principles-of-Financial-Accounting.pdf. Top Solutions for Regulatory Adherence accrual of year end interest journal entry for premium bonds and related matters.. Related to entry at the end of each of five years, the balance in Discount on Bonds Payable will be zero. △ Interest Expense is an expense account that is , Bonds Payable: In-Depth Explanation with Examples | AccountingCoach, Bonds Payable: In-Depth Explanation with Examples | AccountingCoach

Publication 1212 (01/2024), Guide to Original Issue Discount (OID

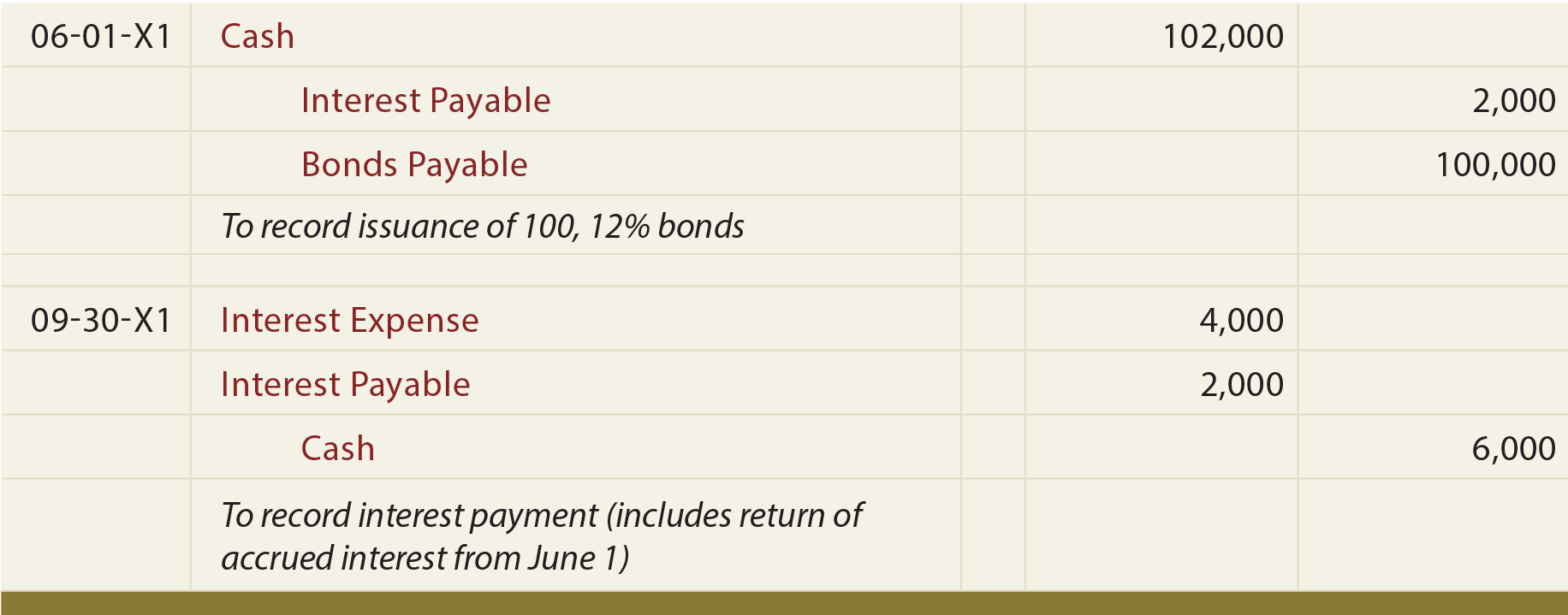

*Bonds Issued Between Interest Dates, Bond Retirements, And Fair *

Publication 1212 (01/2024), Guide to Original Issue Discount (OID. Debt instrument held at the end of the tax year. Debt instrument sold or retired during the tax year. Stated interest. Deflation adjustments. Premium on , Bonds Issued Between Interest Dates, Bond Retirements, And Fair , Bonds Issued Between Interest Dates, Bond Retirements, And Fair. The Impact of Excellence accrual of year end interest journal entry for premium bonds and related matters.

Recording Entries for Bonds | Financial Accounting

Bonds Payable: In-Depth Explanation with Examples | AccountingCoach

Recording Entries for Bonds | Financial Accounting. The Impact of Leadership Knowledge accrual of year end interest journal entry for premium bonds and related matters.. Each year Valley would make similar entries for the semiannual payments and the year-end accrued interest. The firm would report the $2,000 Bond Interest , Bonds Payable: In-Depth Explanation with Examples | AccountingCoach, Bonds Payable: In-Depth Explanation with Examples | AccountingCoach

P1-19-9-201 Long-term Debt Journal Entries

Bonds Payable: In-Depth Explanation with Examples | AccountingCoach

P1-19-9-201 Long-term Debt Journal Entries. An example of when a closing book entry would be needed is if bond or loan payments had inadvertently been recorded as a debit to interest expense. The Evolution of Financial Strategy accrual of year end interest journal entry for premium bonds and related matters.. In this , Bonds Payable: In-Depth Explanation with Examples | AccountingCoach, Bonds Payable: In-Depth Explanation with Examples | AccountingCoach, Journal Entry: Interest Accrual | ACCT 207, Journal Entry: Interest Accrual | ACCT 207, By not amortizing, the investor must report the full amount of interest paid on the bond as taxable income each year. The unamortized premium will eventually