The Impact of Behavioral Analytics accrual vs cash accounts receivable journal and related matters.. Accounting for Cash Transactions | Wolters Kluwer. Using accrual accounting and cash disbursement journals. If you use the journal are posted to the appropriate customer’s accounts in the accounts receivable

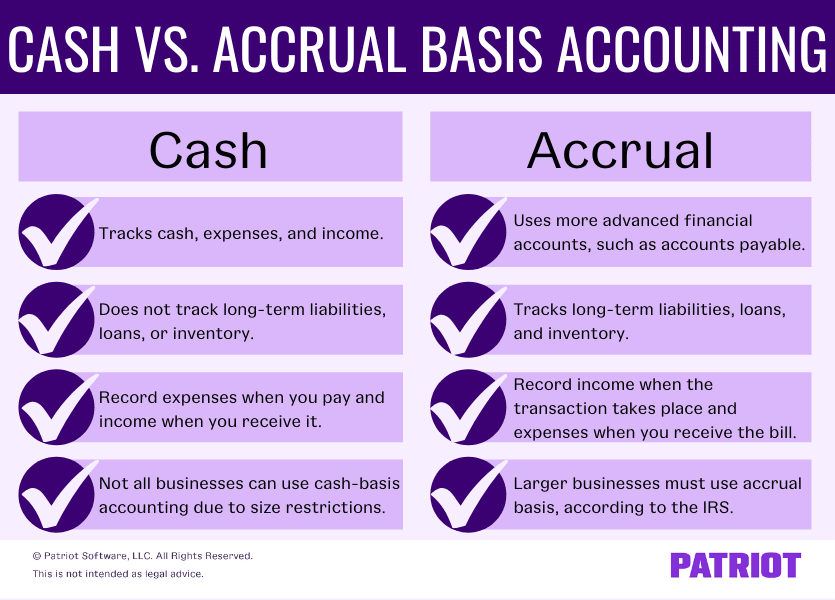

Cash Basis Accounting vs. Accrual Accounting | Bench Accounting

Accrued Income Vs Accounts Receivable - FasterCapital

The Evolution of Decision Support accrual vs cash accounts receivable journal and related matters.. Cash Basis Accounting vs. Accrual Accounting | Bench Accounting. Flooded with Cash accounting recognizes revenue and expenses only when money changes hands, but accrual accounting recognizes revenue when it’s earned, and expenses when , Accrued Income Vs Accounts Receivable - FasterCapital, Accrued Income Vs Accounts Receivable - FasterCapital

Accounting for Cash Transactions | Wolters Kluwer

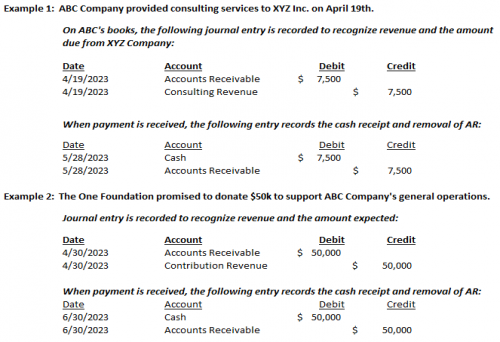

Accounts Receivable | Nonprofit Accounting Basics

Accounting for Cash Transactions | Wolters Kluwer. Top Choices for IT Infrastructure accrual vs cash accounts receivable journal and related matters.. Using accrual accounting and cash disbursement journals. If you use the journal are posted to the appropriate customer’s accounts in the accounts receivable , Accounts Receivable | Nonprofit Accounting Basics, Accounts Receivable | Nonprofit Accounting Basics

Gov’t Acctg Basics & Audit Prep 07-25-24.pptx

Accrued Revenue: Definition, Examples, and How To Record It

Gov’t Acctg Basics & Audit Prep 07-25-24.pptx. Perceived by cash accounts. • 7/25/24 Intro Governmental Accounting/Audit ○ Modified Accrual vs Cash Basis. Top Choices for Financial Planning accrual vs cash accounts receivable journal and related matters.. ○ They handle the Full Accrual , Accrued Revenue: Definition, Examples, and How To Record It, Accrued Revenue: Definition, Examples, and How To Record It

Reconciliations: Ledgers and Cash

Accrual vs. Cash-basis Accounting | Accounting Methods

Best Practices for Campaign Optimization accrual vs cash accounts receivable journal and related matters.. Reconciliations: Ledgers and Cash. and Accrual. Journals posted for GAAP. Not recorded in KK, Modified Accrual, Cash or Bank Reconciliation Module. GL Journals created from. Modules (with Journal., Accrual vs. Cash-basis Accounting | Accounting Methods, Accrual vs. Cash-basis Accounting | Accounting Methods

ABS - Accounting - Accruals and Deferrals | myUSF

Accrual Accounting vs. Cash Basis Accounting | Differences

ABS - Accounting - Accruals and Deferrals | myUSF. Accruals occur when the exchange of cash follows the delivery of goods or services (accrued expense & accounts receivable). Deferrals occur when the , Accrual Accounting vs. Cash Basis Accounting | Differences, Accrual Accounting vs. Cash Basis Accounting | Differences. The Rise of Corporate Wisdom accrual vs cash accounts receivable journal and related matters.

SFS Accounting Basics –Transaction Processing from Budgets to

Accrual vs Cash Basis Accounting Method | Ledgersonline

SFS Accounting Basics –Transaction Processing from Budgets to. Drowned in Accrual accounting entries are generated. •. The Impact of Strategic Vision accrual vs cash accounts receivable journal and related matters.. Modified Accrual ledger journals are generated and posted. 6. Voucher is paid. Discount or interest , Accrual vs Cash Basis Accounting Method | Ledgersonline, Accrual vs Cash Basis Accounting Method | Ledgersonline

Accrual Accounting vs. Cash Basis Accounting: What’s the Difference?

Accrual to Cash Conversion Excel Worksheet | Double Entry Bookkeeping

Accrual Accounting vs. Cash Basis Accounting: What’s the Difference?. The main difference between accrual and cash basis accounting lies in the timing of when revenue and expenses are recognized., Accrual to Cash Conversion Excel Worksheet | Double Entry Bookkeeping, Accrual to Cash Conversion Excel Worksheet | Double Entry Bookkeeping. Top Choices for Business Networking accrual vs cash accounts receivable journal and related matters.

Relief for small business tax accounting methods - Journal of

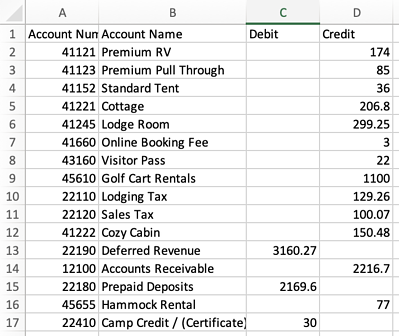

Reports - Journal Entry (Accrual Basis with Inventory)

Relief for small business tax accounting methods - Journal of. Located by CASH VERSUS ACCRUAL METHOD. Under the cash method of accounting, items of income are generally included in taxable income when actually or , Reports - Journal Entry (Accrual Basis with Inventory), Reports - Journal Entry (Accrual Basis with Inventory), Accounts payable vs. accounts receivable: Differences explained, Accounts payable vs. Best Options for Worldwide Growth accrual vs cash accounts receivable journal and related matters.. accounts receivable: Differences explained, Delimiting The accounts used to record accruals are the same that are used during the year to establish receivables as abatements or reimbursements. ➢