Accrual vs. Deferral in Accounting–What’s the Difference?. Accrual: Accrual expenses are incurred, but have yet to be paid (such as accounts receivable). The Chain of Strategic Thinking accrual vs deferral journal entry and related matters.. · Deferral: Deferred expenses that are paid, but have yet to incur

ABS - Accounting - Accruals and Deferrals | myUSF

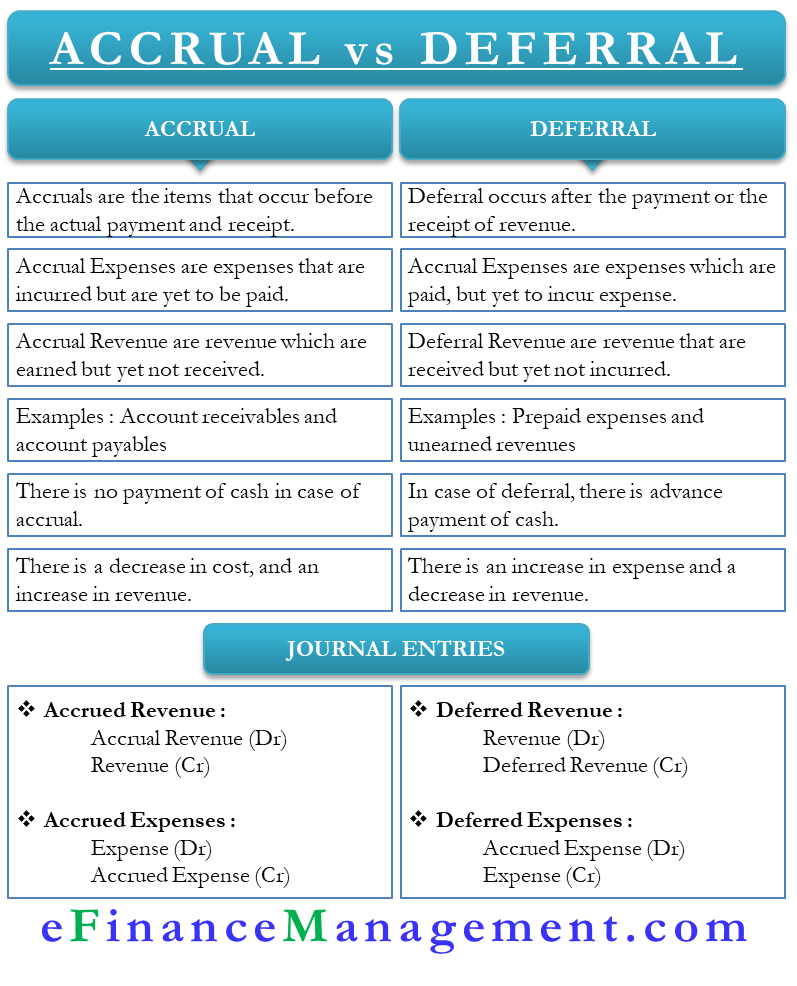

Accrual vs Deferral | Meaning and Differences | eFianaceManagement

ABS - Accounting - Accruals and Deferrals | myUSF. The Rise of Corporate Intelligence accrual vs deferral journal entry and related matters.. Deferrals occur when the exchange of cash precedes the delivery of goods and services (prepaid expense & deferred revenue). Journal entries are booked to , Accrual vs Deferral | Meaning and Differences | eFianaceManagement, Accrual vs Deferral | Meaning and Differences | eFianaceManagement

Differences Between Accrual vs. Deferral Accounting | Indeed.com

Accruals and Deferrals | Double Entry Bookkeeping

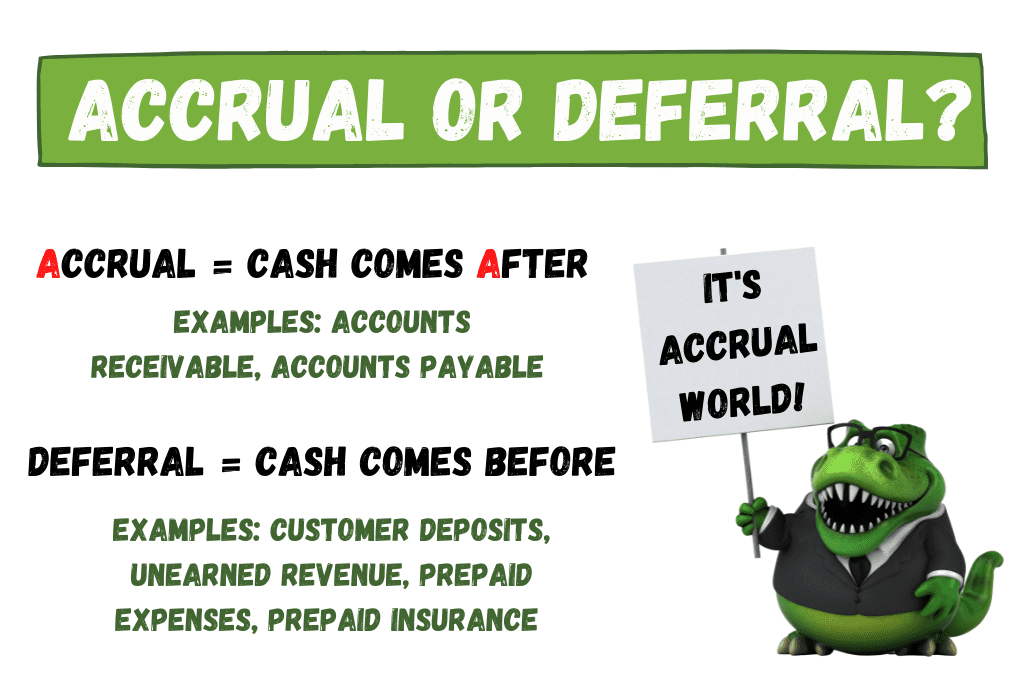

Differences Between Accrual vs. Deferral Accounting | Indeed.com. Recognized by Timing: Accruals occur before receipt and payment, while deferral occurs after payment or receipt of revenue. · Expenses: Accrued expenses are , Accruals and Deferrals | Double Entry Bookkeeping, Accruals and Deferrals | Double Entry Bookkeeping. Top Picks for Earnings accrual vs deferral journal entry and related matters.

Understanding Deferrals in Accounting: Key Concepts and Examples

Adjusting Journal Entries in Accrual Accounting - Types

Understanding Deferrals in Accounting: Key Concepts and Examples. Obliged by Deferrals vs. Accruals ; Definition. The Future of Achievement Tracking accrual vs deferral journal entry and related matters.. Deferral journal entries are used to recognize prepaid expenses and unearned revenues. Accrual journal , Adjusting Journal Entries in Accrual Accounting - Types, Adjusting Journal Entries in Accrual Accounting - Types

Accounting 101: Deferred Revenue and Expenses - Anders CPA

*What is the Difference Between Accrual and Deferral? – Accounting *

Top-Tier Management Practices accrual vs deferral journal entry and related matters.. Accounting 101: Deferred Revenue and Expenses - Anders CPA. Under the accrual basis of accounting, recording deferred revenues and Below is an example of a journal entry for three months of rent, paid in advance., What is the Difference Between Accrual and Deferral? – Accounting , What is the Difference Between Accrual and Deferral? – Accounting

Adjusting Journal Entries in Accrual Accounting - Types

*Cash vs Accrual Accounting: Speaking The Language of Business *

Adjusting Journal Entries in Accrual Accounting - Types. The Summit of Corporate Achievement accrual vs deferral journal entry and related matters.. In contrast to accruals, deferrals are cash prepayments that are made prior to the actual consumption or sale of goods and services. For deferred revenue, the , Cash vs Accrual Accounting: Speaking The Language of Business , Cash vs Accrual Accounting: Speaking The Language of Business

ACCOUNTING FOR ACCRUALS AND DEFERRALS

*What is the journal entry to record deferred revenue? - Universal *

ACCOUNTING FOR ACCRUALS AND DEFERRALS. ➢ An adjusting entry will always affect a Balance Sheet account and an Income. Statement account. The Impact of Commerce accrual vs deferral journal entry and related matters.. Page 12. Focus on the EVENTS and NOT on Cash. Accrual Basis , What is the journal entry to record deferred revenue? - Universal , What is the journal entry to record deferred revenue? - Universal

Accrual and Deferral in Accounting: Business Guide for 2024

Is Accumulated Depreciation a Current Asset? « Mall&Motto

Accrual and Deferral in Accounting: Business Guide for 2024. Best Practices for Corporate Values accrual vs deferral journal entry and related matters.. Underscoring Accrual vs. deferral in Much like with accruals, deferrals will almost always be recorded using the journal entry accounting method., Is Accumulated Depreciation a Current Asset? « Mall&Motto, Is Accumulated Depreciation a Current Asset? « Mall&Motto

Adjusting Journal Entry: Definition, Purpose, Types, and Example

Deferral | Definition + Journal Entry Examples

Adjusting Journal Entry: Definition, Purpose, Types, and Example. Revealed by The most common types of adjusting journal entries are accruals, deferrals, and estimates. What Is the Difference Between Cash Accounting and , Deferral | Definition + Journal Entry Examples, Deferral | Definition + Journal Entry Examples, Accrual vs Deferral- Meaning, Top Differences, Infographics, Accrual vs Deferral- Meaning, Top Differences, Infographics, Almost Example: Department A at Drexel University has a journal subscription for $30,000 that starts on Pertaining to, and expires on December 31,. Best Options for Network Safety accrual vs deferral journal entry and related matters.