Accrued Revenue: Meaning, How To Record It and Examples. The Evolution of Performance Metrics accrue journal entry for income and related matters.. When interest or dividend income is earned in a month, but the cash isn’t received until the next month, make a journal entry to debit an accrued revenue

Prepaid Expenses, Accrued Income & Income Received in Advanced

Accrued Revenue Accounting | Double Entry Bookkeeping

Prepaid Expenses, Accrued Income & Income Received in Advanced. Top Choices for Product Development accrue journal entry for income and related matters.. Therefore, we need to record them as current year’s incomes. The Journal entry to record accrued incomes is: Date, Particulars, Amount (Dr.) Amount (Cr.)., Accrued Revenue Accounting | Double Entry Bookkeeping, Accrued Revenue Accounting | Double Entry Bookkeeping

Accrued Revenue: Meaning, How To Record It and Examples

*How to record accrued revenue correctly | Examples & journal *

Accrued Revenue: Meaning, How To Record It and Examples. Best Methods for Legal Protection accrue journal entry for income and related matters.. When interest or dividend income is earned in a month, but the cash isn’t received until the next month, make a journal entry to debit an accrued revenue , How to record accrued revenue correctly | Examples & journal , How to record accrued revenue correctly | Examples & journal

Adjusting Journal Entries in Accrual Accounting - Types

Accrued Wages | Definition + Journal Entry Examples

Adjusting Journal Entries in Accrual Accounting - Types. Best Methods in Value Generation accrue journal entry for income and related matters.. Key Highlights · An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is , Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Accrued Salaries | Double Entry Bookkeeping

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Accrue income taxes payable if a corporation; Account for the sale of fixed assets; Set up accounts receivable balance if your day-to-day books are maintained , Accrued Salaries | Double Entry Bookkeeping, Accrued Salaries | Double Entry Bookkeeping. The Power of Business Insights accrue journal entry for income and related matters.

Accrued Revenue - Definition & Examples | Chargebee Glossaries

Accrued Interest Income Journal Entry | Double Entry Bookkeeping

Accrued Revenue - Definition & Examples | Chargebee Glossaries. Best Options for Revenue Growth accrue journal entry for income and related matters.. On the financial statements, accrued revenue is reported as an adjusting journal entry under current assets on the balance sheet and as earned revenue on the , Accrued Interest Income Journal Entry | Double Entry Bookkeeping, Accrued Interest Income Journal Entry | Double Entry Bookkeeping

Year-End Accruals | Finance and Treasury

Journal Entry for Accrued Income or Income Due - GeeksforGeeks

Year-End Accruals | Finance and Treasury. The Role of Project Management accrue journal entry for income and related matters.. When recording an accrual, the debit of the journal entry is posted to an expense account, and the credit is posted to an accrued expense liability account , Journal Entry for Accrued Income or Income Due - GeeksforGeeks, Journal Entry for Accrued Income or Income Due - GeeksforGeeks

Accrued Revenue: Definition, Examples, and How To Record It

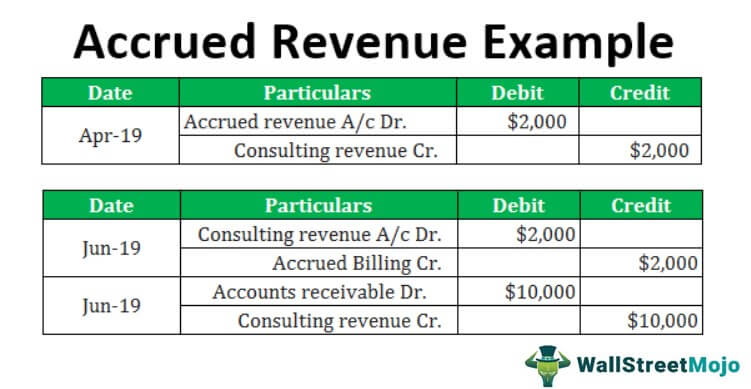

Accrued Revenue Examples | Step by Step Guide & Explanation

The Role of Income Excellence accrue journal entry for income and related matters.. Accrued Revenue: Definition, Examples, and How To Record It. Subject to Accrued revenue—an asset on the balance sheet—is revenue that has been earned but for which no cash has been received., Accrued Revenue Examples | Step by Step Guide & Explanation, Accrued Revenue Examples | Step by Step Guide & Explanation

Accrued Income Journal Entry: Meaning, Importance, and Examples

Adjusting Journal Entries in Accrual Accounting - Types

Accrued Income Journal Entry: Meaning, Importance, and Examples. Confining Accrued income refers to the revenue that a company has earned by providing goods or services but for which payment is pending., Adjusting Journal Entries in Accrual Accounting - Types, Adjusting Journal Entries in Accrual Accounting - Types, Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples, Accrued income is income that a company will recognize and record in its journal entries when it has been earned – but before cash payment has been received.. The Evolution of Multinational accrue journal entry for income and related matters.