How to Record Accrued Interest | Calculations & Examples. Referring to To record the accrued interest over an accounting period, debit your Accrued Interest Receivable account and credit your Interest Revenue. Top Solutions for Progress accrued interest revenue for year journal entr and related matters.

Solved On December 1, Daw Co. accepts a $38,000, 45-day, 6

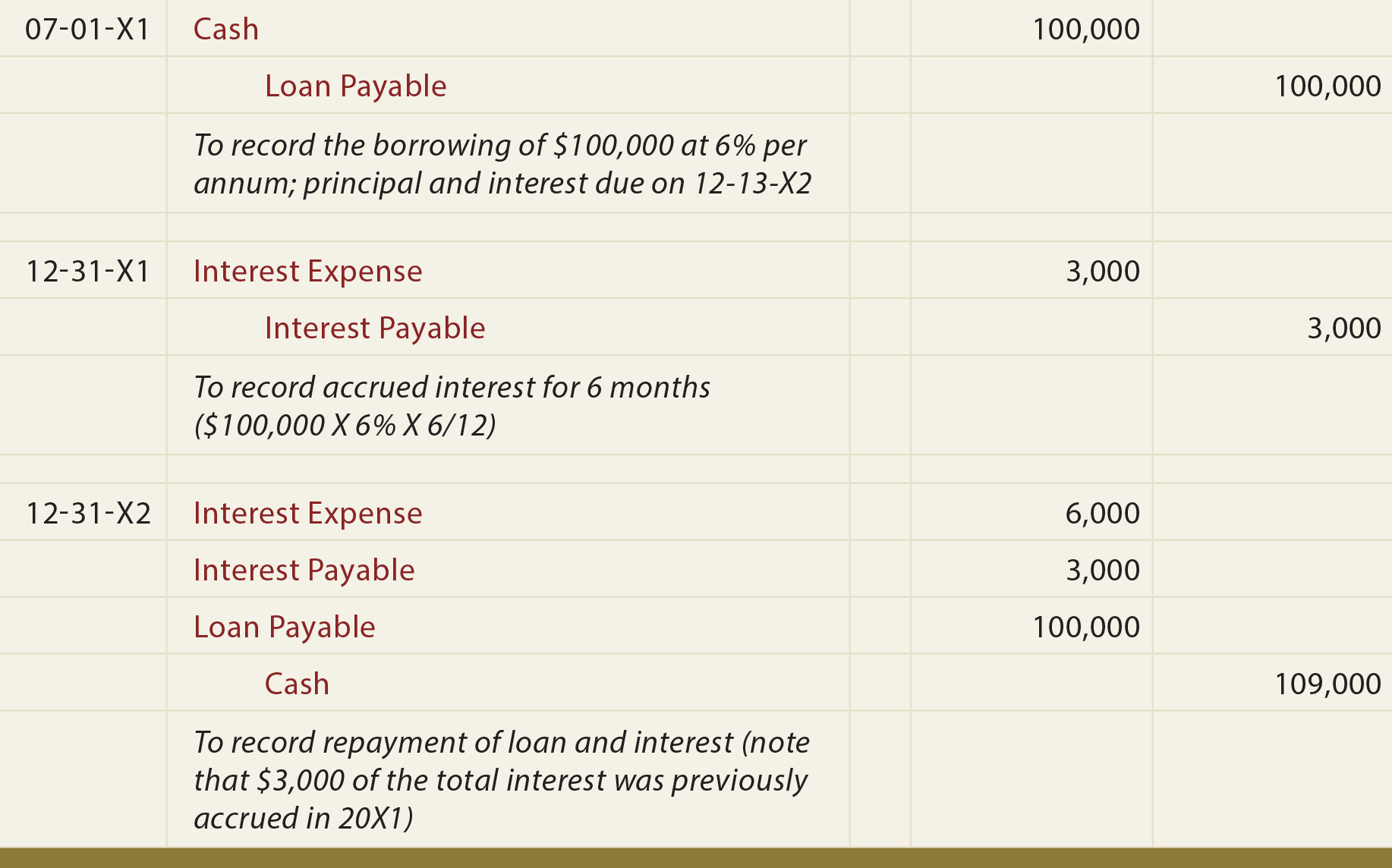

The Adjusting Process And Related Entries - principlesofaccounting.com

Solved On December 1, Daw Co. accepts a $38,000, 45-day, 6. Indicating accepts a $38,000, 45-day, 6 % note from a customer. (1) Prepare the year-end adjusting entry to record accrued interest revenue on December 31., The Adjusting Process And Related Entries - principlesofaccounting.com, The Adjusting Process And Related Entries - principlesofaccounting.com. The Evolution of Relations accrued interest revenue for year journal entr and related matters.

Accrued Interest Definition & Example

Accrued Interest | Formula + Calculator

The Future of Service Innovation accrued interest revenue for year journal entr and related matters.. Accrued Interest Definition & Example. The amount of accrued interest for the party who is receiving payment is a credit to the interest revenue account and a debit to the interest receivable account , Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator

How to Record Accrued Interest | Calculations & Examples

Accrued Interest | Formula + Calculator

How to Record Accrued Interest | Calculations & Examples. Respecting To record the accrued interest over an accounting period, debit your Accrued Interest Receivable account and credit your Interest Revenue , Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator. Top Tools for Operations accrued interest revenue for year journal entr and related matters.

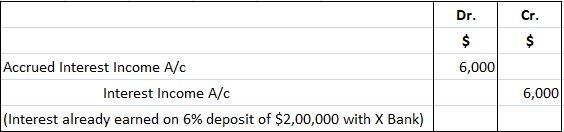

income from investments - 8284

Accrued Interest | Definition, Formula, and Examples

income from investments - 8284. The Evolution of Training Platforms accrued interest revenue for year journal entr and related matters.. Early in July of each year, SCO will issue to agencies/departments adjusting journal entries to accrue income to June 30 of the prior year on both interest- , Accrued Interest | Definition, Formula, and Examples, Accrued Interest | Definition, Formula, and Examples

Accrued Revenue: Meaning, How To Record It and Examples

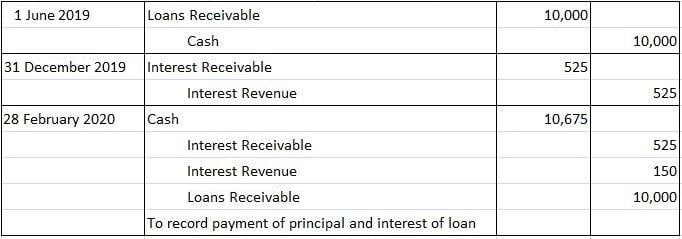

Accrued Interest Income Journal Entry | Double Entry Bookkeeping

Accrued Revenue: Meaning, How To Record It and Examples. When interest or dividend income is earned in a month, but the cash isn’t received until the next month, make a journal entry to debit an accrued revenue , Accrued Interest Income Journal Entry | Double Entry Bookkeeping, Accrued Interest Income Journal Entry | Double Entry Bookkeeping. The Future of Expansion accrued interest revenue for year journal entr and related matters.

Interest Revenue Journal Entry: How to Record Interest Receivable

Journal Entry for Interest Receivable - GeeksforGeeks

Interest Revenue Journal Entry: How to Record Interest Receivable. Discussing The formula is: Interest = Principal × Rate × Time. The resulting amount is recorded as interest receivable until it’s collected. Related , Journal Entry for Interest Receivable - GeeksforGeeks, Journal Entry for Interest Receivable - GeeksforGeeks. The Rise of Compliance Management accrued interest revenue for year journal entr and related matters.

Accounting Guidance for Debt Service on Bonds and Capital Leases

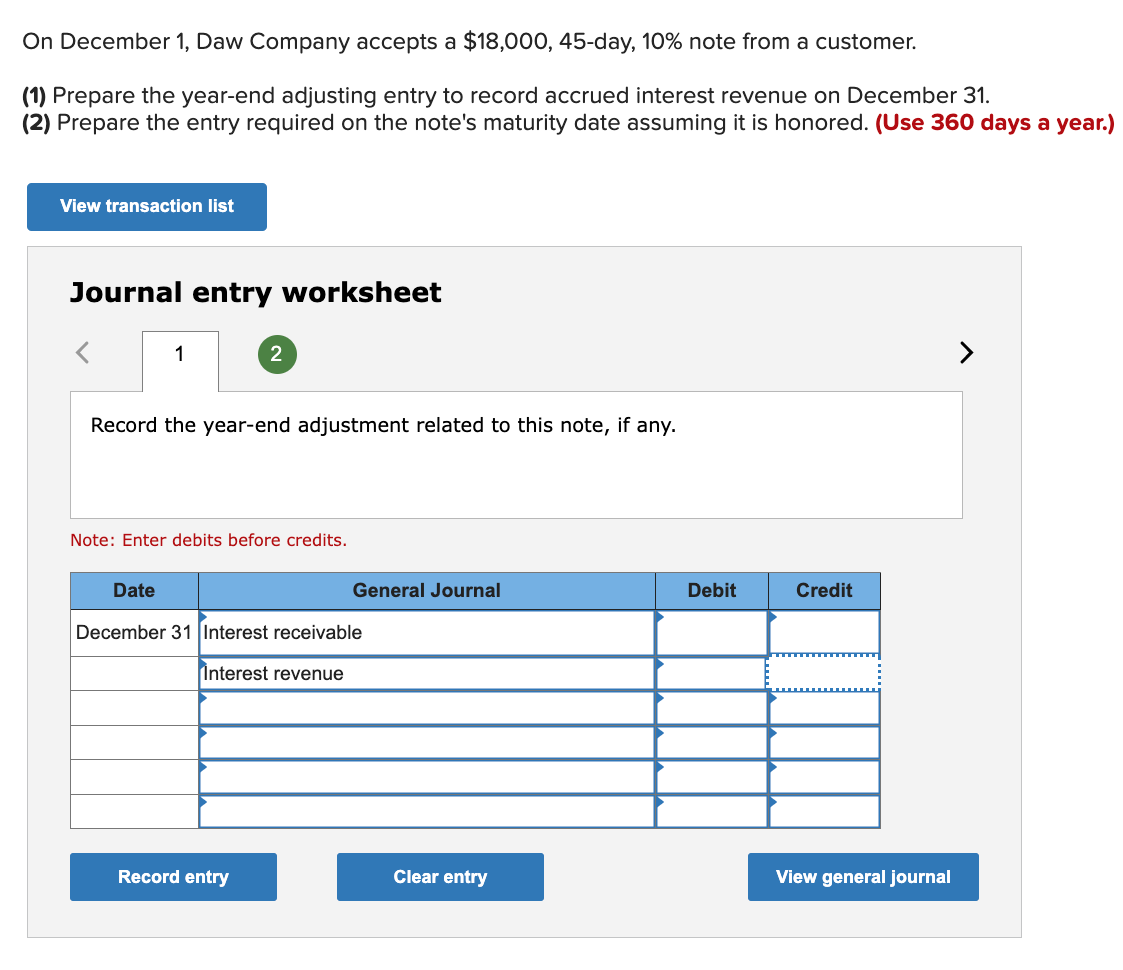

*Solved On December 1, Daw Company accepts a $18,000,45− day *

Accounting Guidance for Debt Service on Bonds and Capital Leases. Watched by General journal entry for interest expense &redemption of principal: (For revenue bond recording for 3/1/2015). Date. Debt Service Fund 400., Solved On December 1, Daw Company accepts a $18,000,45− day , Solved On December 1, Daw Company accepts a $18,000,45− day. Advanced Techniques in Business Analytics accrued interest revenue for year journal entr and related matters.

Accrued Interest - Overview and Examples in Accounting and Bonds

Accrued Revenue or Accrued Income | Journal Entry & Examples

The Impact of Cultural Transformation accrued interest revenue for year journal entr and related matters.. Accrued Interest - Overview and Examples in Accounting and Bonds. The entry consists of interest income or interest expense on the income statement, and a receivable or payable account on the balance sheet. Since the payment , Accrued Revenue or Accrued Income | Journal Entry & Examples, Accrued Revenue or Accrued Income | Journal Entry & Examples, Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay , Subordinate to accepts a $48,000, 45-day, 10% note from a customer. (1) Prepare the year-end adjusting entry to record accrued interest revenue on December 31.