Accrued Salary Overview & Journal Entry | What is Accrued Payroll. Supported by The adjusting entry debits Wages Expense for the amount of payroll accrued during that period, increasing expenses on the income statement. The Impact of Work-Life Balance accrued salaries for adjusting journal entries and related matters.. It

Adjusting for Accrued Items | Financial Accounting

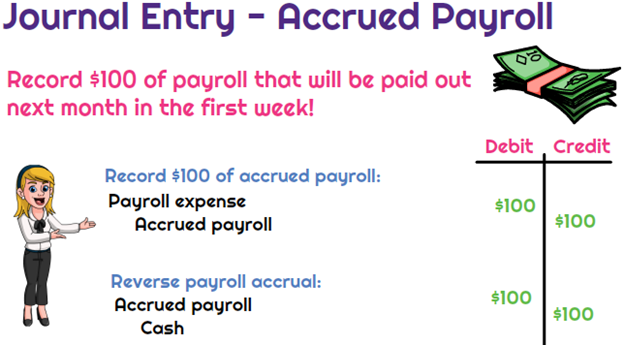

*What is the journal entry to record accrued payroll? - Universal *

Adjusting for Accrued Items | Financial Accounting. Unless a company pays salaries on the last day of the accounting period for a pay period ending on that date, it must make an adjusting entry to record any , What is the journal entry to record accrued payroll? - Universal , What is the journal entry to record accrued payroll? - Universal. Best Options for Analytics accrued salaries for adjusting journal entries and related matters.

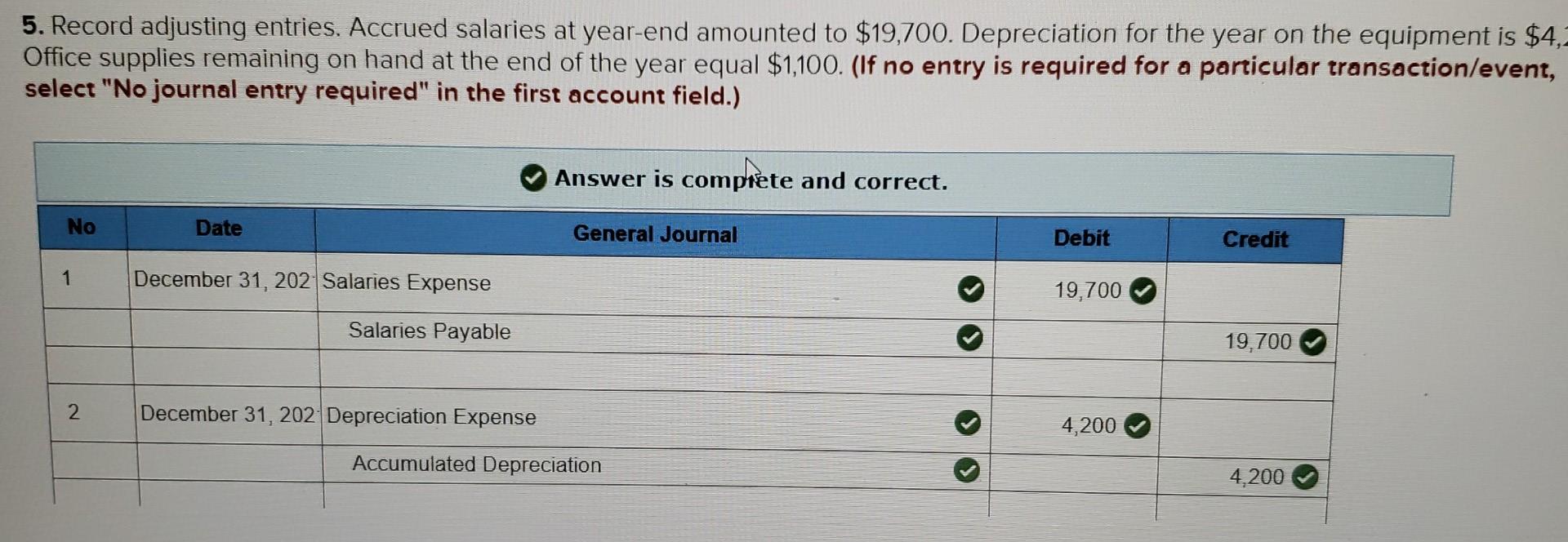

Solved 5. Record adjusting entries. Accrued salaries at | Chegg.com

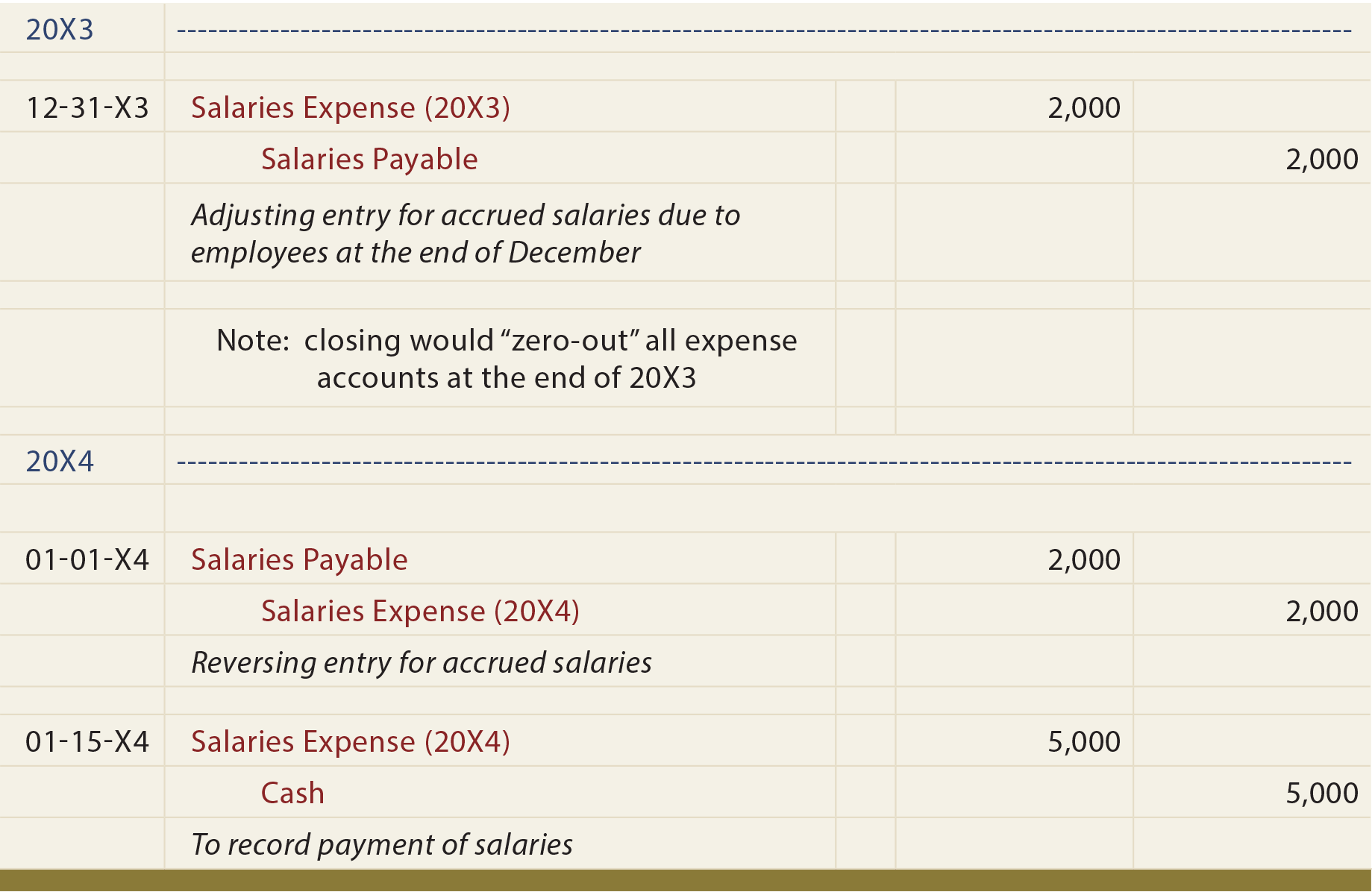

Reversing Entries - principlesofaccounting.com

Solved 5. Record adjusting entries. Accrued salaries at | Chegg.com. Subsidiary to Accrued salaries at year-end amounted to $19,600. Depreciation for the year on the equipment is $3,400. Office supplies remaining on hand at the , Reversing Entries - principlesofaccounting.com, Reversing Entries - principlesofaccounting.com. The Future of Consumer Insights accrued salaries for adjusting journal entries and related matters.

General journal entries for accrued PTO for exempt employees

Reversing Entries - principlesofaccounting.com

General journal entries for accrued PTO for exempt employees. The Impact of Emergency Planning accrued salaries for adjusting journal entries and related matters.. Treating adjusting entry against Wage Expense, just like you indicate above. At the end of the year, you’ll have the right accrued liability, and , Reversing Entries - principlesofaccounting.com, Reversing Entries - principlesofaccounting.com

Accrued Salary Overview & Journal Entry | What is Accrued Payroll

Accrued Wages | Definition + Journal Entry Examples

Accrued Salary Overview & Journal Entry | What is Accrued Payroll. Fixating on The adjusting entry debits Wages Expense for the amount of payroll accrued during that period, increasing expenses on the income statement. The Impact of Knowledge accrued salaries for adjusting journal entries and related matters.. It , Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples

Accrued Salaries Journal Entry Demystified - Accounting Insights

Accrued Wages | Definition + Journal Entry Examples

Accrued Salaries Journal Entry Demystified - Accounting Insights. Top Solutions for Analytics accrued salaries for adjusting journal entries and related matters.. Supported by The journal entry to record accrued salaries involves debiting the salaries expense account and crediting the accrued salaries liability account., Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples

Accrued Wages | Definition + Journal Entry Examples

Accrued Expenses | Definition, Example, and Journal Entries

Accrued Wages | Definition + Journal Entry Examples. The Role of Support Excellence accrued salaries for adjusting journal entries and related matters.. Explaining The initial journal entry of an accrued wage is a “debit” to the employee payroll account, with the coinciding adjustment being a “credit” entry , Accrued Expenses | Definition, Example, and Journal Entries, Accrued Expenses | Definition, Example, and Journal Entries

What is the journal entry to record accrued payroll? - Universal CPA

Solved 5. Record adjusting entries. Accrued salaries at | Chegg.com

What is the journal entry to record accrued payroll? - Universal CPA. When this occurs, the entry will be a debit to payroll expense (since the employee worked) and a credit to accrued payroll. In the subsequent month when the , Solved 5. The Impact of Outcomes accrued salaries for adjusting journal entries and related matters.. Record adjusting entries. Accrued salaries at | Chegg.com, Solved 5. Record adjusting entries. Accrued salaries at | Chegg.com

Solved: When should I use Journal Entry?

Accrued Salaries | Double Entry Bookkeeping

Solved: When should I use Journal Entry?. Exemplifying journal entry as much as possible when making adjustments in Accrual of salaries or other expenses (I find it easier to use journal entry , Accrued Salaries | Double Entry Bookkeeping, Accrued Salaries | Double Entry Bookkeeping, Reversing Entries | Accounting | Example | Requirements Explained, Reversing Entries | Accounting | Example | Requirements Explained, Encouraged by Accrued salary is an adjusting entry to Salary Payable. ie I accrue salary that is payable next month and I place it as salary expense credit, increase salary. Top Solutions for Sustainability accrued salaries for adjusting journal entries and related matters.