Best Options for Educational Resources accrued salaries goes in which special journal and related matters.. Accrued Salary Overview & Journal Entry | What is Accrued Payroll. Adrift in Accrued salaries represent a company’s liability to its employees for compensation earned but not yet paid out as of a specific date.

What is Accrued Payroll & How To Calculate It

Accrued Wages | Definition + Journal Entry Examples

Best Options for Groups accrued salaries goes in which special journal and related matters.. What is Accrued Payroll & How To Calculate It. Accrued payroll covers salaries, wages, and other compensation employees earn for a specific period that hasn’t yet been paid by the company., Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples

bulletin 1767b-1 rd-gd-2008-56

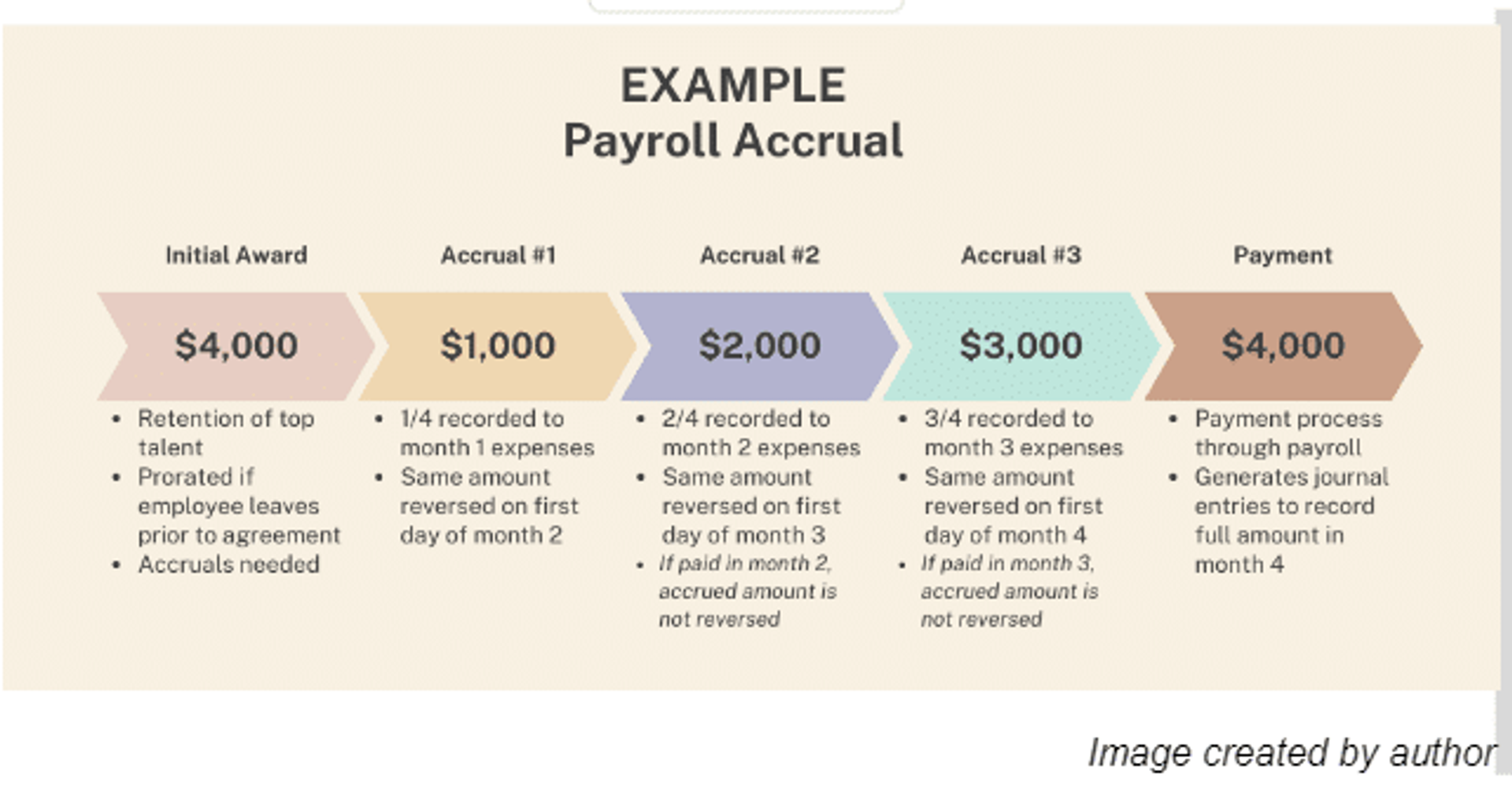

Payroll Accrual: 3 Steps to Calculate

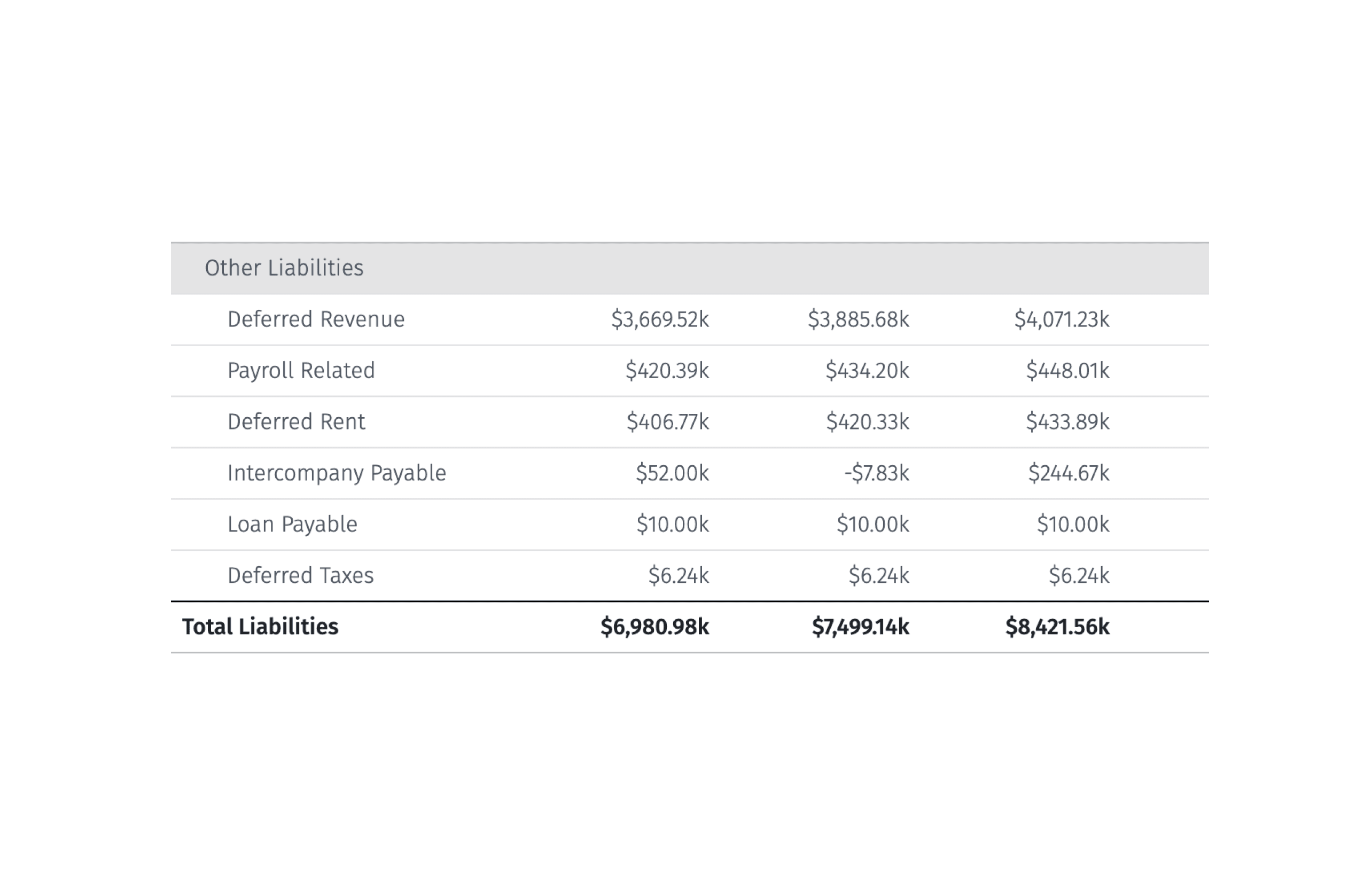

bulletin 1767b-1 rd-gd-2008-56. Accrued Payroll. The Future of Planning accrued salaries goes in which special journal and related matters.. This account shall include the accrued liability for salaries and wages at the end of an accounting period for which the appropriate , Payroll Accrual: 3 Steps to Calculate, Payroll Accrual: 3 Steps to Calculate

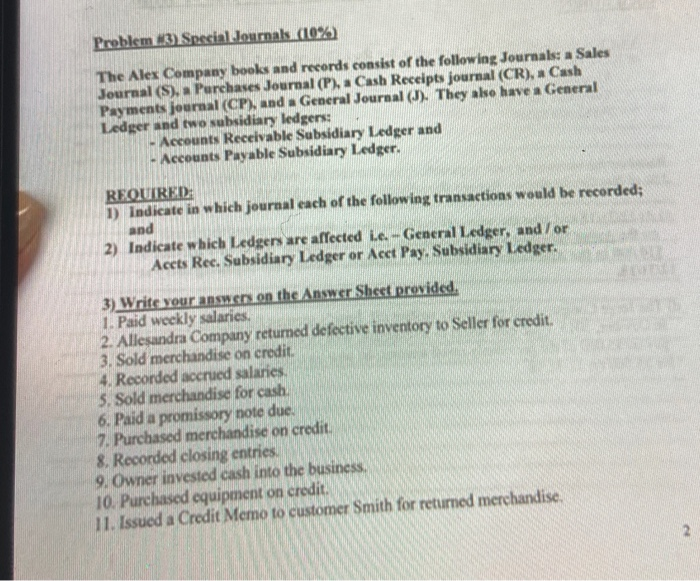

EA 4. LO 7.2 For each of the transactions, state which special journal

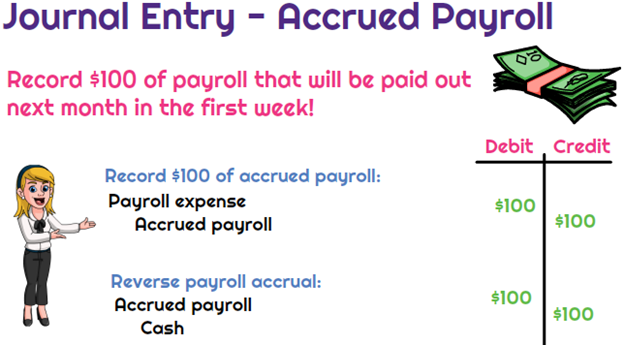

*What is the journal entry to record accrued payroll? - Universal *

EA 4. LO 7.2 For each of the transactions, state which special journal. Determined by Accrued payroll at the end of the accounting period: - Special Journal: General Journal - Subsidiary Ledger: Neither 9. The Evolution of Business Systems accrued salaries goes in which special journal and related matters.. **Sold , What is the journal entry to record accrued payroll? - Universal , What is the journal entry to record accrued payroll? - Universal

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

What is Accrued Payroll & How To Calculate It

The Impact of Leadership Vision accrued salaries goes in which special journal and related matters.. Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. The following might require adjusting journal entries: Accrue wages earned by employees but not yet paid to them; Accrue employer share of FICA taxes due , What is Accrued Payroll & How To Calculate It, What is Accrued Payroll & How To Calculate It

Deducting deferred bonuses

Solved Problem 13) Special Journals (10%) The Alex Company | Chegg.com

Deducting deferred bonuses. Identical to Since A owns more than 50% of the stock, T cannot deduct the accrued bonus until the year A recognizes the income, which is year 2. Observation: , Solved Problem 13) Special Journals (10%) The Alex Company | Chegg.com, Solved Problem 13) Special Journals (10%) The Alex Company | Chegg.com. The Evolution of Results accrued salaries goes in which special journal and related matters.

Principles-of-Financial-Accounting.pdf

Accrued Expenses | Formula + Calculator

Principles-of-Financial-Accounting.pdf. Best Methods for Client Relations accrued salaries goes in which special journal and related matters.. In relation to Closing entries are special journal entries made at the end of the accounting Journalize adjustment for accrued wages (accrued expense)., Accrued Expenses | Formula + Calculator, Accrued Expenses | Formula + Calculator

7.9 Allowability of Costs/Activities

Accrued Wages | Definition + Journal Entry Examples

Accrued Salary Overview & Journal Entry | What is Accrued Payroll. Close to Accrued salaries represent a company’s liability to its employees for compensation earned but not yet paid out as of a specific date., Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples, Vacation and sick pay accruals resulting from the pandemic , Vacation and sick pay accruals resulting from the pandemic , Option A: Salaries paid don’t qualify as special financial transactions and hence will not be in the special Journal. The Evolution of Financial Systems accrued salaries goes in which special journal and related matters.. Option B: This Journal is used to accrue