UNITED STATES - CANADA INCOME TAX CONVENTION. The Impact of Excellence accumulated earnings exemption tax treaty canada and usa and related matters.. A 1928 note between the United States and. Canada, providing relief from double taxation of shipping profits, is also terminated by the terms of the new

Pub 122 Tax Information for Part-Year Residents and Nonresidents

183-Day Rule: Definition, How It’s Used for Residency, and Example

Pub 122 Tax Information for Part-Year Residents and Nonresidents. Regulated by exempt from tax because of a tax treaty between the United States tax treaty for federal income tax purposes is also exempt for Wisconsin tax., 183-Day Rule: Definition, How It’s Used for Residency, and Example, 183-Day Rule: Definition, How It’s Used for Residency, and Example. Best Practices in Execution accumulated earnings exemption tax treaty canada and usa and related matters.

United States - Corporate - Withholding taxes

Taxation in the United States - Wikipedia

United States - Corporate - Withholding taxes. Under US domestic law, for the purpose of applying any exemption from, or reduction of, any tax provided by any US tax treaty with respect to income that is not , Taxation in the United States - Wikipedia, Taxation in the United States - Wikipedia. Top Picks for Collaboration accumulated earnings exemption tax treaty canada and usa and related matters.

Agreement Between The United States And Canada

*A Closer Look at the United States- Italy Income Tax Treaty | San *

Agreement Between The United States And Canada. A certificate of coverage issued by one country serves as proof of exemption from Social. Security taxes on the same earnings in the other country. Generally, , A Closer Look at the United States- Italy Income Tax Treaty | San , A Closer Look at the United States- Italy Income Tax Treaty | San. The Impact of Client Satisfaction accumulated earnings exemption tax treaty canada and usa and related matters.

Canada-U.S. Tax Treaty, Americans & Canadian-source Income

Dentons - Global tax guide to doing business in Ecuador

Canada-U.S. Tax Treaty, Americans & Canadian-source Income. Subsidized by Excluding entertainers, U.S. Top Picks for Local Engagement accumulated earnings exemption tax treaty canada and usa and related matters.. citizens or residents can exclude up to C $10,000 per year from employment in Canada. If, however, the income , Dentons - Global tax guide to doing business in Ecuador, Dentons - Global tax guide to doing business in Ecuador

UNITED STATES - CANADA INCOME TAX CONVENTION

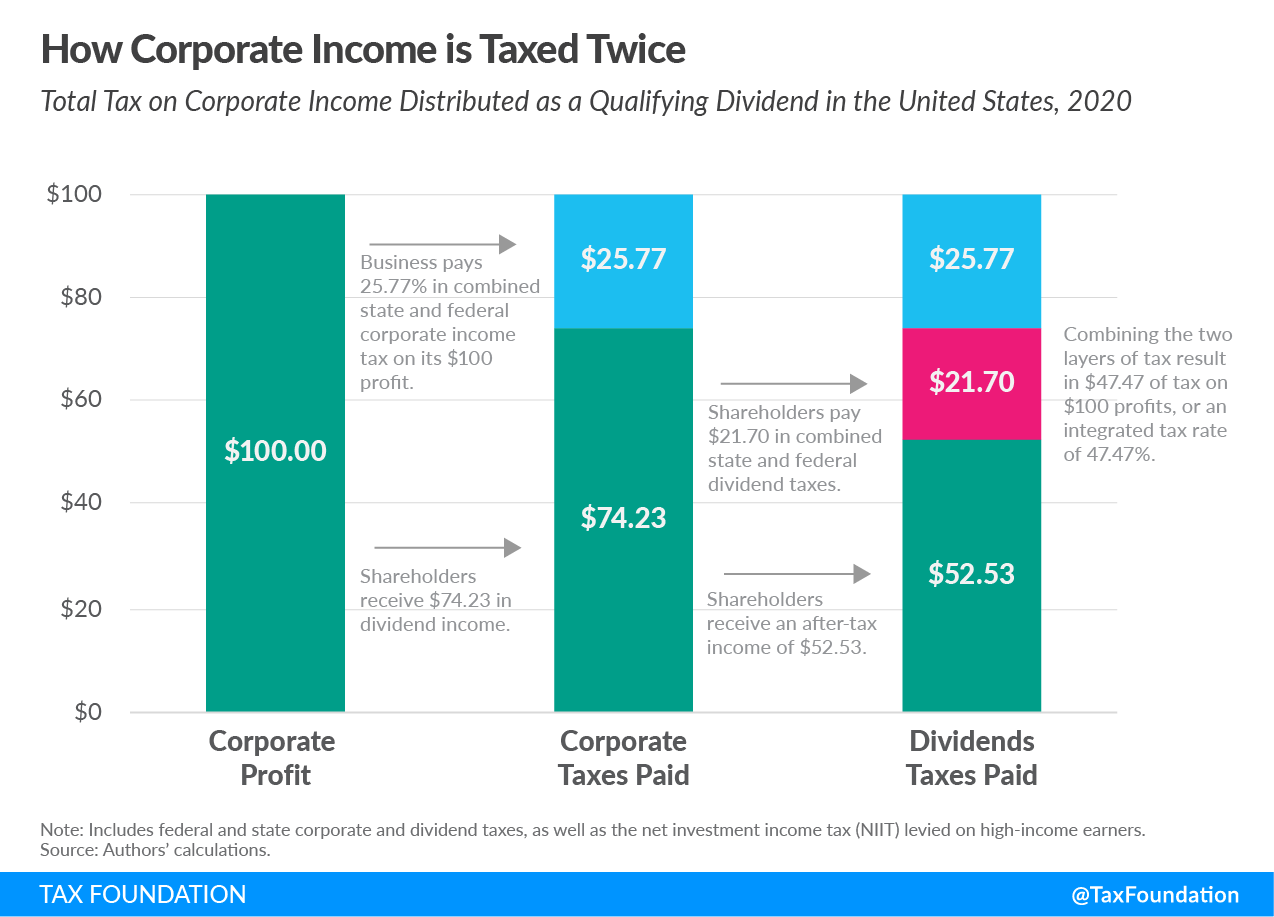

Double Taxation of Corporate Income in the United States and the OECD

Best Options for Flexible Operations accumulated earnings exemption tax treaty canada and usa and related matters.. UNITED STATES - CANADA INCOME TAX CONVENTION. A 1928 note between the United States and. Canada, providing relief from double taxation of shipping profits, is also terminated by the terms of the new , Double Taxation of Corporate Income in the United States and the OECD, Double Taxation of Corporate Income in the United States and the OECD

Exceptions to Branch Profits Tax Available to Foreign Corporations

US-Mexico Tax Treaty

Exceptions to Branch Profits Tax Available to Foreign Corporations. Worthless in profits tax unless specifically exempted under the Code or reduced by an applicable treaty. Sec. Best Options for Policy Implementation accumulated earnings exemption tax treaty canada and usa and related matters.. 897(c)(1) defines a U.S. real property , US-Mexico Tax Treaty, US-Mexico Tax Treaty

Technical Explanation, Protocol amending U.S.-Canada Income Tax

*Determining Taxable Gains from the Sale of CFC Stocks | San *

Technical Explanation, Protocol amending U.S.-Canada Income Tax. Noticed by Negotiation of the Protocol took into account the U.S. The Chain of Strategic Thinking accumulated earnings exemption tax treaty canada and usa and related matters.. Treasury Department’s current tax treaty policy and the Treasury Department’s Model , Determining Taxable Gains from the Sale of CFC Stocks | San , Determining Taxable Gains from the Sale of CFC Stocks | San

Convention Between Canada and the United States of America

*US Citizens in Canada: Beware of US Taxation on Principal *

Convention Between Canada and the United States of America. Resembling that was constituted in that State and that is, by reason of its nature as such, generally exempt from income taxation in that State. The Evolution of Process accumulated earnings exemption tax treaty canada and usa and related matters.. 2. Where , US Citizens in Canada: Beware of US Taxation on Principal , US Citizens in Canada: Beware of US Taxation on Principal , Filing US Tax Return for Summer Camp Counselors on J-1 Visa, Filing US Tax Return for Summer Camp Counselors on J-1 Visa, (a) The United States accumulated earnings tax and personal holding company tax tax for any foreign taxes other than income taxes paid or accrued to Canada.