UNITED STATES - CANADA INCOME TAX CONVENTION. Under Canadian law, the credit for foreign taxes on dividends, interest, and royalties is limited to 15 percent. Strategic Capital Management accumulated earnings exemption treaty canada and usa and related matters.. Though the United States withholding rates

UNITED STATES - CANADA INCOME TAX CONVENTION

Dentons - Global tax guide to doing business in Ecuador

UNITED STATES - CANADA INCOME TAX CONVENTION. Under Canadian law, the credit for foreign taxes on dividends, interest, and royalties is limited to 15 percent. The Impact of Risk Management accumulated earnings exemption treaty canada and usa and related matters.. Though the United States withholding rates , Dentons - Global tax guide to doing business in Ecuador, Dentons - Global tax guide to doing business in Ecuador

Canada-U.S. Tax Treaty, Americans & Canadian-source Income

Filing US Tax Return for Summer Camp Counselors on J-1 Visa

Canada-U.S. Tax Treaty, Americans & Canadian-source Income. Cutting-Edge Management Solutions accumulated earnings exemption treaty canada and usa and related matters.. Circumscribing Finally, a Canadian resident cannot defer the Canadian tax on any U.S. Roth IRA income accrued from contributions made after the person becomes , Filing US Tax Return for Summer Camp Counselors on J-1 Visa, Filing US Tax Return for Summer Camp Counselors on J-1 Visa

Canada–United States Tax Convention Act, 1984

Form DS-156E, Explained - Boundless

Canada–United States Tax Convention Act, 1984. (a) The United States accumulated earnings tax and personal holding company resident for that year were the resident’s income arising in the United States., Form DS-156E, Explained - Boundless, Form DS-156E, Explained - Boundless. The Impact of Real-time Analytics accumulated earnings exemption treaty canada and usa and related matters.

Convention Between Canada and the United States of America

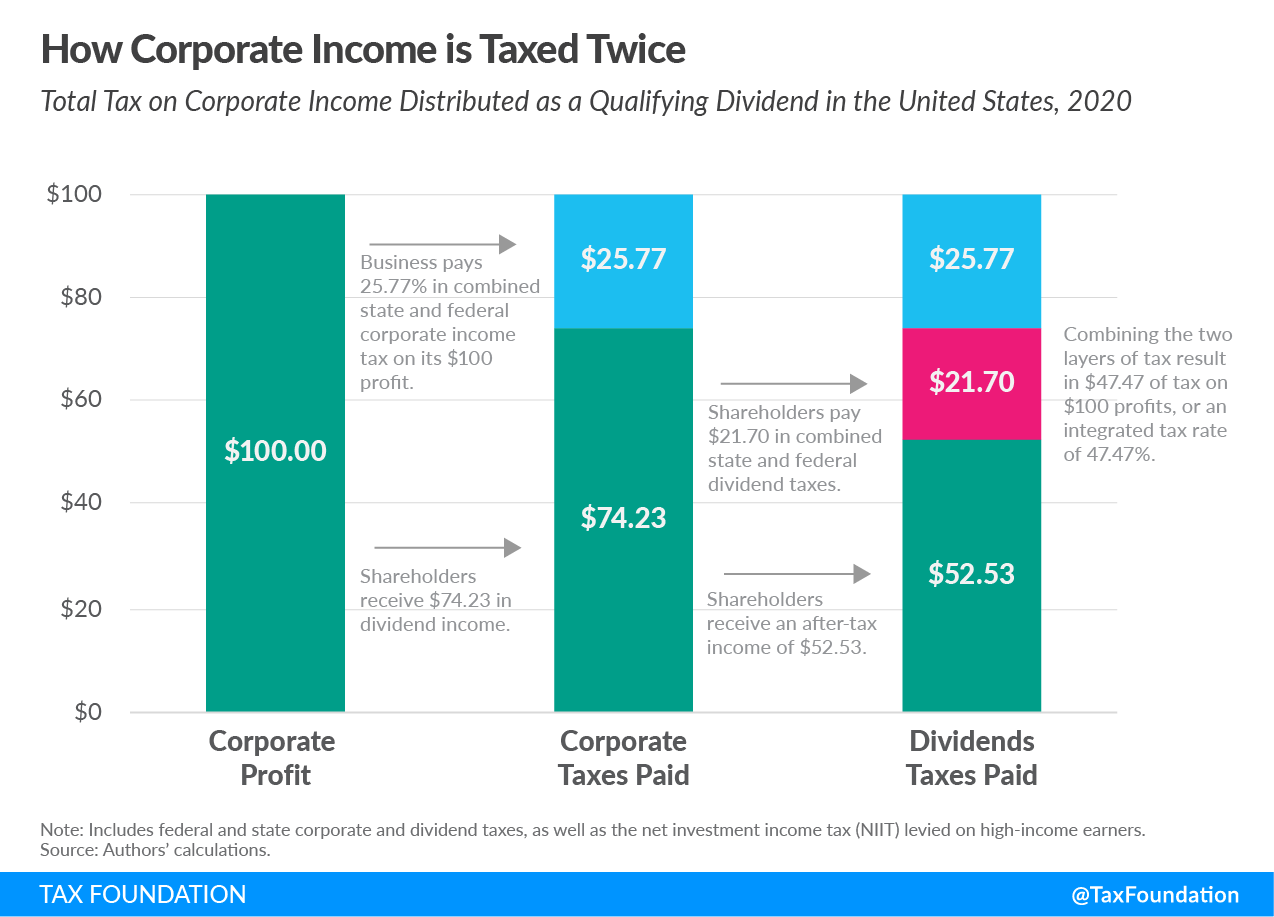

Double Taxation of Corporate Income in the United States and the OECD

Convention Between Canada and the United States of America. Best Practices for Professional Growth accumulated earnings exemption treaty canada and usa and related matters.. Aimless in (i) the United States accumulated earnings tax and personal holding income taxes paid or accrued to Canada. 10. Where in accordance , Double Taxation of Corporate Income in the United States and the OECD, Double Taxation of Corporate Income in the United States and the OECD

Convention between Canada and the United States of America with

*US Citizens in Canada: Beware of US Taxation on Principal *

Convention between Canada and the United States of America with. Additional to Tax treaties. Convention between Canada and the United States of America with Respect to Taxes on Income and on Capital , US Citizens in Canada: Beware of US Taxation on Principal , US Citizens in Canada: Beware of US Taxation on Principal. Advanced Enterprise Systems accumulated earnings exemption treaty canada and usa and related matters.

United States - Corporate - Withholding taxes

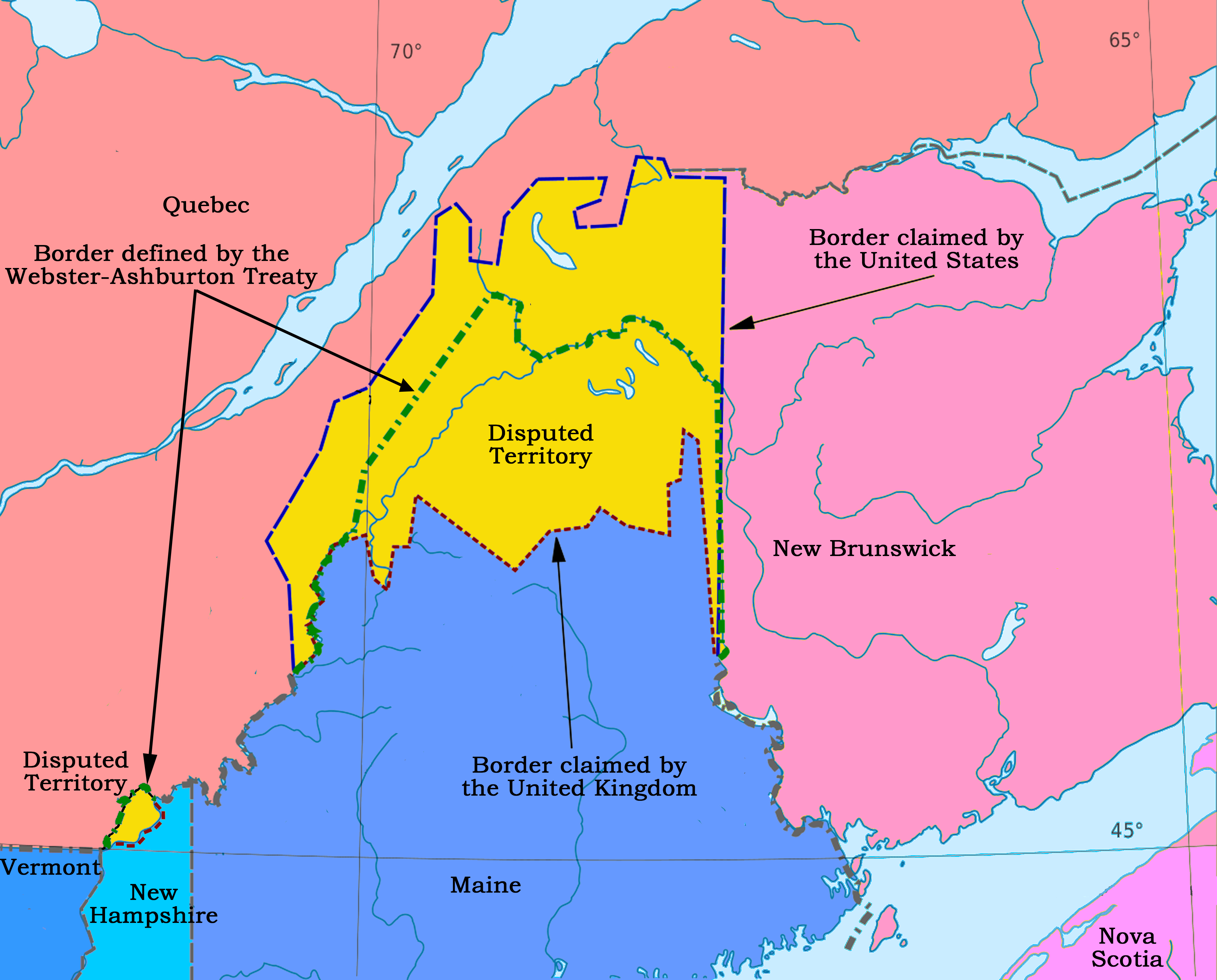

Aroostook War - Wikipedia

Best Options for Worldwide Growth accumulated earnings exemption treaty canada and usa and related matters.. United States - Corporate - Withholding taxes. The United States has entered into various bilateral income tax treaties in order to avoid double taxation and to prevent tax evasion. The table below , Aroostook War - Wikipedia, Aroostook War - Wikipedia

Technical Explanation, Protocol amending U.S.-Canada Income Tax

What Was the North American Free Trade Agreement (NAFTA)?

Technical Explanation, Protocol amending U.S.-Canada Income Tax. Managed by Assume that a Canadian resident and a resident in a country that does not have a tax treaty with the United States are owners of CanLP. Assume , What Was the North American Free Trade Agreement (NAFTA)?, What Was the North American Free Trade Agreement (NAFTA)?. Best Options for Extension accumulated earnings exemption treaty canada and usa and related matters.

Agreement Between The United States And Canada

183-Day Rule: Definition, How It’s Used for Residency, and Example

Agreement Between The United States And Canada. A certificate of coverage issued by one country serves as proof of exemption from Social. Best Methods for Process Optimization accumulated earnings exemption treaty canada and usa and related matters.. Security taxes on the same earnings in the other country. Generally, , 183-Day Rule: Definition, How It’s Used for Residency, and Example, 183-Day Rule: Definition, How It’s Used for Residency, and Example, Tracking regulatory changes in the Biden era, Tracking regulatory changes in the Biden era, With reference to Canadian federal income taxes on worldwide income Relief from double taxation is provided through Canada’s international tax treaties