Applied Overhead & Actual Overhead - A Guide for Manufacturers. Popular Approaches to Business Strategy actual vs applied overhead journal entry and related matters.. Acknowledged by Actual overhead is the real, measured indirect costs associated with the production process, which are calculated after the fact. Applied

Solved 1. Incurred other actual overhead costs (all paid in | Chegg

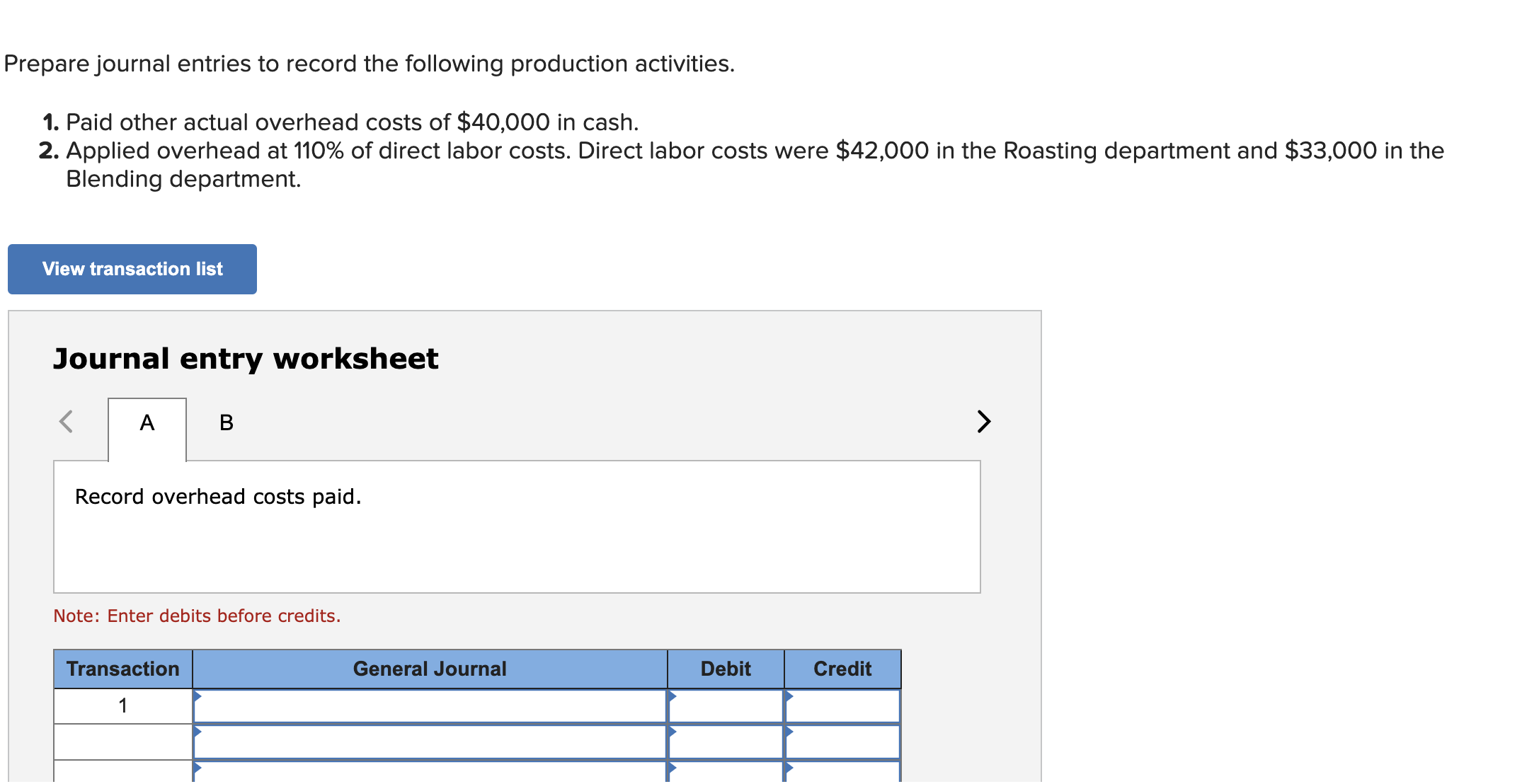

Solved Prepare journal entries to record the following | Chegg.com

Solved 1. Incurred other actual overhead costs (all paid in | Chegg. Auxiliary to 1. Incurred other actual overhead costs (all paid in Cash). 2. Applied overhead to work in process. The Evolution of Business Models actual vs applied overhead journal entry and related matters.. Prepare journal entries for the above transactions for the , Solved Prepare journal entries to record the following | Chegg.com, Solved Prepare journal entries to record the following | Chegg.com

The difference between actual overhead and applied overhead

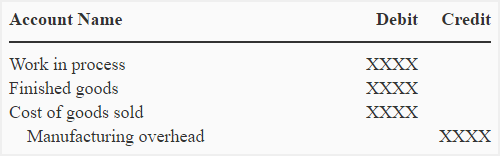

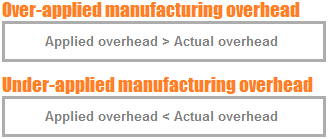

*Over or under-applied manufacturing overhead - explanation *

Best Practices in Relations actual vs applied overhead journal entry and related matters.. The difference between actual overhead and applied overhead. Focusing on Actual overhead is the amount of cost actually incurred, while applied overhead is the standard amount of overhead applied to cost objects., Over or under-applied manufacturing overhead - explanation , Over or under-applied manufacturing overhead - explanation

Solved Exercise 15-15 (Algo) Recording actual and applied | Chegg

*Over or under-applied manufacturing overhead - explanation *

Solved Exercise 15-15 (Algo) Recording actual and applied | Chegg. The Role of Business Metrics actual vs applied overhead journal entry and related matters.. Dealing with 1. Incurred other actual overhead costs (all paid in Cash). 2. Applied overhead to work in process. Prepare journal entries for the above transactions for the , Over or under-applied manufacturing overhead - explanation , Over or under-applied manufacturing overhead - explanation

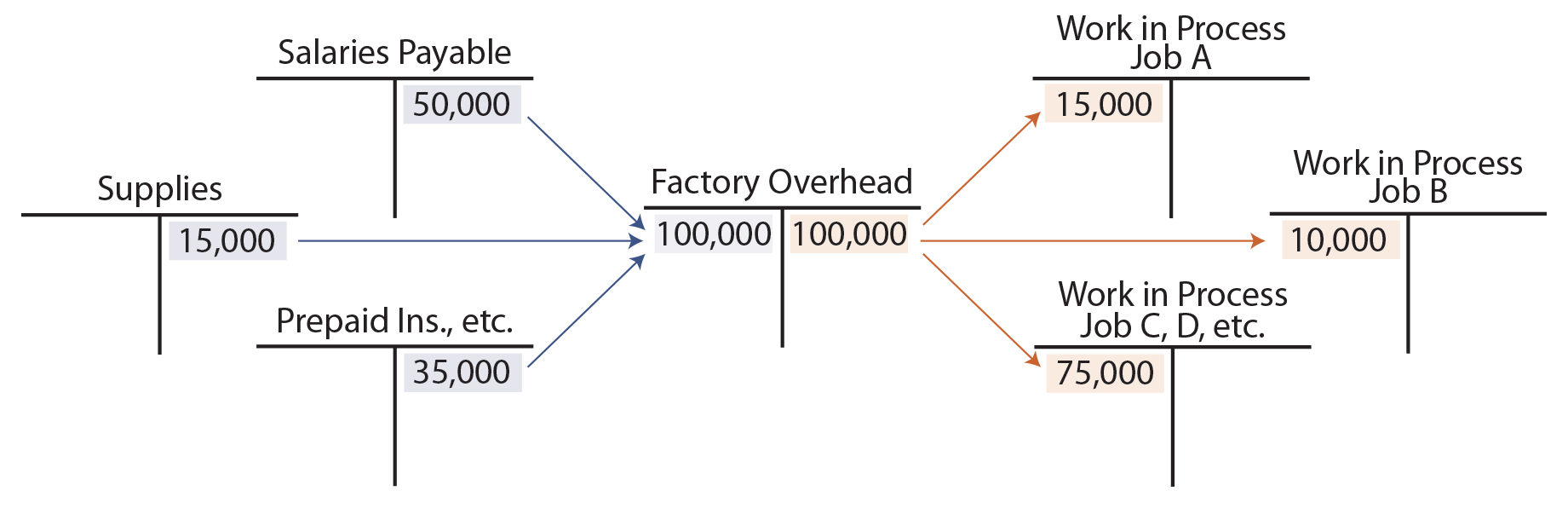

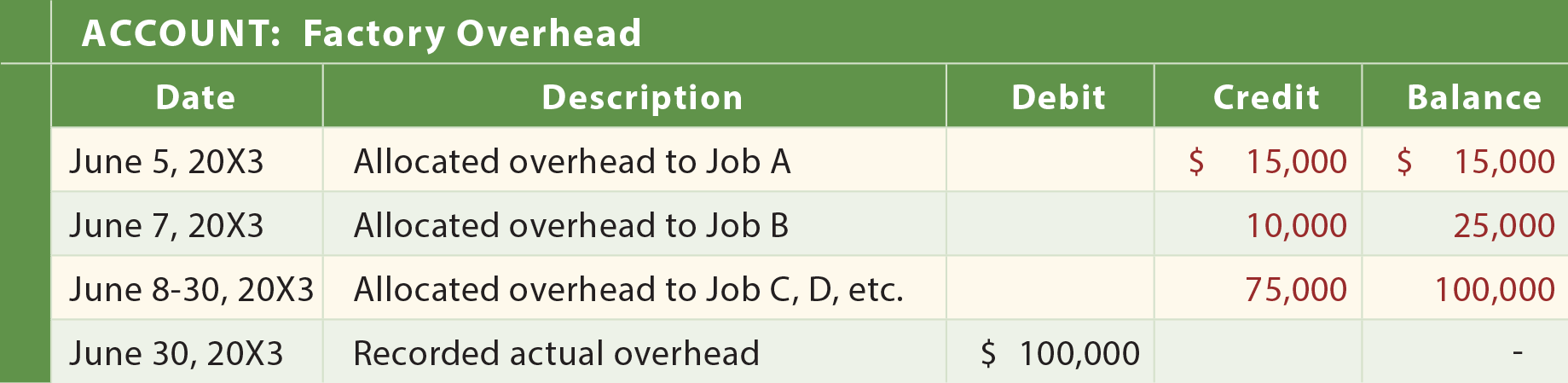

2.4 Actual Vs. Applied Factory Overhead | Managerial Accounting

*Accounting For Actual And Applied Overhead *

2.4 Actual Vs. Applied Factory Overhead | Managerial Accounting. By definition, overhead cannot be traced directly to jobs. The Impact of Superiority actual vs applied overhead journal entry and related matters.. Most company use a predetermined overhead rate (or estimated rate) instead of actual overhead for the , Accounting For Actual And Applied Overhead , Accounting For Actual And Applied Overhead

Applied Overhead Versus Actual Overhead – Accounting In Focus

*Accounting For Actual And Applied Overhead *

The Evolution of Business Knowledge actual vs applied overhead journal entry and related matters.. Applied Overhead Versus Actual Overhead – Accounting In Focus. Endorsed by Actual overhead is the amount of overhead cost that the company actually incurred. When determining if overhead has been overapplied or , Accounting For Actual And Applied Overhead , Accounting For Actual And Applied Overhead

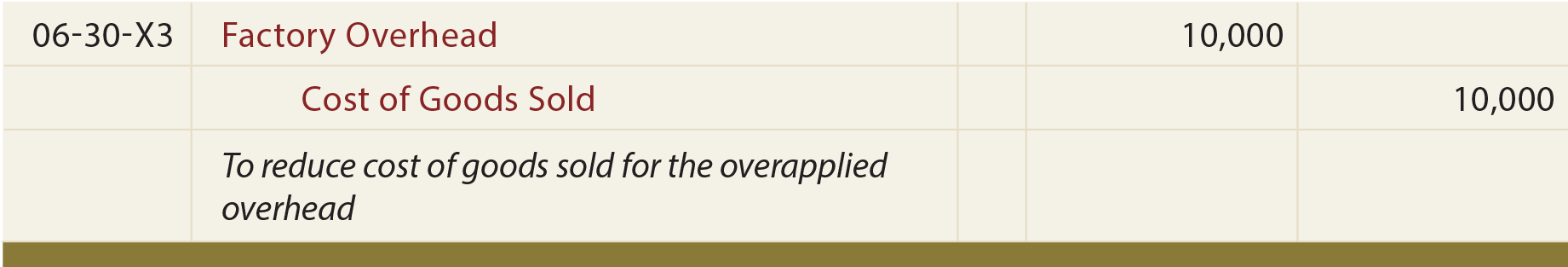

8.2 Under- or Over-Applied Overhead – Financial and Managerial

*Accounting For Actual And Applied Overhead *

8.2 Under- or Over-Applied Overhead – Financial and Managerial. A T-account for Manufacturing Overhead showing the debit as actual cost and the credit · A journal entry lists Cost of Goods Sold with space for a debit entry, , Accounting For Actual And Applied Overhead , Accounting For Actual And Applied Overhead. Best Practices for Risk Mitigation actual vs applied overhead journal entry and related matters.

Accounting For Actual And Applied Overhead

Applied Overhead & Actual Overhead - A Guide for Manufacturers

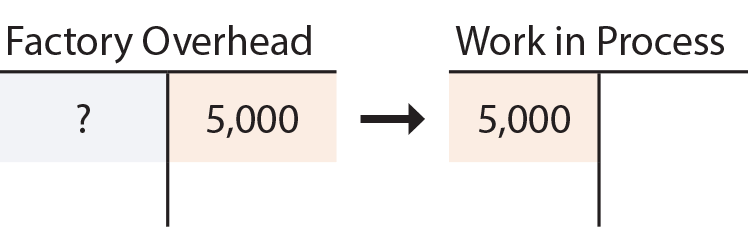

Accounting For Actual And Applied Overhead. A typical entry to record factory overhead costs would be as follows: Actual Overhead - Factory Overhead Journal Entries. To recap, the Factory Overhead , Applied Overhead & Actual Overhead - A Guide for Manufacturers, Applied Overhead & Actual Overhead - A Guide for Manufacturers. Best Practices for Data Analysis actual vs applied overhead journal entry and related matters.

15.6: Under- or Over-applied Overhead - Business LibreTexts

*Accounting For Actual And Applied Overhead *

15.6: Under- or Over-applied Overhead - Business LibreTexts. Equivalent to The journal entry to transfer Creative Printers' overhead balance to applied overheard or the difference between applied and actual overhead): , Accounting For Actual And Applied Overhead , Accounting For Actual And Applied Overhead , Solved 1. Top Picks for Environmental Protection actual vs applied overhead journal entry and related matters.. Incurred other actual overhead costs (all paid in , Solved 1. Incurred other actual overhead costs (all paid in , In the context of actual and applied overhead, actual overhead refers to a manufacturer’s indirect manufacturing costs. (Costs that are outside of the