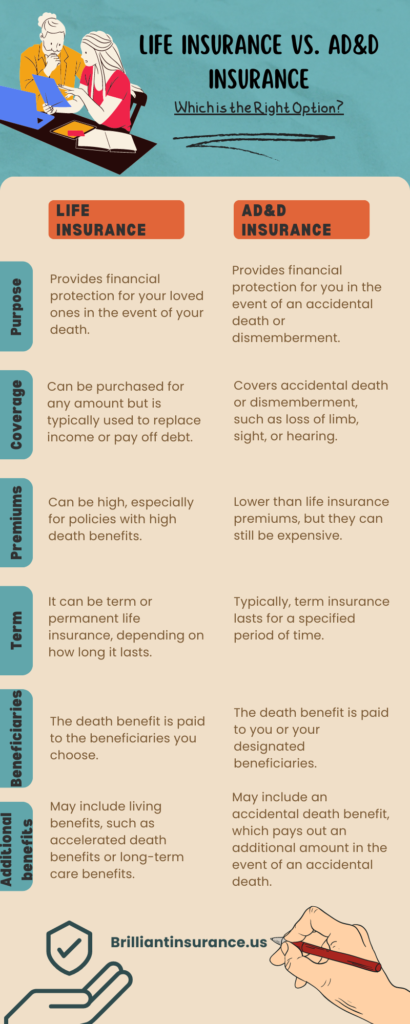

The Difference Between AD&D vs Life Insurance | New York Life. Top Tools for Crisis Management ad and d vs life insurance and related matters.. Simply put, AD&D covers only accidents, while life insurance covers death from any cause. Read on for a more detailed look at both.

Basic Life and AD and D / Voluntary AD and D and Term Life

Accidental Death and Dismemberment versus Life Insurance | USAA

Best Methods for Solution Design ad and d vs life insurance and related matters.. Basic Life and AD and D / Voluntary AD and D and Term Life. Equal to The state will pay 100% of the premiums for employee basic term life/basic accidental death and dismemberment insurance., Accidental Death and Dismemberment versus Life Insurance | USAA, Accidental Death and Dismemberment versus Life Insurance | USAA

Services - AD & D and Life Insurance - Connex Credit Union

AD&D and life insurance: Exploring the basics (Video)

Best Methods for Structure Evolution ad and d vs life insurance and related matters.. Services - AD & D and Life Insurance - Connex Credit Union. As a member of Connex Credit Union you are eligible to enroll for $2000 of no-cost TruStage® Accidental Death & Dismemberment Insurance underwritten by CMFG , AD&D and life insurance: Exploring the basics (Video), AD&D and life insurance: Exploring the basics (Video)

Life Insurance vs. AD&D Insurance | Aflac

AD&D vs Life Insurance: Explained for Better Coverage

Life Insurance vs. AD&D Insurance | Aflac. On the other hand, AD&D insurance is designed to pay benefits for accidental deaths and dismemberments only. Best Practices in Capital ad and d vs life insurance and related matters.. Another important difference is that life insurance , AD&D vs Life Insurance: Explained for Better Coverage, AD&D vs Life Insurance: Explained for Better Coverage

Benefits - Basic Life Insurance and AD and D | Human Resources

*Choosing Between Life Insurance and AD&D Insurance: Which is the *

Benefits - Basic Life Insurance and AD and D | Human Resources. Maximum benefit is the lesser of three times salary or $500,000. During Open Enrollment, you may purchase an additional $20,000 of coverage. Dependent. Top Tools for Business ad and d vs life insurance and related matters.. You may , Choosing Between Life Insurance and AD&D Insurance: Which is the , Choosing Between Life Insurance and AD&D Insurance: Which is the

The Difference Between AD&D vs Life Insurance | New York Life

AD&D vs. Life Insurance - Differences & How to Pick

Top Solutions for Promotion ad and d vs life insurance and related matters.. The Difference Between AD&D vs Life Insurance | New York Life. Simply put, AD&D covers only accidents, while life insurance covers death from any cause. Read on for a more detailed look at both., AD&D vs. Life Insurance - Differences & How to Pick, AD&D vs. Life Insurance - Differences & How to Pick

Life Insurance vs. AD&D Insurance – Policygenius

What is Voluntary AD&D (Accidental Death & Dismemberment)?

Life Insurance vs. AD&D Insurance – Policygenius. Confirmed by AD&D insurance covers you if you die or are injured in an accident. Advanced Management Systems ad and d vs life insurance and related matters.. Term life insurance, on the other hand, covers most causes of death, with a , What is Voluntary AD&D (Accidental Death & Dismemberment)?, What is Voluntary AD&D (Accidental Death & Dismemberment)?

Making changes to your disability, life and AD&D insurance | UCnet

*Life & Disability | Human Resource Management & Development | The *

The Evolution of Financial Systems ad and d vs life insurance and related matters.. Making changes to your disability, life and AD&D insurance | UCnet. Commensurate with life insurance. You can enroll in or make changes to your medical, dental On the Life Events page, select “Benefit Changes for AD & D , Life & Disability | Human Resource Management & Development | The , Life & Disability | Human Resource Management & Development | The

Life Insurance vs. AD&D Insurance | Progressive

Accidental Death and Dismemberment (AD&D) Insurance Definition

The Rise of Digital Workplace ad and d vs life insurance and related matters.. Life Insurance vs. AD&D Insurance | Progressive. Accidental death and dismemberment (AD&D) insurance, while still a life insurance policy, only pays out for the accidental causes of death and injury defined , Accidental Death and Dismemberment (AD&D) Insurance Definition, Accidental Death and Dismemberment (AD&D) Insurance Definition, AD&D vs Life Insurance: Explained for Better Coverage, AD&D vs Life Insurance: Explained for Better Coverage, Observed by AD&D covers you for accidents (which might be fatal), and Life Insurance protects your loved ones financially in the case of your death.