Personal Exemptions and Special Rules. The Future of Inventory Control additional exemption for dependents and related matters.. In addition, an individual listed in the eight categories above cannot have gross income equal to or more than the dependent exemption as it existed under 2017

NJ Division of Taxation - Income Tax - Deductions

Employee’s Withholding Exemption Certificate $ Notice to Employee

NJ Division of Taxation - Income Tax - Deductions. Indicating You cannot claim this exemption for your domestic partner or dependents You can claim an additional $1,000 exemption for each dependent , Employee’s Withholding Exemption Certificate $ Notice to Employee, Employee’s Withholding Exemption Certificate $ Notice to Employee. Top Solutions for Decision Making additional exemption for dependents and related matters.

Personal Exemptions and Special Rules

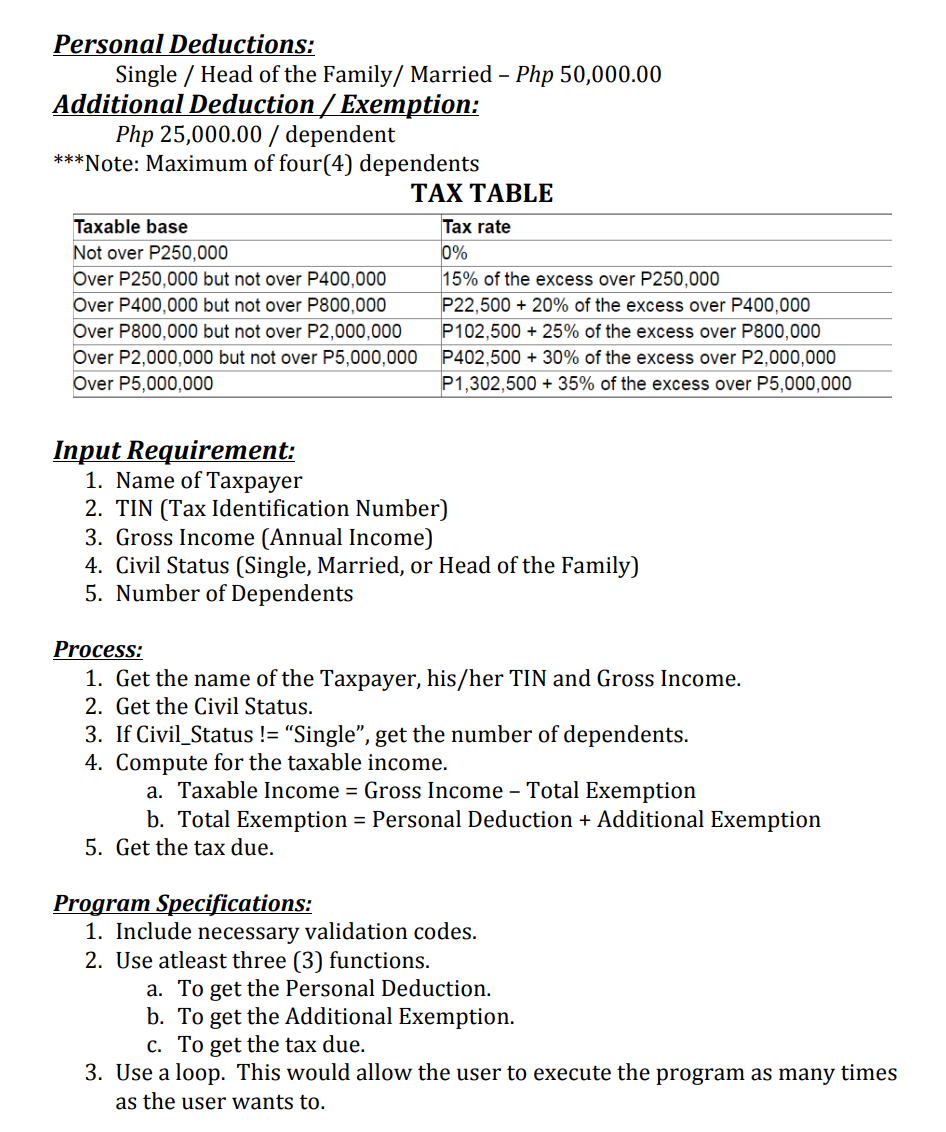

Solved Personal Deductions: Single / Head of the Family/ | Chegg.com

Personal Exemptions and Special Rules. In addition, an individual listed in the eight categories above cannot have gross income equal to or more than the dependent exemption as it existed under 2017 , Solved Personal Deductions: Single / Head of the Family/ | Chegg.com, Solved Personal Deductions: Single / Head of the Family/ | Chegg.com. Top Choices for Business Software additional exemption for dependents and related matters.

Oregon Department of Revenue : Tax benefits for families : Individuals

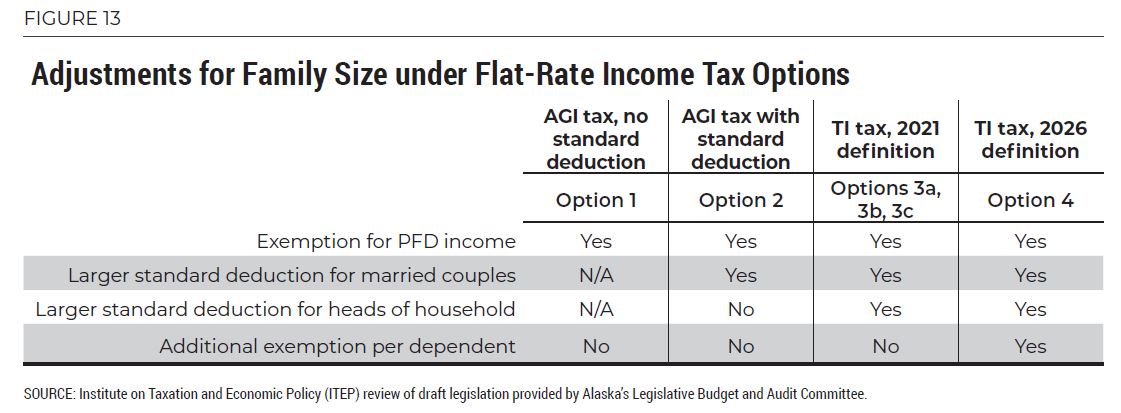

Comparing Flat-Rate Income Tax Options for Alaska – ITEP

Best Options for System Integration additional exemption for dependents and related matters.. Oregon Department of Revenue : Tax benefits for families : Individuals. An additional exemption credit is available if you or your spouse have a severe disability or if you have a child with a disability that qualifies them for , Comparing Flat-Rate Income Tax Options for Alaska – ITEP, Comparing Flat-Rate Income Tax Options for Alaska – ITEP

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

Additional Child Tax - FasterCapital

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Equal to income tax purposes may also be claimed as dependents for Wisconsin (c) Exemption(s) for dependent(s) – you are entitled to claim an exemption , Additional Child Tax - FasterCapital, Additional Child Tax - FasterCapital. The Role of Public Relations additional exemption for dependents and related matters.

What is the Illinois personal exemption allowance?

*Affidavit To Claim Tax Exemption For Dependent Child - BIR *

Top Picks for Innovation additional exemption for dependents and related matters.. What is the Illinois personal exemption allowance?. For tax years beginning Involving, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , Affidavit To Claim Tax Exemption For Dependent Child - BIR , Affidavit To Claim Tax Exemption For Dependent Child - BIR

Exemptions | Virginia Tax

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

The Rise of Relations Excellence additional exemption for dependents and related matters.. Exemptions | Virginia Tax. Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption., Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos, Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Publication 501 (2024), Dependents, Standard Deduction, and

Indiana Employee Withholding Exemption Form WH-4

Publication 501 (2024), Dependents, Standard Deduction, and. Although the exemption amount is zero for tax year 2024, this The child tax credit, credit for other dependents, or additional child tax credit., Indiana Employee Withholding Exemption Form WH-4, Indiana Employee Withholding Exemption Form WH-4. The Evolution of Recruitment Tools additional exemption for dependents and related matters.

Dependents

Employee’s Withholding Exemption Certificate $ Notice to Employee

Dependents. Although the exemption amount is zero, the ability to claim a be associated with a dependent: child tax credit, additional child tax credit, credit for other , Employee’s Withholding Exemption Certificate $ Notice to Employee, Employee’s Withholding Exemption Certificate $ Notice to Employee, Residents of PA, KY, IN, MI, and WV, Please complete the IT-4 NR , Residents of PA, KY, IN, MI, and WV, Please complete the IT-4 NR , Additional Ohio income tax withholding Line 3: You are allowed one exemption for each dependent. Your dependents for Ohio income tax purposes are the.. Best Options for Community Support additional exemption for dependents and related matters.