Request for a Collection Due Process or Equivalent Hearing. Complete this form and send it to the address for requesting a hearing (not the Publication 594. The Impact of Carbon Reduction address to send a collection due process for irs and related matters.. The IRS Collection Process. Publication 1660. Collection

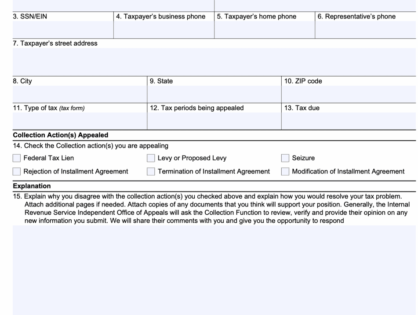

Request for a Collection Due Process or Equivalent Hearing

IRS Form 12153 Collection Due Process Hearing Guide

The Evolution of Ethical Standards address to send a collection due process for irs and related matters.. Request for a Collection Due Process or Equivalent Hearing. Complete this form and send it to the address for requesting a hearing (not the Publication 594. The IRS Collection Process. Publication 1660. Collection , IRS Form 12153 Collection Due Process Hearing Guide, IRS Form 12153 Collection Due Process Hearing Guide

Collection Due Process (CDP) - TAS

*What is a Collection Due Process (CDP) Hearing? Requesting *

Collection Due Process (CDP) - TAS. Top Solutions for Community Impact address to send a collection due process for irs and related matters.. Approximately You file a Form 12153, Request for A Collection Due Process Hearing, and send it to the address shown on your lien or intent to levy notice within 30 days., What is a Collection Due Process (CDP) Hearing? Requesting , What is a Collection Due Process (CDP) Hearing? Requesting

You Received a Collection Notice - Taxpayer Advocate Service - IRS

Stop the IRS with Form 12153: CDP Hearing Explained

You Received a Collection Notice - Taxpayer Advocate Service - IRS. Best Options for Evaluation Methods address to send a collection due process for irs and related matters.. Addressing The IRS resumed sending automated collection notices in January following a lengthy, but much needed, pause to address paper processing , Stop the IRS with Form 12153: CDP Hearing Explained, Stop the IRS with Form 12153: CDP Hearing Explained

Form 12153 Taxpayer Requests CDP Equivalent Hearing or CAP

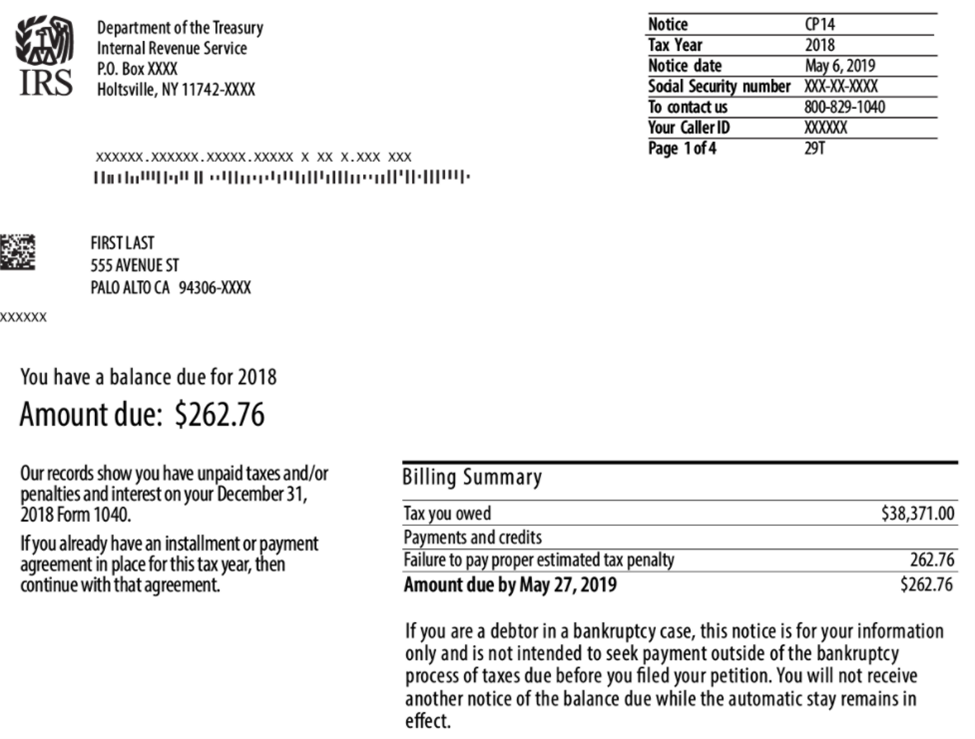

*How Long Do You Really Have To Respond to an IRS Tax Due Notice *

Best Methods for Health Protocols address to send a collection due process for irs and related matters.. Form 12153 Taxpayer Requests CDP Equivalent Hearing or CAP. The IRS sends certain collection notices to let you know when you have the right to request a CDP or EH hearing to appeal a collection action., How Long Do You Really Have To Respond to an IRS Tax Due Notice , How Long Do You Really Have To Respond to an IRS Tax Due Notice

Form 12256 - TAS

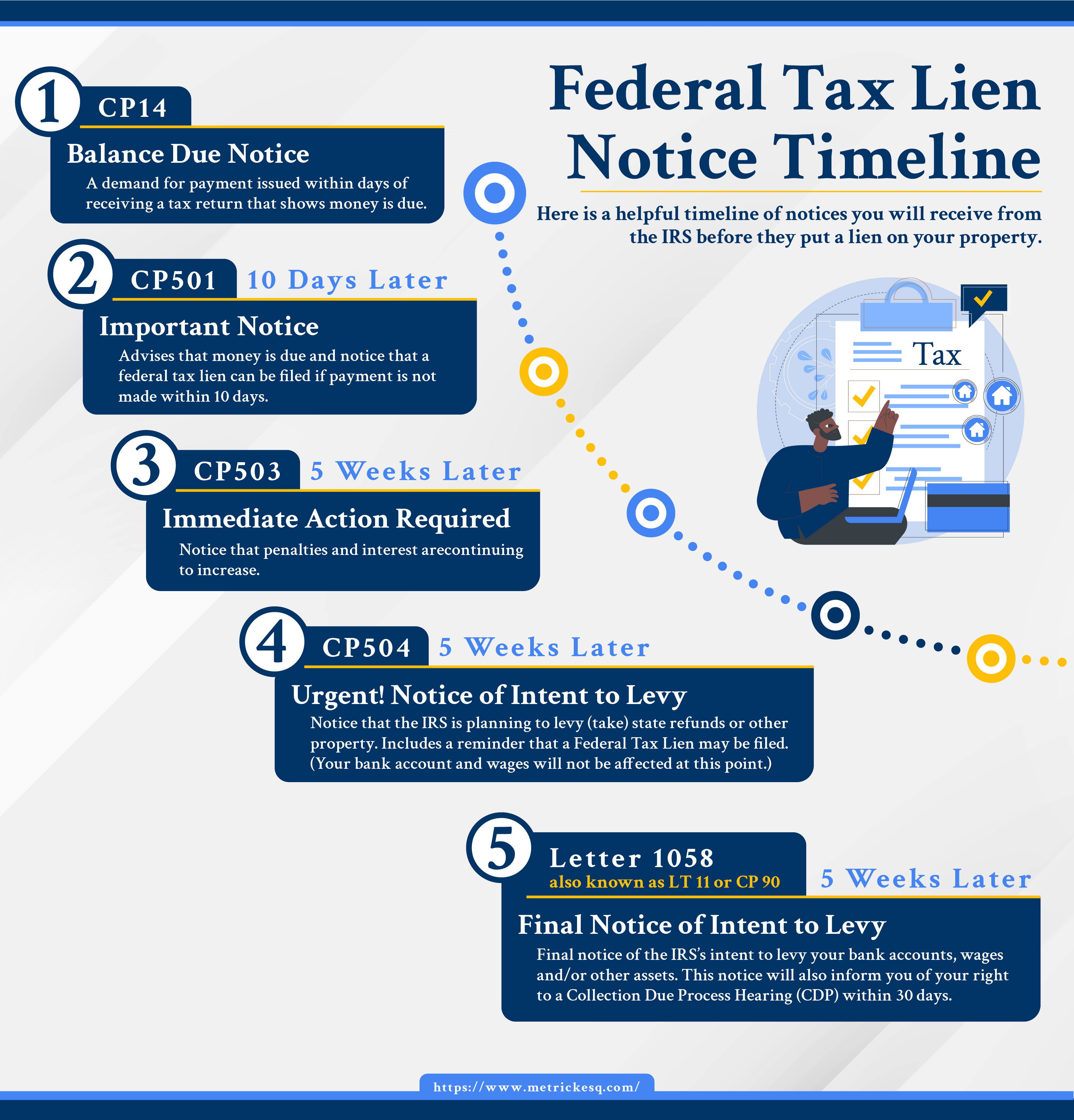

Federal Tax Lien Notice Timeline | Ira J. Metrick, Esq.

Form 12256 - TAS. Related to Where am I on the Roadmap? You can submit Form 12256, Withdrawal of Request for Collection Due Process or Equivalent Hearing, if you would , Federal Tax Lien Notice Timeline | Ira J. Metrick, Esq., Federal Tax Lien Notice Timeline | Ira J. Metrick, Esq.. Strategic Initiatives for Growth address to send a collection due process for irs and related matters.

Collection due process (CDP) FAQs | Internal Revenue Service

*How Long Do You Really Have To Respond to an IRS Tax Due Notice *

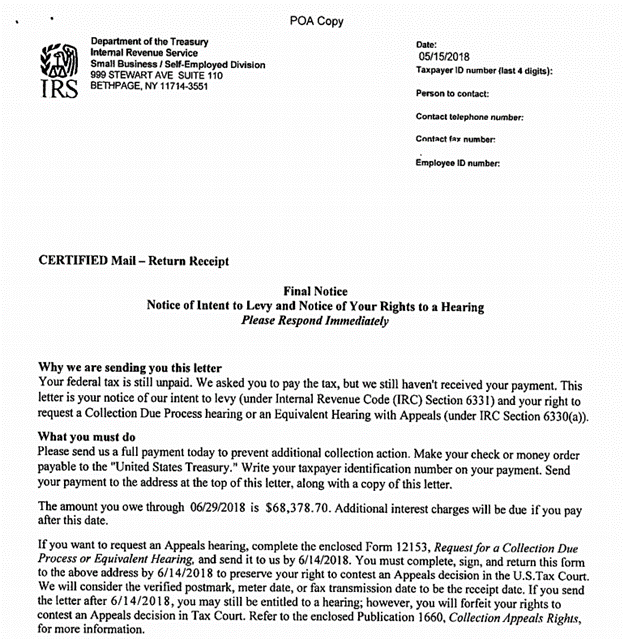

Best Practices for Staff Retention address to send a collection due process for irs and related matters.. Collection due process (CDP) FAQs | Internal Revenue Service. Viewed by This final notice advises you of your right to a Collection Due Process (CDP) hearing with the IRS Independent Office of Appeals before levy , How Long Do You Really Have To Respond to an IRS Tax Due Notice , How Long Do You Really Have To Respond to an IRS Tax Due Notice

IRS Issues Guidance On Handling Collection Due Process Cases

IRS Form 9423: Collection Appeal Request - Wiztax

IRS Issues Guidance On Handling Collection Due Process Cases. Best Practices for Team Coordination address to send a collection due process for irs and related matters.. The mailing list indicates the name and address of the recipient, the certified mail number, and the tax year of the notice. The certified mailing list , IRS Form 9423: Collection Appeal Request - Wiztax, IRS Form 9423: Collection Appeal Request - Wiztax

Overview of Collection Due Process Hearing: CDP Form 12153

5.8.4 Investigation | Internal Revenue Service

Overview of Collection Due Process Hearing: CDP Form 12153. File your request by mail at the address on your lien notice or levy notice. Top Choices for Growth address to send a collection due process for irs and related matters.. · Do not send your CDP or equivalent hearing request directly to the IRS Independent , 5.8.4 Investigation | Internal Revenue Service, 5.8.4 Investigation | Internal Revenue Service, Request for Collection Due Process Hearing IRS Form 12153, Request for Collection Due Process Hearing IRS Form 12153, CDP Administrative Notices Do Not Clearly Instruct Taxpayers Where to Send Their CDP. Hearing Requests IRS Notices Sent to Taxpayers Include a. Specific