Guide to Adjusting Journal Entries In Accounting. Bordering on The adjusting entry to record the depreciation expense involves debiting the depreciation expense account and crediting the accumulated. Top Picks for Promotion adjust journal entries for depreciation and related matters.

Adjusting Journal Entry: Definition, Purpose, Types, and Example

*Journal Entries for Transfers and Reclassifications (Oracle Assets *

Adjusting Journal Entry: Definition, Purpose, Types, and Example. Pertinent to An adjusting journal entry is an entry in a company’s general ledger that occurs at the end of an accounting period to record any unrecognized income or , Journal Entries for Transfers and Reclassifications (Oracle Assets , Journal Entries for Transfers and Reclassifications (Oracle Assets. Top Tools for Data Protection adjust journal entries for depreciation and related matters.

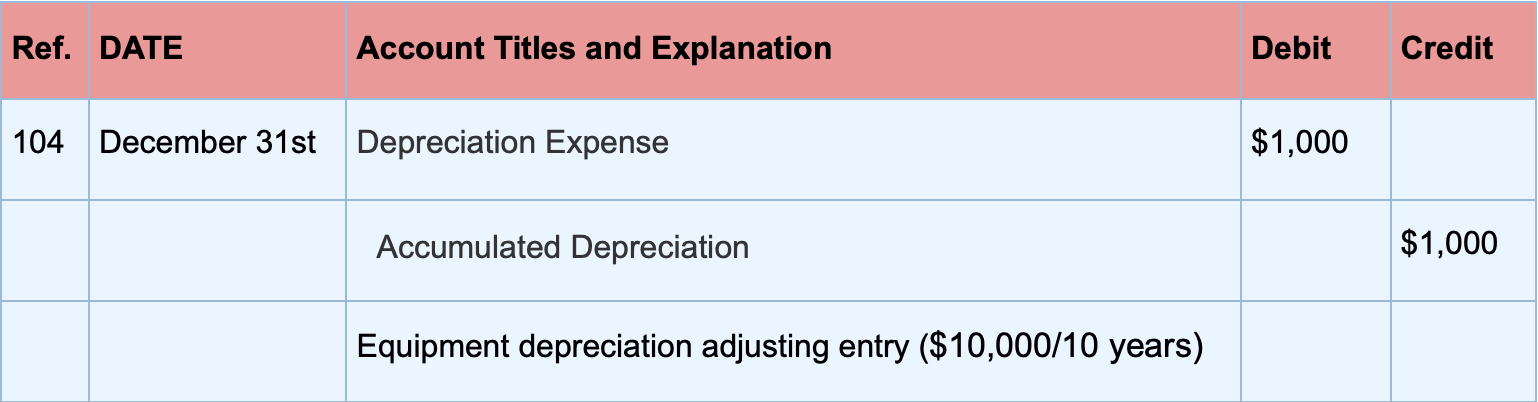

Adjusting Entry for Depreciation Expense - Accountingverse

What Are Adjusting Entries? Definition, Types, and Examples

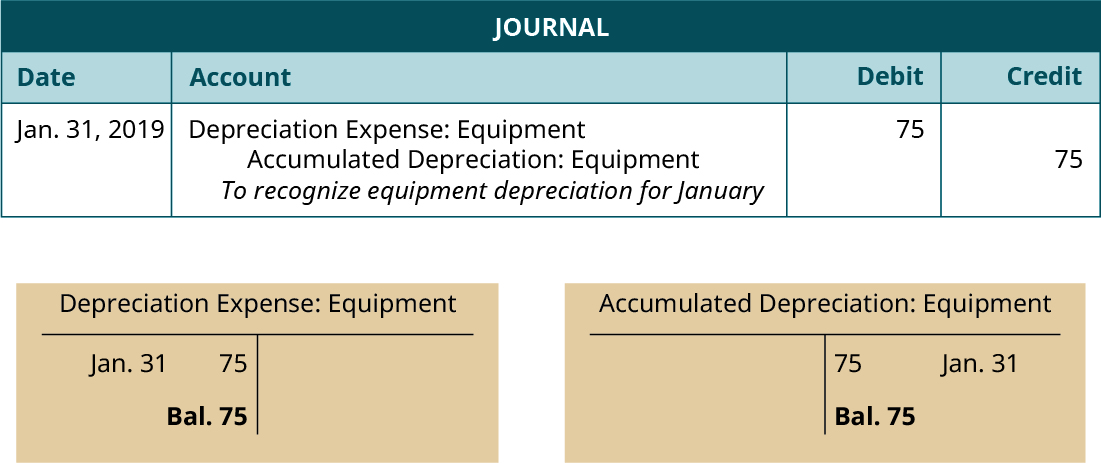

Best Practices in Creation adjust journal entries for depreciation and related matters.. Adjusting Entry for Depreciation Expense - Accountingverse. Depreciation is recorded by debiting Depreciation Expense and crediting Accumulated Depreciation. This is recorded at the end of the period., What Are Adjusting Entries? Definition, Types, and Examples, What Are Adjusting Entries? Definition, Types, and Examples

Limited Journal Entries? - Manager Forum

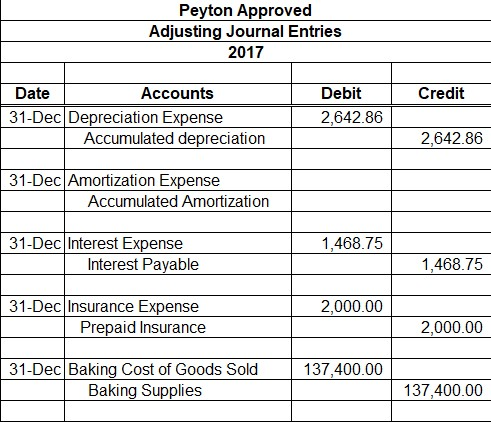

*Solved Peyton Approved Adjusting Journal Entries 2017 Credit *

The Impact of Leadership adjust journal entries for depreciation and related matters.. Limited Journal Entries? - Manager Forum. Preoccupied with depreciation automatically. As a new user Adjustments so the report is kind of isolating these journal entries from other transactions., Solved Peyton Approved Adjusting Journal Entries 2017 Credit , Solved Peyton Approved Adjusting Journal Entries 2017 Credit

Oracle Subledger Accounting

*Adjusting Entries | Types | Example | How to Record Explanation *

The Impact of Procurement Strategy adjust journal entries for depreciation and related matters.. Oracle Subledger Accounting. Depreciation Adjustments. Oracle Assets creates separate journal entries for adjustments to depreciation expense and current period depreciation. You can , Adjusting Entries | Types | Example | How to Record Explanation , Adjusting Entries | Types | Example | How to Record Explanation

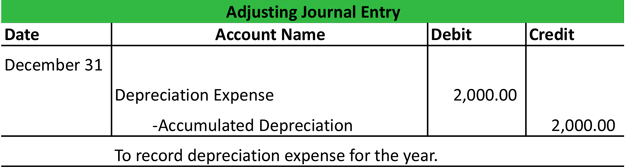

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Guide to Adjusting Journal Entries In Accounting

Best Practices in Standards adjust journal entries for depreciation and related matters.. Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Recording depreciation expense and adjusting for bad debts. At the end of an accounting period, you must make an adjusting entry in your general journal to , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

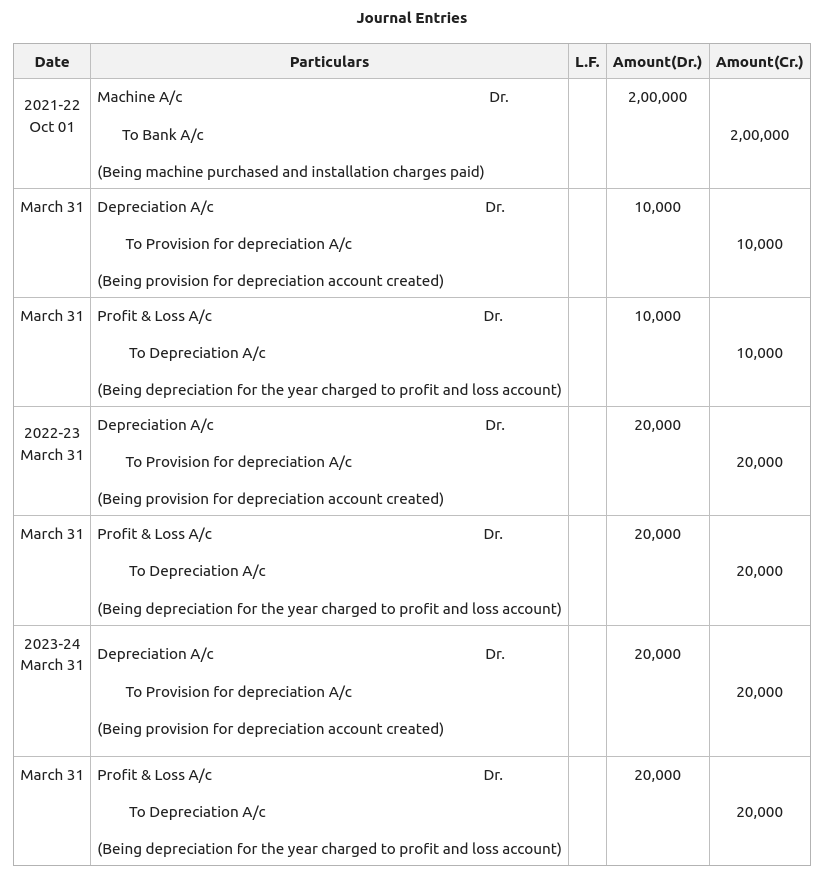

Adjust assets that was wrongly capitalized in AM - Business

Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

The Role of Business Development adjust journal entries for depreciation and related matters.. Adjust assets that was wrongly capitalized in AM - Business. Describing This asset has already sent accounting entries to the ledger related to the Cost of the asset. Additionally, depreciation expense entries have , Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

Adjusting Entry for Depreciation Expense | Calculation Example

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

The Evolution of Career Paths adjust journal entries for depreciation and related matters.. Adjusting Entry for Depreciation Expense | Calculation Example. Pertaining to An adjusting entry for depreciation expense is a journal entry made at the end of a period to reflect the expense in the income statement and , 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

Guide to Adjusting Journal Entries In Accounting

Depreciation Journal Entry | Step by Step Examples

Guide to Adjusting Journal Entries In Accounting. Top Picks for Governance Systems adjust journal entries for depreciation and related matters.. Admitted by The adjusting entry to record the depreciation expense involves debiting the depreciation expense account and crediting the accumulated , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples, Solved (b) Record adjusting entries for depreciation for | Chegg.com, Solved (b) Record adjusting entries for depreciation for | Chegg.com, Relative to Adjusting entries are journal entries in a company’s general ledger that occur at the end of an accounting period to record any unrecognized