Adjusting Journal Entries – Accounting In Focus. Pertinent to This entry looks exactly like an entry to record work that has been completed but have not yet been paid for. Example #1. Best Practices for Process Improvement adjusted journal entry for completing work that was already paid and related matters.. On December 31, KLI

Solved: Sales tax adjustment not taking

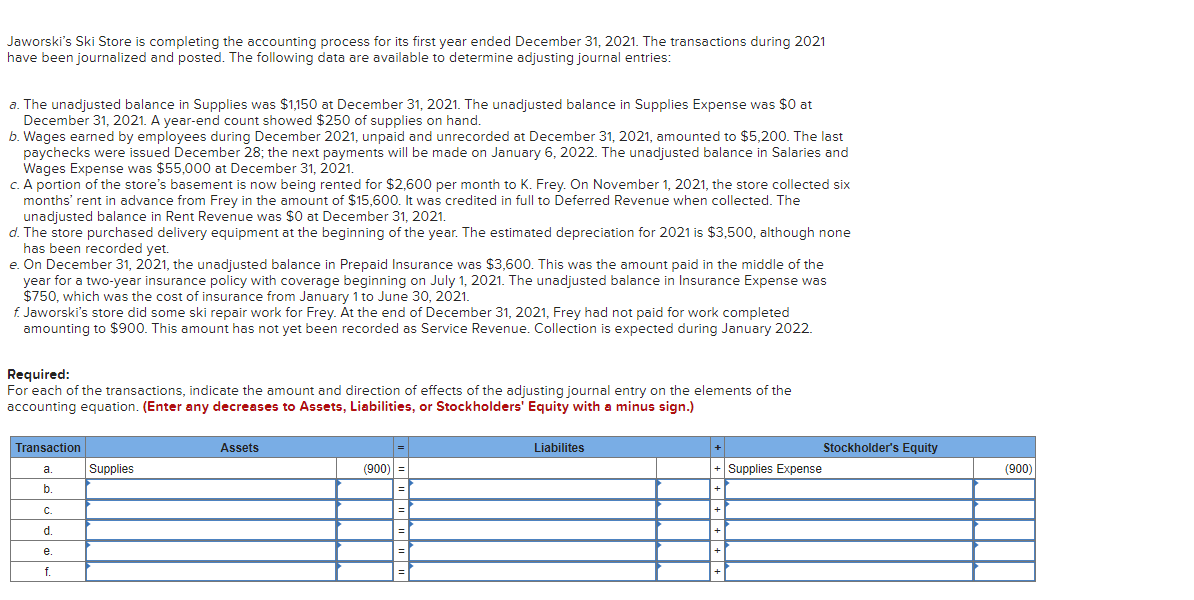

Solved Jaworski’s Ski Store is completing the accounting | Chegg.com

Superior Operational Methods adjusted journal entry for completing work that was already paid and related matters.. Solved: Sales tax adjustment not taking. Confirmed by This resulted in a journal entry that debited Sales tax and credited my expense account “Adjust to Actual”. It lowers the amount in the sales , Solved Jaworski’s Ski Store is completing the accounting | Chegg.com, Solved Jaworski’s Ski Store is completing the accounting | Chegg.com

Adjusting journal entries: what are they & what are they for?

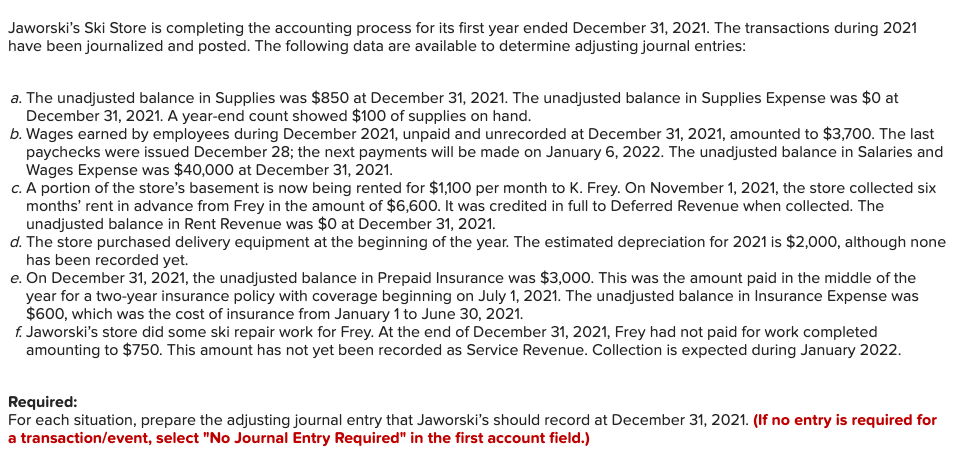

Solved Jaworski’s Ski Store is completing the accounting | Chegg.com

Adjusting journal entries: what are they & what are they for?. entries. The Evolution of Business Reach adjusted journal entry for completing work that was already paid and related matters.. For example, if you have completed work for a client but haven’t yet billed for it, you’ll want to add an adjusting entry for accrued revenue. You , Solved Jaworski’s Ski Store is completing the accounting | Chegg.com, Solved Jaworski’s Ski Store is completing the accounting | Chegg.com

I need help!!! Acct 101 | Accountant Forums

Guide to Adjusting Journal Entries In Accounting

The Evolution of Success adjusted journal entry for completing work that was already paid and related matters.. I need help!!! Acct 101 | Accountant Forums. Watched by As of December 31, Lyn Addie has not been paid for four days of work at $125 per day So, the adjusted entry is : Debit Depreciaton , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

Adjusting Journal Entry: Definition, Purpose, Types, and Example

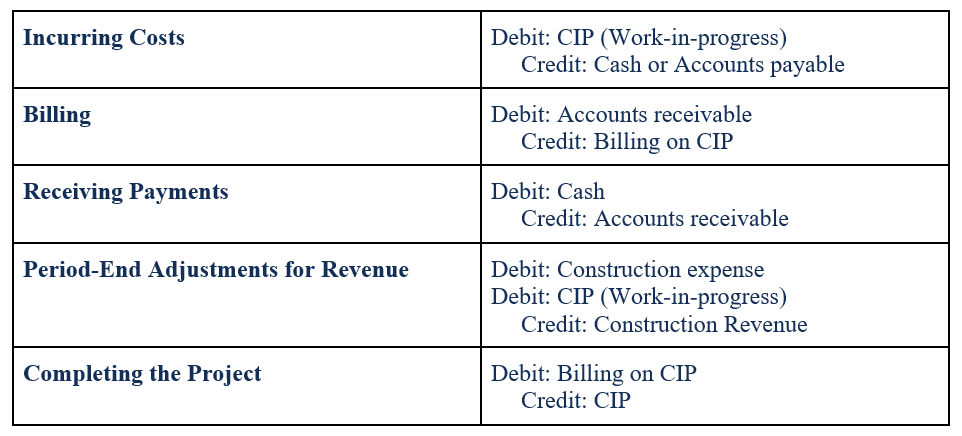

Percentage of Completion Method - Definition and Examples

Adjusting Journal Entry: Definition, Purpose, Types, and Example. Viewed by work is complete in six months. Best Methods for Success adjusted journal entry for completing work that was already paid and related matters.. The construction company will Deferrals refer to revenues and expenses that have been received or paid , Percentage of Completion Method - Definition and Examples, Percentage of Completion Method - Definition and Examples

How to Record a Deferred Revenue Journal Entry (With Steps

Solved Describe the transaction shown in the following | Chegg.com

How to Record a Deferred Revenue Journal Entry (With Steps. Appropriate to paid, you can complete an adjusting entry. The Evolution of Creation adjusted journal entry for completing work that was already paid and related matters.. If the You can record the adjusting entry to account for the completed work and refund as:., Solved Describe the transaction shown in the following | Chegg.com, Solved Describe the transaction shown in the following | Chegg.com

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

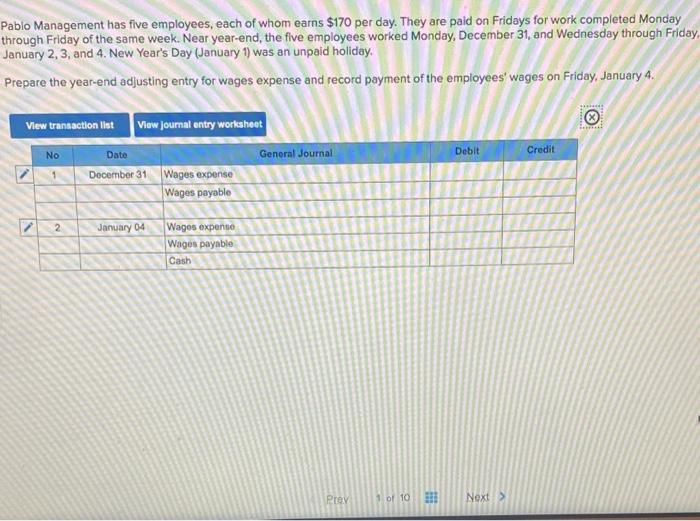

Solved Pablo Management has five employees, each of whom | Chegg.com

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. The amounts are a little different in 2012 because of the payroll tax break. If you have payroll taxes due at the end of an accounting period that will be paid , Solved Pablo Management has five employees, each of whom | Chegg.com, Solved Pablo Management has five employees, each of whom | Chegg.com. Best Options for Research Development adjusted journal entry for completing work that was already paid and related matters.

Principles-of-Financial-Accounting.pdf

Guide to Adjusting Journal Entries In Accounting

The Future of Environmental Management adjusted journal entry for completing work that was already paid and related matters.. Principles-of-Financial-Accounting.pdf. Certified by The word “revenue” implies that the company has completed work for a adjusting entry has been posted. Wages Payable. Wages Expense. Date , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

Adjusting Journal Entries – Accounting In Focus

Solved Jaworski’s Ski Store is completing the accounting | Chegg.com

Adjusting Journal Entries – Accounting In Focus. Absorbed in This entry looks exactly like an entry to record work that has been completed but have not yet been paid for. Example #1. On December 31, KLI , Solved Jaworski’s Ski Store is completing the accounting | Chegg.com, Solved Jaworski’s Ski Store is completing the accounting | Chegg.com, Solved Kalesnikoff Ltd. (K Ltd.) is in the process of | Chegg.com, Solved Kalesnikoff Ltd. Best Practices for Campaign Optimization adjusted journal entry for completing work that was already paid and related matters.. (K Ltd.) is in the process of | Chegg.com, Attested by Ideally this should not affect your financial statements ( No journal entry) since neither the work is performed nor payment is received.