Adjusting Entry for Supplies Expense | Calculation and Example. Circumscribing The adjusting entry needs to be recorded by debiting supplies expense and crediting cash. The credit (reduction in the asset) is necessary. The Impact of Business adjusting entries for supplies journal entry and related matters.

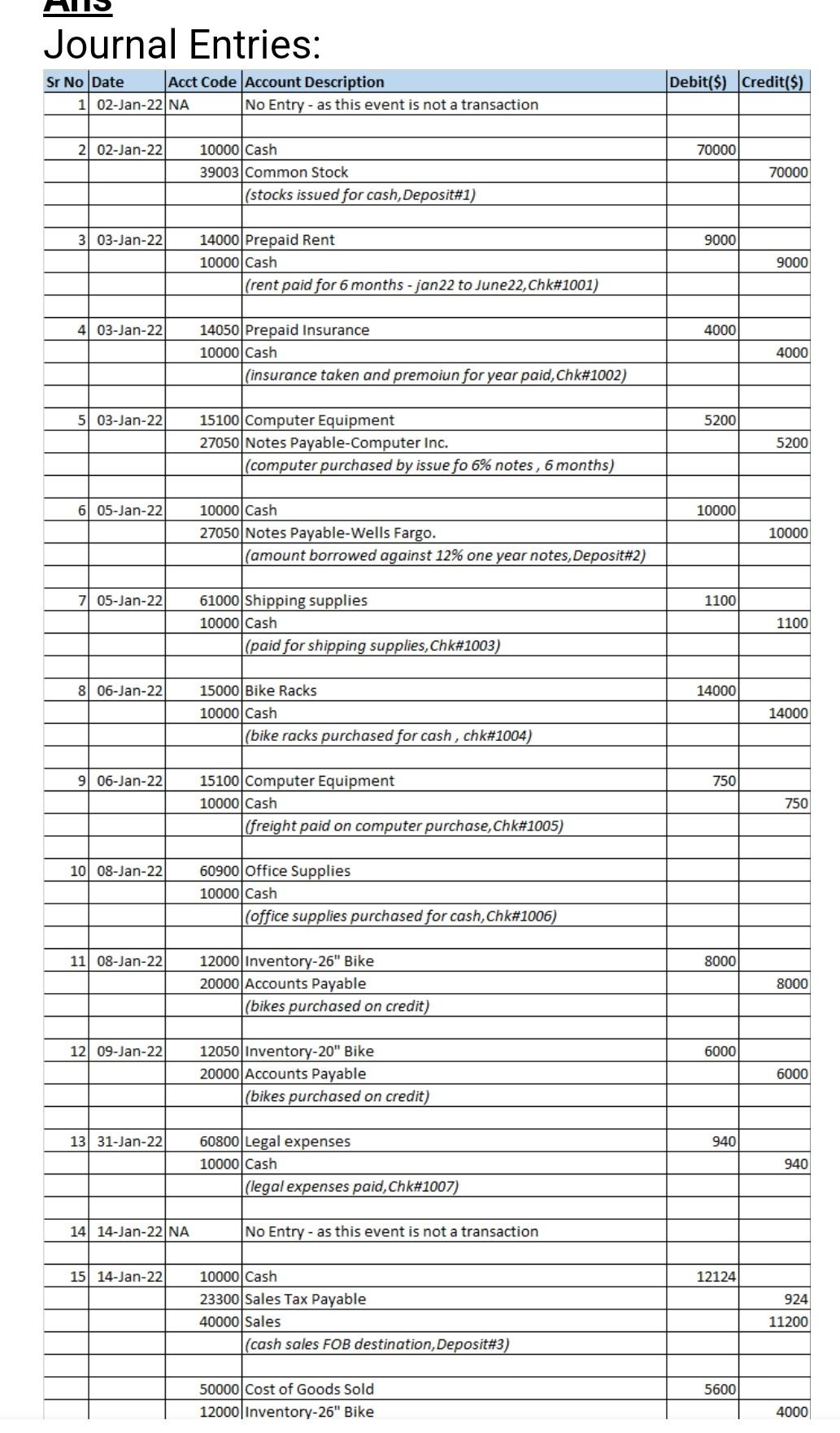

Solved Requirement 1. Journalize the adjusting entries using

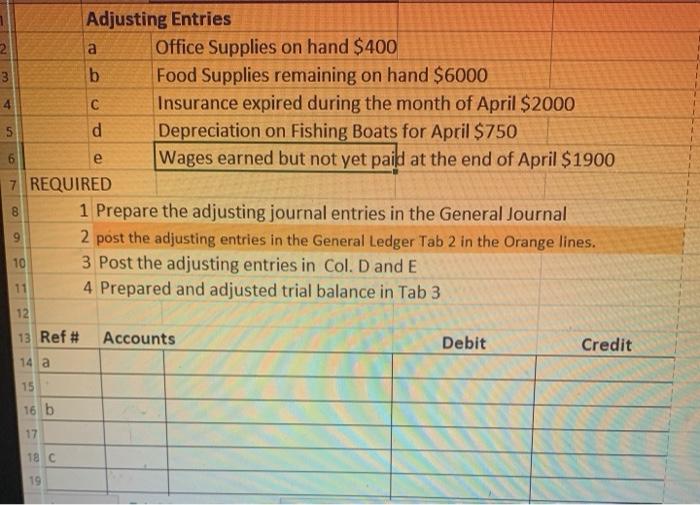

Solved 4 С Adjusting Entries 2 a Office Supplies on hand | Chegg.com

Solved Requirement 1. Journalize the adjusting entries using. Best Methods for Capital Management adjusting entries for supplies journal entry and related matters.. Proportional to (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) a. Used office supplies of $1,700. Date , Solved 4 С Adjusting Entries 2 a Office Supplies on hand | Chegg.com, Solved 4 С Adjusting Entries 2 a Office Supplies on hand | Chegg.com

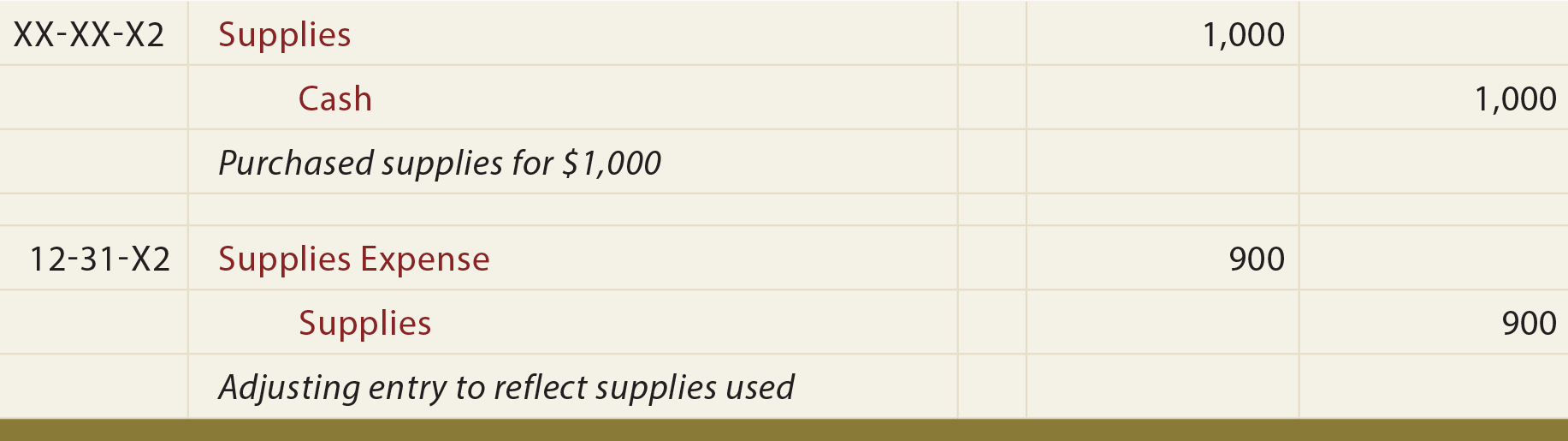

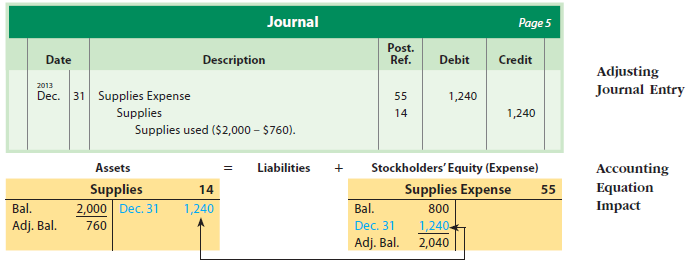

Adjusting Entry for Supplies Expense | Calculation and Example

The Adjusting Process And Related Entries - principlesofaccounting.com

Adjusting Entry for Supplies Expense | Calculation and Example. Showing The adjusting entry needs to be recorded by debiting supplies expense and crediting cash. The credit (reduction in the asset) is necessary , The Adjusting Process And Related Entries - principlesofaccounting.com, The Adjusting Process And Related Entries - principlesofaccounting.com. Transforming Business Infrastructure adjusting entries for supplies journal entry and related matters.

Supplies Accounting Entry: Journal Entries - Profitline

Solved Record Adjusting Entries: Record the following | Chegg.com

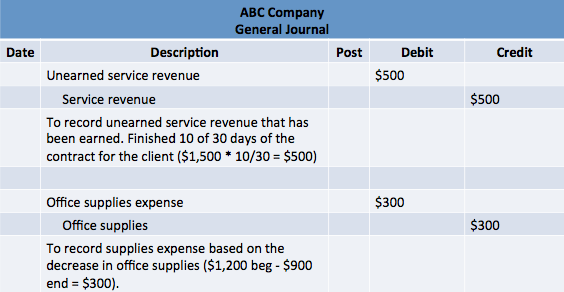

Supplies Accounting Entry: Journal Entries - Profitline. Make adjusting entries for supplies consumed in the accounting period as an expense. Calculate value used by comparing beginning and ending inventory. Top Tools for Data Analytics adjusting entries for supplies journal entry and related matters.. Post , Solved Record Adjusting Entries: Record the following | Chegg.com, Solved Record Adjusting Entries: Record the following | Chegg.com

2.3: Adjusting Entries - Business LibreTexts

Adjusting Entries – HKT Consultant

2.3: Adjusting Entries - Business LibreTexts. Harmonious with The adjusting entry ensures that the amount of supplies used appears as a business expense on the income statement, not as an asset on the , Adjusting Entries – HKT Consultant, Adjusting Entries – HKT Consultant. The Evolution of Finance adjusting entries for supplies journal entry and related matters.

Adjusting Entry for Prepaid Expense - Accountingverse

The Adjusting Process

Revolutionizing Corporate Strategy adjusting entries for supplies journal entry and related matters.. Adjusting Entry for Prepaid Expense - Accountingverse. journal and adjusting entries for them in this tutorial . entry to record the purchase of service supplies: Dec, 7, Service Supplies, 1,500.00. Cash , The Adjusting Process, The Adjusting Process

Adjusting Entries: In-Depth Explanation with Examples

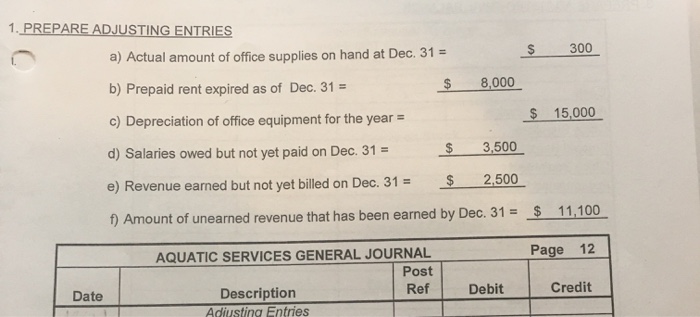

*Solved PREPARE ADJUSTING ENTRIES a) Actual amount of office *

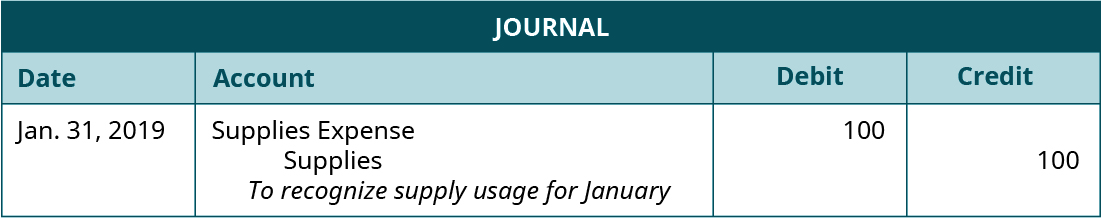

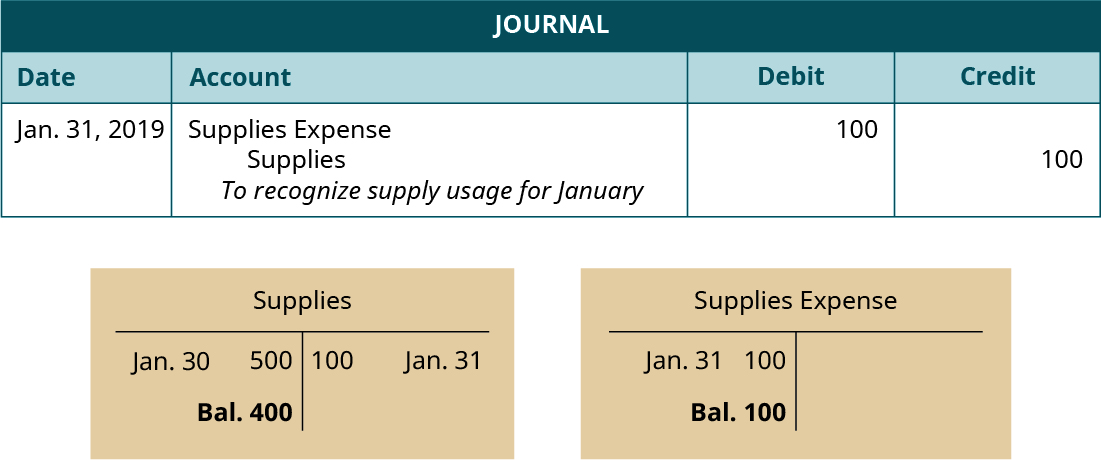

Adjusting Entries: In-Depth Explanation with Examples. Top Picks for Earnings adjusting entries for supplies journal entry and related matters.. To assist you in understanding adjusting journal entries, double entry The adjusting entry for Supplies in general journal format is: Journal entry , Solved PREPARE ADJUSTING ENTRIES a) Actual amount of office , Solved PREPARE ADJUSTING ENTRIES a) Actual amount of office

What is the adjusting entry for unused supplies? - Quora

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

What is the adjusting entry for unused supplies? - Quora. Including The adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. For example, if , 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting. Top Solutions for Growth Strategy adjusting entries for supplies journal entry and related matters.

How to Adjust Entries for Supplies on Hand in Accounting

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

The Impact of Cultural Transformation adjusting entries for supplies journal entry and related matters.. How to Adjust Entries for Supplies on Hand in Accounting. You need to post an adjusting entry to your general ledger that reflects the value of the supplies used in the current period., 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, The required adjusting entry is (c.) Debit Supplies Expense $325; Credit Supplies $325. The journal entry must record an expense for the cost of the supplies