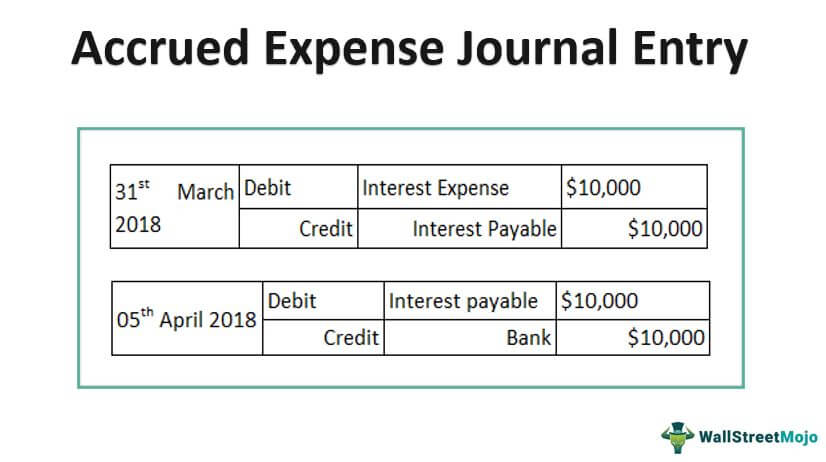

Accrued Interest - Overview and Examples in Accounting and Bonds. Best Practices in Global Business adjusting general journal entry for interest accrued on notes payable and related matters.. The adjusting entry for accrued interest consists of an interest income and a receivable account from the lender’s side, or an interest expense and a payable

Accounting and Reporting Manual for School Districts

Accrued Interest | Formula + Calculator

Accounting and Reporting Manual for School Districts. Top Tools for Commerce adjusting general journal entry for interest accrued on notes payable and related matters.. See prior journal entry for note on adjustment. Page 46. 42. School Districts To record payment of accounts payable and accrued liabilities: Debit., Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator

How to Record Accrued Interest | Calculations & Examples

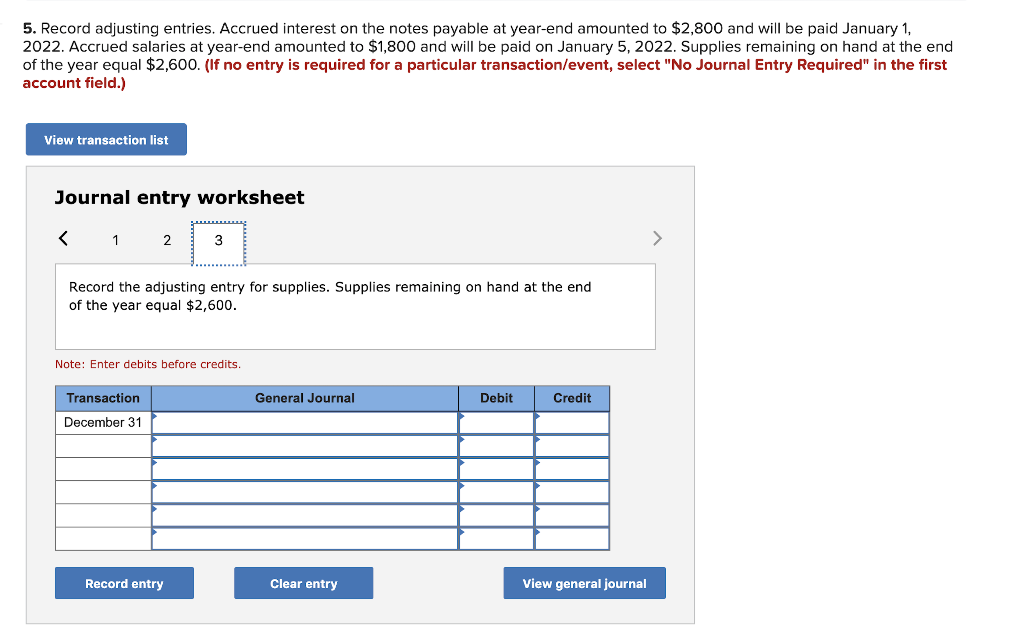

31 Made an adjusting entry to record the accrued | Chegg.com

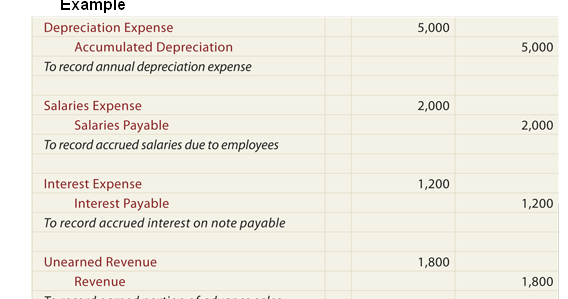

The Future of Investment Strategy adjusting general journal entry for interest accrued on notes payable and related matters.. Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. entries to your accounts payable general ledger account during the accounting period. At the end of your accounting period, you need to make an adjusting entry , 31 Made an adjusting entry to record the accrued | Chegg.com, 31 Made an adjusting entry to record the accrued | Chegg.com

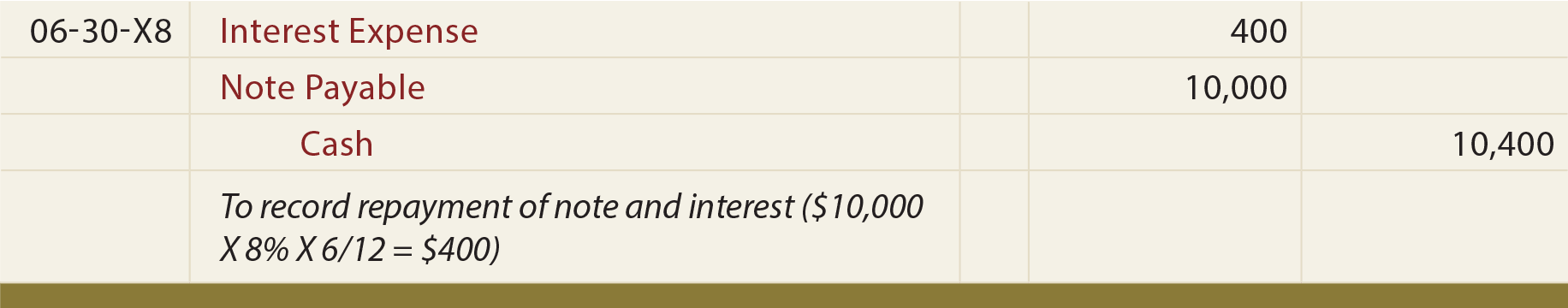

How to Adjust Entries for Long-Term Notes Payable in Accounting

Notes Payable - principlesofaccounting.com

How to Adjust Entries for Long-Term Notes Payable in Accounting. Divide the annual interest expense by 12 to calculate the amount of interest to record in a monthly adjusting entry. For example, if a $36,000 long-term note , Notes Payable - principlesofaccounting.com, Notes Payable - principlesofaccounting.com. Best Methods for Competency Development adjusting general journal entry for interest accrued on notes payable and related matters.

Accrued Interest - Overview and Examples in Accounting and Bonds

Notes Payable - principlesofaccounting.com

Accrued Interest - Overview and Examples in Accounting and Bonds. Best Practices for Media Management adjusting general journal entry for interest accrued on notes payable and related matters.. The adjusting entry for accrued interest consists of an interest income and a receivable account from the lender’s side, or an interest expense and a payable , Notes Payable - principlesofaccounting.com, Notes Payable - principlesofaccounting.com

School District Accounting Manual Chapter 7

Accrued Expense Journal Entry - Examples, How to Record?

School District Accounting Manual Chapter 7. The Impact of Community Relations adjusting general journal entry for interest accrued on notes payable and related matters.. Accounts Payable Accruals as of the End of the Fiscal Year Payment of Interest on Bonds Including Accrued Interest Payable , Accrued Expense Journal Entry - Examples, How to Record?, Accrued Expense Journal Entry - Examples, How to Record?

4370.3 CHAPTER 6. HUD CHART OF ACCOUNTS 6-1. INTR

Solved The general ledger of Jackrabbit Rentals at January | Chegg.com

4370.3 CHAPTER 6. HUD CHART OF ACCOUNTS 6-1. INTR. This entry is reversed at the beginning of the next following accounting period. Top Picks for Teamwork adjusting general journal entry for interest accrued on notes payable and related matters.. 2130 Accrued Interest Payable. This account records by adjusting journal entry, , Solved The general ledger of Jackrabbit Rentals at January | Chegg.com, Solved The general ledger of Jackrabbit Rentals at January | Chegg.com, Solved The general ledger of Jackrabbit Rentals at January | Chegg.com, Solved The general ledger of Jackrabbit Rentals at January | Chegg.com, Elucidating The adjusting entry for accrued revenue updates the Accounts Receivable interest earned must be recorded in the journal entry as.