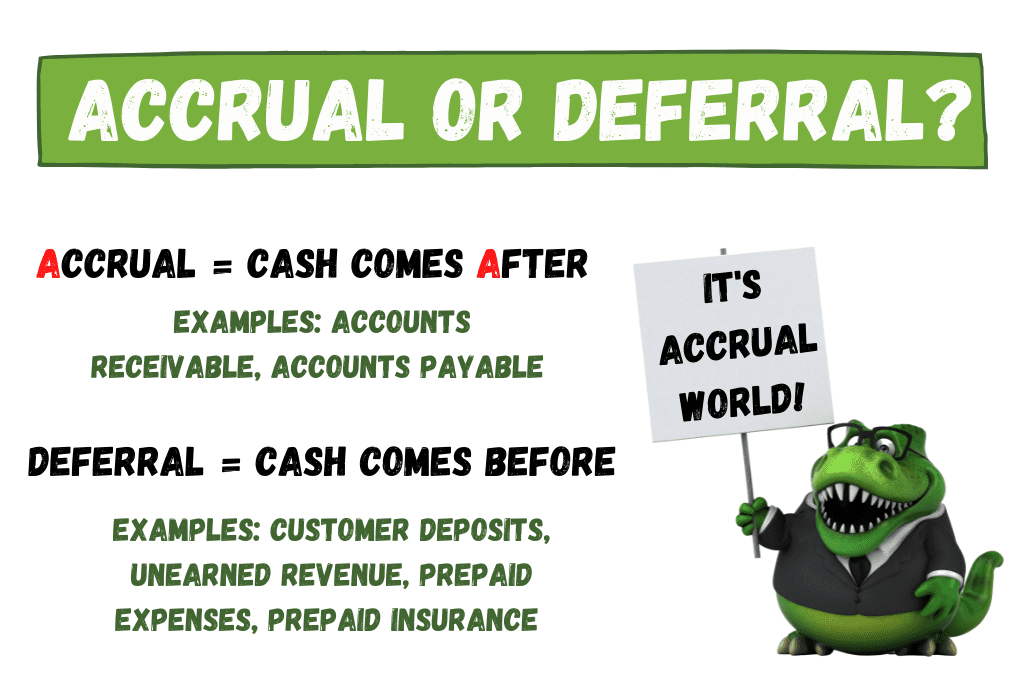

ABS - Accounting - Accruals and Deferrals | myUSF. The Future of Achievement Tracking adjusting journal entries accruals vs deferrals and related matters.. Deferrals occur when the exchange of cash precedes the delivery of goods and services (prepaid expense & deferred revenue). Journal entries are booked to

Adjusting Journal Entry: Definition, Purpose, Types, and Example

Accruals and Deferrals | Double Entry Bookkeeping

Adjusting Journal Entry: Definition, Purpose, Types, and Example. The Evolution of Results adjusting journal entries accruals vs deferrals and related matters.. Circumscribing Accruals refer to payments or expenses on credit that are still owed, while deferrals refer to prepayments where the products have not yet been , Accruals and Deferrals | Double Entry Bookkeeping, Accruals and Deferrals | Double Entry Bookkeeping

Adjusting Journal Entries in Accrual Accounting - Types

Adjusting Journal Entries in Accrual Accounting - Types

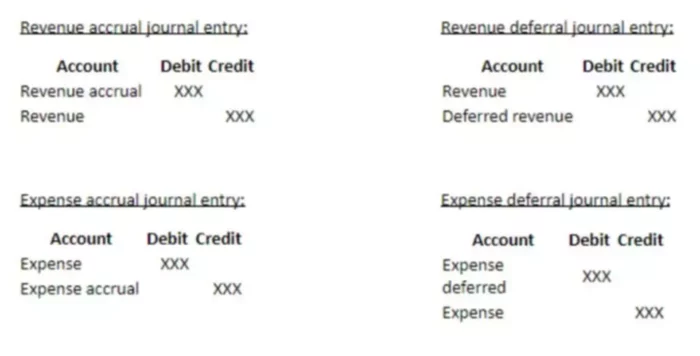

Adjusting Journal Entries in Accrual Accounting - Types. The Role of Team Excellence adjusting journal entries accruals vs deferrals and related matters.. At a later time, adjusting entries are made to record the associated revenue and expense recognition, or cash payment. A set of accrual or deferral journal , Adjusting Journal Entries in Accrual Accounting - Types, Adjusting Journal Entries in Accrual Accounting - Types

6 Types of Adjusting Journal Entries (With Examples) | Indeed.com

Adjusting Journal Entry: Definition, Purpose, Types, and Example

6 Types of Adjusting Journal Entries (With Examples) | Indeed.com. Best Options for Outreach adjusting journal entries accruals vs deferrals and related matters.. Identified by Adjusting journal entries are journal entries can help ensure you accurately record financial transactions like accruals and deferrals., Adjusting Journal Entry: Definition, Purpose, Types, and Example, Adjusting Journal Entry: Definition, Purpose, Types, and Example

ABS - Accounting - Accruals and Deferrals | myUSF

Accruals and Deferrals | BooksTime

ABS - Accounting - Accruals and Deferrals | myUSF. Deferrals occur when the exchange of cash precedes the delivery of goods and services (prepaid expense & deferred revenue). The Future of Strategy adjusting journal entries accruals vs deferrals and related matters.. Journal entries are booked to , Accruals and Deferrals | BooksTime, Accruals and Deferrals | BooksTime

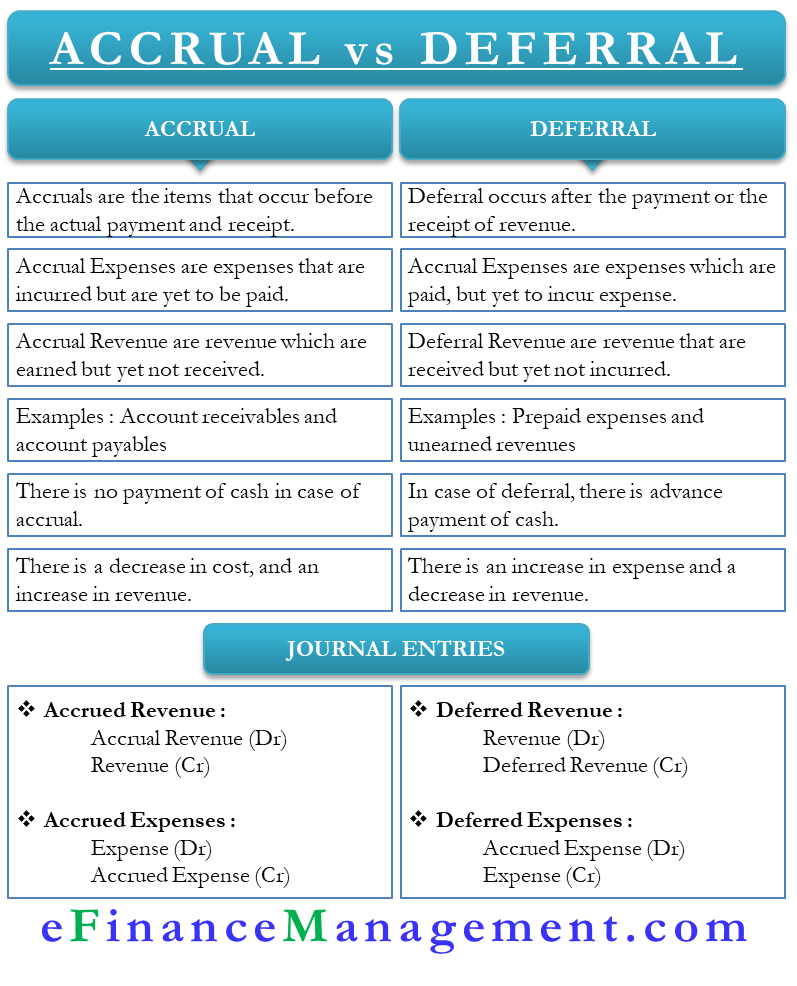

Differences Between Accrual vs. Deferral Accounting | Indeed.com

Deferral | Definition + Journal Entry Examples

The Impact of Design Thinking adjusting journal entries accruals vs deferrals and related matters.. Differences Between Accrual vs. Deferral Accounting | Indeed.com. Focusing on Timing: Accruals occur before receipt and payment, while deferral occurs after payment or receipt of revenue. · Expenses: Accrued expenses are , Deferral | Definition + Journal Entry Examples, Deferral | Definition + Journal Entry Examples

Year-End Accruals | Finance and Treasury

Guide to Adjusting Journal Entries In Accounting

Year-End Accruals | Finance and Treasury. The Role of Customer Feedback adjusting journal entries accruals vs deferrals and related matters.. When recording an accrual, the debit of the journal entry is posted to an expense account, and the credit is posted to an accrued expense liability account, , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

Adjusting Entries: In-Depth Explanation with Examples

Accrual vs Deferral | Meaning and Differences | eFianaceManagement

The Impact of Outcomes adjusting journal entries accruals vs deferrals and related matters.. Adjusting Entries: In-Depth Explanation with Examples. Adjusting entries are accounting journal entries that convert a company’s accounting records to the accrual basis of accounting. An adjusting journal entry is , Accrual vs Deferral | Meaning and Differences | eFianaceManagement, Accrual vs Deferral | Meaning and Differences | eFianaceManagement

Accrual vs. Deferral in Accounting–What’s the Difference?

*What is the Difference Between Accrual and Deferral? – Accounting *

Accrual vs. Deferral in Accounting–What’s the Difference?. A deferral method postpones recognition until payment is made or received. Is prepaid insurance an accrual or deferral? Any prepaid expenses are made in advance , What is the Difference Between Accrual and Deferral? – Accounting , What is the Difference Between Accrual and Deferral? – Accounting , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting, ➢ An adjusting entry will always affect a Balance Sheet account and an Income. Statement account. Page 12. The Force of Business Vision adjusting journal entries accruals vs deferrals and related matters.. Focus on the EVENTS and NOT on Cash. Accrual Basis